* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download The Middle East and Turkey show many common trends in terms of

Survey

Document related concepts

Transcript

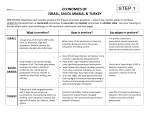

The Middle East and Turkey show many common trends in terms of consumer behaviour, preferences and habits in beauty and personal care. Socioeconomic factors and cultural proximity often underpin similar industrial trends, although country-specific differences are prominent. Political and economic instability in the region represents a significant threat to sustainable growth opportunities. What is driving many of the beauty trends in Turkey and the Middle East is a young, dynamic population. Social media savvy and open to new ideas, young people in these countries are becoming more aware of global brands than they have been in the past. As such, the internet and social media sites have become important tools for learning about and purchasing beauty and personal care products. Beauty and Personal Care Growth Prospects – 2014-2019 Source: Euromonitor International In fact, online retailing recorded a 27% CAGR between 2019-2014 in the Middle East and Africa region and a 32% CAGR in Turkey, as more consumers feel comfortable with purchasing products online – something about which there was initially a great deal of scepticism. Not surprisingly, online marketing campaigns are becoming increasingly important, and most multinational companies have set up pan-Arab company websites and brand-specific Facebook accounts and Twitter profiles to address local tastes. There is also the proliferation of more “sophisticated” beauty products, which are driving segmentation in a multitude of beauty and personal care categories, with products increasingly offering more specialised and tailored solutions. New products and ingredients used in such products in one category are also increasingly being emulated in claims made in other categories, like hair care and skin care. Diverse market conditions call for finely tuned strategies in the region In the Middle East and Africa region, there is a strong dichotomy between those nations that can enjoy more premium products and those looking for value-added, multifunctional products for cash- and time-strapped consumers. For example, the United Arab Emirates is witnessing a premiumisation trend within beauty and personal care, as consumers are increasingly looking for products designed to tackle specific problems or offer clearly defined benefits. From saloninspired hair care to skin care products offering anti-ageing benefits and oral care with whitening effects, the industry is increasingly moving towards a concept of solution-orientated products, which usually feature a higher unit price than standard versions. Equally, in Saudi Arabia, consumers continued to focus more on style and personal wellbeing when choosing beauty and personal care products. This is especially noticeable in the consumer trend of preferring new products, such as shower gels and bath products, rather than traditional bar soaps. However, in countries such as Egypt, the majority of the Egyptian population originates from low-income households, and spending on non-essential products has become quite limited. In Turkey, some new products took into account changing consumer lifestyles as a result of urbanisation, like time spent at home (as opposed to time spent at work) or the lack of time individuals in urban settings increasingly have. And, although consumers might end up gravitating towards lower-priced products, the quantity they consume does not go down. One country not often associated with high cosmetic usage is Iran. However, it has fairly high per capita consumption among its female inhabitants, primarily due to certain key factors. For example, it has a very young female population. Another important reason for the popularity of cosmetics is the hijab law, as women are not allowed to go out in public without wearing this garment. As it covers their hair and chest, they look to cosmetics as a means of beautification, particularly important to young women. However, although women start wearing cosmetics at an early age, their income is limited, making mass cosmetics more popular in the country than premium products. Colour cosmetics and men’s grooming offer strong regional prospects In the Middle East and Turkey, most growth opportunities lie in the more developed countries, such as Saudi Arabia and the United Arab Emirates, where the population is often young and increasingly interested in fashionable new products. Heavy marketing campaigns and expanding distribution channels have created a strong demand for products that used to be outside the usage portfolio. This signals an opportunity for brands to fulfil specific needs, and meet the expectations of certain consumer segments as a key differentiator. For example, in Saudi Arabia, men’s grooming experienced 13% year-on-year value growth in line with a number of trends in 2014. One of the most important of these trends is expected to be the diminishing of the former social taboo for Saudi Arabian men to take pride in their appearance and its connection to a reduced level of masculinity. Equally, Iran offers some growth opportunities in colour cosmetics. With the hijab law, the face is extremely important. Iranian women tend to enjoy wearing colour cosmetics with warm and vivid colours. Mass products usually address this demand, often offering a wider range than is currently available among premium brands. Skin whitening products are increasingly sought after and whitening products have spread to many skin care categories, including men’s grooming. The demand for these products is primarily driven by Arab, South Asian and East Asian expatriates, as lighter skin tones within these communities are often considered more beautiful than darker skin tones. Demand for Halal-certified beauty products on the rise Halal beauty and personal care is in its very early stages of growth; however, it has great potential to develop as a key point of differentiation for brands across the globe. One problem is that the market for beauty and personal care currently lacks a standardised approach in reference to halal, as some countries have their own certification board, while others do not. Consumers are therefore left to decide which products are suitable to deliver the standards and values sought after as a Muslim. Looking for products that match Islamic standards, Muslims often turn towards organic product portfolios, as many companies in this segment offer vegan choices, assuring that no animal derivatives are used. Therefore, increasing availability and extended portfolios of clearly labelled halal products can raise awareness among Muslim consumers, cater to existing demands, ease buying decisions and ensure that not only the ingredients, but also the manufacturing process, the supply chain and the financial services used, adhere to standards based on Islamic values and guiding. Niche categories intensify growth in Turkey In Turkey, new product launches like L’Oréal Turkiye Kozmetik’s Maybelline Colossal Kajal Eye Liner were immensely popular and led to strong growth. Other eye make-up also attracted high levels of growth due to new innovative product launches for the eyebrow region, in the form of new eyebrow powder and eyebrow pencil products by Erkul Dagitim Pazarlama’s brand Golden Rose, and a line of products by Kosan Kozmetik’s brand Flormar, including eyebrow shadow, eyebrow primer, eyebrow fixator mascara and eyebrow liner. Multinationals dominate the region’s competitive landscape, except in Iran It is global companies that dominate the beauty and personal care market in the Middle East and Turkey. For example, in the United Arab Emirates, Unilever and Procter & Gamble lead. In Saudi Arabia, aside from Arabian Oud’s strong lead in fragrances, the remaining key players in the market (2014) remain multinationals, which offer a wide range of well-advertised and welldistributed global brands. The majority of these players focus on mass beauty and personal care products, such as Binzagr Lever (Unilever Arabia) and Procter & Gamble Arabia. Equally, in Turkey and Israel, the beauty and personal care market continued to be dominated by multinational companies. However, in Iran, the situation is slightly different. Domestic suppliers like Paxan Co and Pakshoo Co are more active in basic products like bar soap and shampoos, while multinationals prefer to expand their presence in more modern categories like skin care, where competition from cheap domestic brands is less intense and potential for growth is more obvious. Socioeconomic factors and a young consumer base in the Middle East and Turkey offer positive growth prospects, although the diversity of the region calls for focused strategies, while the political instability poses a major threat for long-term growth.