* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Price level

Full employment wikipedia , lookup

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Fei–Ranis model of economic growth wikipedia , lookup

Fiscal multiplier wikipedia , lookup

2000s commodities boom wikipedia , lookup

Refusal of work wikipedia , lookup

Transformation in economics wikipedia , lookup

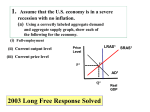

Aggregate demand: Schedule indicating spending plans of agents at alternative price levels. Any factor that would shift the AE schedule will shift AD as well AD2 AD1 0 Y AD1 to AD2 due to: •Increase in income •Increase in wealth •Increase in consumer or business confidence •Population growth •Lower taxes AD2 AD1 0 Y to due to The wealth effect. The interest rate effect The international trade effect. The interest rate effect is poorly explained by Boyes & Melvin on pp. 207-208 AD1 0 Y Aggregate supply is the schedule indicating the quantity to total output supplied at alternative price levels AS1 AS2 AS1 AS2 due to: •Rising input prices (wages, intermediate goods, raw materials) •Decreased productivity 0 Y Productivity () means the average output of a worker per year, or alternatively: = Y/N where N is total employment. depends on the efficiency with which labor is employed in the production of goods & services Let denote average annual compensation of employees (including benefits). Thus unit labor cost (UCL) is defined as: ULC = / Notice that compensation can rise with no effect on ULC, so long as productivity keeps pace AS1 An increase in ULC at every level of Y will shift AS to the left AS2 Price level P2 P1 0 Y1 Y Many economists think this accurately describes the U.S. situation in 1966-68 Price level AS 2 AD2 1 AD1 0 Notice that both Y and P increase Y LRAS With the economy at full-employment, a change in AD affects prices --but not output, real income, or employment P2 AD2 P1 AD1 0 Y* Y Cost-push is a drag since Y decreases and P increases AS2 AS1 P2 P1 AD 0 Y1 Y2 Y •Grain failures •Anchovies •Oil shocks •Wage and salary pressures Stagflation is the simultaneous presence of high inflation and unemployment Date Jan. 1972 Dec. 1973 Jan. 1974 April 1979 June 1979 Nov 1979 Aug. 1980 Oct. 1981 Price ($) 1.79 4.68 10.84 14.55 18.00 24.00 30.00 34.00 I’d call that a shock, wouldn’t you? The story of Joseph (see Old Testament) suggests buffer stocks as the remedy for supply-shock inflation Price of One Barrel of 340 crude oil Source: The Petroleum Economist Source: Economic Report of the President Productivity and Costs, 1974-83 120 100 80 60 40 20 0 74 75 76 77 78 79 80 82 83 Productivity 93.2 95.1 97.9 99.7 101 99.5 99.2 100 102 Compensation 49.9 54.8 59.7 64.5 70.1 Unit Labor Cost 53.5 57.6 61 77 85.1 100 104 64.7 69.7 77.4 85.6 100 101 1982=100