* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download MV=PQ I

Exchange rate wikipedia , lookup

Modern Monetary Theory wikipedia , lookup

Phillips curve wikipedia , lookup

Great Recession in Russia wikipedia , lookup

Early 1980s recession wikipedia , lookup

Monetary policy wikipedia , lookup

Real bills doctrine wikipedia , lookup

Nominal rigidity wikipedia , lookup

Long Depression wikipedia , lookup

Inflation targeting wikipedia , lookup

Quantitative easing wikipedia , lookup

Stagflation wikipedia , lookup

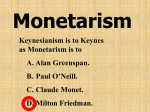

Milton Friedman (1912 - 2006) The Revival of the Equation of Exchange and the Quantity Theory of Money A Great Economist And a Product of his Times Roger W. Garrison 2011 CPI 220 CONSUMER PRICE INDEX (1982-1984 = 100) 100 221 CPI (1982-1984 = 100) Last five years 221 220 211 Printing Money and Spending it. CFO Chapter 18, pp. 341-343: Monetarism The Equation of Exchange CFO Chapter 10: and the Quantity Theory of Money The Money Supply and the Federal Reserve System How much money is there, anyway? But first…. What do we mean by “money”? Tim Hudson earns a lot of money. Bill Gates has a lot of money. It’s better to buy a house when money is cheap. I need to cash a check to get some money. Money facilitates the exchange of goods and services. Tim Hudson earns a lot of money. Bill Gates has a lot of money. CURRENCY It’s better to buy a house when money is cheap. CREDIT I need to cash a check to get some money. INCOME Money facilitates the exchange of goods and services. MONEY WEALTH How much money is there, anyway? (Money is the medium of exchange.) $ 1,861,000,000,000 M1 = $ 1,861 billion Currency and coin: $ 920 billion Checking deposits: $ 941 billion C&C/M1 = 0.494, or about 49.4% M1 = $ 1,861 billion Currency and coin: $ 920 billion US Population: 311,000,000 Per capita C&C: $ 2,958 Per family of four: $ 11,833 Just who’s holding all this C&C? M is the money supply. M1 = $ 1,861 billion Inquiring minds want to know: Has M1 always been $1,861 billion? How does more MI get created? Who makes the decisions? Is more money always a good thing? Are there some politics in play? Did Keynes actually ignore M? Monetarism Friedman was a Marshallian, but he was a macroeconomist. He had his own research Agenda: Money and Inflation. And he was out to counter Keynesian theory and policy. MILTON FRIEDMAN M stands for the Money supply. M1 = $ 1,861 billion GDP = Y = $ 14,870 billion V = Y/M = 14,870 / 1,861 = 7.99 MV = Y M1 = $ 1,861 billion GDP = Y = $ 14,870 billion V = Y/M = 14,870 / 1,861 = 7.99 MV = Y = E M1 = $ 1,861 billion GDP = Y = $ 14,870 billion V = Y/M = 14,870 / 1,861 = 7.99 MV = Y = E = PQ M1 = $ 1,861 billion GDP = Y = $ 14,870 billion V = Y/M = 14,870 / 1,861 = 7.99 MV = Y = E = PQ 2008: 2009: 2010: 2011: V V V V = = = = 10.18 9.09 8.22 7.99 Dating from the beginning of the most recent contraction, the velocity of money has declined. MV = Y = E = PQ V V V V = = = = 10.18 9.09 8.22 7.99 VELOCITY 2008: 2009: 2010: 2011: 11.0 10.0 9.0 8.0 7.0 6.0 5.0 2008 2009 2010 2011 2012 Dating from the beginning of the most recent contraction, the velocity of money has declined. MV = PQ M is the money supply (outside the banking system). V is money’s velocity of circulation. P is the price level. Q is the economy’s output. PQ is total expenditures (E). MV is total income (Y) A SAMPLE QUESTION How much money is there, anyway? A. M1 is a little under $1.861 billion. B. M1 is a little under $6.168 billion. C. M1 is a little under $1.861 trillion. D. M1 is a little under $6.168 trillion. Ask FRED. (FRED means Federal Reserve Economic Data.) Click on Ben to go there. MV = PQ This is the “Equation of Exchange.” No economist, dead or living, has ever denied that MV actually does equal PQ... …because V is defined as PQ/M. MV = PQ In normal times: V doesn’t change much. Q changes in the low single digits. Keynes believed that the velocity of money was subject to dramatic and unpredictable change. He believed that people “hoard” money, more so some times than others. (increased hoarding means a decrease in velocity.) In extreme episodes, people may be overcome by the “fetish of liquidity,” the fetish often accompanying the waning of animal spirits. MV = PQ So, what happens when M is doubled—say, from $ 1,861 billion to $ 3,722 billion? P would also double. But the doubling of P takes time. MV = PQ In the long run and with a constant V, the price level (P) moves in proportion to the money supply (M) in a no-growth (i.e., constant-Q) economy. This is “The Quantity Theory of Money.” A more descriptive name would be: “The Quantity of Money Theory of the Price Level.” MV = PQ More generally, In the long run, money-supply growth in excess of real economic growth impinges wholly on the price level (P) and not at all on the level of real output. Put bluntly: you can’t create real wealth by slapping green ink on paper. Monetarism MV = PQ This is the unadorned tautology that we call the Equation of Exchange Monetarism MV = PQ 18-30 months ThisInisthe thelong “Quantity Theory ofinMoney.” run, increases M affect nothing P (and W). (The Quantity of Moneybut Theory of the Price Level) Monetarism Keynesianism is to Keynes as Monetarism is to A. Ben Bernanke. C. Claude Monet. B. Tim Geithner. D. Milton Friedman. Milton Friedman (1912 - 2006) • MV = PQ • Inflation is always and everywhere a monetary phenomenon!!! The equation of exchange is so near and dear to Milton Friedman’s heart that he A. has made C. B. D. had written adopted it spelled his a itparody wife as his out Rose to vanity inthe pansies promise popular license inthat the plate it Y.M.C.A flower number will make garden for to memorialize his a tasteful atCadillac Stanford’s appearance Eldorado. the Hoover equation oninhis head stone. song. Institution. The equation of exchange is so near and dear to Milton Friedman’s heart that he A. tasteful appearance on his head stone. B. spelled out in pansies in flower garden. C. parody to the popular Y.M.C.A. D. vanity license plate number. Gribouillis économiques GREG MANKIW’S BLOG Random Observations for Students of Economics September 16, 2006: Curious question from Mankiw: “How can you identify my car?” Gregory Mankiw Former Chairman Council of Economic Advisors George W. Bush Administration mvpy writes: You know, I hate to spoil things, but I must say, I think Milton Friedman has a better plate. This is from an article I came across: "Years ago, trying to find the Friedman’s apartment in San Francisco, I knew I was in the right location when I spotted a car with the number plate MV = PT." A. Delaique writes: Milton Friedman's license plate was MV = PQ, not MV = PT. Picture here : http://gribeco.free.fr/article.php3?id_article=12 Anonymous writes: That's pretty ridiculous.. Canée writes: I love economists. Monetarist Policy FOR A GROWING ECONOMY MV = PQ Policy implication: Normally, a healthyIncrease economyMwill at a experience slow, steadyreal rate economic (2% or 3%) growth to match the long-run growth. amounting to 2% orrate 3%of per year. Monetarist Policy FOR A GROWING ECONOMY MV = PQ With this “Monetarist Rule” in effect, there will be no inflation and no deflation. Price-level stability is the hallmark of macroeconomic stability. Monetarism Some diagnostics: With the “Monetarist Rule” in effect (2 or 3%) and a constant V, the rate of inflation would be zero—or very close to zero. Has the rate of inflation been zero? Monetarism Some diagnostics: CPI for 1982-1984 = 100 CPI for January 2010 = 216 That is, prices on average are more than double now what they were in the early 1980s. (See FRED.) CPI CONSUMER PRICE INDEX (1982-1984 = 100) Last five years of the CPI Monetarism MV = PQ Some diagnostics: Has Q been falling for the past 25 years? Has V been rising for the past 25 years? Has M been rising for the past 25 years? Monetarism MV = PQ Q rose by 88.5%, which is 2.80% per year. V rose by 23.7%, which is 0.90% per year. Suppose M had increased (in accordance with the monetary rule) at the rate of 2.5% per year. Monetarism 2.80% 2.50% 0.90% 0.60% MV = PQ Monetarism If M had risen at the rate of 2.5% over the period 1983—2008 and P had risen at the rate of 0.60%, the current CPI would be 115.0 instead of 216. That is, prices in general would’ve been only 15% higher than they were in 1983. 5.0% Monetarism 2.80% 3.1% 0.90% MV = PQ Monetarism Q rose by 88.5%, which is 2.80% per year. V rose by 23.7%, which is 0.90% per year. M actually increased by 5.0% per year. M, which rose from $450 billion to $1,383 billion (in 2008), more than tripled. P more than doubles (from 100 to 216 THE NATURAL RATE OF UNEMPLOYMENT SEPT 11 2001 SEPT 11 2001 SEPT 11 2001 Sidewalk Survey on Dexter Avenue: “What’s the cause of inflation?” Greed. Oil companies. Medical industry. Home-building industry. Labor unions. The Jane Fonda bull-by-the-horn approach to ending inflation. Identify major groups of products whose prices have risen the most: energy, medical, housing, food. Enact pricing policies that hold the prices in these areas down and thereby counter the inflationary pressures. What about the major groups of products whose prices have fallen the most: computers, cameras, electronics. Is the economic activity in these areas creating deflationary pressures? MV = PQ CPI = avg.(p1, p2, p3, p4, pgasoline, … pn) The P in the equation of exchange is measured by the CPI (or the WPI or GPI), which is a price index. The index tracks the average of all prices. ? CPI = avg.(p1, p2, p3, p4, pgasoline, … pn) Good arithmetic; bad economics. MV = PQ CPI = avg.(p1, p2, p3, p4, pgasoline, … pn) Many other prices go down. Some up, too. --the (firewood). --theprice priceofofsubstitutes complements (RV’s) --the and services for which --theprice priceofofgoods so-called “normal” oil in a substantial input (airfares). goods generally (restaurant meals). Suppose that unrest in the Middle East causes a reduction in the supply of oil flowing to the U.S., which leads to a 20% increase in the price of oil. Economists who accept the quantity theory of money will claim that A. prices in general will rise because everything depends upon (is related to) oil. B. the Federal Reserve should increase the money supply so that people can pay the higher gas prices. C. whatever the Federal Reserve does, there will be substantial inflation–although not a 20% inflation rate. D. there will be no inflation in the U.S. so long as the Federal Reserve does not increase the money supply. Bubbalonia is experiencing inflation. Prices INFLATION in general are rising. IS ALWAYS AND EVERYWHERE What are the logically possible causes, A MONETARY PHENOMENON. as implied by the Equation of Exchange? What is the actual (empirically demonstrated) --- Milton Friedman cause according to the Quantity Theory? MV = PQ a. Increasing Q. g. Increasing gas prices. b. Decreasing Q h. Credit-card mania. c. Increasing V. i. Labor unions. d. Decreasing V. j. Greed. e. Increasing M. f. Decreasing M. Suppose that new taxes on tobacco products cause the tax-included price of cigarettes to double. Microeconomists would predict that the quantity of tobacco products bought will fall only slightly and that total spending on cigarettes will nearly double. Monetarists would claim that the tax will A. result in a slightly higher rate of inflation. B. cause the Federal Reserve to undertake compensatory policy actions. C. have no effect on the general price level. D. result in a slightly higher velocity of money. Can you apply similar reasoning to show that none of the other oftmentioned culprits are responsible for inflation? Greed. Oil companies. Medical industry. Home-building industry. ● Labor unions. Do labor unions cause inflation? Labor unions can call a strike—or just threaten to call a strike—in order to get higher wages. And higher wages get translated into higher prices. That’s inflation, isn’t it? W S D Union labor N W S D Union labor N W S S’ Non-union labor D N W P S S’ S D Union labor D N W Product market S S’ Non-union labor D N Q W P S S’ S D Union labor D N W Q Product market P S S S’ Non-union labor D N S’ D Product market Q Do labor unions cause inflation? No. But they can cause the prices of goods made by unionized labor to rise and the prices of goods made by non-unionized labor to fall. However, if the central bank increases the money supply in an attempt to neutralize the effects of labor unions, the general price level will rise. A Ceiling on Your Home (1945) By the Office of Price Administration (OPA) Synopsis: [This 12 minute film] shows the economic factors affecting postwar inflation and an appeal for public cooperation, an appeal to the public to assist in retail price control, and the difficulties veterans faced in locating jobs and housing. CLICK ON POSTER GIRL TO SEE VIDEO Reviewer: ERD -- March 7, 2006 Subject: "Ceiling on Your Home" does a good job This 1945 film does a good job explaining about the purpose of rent control after World War II. Excellent narrative script and filming. Reviewer: Christine Hennig -- December 9, 2003 Subject: No Rentals Today, But Keep in Touch! This post-WWII film advocates rent control as a way to control inflation as a result of the post-war housing shortage. It portrays young couples struggling to find a decent place to live and start their families, and finding “NO RENTALS” signs everywhere. This is an interesting slice of life from the post-WWII era, before the problem would be eventually solved by huge housing developments in the suburbs. Reviewer: Spuzz -- February 26, 2003 Subject: Rent Rant. As the boys were coming home from war, much concern (I guess) was made about the lack of affordable housing for the soldiers and their new families. Luckily, the Office of Price Administration (whatever that is) was there to see that there was rent fixing, and that everyone would pay the same price. A persuasive film with plenty of great images. Is it possible to increase the money supply without causing inflation? Suppose that the velocity of money can (somehow) be made to fall as the money supply was being increased? Couldn’t an increased M and a decreased V combine to allow for a constant price level? The Anti-inflation campaign of the Ford Administration Whip W I Inflation N Now The Anti-inflation campaign of the Ford Administration People should wear their WIN buttons. They should look for bargains… …holding on to their money while they look. Don’t spend it. Just hold it. MV=PQ The Anti-inflation campaign of the Ford Administration The Federal Reserve is increasing the money supply. That means that prices will be rising. It’s called inflation. What can you do to keep inflation from occurring? MV=PQ The Anti-inflation campaign of the Ford Administration You can earn money and then words, just hold In other the on to it. government can create money and Holding on to money spend it, and that in means a decrease won’t cause inflation velocity. if you are willing to The V will earndecreased money and not offset spendour it. increasing M, keeping P from rising. MV=PQ The Anti-inflation campaign of the Ford Administration MV=PQ: It’s always right, but there are no votes in it. Milton Friedman (1912- 2006) • MV = PQ • Inflation is always and everywhere a monetary phenomenon!!!