* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download MIDLANDS STATE UNIVERSITY FACULTY OF COMMERCE

Survey

Document related concepts

Transcript

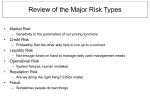

MIDLANDS STATE UNIVERSITY FACULTY OF COMMERCE DEPARTMENT OF BANKING & FINANCE Course Outline: Financial Risk Management (BF410) Lecturer: Mr N. Nkomazana (Email: [email protected], Cell: 0774 382 517) COURSE OBJECTIVES This course will focus on the management of financial risk that portfolio managers encounter, with special emphasis on market risk. This course will equip students with a variety of risk management techniques that are available to financial managers, their strengths and limitations. ASSESSMENT Coursework will constitute 30% of the total mark, with the final examination, at the end of the semester, contributing the remaining 70%. Coursework will be made up of two tests to be administered during the semester. The course contents are as follows: COURSE CONTENT 1. Introduction and Overview of Risk Introduction to risk & risk management Types and sources of risk (risk and risk factors) Importance of a risk management focus 2. Infamous Risk Management Disasters Metallgesellschaft (1993) Orange County (1994) Barings bank (1995) AIG (2008) Societe Generale (2008) Subprime Mortgage Losses (2007) Lessons for risk management 3. How Traders Manage Their Exposures The “Greek letters” (Delta, Gamma, Vega, Theta and Rho) Calculating Greek letters Page 1 of 3 Taylor series Hedging exotic options 4. Market risk and Value at Risk (VaR) Benefits of market risk measurement Daily Earnings at Risk (DEAR) Definitions and calculation of VaR VaR and expected shortfall VaR and capital Coherent risk measures Choice of parameters for Var Marginal, Incremental and Component VaR Other approaches to VaR (Historical simulation, The model building approach, Stress testing and Monte-Carlo simulation) 5. Managing Interest Rate Risk Management of net interest income Duration (standard duration, modified duration and dollar duration) Convexity (standard and dollar duration) Principal component analysis Portfolio and Bond immunisation 6. Regulation, Basel II and Solvency II Reasons for regulating banks Bank regulation pre-1988 and the 1988 BIS Accord The G-30 policy recommendations and the 1996 amendment Basel II and the recent revisions to Basel II Solvency II 7. Scenario analysis & stress testing Generating scenarios Incentives for financial institutions Subjective vs objective probabilities Page 2 of 3 TEXTBOOKS: A number of alternative textbooks and articles are considered suitable for the material covered in this course. The following are some of the recommended texts: Bohdalova, M. (2007) A comparison of Value–at–Risk methods for measurement of the financial risk. E-Leader Plague 2007 Crouhy, M., Galai, D. and Mark, R (2006) The essentials of Risk Management, McGraw-Hill. Fabozzi, F. J. (2007) Fixed Income analysis, 2nd Edition, John Wileys & Sons, Inc Hull, J. C. (2010) Risk management and financial institutions, 2nd edition, InternationalEdition, Pearson Jorion, P. (2003) Financial Risk Manager Handbook. 2nd Edition. John Wiley & Sons: Canada. Saunders, A. and Cornett, M. (2008) Financial institutions management: A risk management approach (6th Edition), Mc Graw-Hill. Torben, J. A (2006) Global Derivatives: A strategic risk management perspective, FT Prentice Hall. Page 3 of 3