* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Study Unit 2 - CMAPrepCourse

Survey

Document related concepts

Transcript

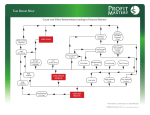

Part 2 Study Unit 2.1– 2.3 Ratio Analysis Liquidity Ratios • Liquidity is the firm’s ability to pay its current obligations as they come due. - Short run – How easy is it to convert assets to cash. • Liquidity ratios relates liquid assets to current liabilities. – Current assets – converted to cash within 1 year or operating cycle. • Current asset ratios – Firm’s ability to operate in short term. • Current assets/liabilities are shown in descending order of liquidity. Liquidity Ratios • Liquidity is the firm’s ability to pay its current obligations as they come due. - Short run – How easy is it to convert assets to cash. • Liquidity ratios relates liquid assets to current liabilities. – Current assets – converted to cash within 1 year or operating cycle. • Current asset ratios – Firm’s ability to operate in short term. • Current assets/liabilities are shown in descending order of liquidity. • Net Working Capital = Current assets – Current Liabilities – How much capital is left after paying current obligations. Liquidity Ratios • Current ratio = Current Assets / Current Liabilities • Most common liquidity measurement – Low ratio = Possible liquidity problems – High ratio = Management not investing assets • Should be proportional to the operating cycle. – Shorter operating cycles may justify lower ratio. • Converting to cash quicker. • Evaluate A/R and inventory turn • LIFO lowers ratio. Liquidity Ratios • Quick ratio – (Acid test) = Cash + Mkt Securities + Net receivables / Current liabilities – Avoids inventory valuation issues. – Conservative approach. • Cash ratio = Cash + Mkt Securities/Current Liab. • Cash Flow ratio = C/F from Operations/Cur. Liab. • Net Working Capital ratio = Cur. Assets – Cur. Liab./Total Assets – Most conservative of working capital ratios. • Liability liquidity – The ease of issuing new debt/funds. Activity Measures • Measures how quickly noncash assets are converted to cash. • Over a period of time. Includes I/S data. • The Balance Sheet data should always be an average • A/R Turnover = Net credit sales / Ave. A/R – Efficiency of A/R collections. – High ratio : Customers pay promptly. – Highly seasonal should use monthly A/R average. Activity Measures • Days’ Sales Outstanding (DSO) • DSO = Days in year / AR turnover – Average collection period in days. – May use 365, 360 or 300 days – Compared to credit terms to determine if customers pay within terms. Activity Measures • Inventory turnover = COGS / Ave. Inventory – Measures efficiency of inventory management. – High ratio : Quicker inventory turns • Inventory not obsolete, not carrying excess. – Highly seasonal should use monthly Inv. average. – LIFO valuation not comparable to other methods. – Inventory turnover is industry specific. • Grocery vs. Concrete • Days’ Sales in Inventory = Days in year/Inv. Turnover – How many days sales are tied up in inventory. Activity Measures • Accounts Payable Turnover = Purchases / Ave. AP – Highly seasonal should use monthly Payables average. • Days’ Purchases in Accounts Payable (DPO) • DPO =Days in year / AP Turnover – Compared to credit terms to determine if the firm is paying within terms. Activity Measures • Operating Cycle = DSI + DSO – The amount of time to convert inventory to cash. – Figure 2-2 Page 67 • Cash Cycle = Operating Cycle – DPO – Is the days that cash is tied up as another asset. Activity Measures • Fixed Assets Turnover Ratio = Net Sales / Ave. Net PP&E – How efficiently the company deploys its investment in plant assets to generate revenues. – Higher turnover is preferable. – Affected by the capital intensiveness of the company and its industry, by the age of the assets, and by depreciation method used. • Total Assets Turnover Ratio = Net Sales / Ave. Total Assets – Higher turnover is preferable. – Exclude assets that do not relate to sales. Ex: investments Calculate: Current Year Net Working Capital Calculate: Current Year Net Working Capital Current Assets – Current Liabilities $760 – 390 = $370,000 Calculate: Current Year Current Ratio Calculate: Current Year Current Ratio Current Assets / Current Liabilities 760 / 390 = 1.949 Calculate: Current Year Quick (Acid Test) Ratio Calculate: Current Year Quick (Acid Test) Ratio Cash + Mkt Securities + Net Rec / Current Liabilities (325 + 165 + 120 + 55) / 390 = 1.705 Calculate: Current Year Cash Ratio Calculate: Current Year Cash Ratio Cash + Mkt Securities / Current Liabilities (325 + 165) / 390 = 1.256 Calculate: Current Year Net Working Capital Ratio Calculate: Current Year Net Working Capital Ratio Current Assets - Current Liabilities / Total Assets (760 – 390) / 1,800 = .206 Calculate: CY AR Turnover * All sales are 365 day credit sales Calculate: CY AR Turnover Net Credit Sales / Ave. AR 1,800 / ((120 + 115) /2) = 15.3 Calculate: CY DSO * All sales are 365 day credit sales Calculate: CY DSO Days in Year / AR Turnover 365 / 15.3 = 23.9 Days Calculate: CY Inventory Turnover * All sales are 365 day credit sales Calculate: CY Inventory Turnover COGS / Ave. Inventory 1650 / (85 +55)/2 = 23.6 Calculate: CY DSI Days in Year / Inventory Turnover 365 / 23.6 = 15.5 Days Calculate: CY AP Turnover Purchases *CY = $1,760,000 PY = $1,440,000 Calculate: CY AP Turnover Purchases / Ave AP $1,760 / (150 + 75) /2 = 15.6 Calculate: CY DPO Calculate: CY DPO Days in Year / AP Turnover 365 / 15.6 = 23.4 Days Calculate: CY Operating Cycle Calculate: CY Operating Cycle DSO + DSI 23.9 + 15.5 = 39.4 Days Calculate: CY Cash Cycle Calculate: CY Cash Cycle Operating Cycle - DPO 39.4 – 23.4 = 16.0 Days Calculate: CY Fixed Asset Turnover Ratio Calculate: CY Fixed Asset Turnover Ratio Net Sales / Ave PP&E $1,800 / (915+ 845)/2 = 2.05 Calculate: CY Total Asset Turnover Ratio Calculate: CY Total Asset Turnover Ratio Net Sales / Ave Total Assets $1,800 / (1,800 + 1,600)/2 = 1.06