* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Real Estate

Private equity wikipedia , lookup

Financialization wikipedia , lookup

Investor-state dispute settlement wikipedia , lookup

United States housing bubble wikipedia , lookup

International investment agreement wikipedia , lookup

Private equity secondary market wikipedia , lookup

Syndicated loan wikipedia , lookup

Early history of private equity wikipedia , lookup

Real estate broker wikipedia , lookup

Investment management wikipedia , lookup

Stock trader wikipedia , lookup

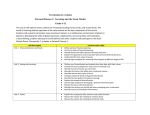

• I. Three main theories have been developed to evaluate possible investment strategies: • A. The Fundamental Theory • 1. This theory assumes that a stock’s real value is determined by looking at the company’s future earnings • 2. If earnings are expected to increase, then the stocks price should go up and vice versa • 3. Fundamental Theorist look at; • • • • The financial strength of the company The type of industry the company is in The company’s new products The state of the economy • B. The Technical Theory Is based on the premise that a stock’s value is determined by forces in the stock market itself 1.Technical Theorist look at factors such as; - The number of stocks bought or sold over a specific period of time - or the total amount of shares traded • C. The Efficient Market Theory also known as the Random Walk Theory • 1. This theory is based on the premise that stock price movements are purely random • 2. Efficient Market Theorist believe that investors have looked at all pertinent information on a stock as they make their decisions • 3. These Theorists believe that it is impossible for an investor to out perform the stock market over a long period of time • A. Mutual Fund is an investment tool where a group of investors pool their money together to invest in a diversified set of investments • 1. Why do people invest in mutual funds • a. Diversification offers investors a cost-effective means of purchasing a diversified portfolio • b. Professional Management have Professionals who manage the funds • c. Liquidity easy to sell; can get your money quickly, usually within days • d. Cost It takes as little as $1000 to invest in most mutual funds • 2. Types of Mutual Funds there are 3 broad groupings of mutual funds • a. Money Market Funds are the least risky of the mutual funds because they invest in short term obligations, they offer a higher interest rate than a regular savings account and are very liquid • b. Bond Mutual Funds are mutual funds consists solely of bonds • c. Stock Mutual Funds (Equity Funds) are mutual funds that invest stocks • I. Real Estate- Includes land, all the things that are attached to it, or grow on it, such as buildings, fences, crops, etc. It also includes natural resources found on the land such as water, trees and minerals, etc. • A. Real Estate Investments can be direct or indirect • 1. The owner of a direct real estate investment holds the legal title to the property he/she owns • 2. Direct investments include single-family houses, condominiums, duplexes, apartments, land and commercial property (land and buildings that produce rental income) • 3. Indirect Real Estate Investments is an investment in which a trustee is appointed to hold legal title to the property on behalf of an investor or group of investors • a. Indirect investments include real estate syndicates, real estate investment trusts, high risk mortgages and participation certificates • 1. Real Estate Syndicates consists of a group of individuals or business firms that invest in real estate • a. A Real Estate Syndicate typically consists of Corporations, LLC’s or Full/limited Partnerships • b. It is simply the pooling of money from many investors and investing the money in commercial real estate projects • 2. Real Estate Investment Trusts (REITS) is like a mutual fund, where combined money from various investors are combined to purchase real estate, new construction or mortgage loans (loans to buy residential or commercial property) • a. They invest in or own real estate • b. They lend money for mortgages to owners of real estate or purchase existing mortgages • c. Their revenues are earned primarily by the interest they earn on mortgages • 3. High-Risk Mortgages are investments some investors accept in exchange for high, possible profits • a. These investors are willing to take risks that financial institutions, such as banks as savings and loans are not willing to take on • b. The upside is if the demand for the property increases the investor will make a profit, if demand is low, the investor could lose some or all of their investment • 4. Participation Certificates is an in investment in a group of mortgages that have been purchased by a gov’t. agency • a. Because it’s a group of different mortgages it’s considered a mutual fund • b. These certificates can be purchased from various federal agencies (eg. Federal National Mortgage Association (Fannie Mae); Federal Home Loan Mortgage Corporation (Freddie Mac) etc. • A. Advantages of Real Estate Investments • 1. Easy Entry by making an indirect investment in a real estate syndicate you can easily become a part owner of an apartment building or a shopping center • b. The minimum requirement for the purchase of commercial property is normally a million dollars or more, however by investing with others your investment could be considerably lower • c. Limited Financial Liability an indirect investment in a real estate syndicate allows you to be a limited partner, meaning you’re not liable for losses beyond your original investment; this is advantageous if the syndicate is investing in a risky venture • B. Disadvantages of Real Estate Investments • 1. Illiquidity real estate is an illiquid investment, meaning it can’t be converted into cash quickly • 2. Declining property values meaning when interest rates fall, or if the economy is in a decline, the value of real estate investments will decline • 3. Lack of diversification because real estate is an expensive many investors can afford only one or two properties • II. Precious Metals, Gems and Collectibles • A. Precious Metals include valuable ores such as gold, platinum and silver • 1. Many people invest in precious metals as a hedge (protection) against inflation • 2. The prices of these precious metals rise when people believe that war, political unrest, or inflation may just around the corner • 3. Palladium and Rhodium, lesser-known precious metals, are also popular investments, because they have industrial uses, especially in the automobile industry • • B. Precious Gems are rough mineral deposits that are dug from the earth by miners, and then cut and shaped into brilliant jewelry • a. These gems include diamonds, sapphires, rubies and emeralds • 1. They appeal to investors because of their small size, ease of storage, durability, and their potential as a protection against inflation • 2. The investment risk is the great fluctuation in prices, which are influenced by global, economic and political forces • C. Collectibles include rare coins, works of art, antiques, stamps, rare books, comic books, sports memorabilia and other items that appeal to collectors and investors • 1. Collectibles offer collectors and investors both pleasure and the opportunity for profit • 2. Many collectors have been surprised to discover that items that they bought for their own enjoyment have increased greatly in value while they owned them