* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Theories of Economic Growth

Survey

Document related concepts

Transcript

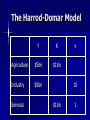

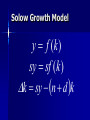

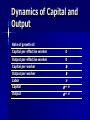

Chapter 4 Theories of Economic Growth Five Equations Aggregate production function Saving function Saving = Investment Relation between new investment and change in capital stock Growth rate of labor Aggregate production function Y F ( K , L) What is exactly the shape of the function F ? Where do K and L come from? Saving function S s Y Gross savings (% of GDP), 2005 Chile China Sierra Leone Bolivia 18.9 50.4 7.6 20.4 Nigeria India 30.5 32.7 Saving and Investment SI Assume no trade and no government Or assume that SS private S gov S foreign with “foreign saving” = capital inflows New investment and change in capital stock Kt 1 Kt K I dK d = rate of depreciation I $2bn $2bn d 3% 7% Kt $30bn $30bn K Kt+1 New investment and change in capital stock K I dK S dK sY dK Y $10bn $10bn s 20% 7% I d 3% 7% Kt $30bn $30bn K Labor Force Growth Lt 1 Lt L nL n = rate of population growth n 2% 4% Lt 1mn 1mn L Lt+1 The Harrod-Domar Model R. F. Harrod, The Economic Journal, Vol. 49, No. 193. (Mar., 1939), pp. 14-33. Econometric a, Vol. 14, No. 2. (Apr., 1946), pp. 137-147 Fixed Coefficient Production Function Isoquants – Combination of inputs that produce equal amounts of output Fixed coefficient production function – Assume capital and labor have to be used in constant proportions (i.e., 10 people for every $1m of capital). – What happens if you raise K, keeping L constant? Y=200,000*$50=$10,000,000 K/Y=$20,000,000/$10,000,000 =2 Fixed Coefficient Production Function Fixed coefficient production function – K/L is constant if production is efficient – Constant returns to scale K/Y and L/Y are constant The Harrod-Domar Model Assume labor is unemployed Capital is the binding constraint K Y v K v Y K ICOR v Y The Harrod-Domar Model Capital-output ratio – Capital intensity of production process and of product – Efficiency with which capital is used Capital-output ratio versus Incremental Capital-Output Ratio – Assume average K/Y = ICOR The Harrod-Domar Model Y K Agriculture $5bn $1bn Industry $5bn Services v 10 $1bn 1 The Harrod-Domar Model Y K v Y K K v g Y Y Yv The Harrod-Domar Model g Y Y K Yv Yv K K sY dK sY dK s g d Yv v The Harrod-Domar Model s g d v Capital created by investment is the main determinant of growth. Saving makes investment possible The Harrod-Domar Model s g d v g d v 3% 5% 3% 5% 5% 27% 5% 24.4 (same as above) s The Harrod-Domar Model Consequences – Saving as crucial for growth – Knife-edge dynamics If n>g (g=s/v-d), then chronic unemployment If n<g , then chronic labor shortages, capital becomes idle – No endogenous process to bring the economy to equilibrium The Harrod-Domar Model Strengths – Simplicity – Few data requirements – Short-term accuracy – Saving as necessary The Harrod-Domar Model Weaknesses – Saving as sufficient Investment is uncertain, subject to inefficiency, etc. – Rigid assumption of fixed proportions No diminishing returns; no factor substitution No technological change Un-realistic lack of response of v to policy, changes in income levels, etc. – Development should raise ICOR endogenously The Harrod-Domar Model Still widely used to calculate financing gaps s g d – How much foreign assistance to v achieve a particular rate of output growth? d v sprivate spublic sforeign g 5% 3% 10% -3% 8% 5% 3% 10% -3% 2% 5% 3% 10% -3% 5% “Technical Change and the Aggregate Production Function,” Review of Economics and Statistics 39 (August 1957), 312-20. Solow Growth Model Drop fixed coefficients Neoclassical production function – Factor substitution, depending on factor availability, marginal product, and prices Y=200,000*$50=$10,000,000 K/Y=$24,000,000/$10,000,000 =2.4 $24 $20 $17 Y=200,000*$50=$10,000,000 K/Y=$20,000,000/$10,000,000 =2 Y=200,000*$50=$10,000,000 K/Y=$17,000,000/$10,000,000 =1.7 Solow Growth Model Because factors can be substituted for each other, policy (and the market) can encourage the use of abundant inputs by making scarce resources more expensive. Solow Growth Model Y F ( K , L) Y K F L L y f (k ) Constant returns to scale Diminishing returns to capital Solow Growth Model K sY dK The capital stock grows as more is saved out of output… and declines as more capital depreciates. Solow Growth Model k K L k K L k sY dK n k K k sY n d k K sY k k n d k K sY k n d k L k sy (n d )k Solow Growth Model K k sy n d k L The amount of capital per worker – grows as more is saved out of output… – declines as more capital depreciates… – and declines as population grows faster Solow Growth Model k sy n d k Capital deepening Saving - Required for capital widening Solow Growth Model y f (k ) sy sf (k ) k sy n d k Steady state change in k = Solow Growth Model k sy n d k In the steady state, k=0 sy* sf k * n d k * n d k * f k * s Getting a Sense of the Magnitudes Assume the production function is: Y K L Output per worker is: Y K L K L K L L L L L That is, the first relation of the model (capital/worker determines output) is Y K y k L L Getting a Sense of the Magnitudes And the second relation of the model (output determines capital accumulation) is k sy d nk Then, k s k d n k Getting a Sense of the Magnitudes k s k d n k In steady state, s k d n k the left side equals zero: Squaring both sides, s k d nk 2 Dividing by k and rearranging, 2 s k* d n 2 Getting a Sense of the Magnitudes 2 s k* d n The steady state capital per worker is equal to the square of the ratio of the saving rate to the depreciation rate + population growth rate. Steady-State Output per worker is given by: 2 s s y* k * d n d n Getting a Sense of the Magnitudes s y* d n Steady-state output per worker is equal to the ratio of the saving rate to the depreciation rate+population growth rate. A higher saving rate, a lower depreciation rate, and a lower population growth rate lead to higher steady-state capital per worker and higher steady-state output per worker. Solow Growth Model At the steady state –y –k –Y –K stays constant stays constant grows at the rate n grows at the rate n Solow Growth Model 1. 2. 3. Ceteris paribus, poor countries have much larger growth potential. Ceteris paribus, growth will slow as a country gets richer Ceteris paribus, poor and rich countries will converge. Solow Growth Model output / worker, y Depreciation / worker, dk* Output / worker, f(k*) Saving / worker, sf(k*) kpoor krich Steady State capital / worker, k* Effects of Changes in the Saving Rate Higher saving rate leads to more investment… Capital accumulates faster… But eventually diminishing returns lead to an end to growth. (at a higher steady state level of output) Effects of Changes in the Population Growth Rate Higher population growth rate requires more capital for widening… for a given sy, So k and y decline to a lower steady state Y* s y* L d n But because L is growing faster, Y* must grow faster to keep y* constant. Same, different Different steady states will result from – Different production functions. Before we found that if Y K L then 2 s and y* s k* d n d n Likewise, if Y K 1/ 3 then s k* d n 3/ 2 L 2 / 3 and y* 1/ 2 s d n Same, different Different steady states will result from – Different levels of saving, depreciation, and population growth s y* d n Same, different Two countries may have the same level of output, but different growth rates if they have different steady states k s1 y n1 d1 k k s2 y n2 d2 k Technological change Y F K , T L Technology “T” augments labor. Technological improvements increases output … without adding workers. Requirements for capital widening don’t increase. Technological change allows output per worker to increase. Technological change Y F K , T L Assume technology grows at a constant rate, q. If q = 1 and n = 2, Population growth is 2% but “effective population growth” is 3%. keffective syeffective n d q keffective Dynamics of Capital and Output Rate of growth of: Capital per effective worker 0 Output per effective worker 0 Capital per worker q q n Output per worker Labor Capital Output q+n q+n The Solow Growth Model Strengths – More flexibility – Emphasizes role of saving and technological change – Emphasizes transition between current output and steady-state output The Solow Growth Model Weaknesses: does not explain source of – Technological growth – The shape of the production function – Saving rate; population growth rate; depreciation rate The Solow Growth Model Productivity is key and related to – economic and political stability; – health and education; – governance and institutions; – trade and openness; – geography. Two-Sector Models Two-Sector Models Captures key element of development: rise in share of industry. Two-Sector Models Diminishing returns to labor (keeping land fixed) Labor surplus: marginal worker has marginal product = 0 Agricultural wage = Average Product – Hence Wage > MPL Wage: Industry must pay at least this to farm workers to get them to switch As people leave agriculture, farm output doesn’t fall for a while, but later it starts to fall … Direction of increase in labor input in industry As people leave agriculture, farm marginal product doesn’t change for a while, but later it starts to rise … Direction of increase in labor input in agriculture Direction of increase in labor input in industry As people leave agriculture and join industry, farm marginal product doesn’t change for a while, keeping farm and industry wages constant. Later, as farm output falls more and farm MP rises, wages begin to rise for farmers and for industry workers. Two-Sector Model Capital-owners reinvest their profits and accumulate capital Capital accumulation in industry allows for more employment (higher MPL in industry). More labor can be hired at a constant wage because there’s surplus labor in the rural sector. – This keeps industrial profits going As capital accumulates, labor shifts from agriculture to industry. Two-Sector Model Eventually, there’s no surplus labor, labor supply becomes upward sloping – Wages begin to rise – Food prices begin to rise – The economy has developed Two-Sector Model and Population Growth As population grows, – More workers are added to the labor surplus – Same food is divided among more people – Industrial wages fall – In this model, population growth is undoubtedly bad. Neo-Classical Two-Sector Model Suppose there is no surplus labor – Then any transfer of labor to industry raises wages. – Agricultural productivity must grow fast so that higher wages don’t translate into higher prices, chocking off industrial profits and growth. – Population growth raises farm output (there’s no point of MPL=0), so it may be good. Endogenous Growth Models New Growth Theory: Endogenous Growth Motivation for the new growth theory – Neoclassical theory predicts extremely high rates of return in low-capital countries. But it’s not so. – Maybe growth “generates itself”, i.e., it is endogenous: poor countries generate little growth, not because of outside forces but because of internal (dis)incentives. New Growth Theory: Endogenous Growth New growth theory – Discards diminishing returns: – Accumulation of HUMAN capital offsets diminishing returns to capital. Human capital accumulation responds to incentives. – There can be increasing returns due to externalities. One person’s knowledge spills over to another person, leading to increasing returns. This may reduce incentives to acquire skills. – Technology is no longer essential in explaining the Solow Residual. New Growth Theory: Endogenous Growth New growth theory – Education and physical capital are complementary: No diminishing returns. – There’s sustained long-term growth; – Education and Capital accumulation are important; – There’s no convergence; Lack of complementary inputs (education, infrastructure, R&D) leads to low rates of return to capital and therefore low capital accumulation. New Growth Theory: Endogenous Growth New growth theory – Externalities imply that the private returns to education are much lower than the social returns. – Governments can generate growth by investing in infrastructure or by funding knowledge-intensive industries. – The key is to generate spillovers that will make production more profitable. New Growth Theory: Endogenous Growth For rich countries, growth may be selfgenerating because of externalities in the industry of Research and Development (New Growth Theory applies). But poor countries can grow without big R&D departments, rather by appropriating technology from rich countries (Solow Model applies). Coordination Failures Underdevelopment as a Coordination Failure Coordination failures occur when agents’ inability to coordinate their actions leads to an outcome (an equilibrium) that makes all agents worse off compared to another equilibrium. In development, many factors must be present and effective at the same time, so there’s need for coordination. Complementarities depend on networks, where results depend on other people’s actions. Underdevelopment as a Coordination Failure Government has a role in coordinating the acquisition of skills and investment in production processes that will use those skills. Government can both help and hinder development, because a one-time choice can put the economy in either the good or the bad equilibrium. Underdevelopment as a Coordination Failure Suppose farmers are trying to choose what to produce. If they choose one product, a middleman will arise. – Middlemen are necessary because they acquire information and they guarantee the quality of the product. – A quality guarantee allows for sales to the city. But if everyone produces something different, no middleman arises and production is low. Communication, continued leadership, and knowledge of key agents are essential. Multiple Equilibria: A Diagrammatic Approach Generally, these models can be diagrammed by graphing an S-shaped function and the 45º line. The privately rational decision is on the vertical axis; the expected decision by other agents is on the vertical axis. In this type of situation, private actions by one agent only make sense if other agents undertake the appropriate complementary action. Then an equilibrium is found when the privately rational decision is matched by the expected decision by others. Multiple Equilibria: A Diagrammatic Approach For example, an equilibrium is found when the privately rational level of investment is matched by the expected level of investment by others. Suppose a country is considering building a factory to produce keyboards with better design. – The level of investment is to be decided. This will determine the capacity of the factories: to produce 100 or 1,000,000 keyboards per year. Multiple Equilibria: A Diagrammatic Approach Building new-keyboard factories makes sense only if, at the same time, other countries build computer-making factories that will use those keyboards. Other countries are considering building the necessary computer-factories, but only if the keyboards are available. So these actions are complementary, not competitive. Multiple Equilibria: A Diagrammatic Approach If country B expands the capacity of its computer factory, country A adjusts its expectations and expands the capacity of its keyboard factory. As country A enlarges the keyboard factory, this action feeds back into computer-builders, who build larger computer factories. So more keyboards lead to more computers which lead to more keyboards and to more computers and to more… – Some capacity may be installed even without any action by others. The “S” has a positive intercept. Multiple Equilibria: A Diagrammatic Approach If expected C capacity is more than K capacity, K capacity increases. If K capacity is more than expected C capacity, K capacity falls. Equilibrium is found where the capacity of keyboard-factories matches the expected capacity of computer-factories. Does this process converge (i.e., come to a sensible stop) or does it diverge (keep going forever)? Are there multiple equilibria? Stable, Unique Equilibrium Private action 45° The slope of this line is determined by the “feedback” effect of others’ expected actions on private decisions. E Here $1 of others’ investment creates less than $1 of private investment. To the left of E, private investment increases, which changes others’ expectations and actions. This is fed back because others’ actions affect private expectations. Feedback slows down as E is approached. Past E, private investment falls towards E. Expected action by others Unstable, Unique Equilibrium Private action Here $1 of others’ investment creates more than $1 of private investment: there’s increasing E feedback. 45° Below E, private investment decreases. This causes others to reduce their investment by $X, which reduces private investment by more than $X. Negative feedback speeds up as the economy moves away from E. Past E, private investment rises, faster and faster. Expected action by others Multiple Equilibria Equilibria are stable when the function crosses the 45º line from above; and unstable when the function crosses the 45º line from below Kremer’s O-Ring Theory of Economic Development The O-ring model – Modern production requires many activities done well together in order for any of them to amount to high value. – Suppose that in a production process there are n activities. – They can be carried out in a variety of ways, each of which gives a quality q to the outcome. Order the methods by q. Kremer’s O-Ring Theory of Economic Development The O-ring model – Suppose there are different types of workers, each with skills so that they can produce a quality q. – The model shows that… If workers are imperfect substitutes for one another (which is true)… And if workers’ tasks are complementary (which is often true)… – Then high-quality workers will match with other high-quality workers; low-quality workers will also get together. The reason is that production (and therefore wages) are higher if there is this “matching” than if there isn’t. – Then some firms (or countries) may be caught in low-quality (i.e., under-development) traps The O-Ring Production Function: Wage as a Function of Human Capital Quality As average skill increases, wages go up faster than proportionately to one person’s skill – because my productivity depends on other people’s skills. Therefore my incentive to acquire skills depends on whether other people acquire skills at the same time. There are “o-rings”: low-quality parts that can cause a collapse of the whole. Therefore public qualityenhancing programs may be needed. Kremer’s O-Ring Theory of Economic Development Implications of the O-ring theory – Bottlenecks can arise, making the whole collapse. Absolute bottlenecks rarely exist because people can work around low-quality co-workers or industries. One important work-around is international trade: openness leads to growth. – Complicated technologies require high-skill workers. Therefore only firms (and countries) that can afford to get high skill workers will adopt high-value, complicated technologies. Brain drain follows: why people get paid more, for the same skills, when they move. Coordination Failure It’s clear that problems are very deep, and that a series of small failures can lead to huge traps. Some coordination problems can be solved by a onetime fix. – This is an attractive area for public policy because the costs may be small but the benefits, forever, may be large. These models also imply that the destructive potential of government is enormous. – It can lead the economy from a better equilibrium to a worse one. – Similarly for international aid.