* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

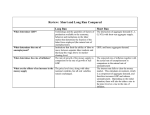

Download Key Review Questions for ECO 2030 final exam

Survey

Document related concepts

Pensions crisis wikipedia , lookup

Nominal rigidity wikipedia , lookup

Exchange rate wikipedia , lookup

Full employment wikipedia , lookup

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Monetary policy wikipedia , lookup

Money supply wikipedia , lookup

Interest rate wikipedia , lookup

Phillips curve wikipedia , lookup

Early 1980s recession wikipedia , lookup

Business cycle wikipedia , lookup

Transcript