* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Chapter 16 and 17

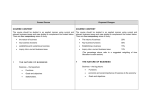

Systemic risk wikipedia , lookup

Debt settlement wikipedia , lookup

Debt collection wikipedia , lookup

Financial economics wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

Debtors Anonymous wikipedia , lookup

Stock selection criterion wikipedia , lookup

Present value wikipedia , lookup

First Report on the Public Credit wikipedia , lookup

Private equity wikipedia , lookup

Global saving glut wikipedia , lookup

Private equity secondary market wikipedia , lookup

Government debt wikipedia , lookup

Business valuation wikipedia , lookup

Financialization wikipedia , lookup

Private equity in the 2000s wikipedia , lookup

Household debt wikipedia , lookup

Early history of private equity wikipedia , lookup

Corporate Financial Management Professor James J. Barkocy “You can observe a lot by watching.” Yogi Berra McGraw-Hill/Irwin Copyright © 2012 by The McGraw-Hill Companies, Inc. All rights reserved. Financial Leverage, EPS, and ROE Consider an all-equity firm that is considering going into debt. (Maybe some of the original shareholders want to cash out.) Current Assets $8,000 Debt $0 Equity $8,000 Debt/Equity ratio 0 Interest rate n/a Shares outstanding 400 Share price $20 Proposed $8,000 $4,000 $4,000 1/1 10% 200 $20 2 EPS and ROE Under Both Capital Structures All-Equity Recession EBIT $400 Interest 0 Net income $400 EPS 1.00 ROA (Earnings/Assets) 5% ROE (Earnings/Equity) 5% Current Shares Outstanding = 400 shares Expected $1,200 0 $1,200 $3.00 15% 15% Expansion $2,000 0 $2,000 $5.00 25% 25% Levered Recession EBIT $400 Interest -400 Net income $0 EPS $0 ROA 5% ROE 0% Proposed Shares Outstanding = 200 shares Expected $1,200 -400 $800 $4.00 15% 20% Expansion $2,000 -400 $1,600 $8.00 25% 40% 3 Value and Capital Structure Assets Liabilities and Value of cash flows from firm’s real assets and operations Stockholder’s Equity Market value of debt Market value of equity Value of Firm Value of Firm 4 M&M (Debt Policy Doesn’t Matter) Modigliani & Miller When there are no taxes and capital markets function well, it makes no difference whether the firm borrows or individual shareholders borrow. Therefore, the market value of a company does not depend on its capital structure. 5 Homemade Leverage: An Example Strategy A: Buy 100 of Levered Recession Expected Expansion EPS of Levered Equity $0.0 $4.00 $8.00 Earnings per 100 shs. 0 400 800 Initial Cost = 100 shs. @ $20/sh. = $2,000 Strategy B: Homemade Leverage EPS of Unlevered Equity Earnings per 200 shs. Interest @10 on $2,000 Net Earnings Recession Expected Expansion $1.00 $3.00 $5.00 200 -200 0 600 -200 400 1,000 -200 800 Initial Cost = 200 shs. @ $20/sh. = $4,000 - $2,000 borrowed = $2,000 6 M& M’s Proof Type of Firm Action Taken Next period Note: Firm A All Equity V=E Firm B Some equity & some debt V= D+E Investor buys “a” of equity aV Investor buys fraction “a” of both debt and equity aD + aE = a(D+E)=aV Investor receives a fraction of CF aX Investor receives the following a(X-rD)+ arD = aX X-rD is the cash flow less interest expense arD is the “piece” of interest that goes to the investor 7 The Cost of Capital WACC= B S rB + rS B +S B +S Unlevered Firm: (0 x 10%) + (1.00 x 15%) = 15% Levered Firm: (.50 x 10%) + (.50 x 20%) = 15% 8 Weighted Average Cost of Capital without taxes (M&M view) r rs WACC rb Includes Bankruptcy Risk B V 9 Total Cash Flow to Investors Under Each Capital Structure with Corp. Taxes All-equity firm S Levered firm G G S B The levered firm pays less in taxes than does the all-equity firm. Thus, the sum of the debt plus the equity of the levered firm is greater than the equity of the unlevered firm. 10 C.S. & Corporate Taxes Example - You own all the equity of Space Babies Diaper Co. The company has no debt. The company’s annual cash flow is $10,000, before interest and taxes. The corporate tax rate is 35%. You have the option to exchange part of your equity position for 6% bonds with a face value of $50,000. Should you do this and why? 11 C.S. & Corporate Taxes Example - You own all the equity of Space Babies Diaper Co. The company has no debt. The company’s annual cash flow is $10,000, before interest and taxes. The corporate tax rate is 35%. You have the option to exchange part of your equity position for 6% bonds with a face value of $50,000. Should you do this and why? EBIT Interest Pmt Pretax Income Taxes @ 35% Net Cash Flow All Equity 1/2 Debt 10,000 10,000 0 3,000 10,000 7,000 3,500 2,450 6,500 4,550 12 C.S. & Corporate Taxes Example - You own all the equity of Space Babies Diaper Co. The company has no debt. The company’s annual cash flow is $10,000, before interest and taxes. The corporate tax rate is 35%. You have the option to exchange part of your equity position for 6% bonds with a face value of $50,000. Should you do this and why? EBIT Interest Pmt Pretax Income Taxes @ 35% Net Cash Flow All Equity 1/2 Debt 10,000 10,000 0 3,000 10,000 7,000 3,500 2,450 6,500 4,550 13 C.S. & Corporate Taxes Example - You own all the equity of Space Babies Diaper Co. The company has no debt. The company’s annual cash flow is $10,000, before interest and taxes. The corporate tax rate is 35%. You have the option to exchange part of your equity position for 6% bonds with a face value of $50,000. Should you do this and why? EBIT Interest Pmt Pretax Income Taxes @ 35% Net Cash Flow All Equity 1/2 Debt 10,000 10,000 0 3,000 10,000 7,000 3,500 2,450 6,500 4,550 Total Cash Flow All Equity = 6,500 *1/2 Debt = 7,550 (4,550 + 3,000) 14 Capital Structure Firm Value = Value of All Equity Firm + PV Tax Shield VL = VU + TcB Example All Equity Value = 100,000 PV Tax Shield = D x Tc = 50000 x .35 =$17,500 Firm Value with 1/2 Debt = $117,500 15 Tax Shield and Value 16 The Effect of Financial Leverage on the Cost of Debt and Equity Capital with Corporate Taxes Cost of capital: r (%) rS r0 + rS r0 + B (r0 rB ) SL B (1 TC ) (r0 rB ) SL MM’s WACC r0 rWACC B SL rB (1 TC ) + rS B+SL B + SL rB Debt-to-equity ratio (B/S) 17 Financial Distress Costs of Financial Distress - Costs arising from bankruptcy or distorted business decisions before bankruptcy. Market Value = Value if all Equity Financed + PV Tax Shield - PV Costs of Financial Distress 18 Trade- Off Theory Value of firm under MM with corporate taxes and debt Value of firm (V) Present value of tax shield on debt VL = VU + TCB Present value of financial distress costs Maximum firm value V = Actual value of firm VU = Value of firm with no debt Debt (B) 0 B* Optimal amount of debt 19 Bankruptcy Issues 20 Financial Choices Trade-off Theory Pecking Order Theory • Theory that capital structure is based on a trade-off between tax savings and distress costs of debt. • Theory stating that firms prefer to issue debt rather than equity if internal finance is insufficient. 21 How Firms Establish Capital Structure Most Corporations Have Low Debt-Asset Ratios. A number of firms use no debt. There are Differences in Capital Structure Across Industries. There is evidence that firms behave as if they had a target Debt to Equity ratio. 22 Factors in Target D/E Ratio Taxes If corporate tax rates are higher than bondholder tax rates, there is an advantage to debt. Types of Assets The costs of financial distress depend on the types of assets the firm has. Uncertainty of Operating Income Even without debt, firms with uncertain operating income have high probability of experiencing financial distress. 23