* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

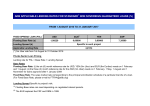

Download determinants of universal bank lending rate in ghana

Financialization wikipedia , lookup

Pensions crisis wikipedia , lookup

Present value wikipedia , lookup

Continuous-repayment mortgage wikipedia , lookup

Fractional-reserve banking wikipedia , lookup

History of pawnbroking wikipedia , lookup

Quantitative easing wikipedia , lookup

Monetary policy wikipedia , lookup

Adjustable-rate mortgage wikipedia , lookup

Interest rate swap wikipedia , lookup

History of the Federal Reserve System wikipedia , lookup

Peer-to-peer lending wikipedia , lookup