* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download The Demand for Domestic Goods and Net Exports

Survey

Document related concepts

Transcript

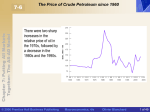

CHAPTER 19 CHAPTER19 The Goods Market in an Open Economy Prepared by: Fernando Quijano and Yvonn Quijano © 2006 Prentice Hall Business Publishing Macroeconomics, 4/e Olivier Blanchard Chapter 19: The Goods Market in an Open Economy 19-1 The IS Relation in the Open Economy Now we must be able to distinguish between the domestic demand for goods and the demand for domestic goods. Some domestic demand falls on foreign goods, and some of the demand for domestic goods comes from foreigners. © 2006 Prentice Hall Business Publishing Macroeconomics, 4/e Olivier Blanchard 2 of 32 Chapter 19: The Goods Market in an Open Economy The Demand for Domestic Goods In an open economy, the demand for domestic goods is given by: Z C I G IM/ X Until now, we have only looked at C + I + G. But now we have to make two adjustments: First, we must subtract imports. Second, we must add imports. © 2006 Prentice Hall Business Publishing Macroeconomics, 4/e Olivier Blanchard 3 of 32 Chapter 19: The Goods Market in an Open Economy The Determinants of C, I, and G Domestic Demand: C I G C(Y T ) I (Y , r ) G ( ) ( , ) The real exchange rate affects the composition of consumption and investment, but not the overall level of these aggregates. © 2006 Prentice Hall Business Publishing Macroeconomics, 4/e Olivier Blanchard 4 of 32 Chapter 19: The Goods Market in an Open Economy The Determinants of Imports A higher real exchange rate leads to higher imports, thus: IM IM (Y , ) ( , ) An increase in domestic income, Y, leads to an increase in imports. An increase in the real exchange rate, , leads to an increase in imports, IM. © 2006 Prentice Hall Business Publishing Macroeconomics, 4/e Olivier Blanchard 5 of 32 Chapter 19: The Goods Market in an Open Economy The Determinants of Exports Let Y* denote foreign income, thus for exports we write: X X (Y * , ) ( , ) An increase in foreign income, Y*, leads to an increase in exports. An increase in the real exchange rate, , leads to a decrease in exports. © 2006 Prentice Hall Business Publishing Macroeconomics, 4/e Olivier Blanchard 6 of 32 Chapter 19: The Goods Market in an Open Economy Putting the Components Together Figure 19 - 1 The Demand for Domestic Goods and Net Exports The domestic demand for goods is an increasing function of income (output). (Panel a) The demand for domestic goods is obtained by subtracting the value of imports from domestic demand, and then adding exports. (Panel b) © 2006 Prentice Hall Business Publishing Macroeconomics, 4/e Olivier Blanchard 7 of 32 Chapter 19: The Goods Market in an Open Economy The Demand for Domestic Goods Figure 19 - 1 The Demand for Domestic Goods and Net Exports The demand for domestic goods is obtained by subtracting the value of imports from domestic demand, and then adding exports. (Panel c) The trade balance is a decreasing function of output. (Panel d) © 2006 Prentice Hall Business Publishing Macroeconomics, 4/e Olivier Blanchard 8 of 32 Chapter 19: The Goods Market in an Open Economy The Demand for Domestic Goods We can establish two facts about line AA, which will be useful later in the chapter: AA is flatter than DD. As income increases, the domestic demand for domestic goods increases less than total domestic demand. As long as some of the additional demand falls on domestic goods, AA has a positive slope. YTB is the value of output that corresponds to a trade balance. © 2006 Prentice Hall Business Publishing Macroeconomics, 4/e Olivier Blanchard 9 of 32 Chapter 19: The Goods Market in an Open Economy 19-2 Equilibrium Output and the Trade Balance The goods market is in equilibrium when domestic output equals the demand – both domestic and foreign – for domestic goods: Y Z Collecting the relations we derived for the components of the demand for domestic goods, Z, we get: Y C(Y T ) I (Y , r ) G M (Y , ) X (Y , ) © 2006 Prentice Hall Business Publishing * Macroeconomics, 4/e Olivier Blanchard 10 of 32 Chapter 19: The Goods Market in an Open Economy Equilibrium Output and the Trade Balance Figure 19 - 2 Equilibrium Output and Net Exports The goods market is in equilibrium when domestic output is equal to the demand for domestic goods. At the equilibrium level of output, the trade balance may show a deficit or a surplus. © 2006 Prentice Hall Business Publishing Macroeconomics, 4/e Olivier Blanchard 11 of 32 Chapter 19: The Goods Market in an Open Economy 19-3 Increases in Demand, Domestic or Foreign Figure 19 - 3 The Effects of an Increase in Government Spending An increase in government spending leads to an increase in output and to a trade deficit. © 2006 Prentice Hall Business Publishing Macroeconomics, 4/e Olivier Blanchard 12 of 32 Chapter 19: The Goods Market in an Open Economy Increases in Demand, Domestic or Foreign There are two important difference you should note between open and closed economies: There is now an effect on the trade balance. The increase in output from Y to Y’ leads to a trade deficit equal to BC. Imports go up, and exports do not change. Government spending on output is smaller than it would be in a closed economy. This means the multiplier is smaller in the open economy. © 2006 Prentice Hall Business Publishing Macroeconomics, 4/e Olivier Blanchard 13 of 32 Chapter 19: The Goods Market in an Open Economy Increases in Foreign Demand Figure 19 - 4 The Effects of an Increase in Foreign Demand An increase in foreign demand leads to an increase in output and to a trade surplus. © 2006 Prentice Hall Business Publishing Macroeconomics, 4/e Olivier Blanchard 14 of 32 Chapter 19: The Goods Market in an Open Economy Increases in Foreign Demand The direct effect of the increase in foreign output is an increase in U.S. exports by some amount, which we shall denote by X : For a given level of output, this increase in exports leads to an increase in the demand for U.S. goods by X , so the line shifts by X from ZZ to ZZ’. For a given level of output, net exports go up by X . So the line showing net exports as a function of output in Panel (b) also shifts up by X , from NX to NX’. © 2006 Prentice Hall Business Publishing Macroeconomics, 4/e Olivier Blanchard 15 of 32 Chapter 19: The Goods Market in an Open Economy Fiscal Policy Revisited We have derived two basic results so far: An increase in domestic demand leads to an increase in domestic output, but leads also to a deterioration of the trade balance. An increase in foreign demand leads to an increase in domestic output and an improvement in the trade balance. © 2006 Prentice Hall Business Publishing Macroeconomics, 4/e Olivier Blanchard 16 of 32 Chapter 19: The Goods Market in an Open Economy Fiscal Policy Revisited The so-called G-7 – the seven major countries of the world – meet regularly to discuss their economic situation; the communiqué at the end of the meeting rarely fails to mention coordination. The fact is that there is very limited macro-coordination among countries. Here’s why: Some countries might have to do more than others and may not want to do so. Countries have a strong incentive to promise to coordinate, and then not deliver on that promise. © 2006 Prentice Hall Business Publishing Macroeconomics, 4/e Olivier Blanchard 17 of 32 Chapter 19: The Goods Market in an Open Economy 19-4 Depreciation, the Trade Balance, and Output Recall that the real exchange rate is given by : EP * P In words: The real exchange rate, , is equal to the nominal exchange rate, E, times the domestic price level, P, divided by the foreign price level, P*. © 2006 Prentice Hall Business Publishing Macroeconomics, 4/e Olivier Blanchard 18 of 32 Chapter 19: The Goods Market in an Open Economy Depreciation and the Trade Balance: The Marshall-Lerner Condition NX X (Y , ) IM (Y , )/ As the real exchange rate enters the right side of the equation in three places, this makes it clear that the real depreciation affects the trade balance through three separate channels: Exports, X, increase. Imports, IM, decrease The relative price of foreign goods in terms of domestic goods, 1/ , increases. © 2006 Prentice Hall Business Publishing Macroeconomics, 4/e Olivier Blanchard 19 of 32 Chapter 19: The Goods Market in an Open Economy Depreciation and the Trade Balance: The Marshall-Lerner Condition The Marshall-Lerner condition is the condition under which a real depreciation (an increase in ) leads to an increase in net exports. The French Socialist Expansion: 1981-1983 Table 1 Table 1 summarizes the macroeconomic results of the policy of the Socialist party in the early 1980s geared at improving the economy. © 2006 Prentice Hall Business Publishing Macroeconomic Aggregates, France: 1980-1983 1980 1981 1982 1983 GDP growth (%) 1.6 1.2 2.5 0.7 EU growth (%) 1.4 0.2 0.7 1.6 Budget Surplus 0.0 -1.9 -2.8 -3.2 Current Account Surplus -0.6 -0.8 -2.2 -0.9 Macroeconomics, 4/e Olivier Blanchard 20 of 32 Chapter 19: The Goods Market in an Open Economy The Effects of a Depreciation Figure 19 – 4 again Let’s summarize: The depreciation leads to a shift in demand, both foreign and domestic, toward domestic goods. This shift in demand leads, in turn, to both an increase in domestic output and an improvement in the trade balance. © 2006 Prentice Hall Business Publishing Macroeconomics, 4/e Olivier Blanchard 21 of 32 Chapter 19: The Goods Market in an Open Economy Combining Exchange-Rate and Fiscal Policies Figure 19 - 5 Reducing the Trade Deficit Without Changing Output To reduce the trade deficit without changing output, the government must both achieve a depreciation and decrease government spending. © 2006 Prentice Hall Business Publishing Macroeconomics, 4/e Olivier Blanchard 22 of 32 Chapter 19: The Goods Market in an Open Economy Combining Exchange-Rate and Fiscal Policies If the government wants to eliminate the trade deficit without changing output, it must do two things: It must achieve a depreciation sufficient to eliminate the trade deficit at the initial level of output. The government must reduce government spending. Table 19-1 Exchange-Rate and Fiscal Policy Combinations Initial Conditions Trade Surplus Low output ?G G? High output G? ?G © 2006 Prentice Hall Business Publishing Trade Deficit Macroeconomics, 4/e Olivier Blanchard 23 of 32 Chapter 19: The Goods Market in an Open Economy 19-5 Looking at Dynamics: The J-Curve A depreciation may lead to an initial deterioration of the trade balance; increases, but neither X nor M adjusts very much initially. ( X IM ) Eventually, exports and imports respond, and depreciation leads to an improvement of the trade balance. ( X , IM , ) ( X IM ) © 2006 Prentice Hall Business Publishing Macroeconomics, 4/e Olivier Blanchard 24 of 32 Chapter 19: The Goods Market in an Open Economy Looking at Dynamics: The J-Curve Figure 19 - 6 The J-Curve A real depreciation leads initially to a deterioration, then to an improvement of the trade balance. © 2006 Prentice Hall Business Publishing Macroeconomics, 4/e Olivier Blanchard 25 of 32 Chapter 19: The Goods Market in an Open Economy The U.S. Trade Deficit: Origins and Implications Figure 1 U.S. Exports and Imports as Ratios to U.S. GDP since 1990 © 2006 Prentice Hall Business Publishing Macroeconomics, 4/e Olivier Blanchard 26 of 32 Chapter 19: The Goods Market in an Open Economy The U.S. Trade Deficit: Origins and Implications Table 1 Average Annual Growth Rates in the United States, Japan, the European Union, and the World, 1991-2003 (percent per Year) 1991-1995 1996-2000 2001-2003 United States 2.5 4.1 2.9 Japan 1.5 1.5 0.9 European Union 2.1 2.6 1.9 World (excluding U.S.) 3.2 2.8 1.5 © 2006 Prentice Hall Business Publishing Macroeconomics, 4/e Olivier Blanchard 27 of 32 Chapter 19: The Goods Market in an Open Economy The U.S. Trade Deficit: Origins and Implications Figure 2 The Multilateral Real Exchange Rate since 1990 © 2006 Prentice Hall Business Publishing Macroeconomics, 4/e Olivier Blanchard 28 of 32 Chapter 19: The Goods Market in an Open Economy Looking at Dynamics: The J-Curve Figure 19 - 7 The Real Exchange Rate and the Ratio of Net Exports to GDP: United States, 1980-1990 The real appreciation and the depreciation of the dollar in the 1980s were reflected in increasing, then decreasing trade deficits. There were, however, substantial lags in the effects of the real exchange rate on the trade balance. © 2006 Prentice Hall Business Publishing Macroeconomics, 4/e Olivier Blanchard 29 of 32 Chapter 19: The Goods Market in an Open Economy 19-6 Saving, Investment, and the Trade Balance The alternative way of looking at equilibrium from the condition that investment equals saving has an important meaning: Y C I G IM/ X S Y C T S I G T IM/ X NX X IM/ NX S (T G) I © 2006 Prentice Hall Business Publishing Macroeconomics, 4/e Olivier Blanchard 30 of 32 Chapter 19: The Goods Market in an Open Economy Saving, Investment, and the Trade Balance NX S (T G) I From the equation above, we conclude: An increase in investment must be reflected in either an increase in private saving or public saving, or in a deterioration of the trade balance. An increase in the budget deficit must be reflected in an increase in either private saving, or a decrease in investment, or a deterioration of the trade balance. A country with a high saving rate must have either a high investment rate or a large trade surplus. © 2006 Prentice Hall Business Publishing Macroeconomics, 4/e Olivier Blanchard 31 of 32 Chapter 19: The Goods Market in an Open Economy Key Terms demand for domestic goods domestic demand for goods coordination, G-7 © 2006 Prentice Hall Business Publishing Marshall-Lerner condition J-curve Macroeconomics, 4/e Olivier Blanchard 32 of 32