* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

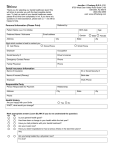

Download UnitedHealthcare of Alabama, Inc. Compass Individual Medical Policy

Survey

Document related concepts

Transcript