* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Pulling these thoughts together, our line to take in response to

Survey

Document related concepts

Transcript

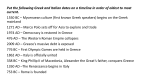

Factsheet: The impact of “Grexit” on EU pension funds 1. Background After a harrowing five months the Greek government now faces a €1.5bn payment to the International Monetary Fund on 30 June 2015. In the likely event of a delayed repayment, according to IMF protocol, Greece could be afforded a 30-day grace period, during which it would be urged to pay back the money as soon as possible, and before IMF’s Managing Director (Ms Lagarde) notifies her executive board of the late payment. However, with talks have broken down in acrimonious fashion between the country and its creditors, Ms Lagarde has said she will renege on this and notify her board "immediately". Then Greece's other creditor burden would also start piling up, with the government due to pay another €6.6bn to the European Central Bank in July and August. In order to contain any bank run, Greece’s government has imposed temporary restrictions on the free movement of capital as from Monday June 29. As a result, banks will remain closed up to and including Monday, July 6 2015. The control of capital will mean the following: Deposits are fully safeguarded; The payment of pensions is exempted from the restrictions on banking transactions. Management of credit institutions will announce how these will be paid; Electronic transactions within the country will not be affected. All transactions with credit or debit cards and other electronic forms (web banking, phone banking) can be conducted as normal; Prepaid cards may be used to the limit existing before the beginning of the bank holiday; From midday June 29, ATMs will operate with a daily cash withdrawal limit of 60 euros per card, which is equivalent to 1,800 euros a month; Foreign tourists can make cash withdrawals from ATMs with their cards without restrictions provided these have been issued abroad; A special Committee to Approve Bank Transactions has been established at the State General Accounting Office in cooperation with the Finance Ministry, the Bank of Greece, the Union of Greek Banks and the Capital Markets Commission. This committee will deal with applications for urgent and imperative payments that can’t be satisfied through the cash withdrawal limits or by electronic transactions (e.g. payments abroad for health reasons). Wages paid electronically to bank accounts are not affected. According to the European Commission, maintaining financial stability is the main and immediate challenge for Greece. The EU institution said on Monday that “while the imposed restrictive measures appear necessary and proportionate at this time, the free movement of capital will however need to be reinstated as soon as possible in the interest of the Greek economy, the Eurozone, and the European Union's single market as a whole.” A referendum to decide whether or not Greece is to accept the bailout conditions proposed by the EU, the IMF and the European Central Bank was announced by the prime minister Alexis Tsipras in the early morning of 27 June 2015 and ratified by the parliament and president the next day. The referendum will take place on 5 July 2015. The refusal of bailout conditions by the Greek voters would likely lead to a process of an exit of the Eurozone (“Grexit”). Finally, there is no clear legal path for a country to exit the Eurozone without leaving the EU first. Euro membership is irrevocable in line with article 140, paragraph 3 of the Lisbon Treaty. 2. What is the direct exposure of pension funds to Greece’s debt default? The default of Greece would be the first-ever debt default by a Eurozone country. According to the rating agency Fitch1, over 80% of Greece’s €320 billion sovereign debt is held by official sector creditors: EU states, the ECB and the IMF. This neutralizes the direct threat for financial markets. Most importantly, European pension schemes do not have major holdings in Greek equities and bonds. Hence the direct exposure of European pension funds to Greece’s default is very low. Question for members: To what extend are pension funds in your country exposed to Greek sovereign bonds? Equities? →No exposure to Greek bonds and for equities only as part of Global indices. 1 6 March 2015 ‘Grexit Still Possible; Systematic Crisis Unlikely’, Douglas Renwick & Mark Brown 3. How Grexit would affect pension funds in the EU? How much a contagion scenario would affect the EU bond market? Although pension funds do not have major direct exposure on Greek assets, it cannot be excluded that the impact of an exit of Greece from the Eurozone could be damaging for pension funds and the overall European economy. However it is crucial to note that there are so many unknowns that it seems difficult to predict the impact of Grexit on pension funds, because it will depend on a large number of factors involving the behaviour of politicians and financial markets. This is new territory: no Member State has ever left the Euro. But in practice possible consequences include: - A failure to reach agreement between the principal lenders to Greece (IMF, ECB) on required structural reforms (including reductions in pension payments) leading to a termination of some of the Greek Government’s credit lines. If Greece is no longer part of the official EU bailout system, then ECB support would cease. The Greek Central Bank would no longer be able to support Greek banks. Greece would no longer be a tenable member of the Eurozone and would revert to printing its own currency. - There would be a run on Greek banks, with savers withdrawing cash in the belief that it is safer under the mattress. This process is already under way. There would be a risk of contagion as the potential collapse of Greek banks weakened parent banking groups beyond Greek borders. Central banks would do their best to prevent this. - Depending on the extent to which the authorities were able to prevent contagion, savers and investors would divert their money from risky countries and equities into the bonds of “safer” Member States. There is thus a risk that peripheral government bond spreads surge to stress levels. The sovereign bond prices of those Member States would rise and yields would fall, thereby increasing further many pension schemes’ liabilities. An early contagion was seen in the Spanish and Italian sovereign bond markets where 10-year bond yields rise sharply, while German equivalents fell. Alike interest rates, the Euro fell on Monday 29 June less than 1% against the dollar. However there is no way to assess what would be the long-term impact of Grexit on the currency of the Eurozone. As part of its Quantitative Easing program, the European Central Bank could step into the market to buy bonds, particularly in places like Portugal, Spain or Italy, and limit the contagion. - One could expect impacts on pension schemes’ liabilities due to wider economic effects feeding through into revised forecasts of growth, inflation and interest rates. The key factor here would be the impact on the sovereign bond market. If some sovereign bonds prices were to rise and yields fall (due to the ‘safe haven’ effect above), then deficits would increase, leading to increased funding demands on sponsoring employers and greater pressure for DB scheme closures. - There would be direct impacts on asset prices – equities, bonds, property etc. However one can think the impact could be different depending on the Member States. Indeed in Member States considered as “safe” and where pension funds hold a large amount of “safe” government bonds, the equity prices could be expected to increase as yields on fixed-income securities decline, investors may shift into equities and other asset classes in search of higher yields, increasing demand for these assets and therefore their prices. On the other side, in other Member States where investors might look to decrease their exposure into volatile government bonds and more risky assets such as equity, the equity prices might decrease. Pension funds’ assets would then be lower (at least most commentators assume so). Obviously this is a major negative factor for pension funds. However, younger workers making regular pension contributions would purchase larger amounts of cheaper equities, exposing them to the opportunity of greater capital appreciation in the future. - Looking a little more widely, a prolonged period of economic crisis and uncertainty would stifle investment, weakening the European and global economy. One could envisage even greater calls for pension funds to fill the investment gap. - Greece’s exit from the Eurozone would set a precedent. In the worst case scenario of Grexit, a collapse of monetary union could happen, should other Member States follow Grexit, and consequently provoke a Eurozone crisis. Question for members: According to investors (mainly pension funds) in your country, what are the biggest threats following a potential Grexit? →More volatile equity markets, pressure on bond yields in Northern Euorpe as a consequence of possible higher yields in Southern Euorpe. 4. Media lines to take Pulling these thoughts together, our line to take in response to media enquiries about what Grexit would mean for pension funds could be: - Pension schemes are long-term investors, designed to be able to ride out short-term shocks to the market. So while immediate fluctuations may be alarming, being a long-term investor allows time for an investment to recover any value lost in the short-to-medium-term and to recoup more value over the longer term. - European pension schemes do not have major holdings in Greek assets So the direct impact on a default would be marginal. - The real issue relates to the impact on the wider European economy and the potential contagion effect. If Grexit were to lead to pressure on other Eurozone countries and a prolonged period of economic uncertainty, then pension schemes’ investments would almost certainly suffer – in the short term at least. And weaker companies would mean less support for the pension schemes that rely on these employers for funding. - Cheaper equities would be good news for younger workers saving towards a DC pension, as their money would buy more shares that could grow in the future. And although PensionsEurope does not make economic forecasts, but there are some scenarios where Grexit clears away economic uncertainty and more favourable conditions return. So it all depends on how economic events unfurl. - PensionsEurope calls upon regulators to address the specific effects of low interest rate consequences and any other impact that Grexit would trigger especially because decreasing interest rates can put funding ratios of DB schemes under pressure and increase the price of annuities for both DB and DC schemes. This can mean lower pension benefits and/or increase in contributions. ____________________