* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Q2- A basic rationale for the objective of maximizing the wealth

Market sentiment wikipedia , lookup

Short (finance) wikipedia , lookup

Financial Crisis Inquiry Commission wikipedia , lookup

Socially responsible investing wikipedia , lookup

Stock market wikipedia , lookup

Systemically important financial institution wikipedia , lookup

Hedge (finance) wikipedia , lookup

Stock exchange wikipedia , lookup

Investment fund wikipedia , lookup

Systemic risk wikipedia , lookup

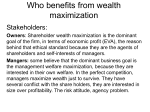

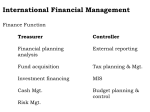

Q1- Why should a company primarily concentrate on wealth maximization instead of profit maximization? Ans1- Maximizing wealth takes into account all factors which influence the market price of the stock. Maximizing earning is not all inclusive because it does not take account of the timing of the earning, of the business and financial risk of the firm and of dividend policy. While shareholder wealth and corporate profitability tend to be correlated over times, the two will deviate for the reasons cited above. As the shareholder wealth is more inclusive, we should use it. Q2- A basic rationale for the objective of maximizing the wealth position of the stockholder as a primary business goal is that such an objective may reflect the most efficient use of society’s economic resources and thus, leads to a maximization of society’s economic wealth”. Briefly evaluate this observation. Ans2- If capital is allocated on a risk adjusted return basis; it will flow to the most productive investment opportunities. In this way, the economic growth of the society will be maximized as the most efficient investment projects are undertaken. As the shareholder wealth is determined by the risk-return nature of the company, only a wealth maximization objective will result in savings in our society being efficiently allocated to productive investment opportunities. Q3- Beta-Max Corporation is considering two investment proposals. One involves the development of 10 discount record stores in Chicago. Each store is expected to provide an annual after tax profit of $35,000 for 8 years, after which the lease will expire and the store will terminate. The other proposal involves a classical record of the month club. Here, the company will devote many efforts to teaching the public to appreciate classical music. Management estimates that the after-tax profits will be zero for 2 years, after which they will grow by $40,000 a years through year 10 and remain level thereafter. The life of the second project is 15 years. On the basis of this information, which project would you prefer? Ans3- The first project is expected to provide $350,000 in annual profit over 8 years or $2.8 million in total. The second project is expected to have the following after-tax profits: Year Profits 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 0 0 $40,000 80,000 120,000 160,000 200,000 240,000 280,000 320,000 320,000 320,000 320,000 320,000 320,000 Total $3,040,000 While the second project is expected to provide greater total profits, these profits are received further in the future than are the profits for the first project. Also, there may be more uncertainty associated with the second project. Because of these factors, most people prefer the first proposal. Q4- What are the major functions of the financial manager? What do these functions have in common? Ans4- The major functions of the financial manager are the investment decision, the financing decision, and the dividend decision. The subsets under each are given in the chapter. These decisions share the common thread that they affect the value of the company’s stock. Together they determine the stock’s value. Q5- Should the managers of a company own sizeable amounts of stock in the company? What are the pros and cons? Ans5- If the managers have sizeable stock positions in the company, they will have a greater understanding for the valuation of the company. Moreover, they may have incentive to maximize shareholder wealth than they would be in the absence of stock holding. However, to the extent persons have not only there human capital but, also most of their financial capital tied up in the company, they may be more risk averse than is desirable. If the company deteriorates because a risky decision proves bad, they stand to lose not only their jobs but, also have a drop in the value of their assets. Excessive risk aversion can work to determine of maximizing shareholder wealth as can excessive risk seeking if the manager is particularly a risk prone. Q6- In recent years, there have been number of environmental, pollution, hiring and other regulations imposed on businesses. In view of these changes, is maximization of shareholder wealth still a realistic objective? Ans6- Regulation imposed by the government constitutes constraints against which shareholder wealth can still be maximized. It is important that wealth maximization remain the principal goal of the firms if economic efficiency is to be achieved in society and people are expected to have increasing real standards of livings. The benefits of regulations to society must be evaluated relative to the costs imposed on economic efficiency. Where benefits are small relative to the costs, businesses need to make this known through political process so that the regulations can be modified. Presently there is considerable attention being given to deregulations. Many things have been done to make regulations less onerous and to allow competitive markets to work more effectively. Q7 As an investor do you believe that some managers are paid too much? Do not their rewards come at your expense? Ans7- As in other thing, there is a completive market for good managers. A company must pay them their opportunity cost, and indeed this is the interest of the stockholders. To the extent managers are paid in excess of their economic contribution, the returns available to investor will be less. However, the stock holders can sell their stock and invest elsewhere. Therefore, there is a balancing force that works in the direction of equilibrating managers’ pay across business firms for a given level of economic contribution. Q8- How does the notion of risk and reward governs the behaviour of the financial managers? Ans8- In completive and efficient marks, greater rewards can only be achieved with greater risk. The financial manager is constantly involved in decisions involving a trade-off between the two. For a company, it is important that it does well what it knows well. If it gets into a new area where it has no expertise there is little reason to believe that the rewards will be commensurate with the risk that is involved.