* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Annual Report

Financialization wikipedia , lookup

Shadow banking system wikipedia , lookup

Bank of England wikipedia , lookup

History of the Federal Reserve System wikipedia , lookup

Fractional-reserve banking wikipedia , lookup

Investment banking wikipedia , lookup

Panic of 1819 wikipedia , lookup

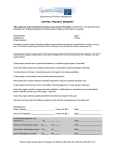

Annual Report 1 About Bank Leumi USA 18 Financial Highlights & Management Analysis 2 Chairman and CEO’s Letter 20 Consolidated Statements of Financial Condition 4 U.S. & International Commercial Banking 8 U.S. & International Private Banking 21Consolidated Statements of Net Income and Comprehensive Income 10 Leumi Investment Services Inc. 22 Board of Directors & Senior Management 12 Information Technology and Service & Delivery 23 Governance 14 The U.S. Economy in 2013 24 Leumi Group Locations 16 The Israeli Economy in 2013 Bank Leumi USA is a FDIC-insured full-service commercial bank that has been operating in the U.S. for over half a century. With offices located in New York, California, Florida, Illinois and a representative office in Israel, we’re a local bank with international clout. We offer commercial and private clients access to a complete range of global banking solutions, including securities and insurance products offered through Leumi Investment Services Inc., our broker-dealer subsidiary. A commitment to building strong and lasting relationships defines how we do business. We offer the high level of service you would expect from a local community bank along with the industry knowledge and capabilities available in a money center bank. Our size allows us to be nimble, providing our clients the benefit of faster decision making and access to all levels of management. With our international heritage, our products and services are tailored to help clients navigate the complicated and dynamic global economic environment. And as the largest subsidiary of the Leumi Group, Israel’s leading bank, we provide unparalleled access to Israeli-generated products and research for our private banking clients and strong foreign exchange and trade finance capabilities for our commercial banking clients. personally involved with every part of serving our clients, from understanding your business to finding creative solutions for reaching your financial goals. Our people— their in-depth knowledge, commitment to excellence and care—are what make us special. The Leumi Group has been characterized as a driving force behind Israel’s economic and industrial development since the bank’s establishment in 1902. Today, it serves as a gateway for investors and businesses in Israel and worldwide, with total assets under management exceeding $315 billion and shareholders’ equity of $7.7 billion. Its global presence spans across 15 countries with 326 branches and offices in major world financial centers as well as a broad network of correspondent banks. As a Bank Leumi USA client, you partner with a talented group of professionals who pride themselves on being BA NK LEUMI US A 1 David Brodet Chairman of the Board Avner Mendelson President and Chief Executive Officer DEAR SHAREHOLDERS, CLIENTS AND EMPLOYEES As we look back on 2013, we remember it as the year we laid the groundwork for the largest investment and capabilities upgrade program that Bank Leumi USA has ever embarked upon, despite the challenges we faced in meeting our financial growth and profitability targets. This multiyear program is designed to upgrade our core technology and operations environment, to define clearer roles and responsibilities throughout our organization and to streamline key processes. Bank Leumi USA will be transformed into an even better bank for clients and employees, who will begin to enjoy our new state-of-the-art technology platform and applications by early 2015. We thank our shareholders and the Board of Directors for their vision, patience and long-term commitment towards fashioning Bank Leumi USA into a profitable growth engine for the Leumi Group. We are carrying out this transformation with a clear vision and purpose. Our goal is to truly become a relationship-driven boutique bank that enjoys longlasting relationships with its commercial and private banking clients by providing personalized services that are tailored and professionally delivered to meet our 2 BA NK LEUMI US A “Our dedicated professionals are the face of Bank Leumi USA and make the greatest impact on our organization.” clients’ specific needs. We will achieve this by building an efficient, agile and technologically advanced platform, and by empowering and continuously developing our devoted and talented professionals. Transformation is essential to the future of both our commercial and private banking businesses. We experienced great success in 2013 as we grew our relationship-driven business in the niche markets that serve as growth engines for commercial banking. At the same time, we continued to identify and penetrate new sectors. Similarly, through our commitment to develop a leading private banking platform, clients benefited from a newly upgraded offering of value-added research, product and trading capabilities through our brokerdealer subsidiary, Leumi Investment Services Inc. In 2014 we will continue to improve our value proposition for both commercial and private banking clients. Our dedicated professionals are the face of Bank Leumi USA and make the greatest impact on our organization. We will continue to invest in our employees by offering opportunities for professional growth and development as well as actively seeking high-caliber, talented individuals who share our values—Passion, Accountability, Care, Excellence and Integrity—to join us in our journey. Last year was also a year of transition in our leadership. We thank Itzhak Eyal, who retired in September from the role of President and CEO, for his vision and leadership in the past three years. We would like to also extend our appreciation to our retiring board members, Donald S. Howard, Malcolm Hoenlein and Robert K. Lifton, who served on our board for 19, 14 and 21 years, respectively. We are grateful for their dedicated service to Bank Leumi USA and wish them all the best. At the same time, we are pleased to welcome several new board members including Daniel Tsiddon, Deputy CEO of the Leumi Group; Gideon Altman, former Head of the Commercial Division of the Leumi Group; Simon B. Jawitz, Senior Managing Director of Sierra Real Estate; and Charles D. Johnston, the former President of Morgan Stanley Smith Barney. We are convinced that the unprecedented investments in our business and our people will allow us to fulfill our vision and deliver continued value to our shareholders, clients and employees. Thank you for your ongoing support. We invite you to visit us at our newly renovated corporate headquarters at 579 Fifth Avenue in New York. Wishing you success in 2014. David Brodet Chairman of the Board Avner Mendelson President and Chief Executive Officer BA NK LEUMI US A 3 U.S. & INTERNATIONAL COMMERCIAL BANKING A relationship-driven, boutique commercial bank, Bank Leumi USA operates with a client-first focus and a commitment to the highest level of professionalism. Our bankers are trusted advisors to their clients, are knowledgeable about their business needs and provide tailored solutions to meet their goals. Coupled with their deep industry and banking expertise, our relationship managers structure creative solutions and offer competitive terms for banking products that are customized for their clients’ businesses. 4 BA NK LEUMI US A RELATIONSHIP MANAGERS AND INDUSTRY EXPERTS Located in New York, California, Florida and Illinois, our teams serve middle market companies. As experienced relationship managers and industry experts, they have an understanding of the economics of the industries in which our clients operate and are able to match loan and collateral requirements with the ebbs and flows of each industry. We offer a full array of lending products that cater to our clients’ needs including term loans, revolving lines of credit and letters of credit. Leumi Commercial Banking serves many industries with a specific focus on: • Commercial & Industrial: For over 50 years, our relationship-driven approach and industry expertise in sectors like apparel and wholesale have allowed us to build our book of business while maintaining a strong and disciplined credit culture. In addition to the apparel and wholesale sectors, we also cover companies in manufacturing, commodity and service industries. • Real Estate: We specialize in financing multifamily, retail, office, shopping centers and mixed-use properties, and, in New York, construction projects and properties that are being repositioned. • Healthcare: Riding the growth in demand for senior care services and due to our industry expertise, we are well positioned to continue building our banking services to the senior care industry. Known for our proficient underwriting and our focus on fostering long-term relationships, we have expanded our business to all the markets in which Bank Leumi USA participates. • I nternational Banking & Technology: Anchored by an experienced team of bankers who work with Israeli companies doing business in the U.S., and as the only Israeli-affiliated bank with an office in Silicon Valley, we specialize in helping Israeli-related technology startups at all stages succeed in the U.S. We offer strong networks in the U.S. and in Israel as well as a full banking platform for technology companies, including lines of credit for growth-stage startups and currency conversion and hedging solutions for Israeli–U.S. companies. PAUL LETOURNEAU FIRST SENIOR VICE PRESIDENT, ILLINOIS When Paul hires a new employee for Bank Leumi USA, he does everything to ensure their success. “I believe in mentoring and coaching. We make sure new hires have adequate training. We help them build relationships and make sure they have the support needed to be successful with their new clients. If you start people off on the right foot, the reward will be their future growth.” Paul brings that same care to his client relationships. One example is the strong growth in client relationships. “We have been serving the senior care living industry for 30 years. Our teams here and across the U.S. have extensive expertise and add unique value for clients. We stay on top of industry trends so we can continue to provide unparalleled service to this vital business.” BA NK LEUMI US A 5 U.S. & INTERNATIONAL COMMERCIAL BANKING WORKING WITH A BANK OUR SIZE Because we are a boutique bank, our senior management team is actively involved with business and credit decisions. Their ongoing review of the business and firsthand knowledge of many of our clients provide a competitive edge. This enhances our decision-making process by giving us the insight needed to respond quickly to our clients’ needs. TREASURY SOLUTIONS Cash Management Services Bank Leumi USA provides expertise and tools to help companies manage cash flows, control risk, maximize working capital and integrate banking and treasury activities. Through Leumi Online, clients can access accurate, up-to-date financial information, enabling them to accelerate receivables, leverage liquidity and enhance overall productivity. The result is improved cash flow, convenient access to account information and more effective control of treasury operations. We also offer customers the ability to hold foreign currencies or foreign currency–denominated investments, which they can see on Leumi Online. Additionally, customers can use Leumi Online to send international wire transfers denominated in U.S. Dollars or in foreign currency. Foreign Exchange Companies that do business outside of the U.S. can benefit from the foreign exchange services we offer. With knowledgeable experts and a dealing room capable of handling all major tradable currencies, Bank Leumi USA can find solutions that satisfy most companies’ needs. Once we understand a client’s overseas business, we work with them to develop currency and hedging strategies that minimize currency risk and maximize returns. Trade Finance We serve as expert advisors to clients who need international banking services to facilitate transactions across national borders. We offer a full range of trade finance products, such as standard and specialized standby and commercial letters of credit, bankers’ acceptances, and documentary collections, for both importers and exporters. Leumi Global Link, our webbased service, connects clients directly to our international trade finance system, where they may apply for letters of credit, view current balances, process collection transactions and acceptances, and do much more. This valuable tool enables clients to facilitate transactions with speed, accuracy and efficiency. Equipment Financing Through our wholly owned subsidiary, Bank Leumi Leasing Corporation, Bank Leumi USA originates and arranges equipment financing for middle market and investment grade clients. We maintain an active syndication desk participating in third-party leasing transactions. Our offerings include term loans, capital leases, vendor programs, finance leases, equipment loans, portfolio acquisitions, rent-discounting programs and synthetic lease structures. COMMERCIAL BANKING TEAM Hilla Eran-Zick Senior Executive Vice President Deputy Chief Executive Officer Shlomo Mosseri First Senior Vice President Deputy Chief Lending Officer Joseph Sciarillo Executive Vice President Real Estate Lending 6 BA NK LEUMI US A Steven Caligor First Senior Vice President New York Commercial Banking President – Bank Leumi Leasing Corporation Stefanie Handsman First Senior Vice President Treasury Services Ofer Koren First Senior Vice President California Paul Letourneau First Senior Vice President Illinois Eric Halpern Senior Vice President Middle Market Lending Akiva Segal First Senior Vice President Florida Ignatius Marotta Senior Vice President Middle Market Lending Jeffrey Carstens Senior Vice President Middle Market Lending Eitan Sapir Senior Vice President International & Technology Banking Christopher Gregg Senior Vice President New York Real Estate Lending MARINA DAVELMAN VICE PRESIDENT, COMMERCIAL BANKING Marina’s expertise in the wholesale and apparel industries helps our commercial banking clients grow their businesses. “Our clients are not just a transaction to us. We understand the unique needs of startups and other businesses and know their business cycles. Our personalized focus provides a foundation on which to build their success.” Marina is making a difference not only to her customers’ businesses, but to Bank Leumi USA as well. “I have opportunities here that I did not have at a larger institution. I do many of the same things I did before, but here they get noticed. I am excited about the possibilities I see ahead of me.” “We understand the unique needs of our clients and know their business cycles. Our personalized focus provides a foundation on which to build their success.” NOAM KATZ VICE PRESIDENT, COMMERCIAL BANKING Noam was accepted into the Bank’s Credit Training Program in 2007. Since then he has worked as a commercial lender in our International Lending business and managed our Corporate Finance department. Today, Noam works with the Deputy CEO to manage the transformation taking place within commercial banking to personalize our client service. “There are intangibles here for employees that you do not get elsewhere. There is a real sense of family and an appreciation for individual contributions. We are focused on becoming even more client centric, which is a critical success factor for a bank. I believe our best days are ahead of us and there are many opportunities for those who want to seize them.” BA NK LEUMI US A 7 U.S. & INTERNATIONAL PRIVATE BANKING At Bank Leumi USA, we work hard to build and maintain long-term relationships with our clients throughout the U.S. and abroad. Here, you find multiple generations among our private banking clients. Each family member is treated like a member of our family, with a dedicated private banker designing a portfolio based on each individual’s goals and risk tolerance. At Bank Leumi USA you will find a significant crossover with our commercial banking clients, who know the kind of personalized, relationshipdriven service we provide. THE STANDARD FOR MEETING OUR CLIENTS’ FINANCIAL OBJECTIVES Our primary focus is to ensure that the financial objectives of our private banking clients are met through a variety of innovative products and services. What sets us apart is our bankers, who are the heart and soul of private banking. They earn the status of trusted advisor every day as they work closely with our clients to provide objective, carefully considered guidance. NAVIGATING DYNAMIC FINANCIAL MARKETS The year 2013 brought exciting changes to our brokerdealer subsidiary, Leumi Investment Service Inc., to help our clients better navigate today’s dynamic financial markets. We work closely with our colleagues in Europe and Israel to fulfill the international investing portion of our clients’ asset allocations. IN THE U.S. AND ABROAD Our relationship with the Leumi Group, Israel’s leading bank, provides our private banking clients unparalleled access to Israeli-generated products and research. Our exceptional banking capabilities, investment expertise and Leumi Group strength all contribute to our wealth management success. We will continue to evolve as our clients’ needs evolve, but we will always remain committed to maintaining deeply personal relationships with each of our clients. PRIVATE BANKING TEAM Chaim Fromowitz Executive Vice President Head of Private Banking 8 BA NK LEUMI US A Mason Salit First Senior Vice President U.S. Private Banking Alex Klein First Senior Vice President International Private Banking MASON SALIT FIRST SENIOR VICE PRESIDENT, U.S. PRIVATE BANKING Mason joined in 2014 to lead the U.S. Private Banking division. “I know that I made the right decision in joining Bank Leumi USA. It is a unique place with a caring culture and passionate people who put integrity and client service above all else. This is a great organization with many opportunities to better leverage our strengths and to deliver more value to our employees and clients. Our focus is on holistic wealth management, and success is achieved when we work with our clients as strategic partners. It is about providing the best solutions for our clients, which is why we serve families generation after generation.” “Bank Leumi USA is a unique place with a caring culture and passionate people who put integrity and client service above all else.” NICOLAS BOGDANOWICZ FIRST VICE PRESIDENT, INTERNATIONAL PRIVATE BANKING Nico has been with Leumi for 16 years in Argentina, New York and now in Aventura, Florida. “We are relationship driven. I know my clients, their children and their extended families. I speak with them on a regular basis and they know I am always here for them. I make it a point to understand their risk tolerance and individual needs. “When you choose a private banker, it is like choosing a doctor: they may all offer the same medicine, but you want to go to the one who you believe really cares about your well-being. I am proud to wear the colors of my Leumi team.” BA NK LEUMI US A 9 LEUMI INVESTMENT SERVICES INC. Bank Leumi USA’s broker-dealer subsidiary, Leumi Investment Services Inc. (LISI), provides a boutique targeted offering to private banking clients who seek a firm with a unique perspective on global financial markets. Our private bankers strive to implement tailored solutions based on individual client needs while leveraging our global footprint to provide optimal investment opportunities. 10 BA NK LEUMI US A CLIENT FOCUS Complex markets require a deeper understanding of the interplay between individual client needs and the investing opportunities available. To navigate these challenges, we present clients with our best ideas from across the globe and monitor their portfolios to ensure they are positioned to meet their goals. We provide a level of service that exceeds client expectations. INVESTMENT SOLUTIONS Our clients look to us for diverse solutions—from conservative to aggressive, tactical to strategic, dynamic to static, and income producing to tax efficient. For investors who prefer making their own investment decisions, our trading desk offers a range of global fixed income securities, including government, corporate and municipal bonds, as well as innovative investments, such as notes linked to market indices and currencies. Through our investment advisory platform, Leumi Advisor, we connect clients to a suite of world-class asset managers offering services across disciplines and strategies. Clients select from a variety of mutual funds and exchange-traded products, ranging from conservative to aggressive growth. BUSINESS AND ESTATE PLANNING SOLUTIONS Business owners have unique financial considerations, including intergenerational transfers, charitable giving and succession planning. Our solutions include key person insurance and qualified/nonqualified retirement plan. LISI offers fixed and variable annuities that allow clients to deposit money periodically and accumulate tax-deferred earnings. For non-U.S. clients, LISI offers universal investment plans with long-term growth potential through a trust formed on clients’ behalf. LEUMI INVESTMENT SERVICES INC. TEAM Ian Bernstein President IAN BERNSTEIN PRESIDENT, LEUMI INVESTMENT SERVICES INC. After 30 years at a large institution, Ian wanted to be at a bank where he could make a more meaningful contribution. “I was looking for an organization where employees care about each other and are treated with respect. All that, and more, is found here. It’s a roll-up-your-sleeves-and-get-it-done kind of place. For me, that is part of the fun. I find being involved in so many different things both challenging and intellectually stimulating.” Ian leads an initiative to grow and enhance the bank’s broker-dealer capabilities. “Traditionally, we focused on helping our private banking clients holistically manage their investments. Now, we want to layer increased access to the Bank’s considerable intellectual capital to help guide their investment choices. If clients choose to invest in any of Israel’s many exciting opportunities such as technology, healthcare or startups, we want to be the firm providing access to those and many other Israeli investments.” Joseph Colleran Senior Vice President Head of Fixed Income Trading Daniel Bernzweig Senior Vice President Head of Sales Trading and Content LISI is a member of FINRA / SIPC. Products offered through LISI are not FDIC Insured, have no bank guarantee, and may lose value. BA NK LEUMI US A 11 INFORMATION TECHNOLOGY AND SERVICE & DELIVERY The Information Technology and Service & Delivery division of Bank Leumi USA is a key driver in the success and future growth of the Bank. The transformation of our operations began in 2013 with a detailed review of our business processes as part of the effort to identify opportunities to better serve our clients. The findings that arose from those sessions are driving the exciting project currently underway to transform the back office “backbone” of our business. Service & Delivery, the new name for Operations, emphasizes our commitment to establishing new best practices across the Bank and delivering the highest level of quality service. ADDING “HIGH TECH” TO “HIGH TOUCH” FOR IMPROVED CLIENT EXPERIENCE Technology changes as rapidly as global economic markets, touching everything from monetary transactions to regulatory requirements to client relationships. With this in mind, we have embarked on a journey to modernize our systems as part of this transformation. Technology enhancements will improve the quality of our client relationships, building upon the deep, one-on-one interactions that differentiate us from our competitors. High tech will be added to our high touch. Some changes, such as an improved online experience, will be immediately visible to our clients. Others may be less visible but equally as valuable, such as the introduction of tools for our employees that will free up more of their time to focus on client relationships. While technology is the enabler of the transformation, our employees are the key to its successful implementation. Committed to this transformation, they are working together across regions and business units to improve our efficiencies and effectiveness. MORE, BETTER, FASTER More, better, faster, proactive, focused, nimble—these are keywords for this transformation, enhancing and improving the quality of our client relationships. Whether the changes are externally or internally focused, the end goal is to improve the Bank Leumi USA experience for all of our clients. INFORMATION TECHNOLOGY AND SERVICE & DELIVERY TEAM Michael Fegan Executive Vice President Chief Operations and Technology Officer Mark La Penta Senior Vice President Head of Information Technology Steven Schieffelin First Senior Vice President Senior Business Solution Architect Tammy Alvarez Senior Vice President Co-Head of Service & Delivery 12 BA NK LEUMI US A Douglas Malich First Vice President Co-Head of Service & Delivery Malinda Robey First Vice President Head of IT Project Management Office Christopher Walsh First Vice President Head of Information Security LILLIAN ORTIZ VICE PRESIDENT, MONEY TRANSFER Lillian has been with the bank 27 years and points to “our personal client relationships” as the differentiating factor between Bank Leumi USA and other financial institutions. “Here, a client can always directly reach a banker who knows them. When we open an account, we work to establish and maintain a close relationship.” Lillian also appreciates the cooperation and camaraderie among Bank Leumi USA employees. “We are similar to a community where employees know one another. Hard work is appreciated and recognized. Management cares about employees professionally and personally; respect among colleagues is key.” “At Bank Leumi USA a client can always directly reach a banker who knows them. When we open an account, we work to establish and maintain a close relationship.” MARK LA PENTA SENIOR VICE PRESIDENT, INFORMATION TECHNOLOGY Mark joined in 2013 and is excited to be part of the Bank’s IT operating model transformation. “The scope of this project is impressive and addresses the technological enablement of business processes. For our clients this means faster response time and deployment of new products and services, which supports our goal of continuously enhancing the client experience.” Coming from a big bank, Mark sees personal advantages to being at Bank Leumi USA. “I have the opportunity to get my hands on everything. What I do has a direct correlation to the strategy and tactics of the Bank. With less bureaucracy we move more quickly, keeping our focus on enhancing client relationships and contributing to our ongoing success.” BA NK LEUMI US A 13 THE U.S. ECONOMY IN 2013 The U.S. economy was incredibly resilient in 2013 despite numerous headwinds. U.S. Real Gross Domestic Product expanded at an annualized rate of 2.7% versus 2.0% in the prior year. This modest acceleration came even after federal spending sequestration, a sixteen-day government shutdown and a stubborn labor market threatened to derail the recovery. 14 BA NK LEUMI US A The Federal Reserve (“Fed”) remained the pervasive theme in 2013, as it continued to inject liquidity into the financial markets with its Large Scale Asset Purchase program, also known as QE3. The Fed’s balance sheet ended the year over $4 trillion. Since September 2012, the Fed has purchased $85 billion of U.S. Treasury and Agency MBS per month, which represents a substantial portion of recent issuance. In May, the Fed hinted that it could begin to trim the size of the purchase program, causing bond investors to head for cover and yields on U.S. Treasury bonds to spike. The yield on 10-year U.S. Treasury notes nearly doubled in four months, from 1.60% in May 2013 to 3.00% in September 2013. But it was not until December that the Fed announced a modest $10 billion per month reduction in purchases. The market expects the Fed, under newly appointed Chair Janet Yellen, to continue to decrease the pace of purchases by $10 billion per meeting, unless the economy weakens in 2014. This would end the purchase program in late 2014 and leave the Fed with a $4.4 trillion balance sheet. The nation’s labor market remains mixed, notwithstanding extraordinary monetary accommodation. The unemployment rate fell from 7.9% to 6.7%, which is the lowest in five years. However, as the unemployment rate decreased, the average number of jobs added slowed in the second half of the year, suggesting that more people were dropping out of the labor force. In fact, the percentage of Americans working or actively seeking a job is 62.8%, a 35-year low. an agreement on the budget, the debt ceiling and healthcare. The result was the first federal government shutdown in 17 years. Ultimately, a U.S. debt default was avoided, but not before an estimated 0.6% was trimmed from GDP growth for the third quarter. Surprisingly, this environment provided a banner year for risk assets. Equity markets generated outsized returns as the Dow Jones Industrial Average rallied 29%, the S&P 500 advanced 32% and the NASDAQ soared 40%. Conversely, the credit risk-free 10-year U.S. Treasury Note lost 3.35% and investment grade bonds lost 1.45%. Gold investors, who either thought the economy would relapse into recession or that inflation would ignite, took a beating as the yellow metal lost 28% and, in doing so, broke a 12-year winning streak. In all, green shoots emerged during 2013, but the recovery remains fragile as headwinds persist and growth remains muted. The economy was able to withstand a great deal of adversity in 2013, but a question that remains for 2014 is: How will the economy respond to the tapering of monetary stimulus? The consensus forecast of economists expects Real GDP to expand by 2.9% and for unemployment to fall to 6.5% in 2014, which suggests moderate acceleration with less fiscal drag compared to 2013. Household net worth rose to record highs as a surging stock market, a steady recovery in home prices and record low interest rates all contributed to the bottom line. The availability of credit loosened as U.S. household debt expanded to the highest level since Q1 2011. However, real household median income has not experienced any meaningful growth and remains at levels equivalent to the mid-1990s. In Washington, fiscal policy continued to act as a drag on the economy. The year began with jitters about a “fiscal cliff,” where automatic across-the-board spending cuts and tax increases went into effect. The debate culminated nine months later, when President Obama and congressional leaders failed to come to BA NK LEUMI US A 15 THE ISRAELI ECONOMY IN 2013 Israel, an OECD member, has continued to maintain its growth gap well above the OECD average in spite of the slowdown of economic expansion in 2013. Israel has clearly been outpacing the OECD since 2004. 16 BA NK LEUMI US A In 2013, Israel’s Gross Domestic Product (GDP) grew by 3.3% (the growth rate is in real terms) as compared to 3.4% in 2012 and 4.6% in 2011. The slowdown of economic activity expansion of the Israeli economy was evident in slower export growth and a major slowdown of investments in non-residential capital such as machinery and equipment. Natural gas fields discovered off Israel’s coast have brightened Israel’s energy security outlook. The ‘Leviathan’ field was one of the world’s largest offshore natural gas finds this past decade, and production from the ‘Tamar’ field is expected to meet all of Israel’s natural gas demand and started production in early 2013. THE SOVEREIGN CREDIT RATING Following the ongoing improvement in the Israeli economy in previous years, the country’s credit rating was increased by the various credit rating agencies in late 2007 and in early 2008. In September 2011 Israel’s credit rating was further increased to A+ by Standard and Poor’s. FISCAL POLICY The government’s deficit in 2013 is expected to be about 3.1% of GDP, compared to a target of 4.3% of GDP. The lower than expected deficit is attributed to higher tax rates and also a series of one-off events that contributed to state tax revenues. In addition, government spending in 2013 is expected to be less than what is allowed by the budget framework limits. Israel’s fiscal path is subject to an explicit feedback rule with a target of a government debt to GDP ratio of 50% of GDP, and with a 2013 year-end debt ratio of about 66% of GDP. The consumer price index is expected to have risen by 1.8–2.3% in 2013, which is well within the official price stability target of 1–3%. A look at the primary components of the CPI change shows that the housing item is still a major contributor to inflation, in addition to food and household maintenance costs, which have contributed to the rise of the price index in 2013. PERFORMANCE OF TEL-AVIV STOCK EXCHANGE TRADED SHARES Prices on the Israeli stock market were relatively stable during the first eight months of 2013. Since late August 2013 and through the end of the year, the Tel-Aviv stock indexes have risen. This recovery of the Tel-Aviv market seems to be related to a further interest cut by the Central Bank in late September 2013, a decline in geopolitical uncertainty, and an improvement in the market perception of global economic risks that have subsided. During 2013, the Israeli TA-25 index of blue chip shares rose by 12%, and the TA-100 index of the most actively traded shares rose by 15%. The daily volume of trading rose in 2013 by 10% compared to 2012 to a daily average of NIS 1.2bn. In 2013, the index of small cap stocks experienced larger rises than that of the TA-25 index of 38.9%. The sectors that experienced relatively high price increases in 2013 compared to the average (the TA-100) included insurance, real estate and construction, oil and gas exploration, and trade and services. Against this background the Tel-Aviv Stock Exchange indices reached record high levels. Initial public offering activity was resumed after several years of very low activity. THE EXCHANGE RATE, INFLATION AND MONETARY POLICY The exchange rate of the shekel appreciated during 2013 to NIS 3.61: US$1 on average from NIS 3.86: US$1 on average in 2012. The strengthening of the shekel seems to have been related to the return to a current account surplus in 2013 along with strong foreign direct investment inflows to Israel. BA NK LEUMI US A 17 FINANCIAL HIGHLIGHTS & MANAGEMENT ANALYSIS Net Income for the year was $11.0 million, compared to $24.5 million in 2012, and can be attributed to lower net interest income after provision for loan losses, a decrease in gains on sales of securities and an increase in other expenses. Assets as of December 31, 2013 were $5.2 billion compared to $5.4 billion in 2012. The provision for Loan Losses was $10.8 million at December 31, 2013, compared to $6.8 million at December 31, 2012. Assets under management increased in 2013 to $8.6 billion from $8.5 billion in 2012. As of December 31, 2013, Bank Leumi USA had $5.2 billion in total assets and a capital base of $547 million in shareholders’ equity. Capital ratios continue to be strong and exceed regulatory requirements. The bank enjoys favorable liquidity, with cash placements and marketable securities representing 24% of total assets as of December 31, 2013. FINANCIAL HIGHLIGHTS OF 2013 2013 2012 Net Income $ Total Assets Shareholders’ Equity Return on Equity 11,049 5,191,130 547,131 2.54% 24,531 5,365,312 540,501 5.20% Total Loans $3,723,907 Total Deposits 4,422,028 Total Securities 711,788 Noninterest Income 42,485 Assets Under Management 8,555,553 3,759,032 4,546,493 698,012 49,400 8,481,027 (dollar amounts in thousands) CAPITAL RATIOS Total Capital Tier 1 Capital Leverage Capital 18 BA NK LEUMI US A 14.54% 11.70% 9.94% 14.47% 11.56% 9.32% Shareholders’ Equity Total equity increased to $547 million as of December 31, 2013 from $541 million as of December 31, 2012. Return on Equity Return on equity was 2.54%. Total Loans As the Bank continues to implement its strategic initiatives and focus on key industries, its loan portfolio composition resulted in a slight decrease year over year. Total Deposits Total deposits declined by $124 million, or 2.7%, in 2013. Credit Quality The allowance for credit losses totaled $46 million at year-end 2013, representing 1.24% of total loans and is 0.47 times the level of nonaccrual loans. Nonaccrual loans at year-end 2013 were $99 million compared to $81 million at year-end 2012. Noninterest Income In 2013, total noninterest income was $42 million, a 14% decrease from the 2012 total of $49 million, mainly due to a decrease in gains on sales of securities. Net Interest Income Net interest for 2013 was $136 million compared to $133 million in 2012. Interest expense as a percentage of total interest income declined to 14.8% in 2013, compared to 19.3% in 2012. Capital Strength Total shareholders’ equity at December 31, 2013 was $547 million, representing 10.54% of year-end assets. This favorably compares to $541 million at December 31, 2012, representing 10.07% of year- end assets. At year-end 2013, Bank Leumi USA’s Tier 1 capital ratio was 11.70%, its total capital ratio was 14.54% and its leverage ratio was 9.94%. Capital ratios continue to be strong and exceed regulatory requirements. LOANS BY INDUSTRY (in millions) A s of December 31, 2013 Real Estate Services, Professional & Health Miscellaneous Textile & Apparel Holding Companies Diamond & Jewelry Wholesale & Import Financing Industry Entertainment Manufacturing Retail 1,173 534 505 290 245 231 203 196 125 125 108 LOANS BY INDUSTRY BA NK LEUMI US A 19 CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION 2013 2012 516,339 $ 4,098 675,834 35,954 3,677,643 35,940 245,322 5,191,130 $ 683,069 4,201 540,853 157,159 3,705,460 21,535 253,035 5,365,312 1,062,679 $ 3,359,349 4,422,028 35,000 - 90,000 96,971 4,643,999 $ 1,082,650 3,463,843 4,546,493 55,000 15,000 90,000 118,318 4,824,811 Capital Stock – $10 Par Value: Authorized, 15,000,000 Shares Outstanding, 12,939,107 Shares $ 129,391 $ Additional Paid-In Capital 150,668 Retained Carnings 291,381 Accumulated Other Comprehensive Loss (24,309) Total Shareholders’ Equity 547,131 Total Liabilities and Shareholders’ Equity $ 5,191,130 $ 129,391 150,668 280,332 (19,890) 540,501 5,365,312 Years Ended December 31 (dollar amounts in thousands) ASSETS Cash and Due from Banks $ Time Deposits with Banks Available for Sale Securities Trading Securities Loans, Net Bank Premises and Equipment (net) Other Assets Total Assets $ LIABILITIES Noninterest-Bearing Deposits $ Interest-Bearing Deposits Total Deposits Borrowings from Federal Home Loan Bank Securities Sold Under Repurchase Agreements Long-Term Debt Other Liabilities Total Liabilities $ SHAREHOLDERS’ EQUITY 20 BA NK LEUMI US A CONSOLIDATED STATEMENTS OF NET INCOME AND COMPREHENSIVE INCOME 2013 2012 148,072 $ 9,795 1,394 159,261 $ 151,217 11,815 1,998 165,030 Interest on Deposits $ Interest – Other Total Interest Expense $ 20,340 $ 3,308 23,648 $ 28,284 3,678 31,962 Net Interest Income Less: Provision for Loan Losses Net Interest Income After Provision for Loan Losses $ 135,613 10,838 124,775 $ 133,068 6,770 126,298 25,040 $ 10,437 1,376 1,582 194 3,856 42,485 $ 23,383 9,390 1,927 (3,481) 7,828 10,353 49,400 Salaries $ 50,133 $ Employee Benefits 20,644 Occupancy 15,210 Professional Services 13,943 Equipment 12,007 Data Processing 8,161 Other 27,945 Total Noninterest Expense $ 148,043 $ Income Before Income Taxes 19,217 Income Tax Expense 8,168 Net Income $ 11,049 $ 52,676 21,246 13,233 14,414 9,818 7,719 18,287 137,393 38,305 13,774 24,531 Years Ended December 31 (dollar amounts in thousands) INTEREST INCOME Interest on Loans $ Interest on Securities Interest on Time Deposits with Banks Total Interest Income $ INTEREST EXPENSE NONINTEREST INCOME Commissions $ Fees Cash Surrender Value of Bank Owned Life Insurance Gain (Loss) on Trading Derivatives, Net Gain on Available for Sale Securities, Net Other, Net Total Noninterest Income $ NONINTEREST EXPENSE OTHER COMPREHENSIVE GAIN (LOSS) Unrealized Actuarial Gains on Pension and Other Post-Retirement Benefits, Net of Tax $ Unrealized (Losses) on Securities Comprehensive Income $ 7,242 $ (11,661) 6,630 $ 1,423 (336) 25,618 BA NK LEUMI US A 21 BOARD OF DIRECTORS & SENIOR MANAGEMENT SENIOR MANAGEMENT AVNER MENDELSON President and Chief Executive Officer HILLA ERAN-ZICK Senior Executive Vice President and Deputy Chief Executive Officer NISAN BLUM Executive Vice President Chief Internal Auditor DAFNA DOTHAN Executive Vice President Chief Risk Officer MICHAEL FEGAN Executive Vice President Chief Technology and Operations Officer CHAIM FROMOWITZ Executive Vice President Head of Private Banking ROBERT R. GIORDANO Executive Vice President Chief Investment Officer JOHN P. MCGANN Executive Vice President Chief Administrative Officer JEREMIAH T. MURNANE III Executive Vice President Chief Compliance Officer JOHN SANFRATELLO Executive Vice President Controller JOSEPH A. SCIARILLO Executive Vice President Real Estate Lending STEVEN CALIGOR First Senior Vice President New York Commercial Banking President Bank Leumi Leasing Corporation KATE ETINGER First Senior Vice President Head of Human Resources WENDI G. GLASSMAN First Senior Vice President General Counsel Corporate Secretary MICHAELA KLEIN First Senior Vice President Chief Credit Risk Officer Risk Management SHLOMO MOSSERI First Senior Vice President Deputy Chief Lending Officer YAIR GROSSMAN Senior Vice President Head of PMO BOARD OF DIRECTORS Back row, from left: Front row, from left: CHARLES D. JOHNSTON Former President Morgan Stanley Smith Barney ROBERT M. BUTCHER Business Consultant Chairman of the Risk Management & Investment Committee ROBERT K. LIFTON Chairman and CEO Medis Technologies Ltd. SIMON B. JAWITZ Senior Managing Director Sierra Real Estate THEODORE P. GLUECK President Eastwood Associates, Inc. Chairman of the Loan Committee AVNER MENDELSON President and Chief Executive Officer DAVID BRODET Chairman of the Board Leumi Group Bank Leumi USA GAIL HOFFMAN Treasurer Columbia University STEVEN LAVIN, ESQ. Lavin & Waldon, P.C. Chairman of Executive, Compliance & Strategy Committees ZEEV NAHARI Business Consultant Former CFO and Deputy CEO Leumi Group MICHAEL URKOWITZ Business Consultant Former Executive Vice President J.P. Morgan Chase Chairman of the Audit & Information Technology Committees Not pictured: PROF. DANIEL TSIDDON Deputy CEO Leumi Group GIDEON ALTMAN Head of Loan Division Leumi Group GOVERNANCE The Board of Directors of Bank Leumi USA has adopted and adheres to corporate governance practices that it believes are sound, comply with applicable law and represent best practices. Bank Leumi USA is not a public company; however, following enactment of the Sarbanes-Oxley Act of 2002, the Board and management enhanced bank policies and procedures to meet many of the standards set by the Act and its implementing rules. The Board of Directors consists of thirteen members, nine of whom are independent of management of the Bank under applicable law. In 2012, the Board of Directors appointed Steven Lavin, a director independent of management, as lead director. In this capacity, Mr. Lavin has additional corporate governance responsibilities. Shareholders and other interested parties may communicate with the lead director or the non-management directors as a group by sending communications to the principal office of Bank Leumi USA in care of the Corporate Secretary. The Board of Directors has five standing committees: Executive, Audit, Compliance, Risk Management and Investment and Loan. In addition, the Executive Committee has two subcommittees: Strategy and Information Technology. In 2013, the Executive Committee met five times, the Audit Committee five times, the Compliance Committee four times, the Risk Management and Investment Committee five times and the Loan Committee nineteen times. The Information Technology and Strategy subcommittees each met six times. The Board of Directors met seven times. The Audit Committee has four members. The Board has determined they (1) are “outside directors,” (2) have banking or related financial management expertise, and (3) are financially literate, as required by applicable FDIC rules and regulations. The Audit Committee members are Robert M. Butcher, Gail Hoffman, Steven Lavin and Michael Urkowitz. At least one of the members, Mr. Robert Butcher, qualifies as an “audit committee financial expert” under SEC criteria. The Audit Committee operates pursuant to a charter, last approved in December 2013. The charter gives the Audit Committee the authority and responsibility for the appointment, retention, compensation and oversight of the Bank’s independent auditors. The Committee pre-approves all audit and non-audit services to be performed by the independent auditors. The Audit Committee appointed Ernst & Young LLP as the independent auditors of the Bank after reviewing the firm’s performance and independence from management. The Bank has a Code of Ethics, last approved by the Board of Directors in May 2013. It is applicable to all directors, officers and employees. It is a code of conduct that expresses the Bank’s commitment to promoting (1) honest and ethical conduct; (2) full, fair, accurate and timely reporting; (3) compliance with all applicable laws, rules and regulations by all directors, officers and employees of the Bank; and (4) the prompt internal reporting of violations of the Code of Ethics in accordance with procedures set forth in the Code of Ethics. The Code of Ethics may be viewed on the Bank’s website at www.leumiusa.com. BA NK LEUMI US A 2 3 LEUMI GROUP LOCATIONS NORTH AMERICA UNITED STATES Bank Leumi USA New York Headquarters 579 Fifth Avenue New York, NY 10017 Tel: 1.917.542.2343 1.800.892.5430 E-mail: [email protected] www.leumiusa.com U.S & International Commercial Banking 579 Fifth Avenue New York, NY 10017 Tel: 1.917.542.2343 U.S. Private Banking 579 Fifth Avenue New York, NY 10017 Tel: 1.212.626.1001 International Private Banking One Turnberry Place 19495 Biscayne Blvd., Suite 500 Aventura, FL 33180 Tel: 1.305.918.6960 California Leumi Investment Services Inc. 562 Fifth Avenue New York, NY 10036 Tel: 1.212.407.4345 Silicon Valley 2000 University Ave., Suite 605 Palo Alto, CA 94303 Tel: 1.650.289.2400 Bank Leumi Leasing Corporation 579 Fifth Avenue New York, NY 10017 Tel: 1.212.626.1230 New York Agency 562 Fifth Avenue New York, NY 10036 Tel: 1.212.626.1355 Los Angeles 555 W. Fifth St., 33rd Floor Los Angeles, CA 90013 Tel: 1.213.452.8600 CANADA Bank Leumi le-Israel B.M. Québec Montréal 1 Westmount Square, Suite 400 Montréal, Québec H3Z 2P9 Tel: 1.514.931.4457 E-mail: [email protected] Illinois Chicago One N. LaSalle St., Suite 200 Chicago, IL 60602 Tel: 1.312.419.4040 Florida Aventura One Turnberry Place 19495 Biscayne Blvd., Suite 500 Aventura, FL 33180 Tel: 1.305.918.6960 EUROPE ISRAEL Bank Leumi le-Israel B.M. Tel Aviv Headquarters 24–32 Yehuda Halevi Street Tel Aviv 65546 Tel: 972.3.514.8111 http://english.leumi.co.il Leumi Private Banking Division 35 Yehuda Halevi Street Tel Aviv 65546 Tel: 972.3.514.3313 E-mail: [email protected] Leumi Private Banking Centers for International Clients Tel Aviv Dizengoff Top Tower, 17th Floor 55 Dizengoff Street Tel Aviv 64332 Tel: 972.3.621.7333 Dizengoff Top Tower, 23rd Floor 55 Dizengoff Street Tel Aviv 64332 Tel: 972.3.621.7444 Jerusalem 19 King David Street Jerusalem 94101 Tel: 972.2.620.1811 Leumi Subsidiaries Leumi Representative Offices Leumi Partners Ltd. 5 Azrieli Center (Square Tower) 36th Floor Tel Aviv 67025 Tel: 972.3.514.1212 www.leumipartners.com Leumi USA Representative Office Ackerstein Towers 11 Hamenofim Street P.O. Box 2148 Herzliya Pituach, Israel 46120 Tel: 972.9.971.5632 E-mail: [email protected] The Bank Leumi le-Israel Trust Company Ltd. 8 Rothschild Boulevard Tel Aviv 66881 Tel: 972.3.517.0777 Leumi Switzerland Representative Office Beit Nolton, 14 Shenkar Street P.O.B. 2134, Herzliya Pituach 46120 Tel: 972.9.955.9571 E-mail: [email protected] Leumi Luxembourg Representative Office 9 Yehuda Halevi Street Tel Aviv 6513515 Tel: 972.774.3283 E-mail: [email protected] 24 BA NK LEUMI US A EUROPE (CONT.) UNITED KINGDOM Bank Leumi (UK) plc London 20 Stratford Place London W1C 1BG Tel: 44.20.7907.8000 E-mail: [email protected] www.bankleumi.co.uk Bank Leumi UK is authorized by the Prudential Conduct Authority and regulated by The Financial Conduct Authority and the Prudential Regulation Authority. North of England Representative Mr. Steve Cooper 5 Carrwood Park Selby Road, Leeds West Yorkshire LS15 4LG Tel: 44.7771.522.907 E-mail: [email protected] Channel Islands Subsidiaries Bank Leumi (Jersey) Limited P.O. Box 510, 2 Hill Street St. Helier, Jersey JE4 5TR Channel Islands Tel: 44.1534.702.525 E-mail: [email protected] www.leumijersey.com Bank Leumi (Jersey) Limited is regulated by The Jersey Financial Services Commission. Leumi Overseas Trust Corporation Ltd. P.O. Box 510, 2 Hill Street St. Helier, Jersey JE4 5TR Channel Islands Tel: 44.1534.702.500 E-mail: [email protected] www.leumijersey.com Leumi Overseas Trust Corporation Limited is regulated by The Jersey Financial Services Commission. Leumi ABL Limited Pacific House, 126 Dyke Road Brighton East Sussex BN1 3TE Tel: 44.1273.716.200 E-mail: [email protected] www.leumiabl.co.uk SWITZERLAND ROMANIA Leumi Private Bank Ltd. Bank Leumi Romania S.A. Zürich Head Office Dianastrasse 5, CH-8022 Zurich Tel: 41.58.207.9111 E-mail: [email protected] www.leumi.ch Head Office B-dul Aviatorilor nr. 45, Sector 1 Bucharest Tel: 40.21.206.7075 E-mail: [email protected] www.leumi.ro Geneva 1 rue de la Tour-de-I’Ile, CH-1211 Geneva Tel: 41.58.207.3555 E-mail: [email protected] LUXEMBOURG Bank Leumi (Luxembourg) S.A. Head Office 6D, Route de Trèves L-2633 Senningerberg Luxembourg Tel: 352.346.390 E-mail: [email protected] www.bankleumi.lu LATIN AMERICA URUGUAY Leumi (Latin America) S.A. CONCEPT/DESIGN: SUKA, NY / SUKACREATIVE.COM Montevideo Edificio World Trade Center Luis A. de Herrera 1248 Torre A, Piso 10, Montevideo Tel: 598.2.628.5838 E-mail: [email protected] www.leumi.com.uy Punta del Este Avenida Gorlero, Calle 28 Edif. Torre de las Américas Local 006, Punta del Este Tel: 598.42.444.303 E-mail: [email protected] ASIA CHINA Bank Leumi Shanghai Shanghai Aurora Building F/11, Unit 1115 99 Fucheng Road Pudong New Area Shanghai 200120m Tel: +86.21.6058.9213 E-mail: [email protected] [email protected] MEXICO Bank Leumi le-Israel B.M. Mexico City Fuente de Pirámides 1-305 Lomas de Tecamachalco 53950 Naucalpan Edo. de México Tel: 52.555.294.6155 E-mail: [email protected] ©2014 Bank Leumi USA