* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download inflation unit

Survey

Document related concepts

Transcript

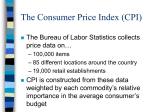

Dr. Evil is having difficulty negotiating… Inflation “A period of rapidly rising prices” The dollar’s value may be said to be falling. Demand - Pull • Demand for goods & services outraces supply. • Example: 1970’s US auto makers stopped producing convertibles. In 1980- Mazda Miata was introduced. The MSRP was $12,000 but dealers were selling them for $15,000. Causes • Changes in spending habits of individuals & business firms • Federal Government spends more than it earns in taxes & other revenues. • Psychological Expectation of inflation Cost Push • A run-up in prices that results as sellers raise their prices because of an increase in their costs. Causes • Wage-price spiral • Profit-push Types of Inflation • Creeping • Chronic • Hyperinflation Inflation Rate • CPI is used to measure the inflation rate or how much price level increases each year. Consumer Price Index • A price index determined by measuring the price of a standard measure of goods meant to represent the typical “market basket” of a urban consumer. • The basket includes food items, air travel, college tuition, electronic equipment, etc. Price Index Y2 – Price Index Y1 X 100 Price Index Y1 Has the cost of going to the movies really increased? Price of a movie ticket in 1970 - $.25 CPI (base year 1990) – 38.3 Expressed in 1990 dollars - $.65 CPI (2014) – 222 1990 Price x 2014 CPI = 2014 Price 2014 Price - $1.44 Problems with CPI 1. Neglects quality improvements 2. Neglects buyer responses to changes in relative prices. 3. Has failed to keep up with the shift consumers have made toward discount outlets. Impact of These Problems Determines changes in an array of payments Wage agreements that include a cost-of-living (COLA) allowance Cost of living adjustment: an automatic increase in income when the inflation rate increases. Social Security benefits Welfare payments About 30% of federal outlays are tied to changes in the CPI Bad news for retirees: No Social Security costof-living increase, higher medical costs for many • Officials say there will be no benefit increase next year for millions of Social Security recipients, disabled veterans and federal retirees. (AP) • Tens of millions of seniors will see no annual cost-of-living adjustment in their Social Security checks in 2016, the government said Thursday, unwelcome news that also will flatten benefit payments for retired federal workers and service members. • The raises are tied to the consumer price index (CPI), which has been flat because of lower gasoline prices. Inflation and Wages 1. Consumers and workers will experience a decline in purchasing power 2. Real Income = Nominal Income CPI x .01 Congratulations! You have received a $5,000 raise! You have gone from making $65,000 last year to $70,000 this year. Last year’s CPI was 100 and this year’s came in at 110. 1. How much inflation has occurred? 2. Are you making more money in real terms? Inflation and Interest Rates 1. The cost of borrowing will rise as inflation rises 2. Financial institutions will charge an inflation premium Real & Nominal Interest Rates Real interest rate = Nominal interest – inflation Example: You borrowed $1000 for one year. Nominal interest rate - 15% During the year inflation - 10% How does inflation impact people ? CONGRATULATIONS! You have just landed a new job as an economic advisor to the President of the United States. You are examining current economic conditions in order to advise the President on what policy actions would best help to improve the economy. The question which you have been tasked to answer is this: Would more or less inflation best help the current economy? What you know: Q4 rGDP growth 2.2% Q1 rGDP growth ~2% Inflation rate - 0.1 % Elevated unemployment 5.5% Wages are stagnant Fewer homes in foreclosure (borrowers unable to pay)