* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Keynesian interpretation of the quantity theory of money

Fiscal multiplier wikipedia , lookup

Monetary policy wikipedia , lookup

Virtual economy wikipedia , lookup

Non-monetary economy wikipedia , lookup

Post–World War II economic expansion wikipedia , lookup

Quantitative easing wikipedia , lookup

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Long Depression wikipedia , lookup

Real bills doctrine wikipedia , lookup

Business cycle wikipedia , lookup

Modern Monetary Theory wikipedia , lookup

Austrian business cycle theory wikipedia , lookup

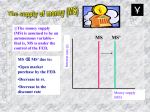

Ukrainian Academy of Banking of the National Bank of Ukraine Banking Department Money and Credit Lecture 2 Theories of money Anna Serhiivna Lasukova, Assistant at Banking Department Agenda 1. Nominalist VS Metalist theory of money. 2. Quantity theory of money. 3. Keynesian interpretation of the quantity theory of money 4. Monetarism The basic Theory of money Marx’s Metalist State (government) Nominalist Theory based on an abstract nature of money Monetarist’s theory of money Classical quantity theory Neoclassical quantity theory Keynesian interpretation Modern monetarism Neo-Keynesian interpretation NOMINALISM Nominalists theory of money formed in XVII-XVIII centuries, when money circulation was full of inferior coins. It is relates to the basic problem of money, the problem of its value. REPRESENTATIVES Georg Friedrich Knapp developed the state theory of money, an approach that is directly opposed to the Metalist view, according to which the value of money derives from the value of the metal standard (for example, gold or silver). According to Knapp, metalists try to “deduce” the monetary system “without the idea of a State.” Money - only symbols that are released into circulation state Nominalism features Value denotes consequently nothing positive or intrinsic, but merely the relation in which two objects stand to each other as exchangeable commodities. Nominalists don't recognize value as a quality immanent to the very nature of the commodity. Value and price are the result of the same mental act. Nominalism disadvantages money arose spontaneously in the development of commodity production and exchange; only after gold (silver) became the general equivalent and the measure of value, there is a possibility of forming a price scale; money can measure and express the value of commodities because they has intrinsic value; the functions of state authority over money are formal METALLISM "Pound Sterling is a certain quantity of gold with a stamp which certifies to its weight and its fineness. A standard unit of account is a certain weight of standard metal”. Sir Robert Peel PRINCIPLES OF METALLISM (1) the amount of wealth was static; (2) country's wealth could best be judged by the amount of precious metals; (3) the need to encourage exports over imports; (4) the value of a large population as a key to self-sufficiency and state power; (5) the state should exercise a dominant role in assisting and directing the national and international economies. "money as a commodity" “it is equivalent to a certain metal from which it is coined” Representatives of the theory In England: Stafford, T. Meng, D. Hope; In Italy: F. Haman; In France: A. de Montchretien. The delusion of mercantilists views are recognition of gold and silver as money of their nature; “goods = money”; lack of understanding of the essence of money as a some kind of commodity, which performs a specific social function as general equivalent; ignoring the fact that money is a historical category Quantity theory of money The quantity theory of money rests on the idea that there is a quantifiable relationship between the supply of money and the level of prices of goods and services in the economy. This assumes that money is just like any other commodity in the economy and that changes in the money supply will be reflected in the relative value of money to goods and services. Representatives of the theory The quantity theory descends from Copernicus, followers of the School of Salamanca, Jean Bodin, Henry Thornton, and various others who noted the increase in prices following the import of gold and silver, used in the coinage of money, from the New World. Representatives of the theory The “equation of exchange” relating the supply of money to the value of money transactions was stated by John Stuart Mill who expanded on the ideas of David Hume. The quantity theory was developed by Simon Newcomb, Irving Fisher, and Ludwig von Mises in the late 19th and early 20th century. THEORY SPECIFICATION the Cambridge cash-balance equation The Cambridge approach is a microeconomic approach, describing individual choice rather than market equilibrium. The Cambridge approach moved the analytical focus from a model where the velocity of money was determined by making payments to one where market agents have a demand for money. the Cambridge cash-balance equation money is held not only as a medium of exchange for making transactions as in Fisher’s case, but also as a store of value, providing satisfaction to its holder the Cambridge cash-balance equation Cambridge economists pointed out the role of wealth and the interest rate in determining the demand for money Formalizing the Cambridge approach The main conclusion of the the Cambridge version of quantity theory of money is that with constancy K and P, there is inverse proportional relationship between the value (purchasing power) currency and the value of existing farm cash balances Keynesian interpretation of the quantity theory of money The essential element of Keynesian economics is the idea the macroeconomy can be in disequilibrium (recession) for a considerable time. Keynesian economics advocates government intervention to help overcome the lack of aggregate demand to reduce unemployment and increase growth. Keynesian interpretation of the quantity theory of money Keynesianism emphasizes the role that fiscal policy can play in stabilizing the economy. In particular Keynesian theory suggests that higher government spending in a recession can help the economy recover quicker. State intervention is necessary to moderate the booms and busts in economic activity, otherwise known as the business cycle. There are three principal tenets in the Keynesian description of how the economy works: 1. Aggregate demand is influenced by many economic decisions – public and private. Private sector decisions can sometimes lead to adverse macroeconomic outcomes, such as reduction in consumer spending during a recession. These market failures sometimes call for active policies by the government, such as a fiscal stimulus package. There are three principal tenets in the Keynesian description of how the economy works: 2. Prices, and especially wages, respond slowly to changes in supply and demand, resulting in periodic shortages and surpluses, especially of labor. 3. Changes in aggregate demand, whether anticipated or unanticipated, have their greatest short-run effect on real output and employment, not on prices. Keynesians believe that, because prices are somewhat rigid, fluctuations in any component of spending cause output to change. If government spending increases, for example, and all other spending components remain constant, then output will increase. Keynesian interpretation of the quantity theory of money Keynesian economics dominated economic theory and policy after World War II until the 1970s, when many advanced economies suffered both inflation and slow growth, a condition dubbed “stagflation” DEFINITION OF 'STAGFLATION' A condition of slow economic growth and relatively high unemployment - a time of stagnation - accompanied by a rise in prices, or inflation. Stagflation occurs when the economy isn't growing but prices are. This happened to a great extent during the 1970s, when world oil prices rose dramatically, fueling sharp inflation in developed countries. For these countries, including the U.S., stagnation increased the inflationary effects. Monetarism If the money supply is growing, the economy will grow, and if money-supply growth is accelerating, so will economic growth. Monetarism Monetarism's leading advocate is the economist Milton Friedman As a holistic system of economic views, monetarism was formed in 1960 Monetarism Monetary policy one of the tools governments have to affect the overall performance of the economy, uses instruments such as interest rates to adjust the amount of money in the economy. Monetarists believe that the objectives of monetary policy are best met by targeting the growth rate of the money supply. Monetarism Monetarism gained prominence in the 1970s –bringing down inflation in the United States and United Kingdom – and greatly influenced the U.S. central bank’s decision to stimulate the economy during the global recession of 2007–09. Monetarists principles Long-run monetary neutrality: an increase in the money stock would be followed by an increase in the general price level in the long run, with no effects on real factors such as consumption or output. Short-run monetary nonneutrality: an increase in the stock of money has temporary effects on real output (GDP) and employment in the short run because wages and prices take time to adjust. Monetarists principles Constant money growth rule: Friedman proposed a fixed monetary rule, which states that the Fed should be required to target the growth rate of money equal to the growth rate of real GDP, leaving the price level unchanged. If the economy is expected to grow at 2 percent in a given year, the Fed should allow the money supply to increase by 2 percent. The Fed should be bound to fixed rules in because discretionary power can destabilize the economy. Interest rate flexibility: the money growth rule was intended to allow interest rates, which affect the cost of credit, to be flexible to enable borrowers and lenders to take account of expected inflation as well as the variations in real interest rates. Monetarism weaknesses It completely ignores the sphere of production playback - basic and crucial structure that directly generated value and surplus value. This area is likened to a "black box" in which internal processes are automatically adjusted based on market forces, and therefore not essential. Monetarists do not exactly represent what is in this box, they care only what must be obtained from it.