* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Chapter 18: The Open Economy

Real bills doctrine wikipedia , lookup

Currency War of 2009–11 wikipedia , lookup

Monetary policy wikipedia , lookup

Modern Monetary Theory wikipedia , lookup

Currency war wikipedia , lookup

Global financial system wikipedia , lookup

Interest rate wikipedia , lookup

Foreign-exchange reserves wikipedia , lookup

Balance of trade wikipedia , lookup

Balance of payments wikipedia , lookup

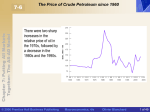

CHAPTER 18 The Open Economy Prepared by: Fernando Quijano and Yvonn Quijano And Modified by Gabriel Martinez The Open Economy Openness has three distinct dimensions: 1. Openness in goods markets. Free trade restrictions include tariffs and quotas. 2. Openness in financial markets. Capital controls place restrictions on the ownership of foreign assets. 3. Openness in factor markets—the ability of firms to choose where to locate production, and workers to choose where to work. 1. The North American Free Trade Agreement (NAFTA) is an example of this. © 2003 Prentice Hall Business Publishing Macroeconomics, 3/e Olivier Blanchard 18-1 Openness in Goods Markets U.S. Exports and Imports as Ratios of GDP, 1960-2000 2 1.8 20% Percentage of GDP Exports and imports, which were equal to 5% of GDP as recently as the 1960s, now stand around 13% of GDP. 25% 1.6 Imports 1.4 15% 1.2 1 Exports 10% 0.8 0.6 5% 0.4 0.2 0% © 2003 Prentice Hall Business Publishing Macroeconomics, 3/e 2005 2002 1999 1996 1993 1990 1987 1984 1981 1978 1975 1972 1969 1966 1963 1960 0 Olivier Blanchard Exports and Imports The behavior of exports and imports in the United States is characterized by: A sharp decline in both exports and imports between 1929 and 1936 as a result of the Smoot-Hawley Act of 1930. Three episodes of surpluses and deficits: The trade surpluses of the 1940s. The trade deficits of the mid-1980s, and The current trade deficit, which reached 6.63% of GDP in Q2 2006—a historical record. © 2003 Prentice Hall Business Publishing Macroeconomics, 3/e Olivier Blanchard Openness in Goods Markets U.S. Current Account Deficit as a ratio of GDP, 1960-2006 2 2% 1 .8 1% 1 .6 0% -2% 2005 2002 1999 1996 1993 1990 1987 1 .2 1 -3% 0.8 -4% 0.6 -5% 0.4 -6% 0.2 -7% © 2003 Prentice Hall Business Publishing 1984 1981 1978 1975 1972 1969 1966 1963 -1% 1 .4 1960 Percentage of GDP Exports and imports, which were equal to 5% of GDP as recently as the 1960s, now stand around 13% of GDP. 3% 0 Macroeconomics, 3/e Olivier Blanchard Exports and Imports Table 18-1 Country Ratios of Exports to GDP for Selected OECD Countries, 2000 Export Ratio (%) Country Export Ratio (%) United States 11 Switzerland 45 Japan 10 Austria 48 Germany 33 Netherlands 74 United Kingdom 27 Belgium 84 The main factors behind differences in export ratios are geography and country size. Countries can have export ratios larger than the value of their GDP because exports and imports may include exports and imports of intermediate goods. © 2003 Prentice Hall Business Publishing Macroeconomics, 3/e Olivier Blanchard Exports and Imports A good index of openness is the proportion of aggregate output composed of tradable goods—goods that compete with foreign goods in either domestic markets or foreign markets. Estimates are that tradable goods represent around 60% of aggregate output in the United States today. © 2003 Prentice Hall Business Publishing Macroeconomics, 3/e Olivier Blanchard The Choice Between Domestic Goods and Foreign Goods When goods markets are open, domestic consumers must decide not only how much to consume and save, … … but also whether to buy domestic goods or to buy foreign goods. Central to the second decision is the price of domestic goods relative to foreign goods, or the real exchange rate. © 2003 Prentice Hall Business Publishing Macroeconomics, 3/e Olivier Blanchard Nominal Exchange Rates The nominal exchange rate is the price of the foreign currency in terms of the domestic currency. units of domestic currency E 1 unit of foreign currency © 2003 Prentice Hall Business Publishing Macroeconomics, 3/e Olivier Blanchard Nominal Exchange Rates An appreciation of the domestic currency is an increase in the price of the domestic currency in terms of the foreign currency, which corresponds to a decrease in the exchange rate. Fewer units of domestic currency are needed to buy 1 unit of foreign currency. units of domestic currency E 1 unit of foreign currency A depreciation of the domestic currency is a decrease in the price of the domestic currency in terms of the foreign currency, or an increase in the exchange rate. More units of domestic currency are needed to buy 1 unit of foreign currency. © 2003 Prentice Hall Business Publishing Macroeconomics, 3/e Olivier Blanchard Nominal Exchange Rates Suppose countries operate under fixed exchange rates, that is, maintain a constant exchange rate between them. If the government changes the value of the currency, we say that Revaluations are decreases in the exchange rate, and Devaluations are increases in the exchange rate. © 2003 Prentice Hall Business Publishing Macroeconomics, 3/e Olivier Blanchard Nominal Exchange Rates The Nominal Exchange Rate Between the Dollar and the Pound (from the Point of View of the United States): Appreciation and Depreciation © 2003 Prentice Hall Business Publishing Macroeconomics, 3/e Olivier Blanchard Nominal Exchange Rates The Nominal Exchange Rate Between the Dollar and the Pound, 19752000 While the dollar has strongly appreciated vis-á-vis the pound over the past 25 years, this appreciation has come with large swings in the nominal exchange rate between the two countries, especially in the 1980s. © 2003 Prentice Hall Business Publishing Macroeconomics, 3/e Olivier Blanchard From Nominal to Real Exchange Rates U.S. cars $10 million U.K. cars $10 million PUS $10m/PUS= $20,000 1 car 500 cars 500 cars £ 13,333 PUK 1 car £ $10million Et = $1.5/£ 1.5 © 2003 Prentice Hall Business Publishing £ 6.67million Macroeconomics, 3/e Olivier Blanchard From Nominal to Real Exchange Rates $10m/PUS= U.S. cars $10 million U.K. cars $10 million $20,000 1 car 500 cars 375 cars £ 13,333 PUK 1 car £ $10million Et = $2/£ 2 £ 5 million A nominal depreciation of the dollar reduces demand for British imports. © 2003 Prentice Hall Business Publishing Macroeconomics, 3/e Olivier Blanchard From Nominal to Real Exchange Rates $10m/PUS= U.S. cars $10 million U.K. cars $10 million $20,000 1 car 500 cars 444 cars £ 15,000 PUK 1 car £ $10million Et = $1.5/£ 1.5 £ 6.67 million An increase in British prices, at the same E, reduces demand for British imports. © 2003 Prentice Hall Business Publishing Macroeconomics, 3/e Olivier Blanchard From Nominal to Real Exchange Rates If the price of a Jaguar is £30,000, and a pound is worth 1.5 dollars, then the price of the Jaguar in dollars is £30,000 x $1.5 = $45,000. If a Cadillac is $40,000, then the relative price of a Jaguar in terms of Cadillacs is $45,000/$40,000 = 1.12 © 2003 Prentice Hall Business Publishing Macroeconomics, 3/e Olivier Blanchard From Nominal to Real Exchange Rates The Real Exchange Rate It is the concept that tells us how much the US’s production is worth in terms of UK production. How much of UK GDP can I buy with 1 unit of US GDP. To take into account all of the goods in a nation’s economy, we use a price index for the economy, or the GDP deflator. © 2003 Prentice Hall Business Publishing Macroeconomics, 3/e Olivier Blanchard From Nominal to Real Exchange Rates The Construction of the Real Exchange Rate The real exchange rate equals the nominal exchange rate times the foreign price level, divided by the domestic price level. © 2003 Prentice Hall Business Publishing EP * P P* = price of British goods in pounds E = price of pounds in terms of dollars EP* = price of British goods in dollars Macroeconomics, 3/e Olivier Blanchard From Nominal to Real Exchange Rates If the US price is $20,000, And the UK price is £15,000, A consumer is indifferent between the two if RER = 1. ($10m / $20,000) = (1/Et)($10m / £15,000) $20,000 = Et £15,000 RER = 1 = Et £15,000 / $20,000 RER = 1 = Et (P* / P) Et = $1.33 £. If Et=1.5, the $ must appreciate. © 2003 Prentice Hall Business Publishing Macroeconomics, 3/e Olivier Blanchard From Nominal to Real Exchange Rates An increase in the relative price of domestic goods in terms of foreign goods: a real appreciation, a decrease in the real exchange rate, . A decrease in the relative price of domestic goods in terms of foreign goods a real depreciation, an increase in the real exchange rate, . © 2003 Prentice Hall Business Publishing Macroeconomics, 3/e Olivier Blanchard From Nominal to Real Exchange Rates The Real Exchange Rate Between U.S. Goods and U.K. Goods (from the Point of View of the United States) Real Appreciation and Real Depreciation © 2003 Prentice Hall Business Publishing Real Macroeconomics, 3/e Olivier Blanchard From Nominal to Real Exchange Rates Real and Nominal Exchange Rates Between the United States and the United Kingdom, 1975-2000 Except for the difference in trend reflecting higher average inflation in the United Kingdom than in the United States, the nominal and the real exchange rates have moved largely together since 1975. © 2003 Prentice Hall Business Publishing Macroeconomics, 3/e Olivier Blanchard From Bilateral to Multilateral Exchange Rates Table 18-2 The Country Composition of U.S. Merchandise Trade, 2000 Exports to Countries $ Billions Imports from Percent $ Billions Percent Canada 179 23 232 19 Western Europe 178 23 243 20 Japan 64 8 146 12 Mexico 86 11 136 11 Asia* 130 17 340 28 OPEC 20 3 42 3 Others 116 15 83 7 Total 773 100 1222 100 * Not including Japan. © 2003 PrenticeOrganization Hall Business Publishing OPEC: of Petroleum Macroeconomics, Exporting Countries.3/e Olivier Blanchard From Bilateral to Multilateral Exchange Rates Bilateral exchange rates are exchange rates between two countries. Multilateral exchange rates are exchange rates between several countries. For example, to measure the average price of U.S. goods relative to the average price of goods of U.S. trading partners, we use the U.S. share of import and export trade with each country as the weight for that country, or the multilateral real U.S. exchange rate. Share of trade with CAN * can Share of trade with MEX * mex Share of trade with JAP * jap © 2003 Prentice Hall Business Publishing Macroeconomics, 3/e Olivier Blanchard From Bilateral to Multilateral Exchange Rates Equivalent names for the relative price of foreign goods vis á vis U.S. goods are: The real multilateral U.S. exchange rate. The U.S. trade-weighted real exchange rate. The U.S. effective real exchange rate. © 2003 Prentice Hall Business Publishing Macroeconomics, 3/e Olivier Blanchard From Nominal to Real Exchange Rates The U.S. Effective Real Exchange Rate, 1975-2000 The large real appreciation of U.S. goods in the first half of the 1980s was followed by an even larger real depreciation in the second half of the 1980s. This large swing in the 1980s is sometimes called the “dance of the dollar.” © 2003 Prentice Hall Business Publishing Macroeconomics, 3/e Olivier Blanchard 18-2 Openness in Financial Markets The purchase and sale of foreign assets implies buying or selling foreign currency sometimes called foreign exchange. Openness in financial markets allows: Financial investors to diversify—to hold both domestic and foreign assets and speculate on foreign interest rate movements. Allows countries to run trade surpluses and deficits. A country that buys more than it sells must pay for the difference by borrowing from the rest of the world. © 2003 Prentice Hall Business Publishing Macroeconomics, 3/e Olivier Blanchard The Balance of Payments The balance of payments account summarizes a country’s transactions with the rest of the world. Transactions in goods or services are current account transactions. Transactions involving only goods (not services) are counted in the trade balance, which is a part of the current account. Trade deficit: Imports > Exports Trade surplus: Exports > Imports © 2003 Prentice Hall Business Publishing Macroeconomics, 3/e Olivier Blanchard The Balance of Payments The balance of payments account summarizes a country’s transactions with the rest of the world. Transactions involving flows of funds are capital account transactions. The current account balance and the capital account balance should add up to zero, but because of data gathering errors they don’t. For this reason, the account shows a statistical discrepancy. © 2003 Prentice Hall Business Publishing Macroeconomics, 3/e Olivier Blanchard The Balance of Payments Table 18-2 The U.S. Balance of Payments, 2000 (billions) Current Account Exports 1070 Imports 1437 Trade balance (deficit = ) (1) 367 Investment income received 345 Investment income paid 359 14 Net investment income (2) Net transfers received (3) 42 53 Current account balance (1) + (2) + (3) 83 434 Capital Account Increase in foreign holdings of U.S. assets (4) 952 Increase in U.S. holdings of foreign assets (5) 553 Capital account balance (4) (5) 399 Statistical discrepancy © 2003 Prentice Hall Business Publishing 35 Macroeconomics, 3/e Olivier Blanchard The Balance of Payments The sum of net payments in the current account balance can be positive, in which case the country has a current account surplus … …or negative—a current account deficit. The capital account balance can be positive if the change in foreign holdings of U.S. assets are greater than U.S. holdings of foreign assets, in which case there is a capital account surplus. If foreign holding of US assets grows faster than US holding of foreign assets, there is a capital account deficit. © 2003 Prentice Hall Business Publishing Macroeconomics, 3/e Olivier Blanchard The Choice Between Domestic and Foreign Assets The Choice Between Domestic and Foreign Assets The decision whether to invest abroad or at home depends not only on interest rate differences, but also on your expectation of what will happen to the nominal exchange rate. If both U.K. bonds and U.S. bonds are to be held, they must have the same expected rate of return. © 2003 Prentice Hall Business Publishing Macroeconomics, 3/e Olivier Blanchard The Choice Between Domestic and Foreign Assets Expected Returns from Holding One-Year U.S. Bonds or U.K. Bonds © 2003 Prentice Hall Business Publishing Macroeconomics, 3/e Olivier Blanchard Expectations, Consumption, and Investment Decisions If both U.K. bonds and U.S. bonds are to be held, they must have the same expected rate of return, so that the following arbitrage relation must hold: 1 * e 1 it (1 i t )( E t 1 ) Et Rearranging the equation, we obtain the uncovered interest parity relation, or interest parity condition: e E t 1 * 1 it (1 i t ) Et © 2003 Prentice Hall Business Publishing Macroeconomics, 3/e Olivier Blanchard Interest Rates and Exchange Rates The relation between the domestic nominal interest rate, the foreign nominal interest rate, and the expected rate of depreciation of the domestic currency is stated as: e E t 1 E t * 1 it (1 i t ) 1 Et A good approximation of the equation above is given by: e * t 1 t t t t i i © 2003 Prentice Hall Business Publishing E E E Macroeconomics, 3/e Olivier Blanchard Interest Rates and Exchange Rates it i * t Et Et e t 1 E This is the relation you must remember: Arbitrage implies that the domestic interest rate must be (approximately ) equal to the foreign interest rate plus the expected depreciation rate of the domestic currency. If E e t 1 Et , then it i * t © 2003 Prentice Hall Business Publishing Macroeconomics, 3/e Olivier Blanchard Interest Rates and Exchange Rates One-Year Nominal Interest Rates in the United States and in the United Kingdom, 1975-2000 U.S. and U.K. nominal interest rates have largely moved together over the last 25 years. © 2003 Prentice Hall Business Publishing Macroeconomics, 3/e Olivier Blanchard 18-3 Conclusions and a Look Ahead The choice between domestic goods and foreign goods depends primarily on the real exchange rate. The choice between domestic assets and foreign assets depends primarily on their relative rates of return, which depend on domestic interest rates and foreign interest rates, and on the expected depreciation of the domestic currency. © 2003 Prentice Hall Business Publishing Macroeconomics, 3/e Olivier Blanchard