* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Macroeconomics Pt.3: Economic Instability A) Business Cycles and

Survey

Document related concepts

Participatory economics wikipedia , lookup

Workers' self-management wikipedia , lookup

Steady-state economy wikipedia , lookup

Non-monetary economy wikipedia , lookup

Full employment wikipedia , lookup

Post–World War II economic expansion wikipedia , lookup

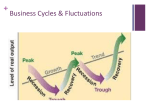

Transcript

Macroeconomics Pt.3: Economic Instability A) Business Cycles and Fluctuations 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Large Economic growth is something that is beneficial to everyone. However, lower or decreases in Economic growth is also a matter of concern. When this happens, businesses lose sales, voters become unhappy, investors get nervous and even the stock market shows its disapproval. Because of this, Economists have developed several elaborate forecasting models & statistical tools to measure the growth or decrease in the performance of the Economy. The first of these are what Economists call Business Fluctuations, which is the rise and fall in an irregular manner of goods that are produced that affects the rate of real GDP. The long-term health of the Economy is measured by Business Cycles, which are regular ups and downs in the Economy that interrupts real economic stability and growth. The two phases of the business cycle are illustrated in Figure A. The first phase is a Recession, which is a period during which real GDP declines for at least two quarters in a row, or six consecutive months. A recession begins when the economy reaches a Peak, which is the point where real GDP reaches the top most point of its growth and stops going up. And a recession ends when the economy reaches a Trough, which is the turnaround point where real GDP stops going down and will start going up. As soon as the recession and the falling down of real GDP end, the economy moves into the second phase of the business cycle called an Expansion, which is a period of recovery from a recession that leads into Economic growth. Expansion continues until the economy reaches a new Peak. When it does, the current business cycle ends and a new one begins. If periods of recessions and expansions did not occur, the economy would follow a steady upward growth path called a Trend Line. As Figure 1 shows that the economy departs from, and then returns to its trend line as it passes through the Business Cycles. If a recession becomes very severe, it may turn into a Depression, which is a state of the economy with large numbers of people out of work, heavy shortages of consumer spending and excess products sitting unsold on store shelves that occurs for a very long time. The Business Cycle 1. 2. 3. 4. 5. 6. 7. 8. Changes in businesses capital expenditures are thought to be one cause of Business Cycles. When the Economy is expanding, businesses expect future sales of their goods to be high, so they invest heavily in new equipment to replace older equipment, more workers, more buildings that can produce new goods. At first, this generates new jobs and more income for workers, but after a while businesses may decide they have expanded enough. If they then decide to cut back on their capital investments, layoff of workers and eventually a recession may result. Another possible cause of business cycles are Innovations, such as a new product or a new way of performing a task. When a business innovates, it often gains an edge on its competitors because the costs of producing its goods go down and /or sales of its goods go up. In either case, this businesses profits increase. If other businesses in the same industry want to stay competitive with this innovative business, then they must copy the innovative businesses new idea. The imitating companies must invest a lot of money to do this, and an investment boom in technology follows. After the innovation takes hold in the industry, further investments are unnecessary and economic activity may slow down. Another possible cause of business cycles is the Federal Reserve System’s policy on interest rates. When “easy loan money” Fed policies are in effect during an Expansion, interest rates are lower and loans on homes and cars are easier to get. Eventually the increased demand for more loans causes interest rates to rise, which in turn discourages new borrowers from taking out loans. As loan borrowing slows down, new cars and homes will not be bought. (We will learn more about the Fed). Another potential cause of business cycles is external shocks, such as increases in oil prices, wars, and international conflict. Most of these shocks leaves negative impacts on consumers and can drive the economy into a downward spiral. 1. 2. 3. 4. 5. 6. Economists use several methods to predict changes in Business Cycles. The leading method that Economists use is the statistical series called the LEI. The Composite Index of Leading Economic Indicators (LEI), is a monthly statistical series that uses a combination of 10 individual numerical indicators to forecast changes in Real GDP and the Economy. A change in a single statistic often indicates a future change in the Business Cycles. For example, if people begin working fewer hours and a lot less take home pay occurs because of this, it signals that a recession is about to begin. Another less used method used by Economists is the Leading Economic Indicator, which shows numerical long-term Economic expansions but also tries to predict trends in the Economy that may lead to a downturn. However, no single statistical series has proven to be completely reliable, so several of these individual methods are combined into one overall Business Cycle Composite Index. This Composite Index is shown in Figure 2, where the shaded areas represent recessions. The average time between dips in the Index, which indicates the onset of a recession, is about nine months. On the other hand, the average time between a rise in the Index, which indicates the start of an expansion is about four months. 1. 2. 3. 4. 5. 6. 7. 8. Of course, the employment of workers greatly influences the Business Cycle. But on the other side of this, the Business Cycle can greatly affect employment in many ways. To understand the severity of unemployment on people and the Economy, Economists need to know how to measure it. The measure of joblessness by Economists is called the Unemployment Rate, which is one of the most closely watched and politically charged Economic statistic in the country today. The Unemployment Rate begins with the process of deciding if someone is unable to work, willing to work but cant find a job, or even working full-time at a job. However, compiling this information is more complicated then most people realize. In the middle of any given month, the Federal Govt. department called the Bureau of Census begins a monthly door-to-door survey of about 60,000 households, which covers all 50 states in America. Census workers conducting this survey are looking for the Unemployed – people available for work who made a specific effort to find a job during the past month and those people who worked less than then part-time for pay or profit. People are also classified as Unemployed if they are physically or mentally unable to work at a job. Unemployment is normally expressed statistically in terms of what is called the Unemployment Rate, which is the number of unemployed individuals divided by the total number of persons in the civilian labor force who are working. 1. 2. 3. 4. 5. 6. 7. 8. Economists have identified several causes and types of unemployment. Understanding the types and causes of each kind of Unemployment can affect how much future unemployment rates can be reduced. A common, less serious type of unemployment is called Fictional Unemployment, which is the situation where workers are between jobs for one reason or another. This is usually a short term condition, and workers suffer little economic hardships while they look for another job. A more serious type of unemployment is Structural Unemployment, which is caused by a company’s downsizing or cutting back of its workforce, which causes many workers within the company to lose their jobs. A third kind of unemployment is Technological Unemployment, which is unemployment that occurs when workers are replaced by machines or automated systems that performs cheaper, faster and better. A fourth kind of unemployment is Cyclical Unemployment – unemployment directly related to downward swings in the Business cycle. During a recession consumers do not buy many goods. As a result, many companies must lay off workers until the Economy recovers. Finally, a fifth kind of unemployment is Seasonal Unemployment, which is unemployment resulting from changes in the weather or in the demand for certain workers during different times of the year. For example, many carpenters and builders have less work in the winter. Finally, Outsourcing has also recently caused unemployment, which is the hiring of workers for lower wages outside of the country to perform functions that will lower the businesses operating costs. Workers in this country, who work for an outsourcing company, lose their jobs to lower wageworkers that were hired elsewhere because of the lure by the company for a cheaper labor force. A good or bad policy?