* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download InSite Vision, Inc.

Survey

Document related concepts

Transcript

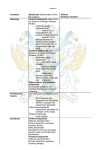

Annual Meeting of Stockholders Corporate Update Tim Ruane, CEO July 16, 2014 Forward Looking Statements Statements contained in this presentation regarding matters that are not historical facts are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. Risks that contribute to the uncertain nature of the forward-looking statements include: InSite’s ability to obtain additional financing; the success and timing of InSite’s preclinical studies and clinical trials; regulatory developments in the United States and foreign countries; the performance of third-party manufacturers; changes in InSite’s plans to develop and commercialize its product candidates; InSite’s ability to obtain and maintain intellectual property protection for its product candidates; and the loss of key scientific or management personnel. These and other risks and uncertainties are described more fully in InSite’s most recently filed SEC documents, including its Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, including those factors discussed under the caption “Risk Factors” in such filings. All forward-looking statements contained in this presentation speak only as of the date on which they were made. InSite undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made. 2 Undervalued Company with Strong Focus and Investment Fundamentals u Two partnered commercial products • AzaSite® – Akorn • Besivance® - Bausch & Lomb u Debt-free balance sheet & royalty revenue recaptured • Retired $43.9M of debt/accumulated interest for one-time $6M payment • AzaSite royalty returns starting Q2 2014 (April 1st) u Multiple near-term NDA filings planned • AzaSite – Europe • BromSite™ – U.S. and Europe • DexaSite™ – U.S. u AzaSite Plus™ • Data and/or endpoint discussions ongoing (European meeting in Q3) u Multiple partnering opportunities u Management team focus on execution 3 Our Approach: Novel Products, Reduced Risk, Efficient Development u DuraSite®: Polymer Drug Delivery Technology • Increases efficacy • Improves dosing and compliance u New DuraSite® 2 Platform Technology • Improved delivery & performance • March 2029 exclusivity/patent life • Basis of BromDex (ISV-504) and ISV-104 formulations u Low safety and regulatory risks u Shorter development timelines • Target indications with high unmet need • Leverage existing data on platform and products u Reduced development costs 4 InSite Vision’s Pipeline Licensed Research Preclinical Phase 1 Phase 2 Phase 3 Filed Marketed AzaSite ® Bacterial conjunctivitis (azithromycin ophthalmic solution 1%) Besivance ® Bacterial conjunctivitis (besifloxacin ophthalmic suspension 0.6%) BromSite ™ (ISV-303) Blepharitis U.S. NDA & EU MAA planned (azithromycin + dexamethasone) AzaSite ® EU Bacterial conjunctivitis EU MAA planned Development (azithromycin + ophthalmic solution 1%) U.S. NDA & EU MAA planned DexaSite ™ (ISV-305) Blepharitis (dexamethasone) AzaSite Plus ™ (ISV-303) Post-op inflammation Data &/or endpoints ongoing (bromfenac) ISV-101 Dry eye Phase 1/2 Planned (low concentration bromfenac) AzaSite ® Xtra ™ Infection treatment & prevention New IND Planned (azithromycin ophthalmic solution 2%) 5 Today’s Review Agenda u AzaSite Franchise • AzaSite/Akron in North America • AzaSite ROW Progress • AzaSite Xtra u Post-Cataract Surgery Franchise • BromSite • DexaSite • BromDex (ISV-504) u Blepharitis Program • DexaSite Progress • AzaSite Plus u Severe Dry Eye Disease Program • ISV-101 & ISV-104 6 AzaSite in North America Opportunity u Partner: Akorn (via 2013 acquisition of Merck assets) • Approved in U.S. & Canada for bacterial conjunctivitis • U.S. “relaunch” in February 2014, following 4-month supply outage u Tiered AzaSite North American royalty • 8% • 12.5% • 15% u Tiered AzaSite Xtra North American royalty • 12.5% • 15% u net sales <$20M $20M to <$50M > 50M+ net sales <$30M > 30M+ Patent protection • AzaSite: Issued IP to March 2019 • AzaSite Xtra: Issued IP to October 2027 7 InSite’s AzaSite Family/ROW Program u AzaSite (1% Azithromycin in DuraSite) • 2013 EU Health Authority meetings • 24-month EU formulation stability • March 2019 patent life/10-year MAA market exclusivity u AzaSite Xtra (2% Azithromycin in DuraSite) • • • • • 2013 EU Health Authority meetings All IND-enabling/formulation work completed 36-month EU formulation stability October 2027 patent life/10-year MAA market exclusivity Potential sNDA pathway following AzaSite MAA 8 InSite’s AzaSite Family/ROW Program Update u Japan: Senju license agreement (June 10th) • $1M upfront, clinical/regulatory milestones, tiered royalty u We own ROW rights to AzaSite and AzaSite Xtra u We regained AzaSite Xtra developmental rights, and the ability to reference the AzaSite IND and NDA, for the North American market in June 2013 u All three EU Health Authorities agreed that we can file U.S./Canada AzaSite NDA (in MAA format) with no further preclinical or clinical studies required • Only require appropriate CMC section supporting EU formulation u Cataleant Manufacturing Suite now EU/ROW compliant, as of January 2014, solving supply chain questions 9 InSite’s PostPost-Cataract Surgery Franchise u Opportunity to control 2/3 drug classes utilized as the “standard of care” pre- and post-cataract surgery • NSAID (e.g., Bromfenac) • Steroid (e.g., Dexamethasone) • Antibiotic (e.g., Besivance) u Opportunity for a partner to commercialize multiple approved products to the same ophthalmology customer • BromSite – 2015 approval • DexaSite – 2016 approval u Opportunity to be first in a new ophthalmology drug class • “BromDex” – First NSAID/steroid combination drug • Potential 2019 approval § Depending upon preclinical toxicology, IND and clinical trial requirements 10 BromSite in PostPost-cataract Surgery: An Attractive & Growing Global Commercial Opportunity u NSAIDs use pre-, peri- and post cataract surgery are 1/3 of U.S. “standard of care” • B&L/ISTA revenue of approximately $80M (pre-Prolensa launch) • 3 million+ cataract surgeries performed annually • “Baby boomer” cataract surgery growth coming (National Eye Institute) § 68.3% prevalence: aged 80+ § 42.8% prevalence: aged 70-79 u 2012 European NSAID segment • EU5 approximates €30M/$39M (44-48% of total) • Rest of Europe, Middle East, Africa is another €30M/$39M u Japan/Asia-Pacific – quantification ongoing u Cataract surgery procedures (World Health Organization) • Estimated 2010: 20 million • Estimated 2020: 32 million 11 BromSite Global Regulatory Update u Clinical packages aligned to fulfill regulatory requirements in North American, Europe and other markets (ex-Asia-Pacific) u Successful Post-Phase 3 Regulatory Meetings – 1st Half 2014 • U.S. FDA: Filing planned by end-2013 • EU MAA: Filing to follow NDA filing in 2015 • 5mL fill volume (largest) confirmed for CMC sections u Single, global formulation strategy u Cataleant Manufacturing Suite now EU/ROW compliant, as of January 2014 12 BromSite for Reduction of Inflammation and Pain Post--Cataract Surgery: Timeline Post u Low dose formulation of bromfenac (0.075%) in DuraSite u Rapid/efficient clinical development • • • • • • • IND filed July 2010 Strong Phase 1/2 clinical study results: March 2011 Superior PK performance vs. ISTA’s Bromday: October 2011 1st Phase 3 Study enrolled: August – November 2012 EU Regulatory positioning: 2H 2012 Positive 1st Phase 3 Study results: March 2013 Positive 2nd Phase 3 study results: December 2013 u Potential IND to NDA/MAA timeline: 4.5 - 5 years u Strong emerging competitive profile 13 BromSite NDA Opportunity: Summary u Opportunity to file U.S. NDA by end-2014 • Timeline driven by CMC section; validation batches stability u EU MAA filings to follow in 2015 • Successful May 2014 meetings u Additional clinical indications hold significant revenue upside • Prevention of CME post-cataract surgery in diabetic population • Synergy with anti-VEGF intravitreal injections for retinal indications u Issued patent/exclusivity to August 2029 u Process of getting the right partnership is ongoing 14 DexaSite for PostPost-Cataract Surgery u Phase 3 pathway confirmed with FDA in October/November • Same primary & secondary endpoints as BromSite Phase 3 Program • BID dosing (other approved steroids given 4-6 times daily) • Clinical trial material & CRO available and ready to start program Primary Endpoint Secondary Endpoints Absence of cells in anterior chamber of the eye at Day 15 Absence of: • Pain, as reported by patient • Anterior chamber flare (ACF) DexaSite BID N=160 R N=240 DuraSite (vehicle) BID All patients evaluated on Days 1, 8, 15, and 29 N= 80 15 ISV--504 (“BromDex”) for PostISV Post-Cataract Surgery u Co-invention with Richard Lindstrom M.D. • Global leader in corneal, cataract, refractive and laser surgery u Potential to be first in a new NSAID/steroid drug class u Formulated in DuraSite 2 u Exact same concentrations of • BromSite – 0.075% bromfenac (in solution) • DexaSite – 0.1% dexamethasone (in suspension) u Stable, aqueous solution/suspension drug combination u GLP toxicology program should be highly abbreviated • Chitosan toxicology – 90 days to support 14 day use • Ability to reference existing INDs of component drugs u Next steps: pre-IND meeting with FDA • GLP toxicology program • Endpoints 16 ISV--504 (“BromDex”) Formulation – Stability in DuraSite 2 ISV 17 InSite’s PostPost-Cataract Surgery Franchise u Opportunity to control 2/3 drug classes utilized as the “standard of care” pre- and post-cataract surgery u Opportunity to be first in a new ophthalmology drug class • “BromDex” – First NSAID/steroid combination drug u Opportunity for a partner to commercialize multiple products to the same ophthalmology customer over a very short timeline • BromSite – 2015 approval • DexaSite – 2016 approval • “BromDex” – 2019 approval 18 Blepharitis:: Global Landscape Overview Blepharitis u No approved agents u Clear market need • Ophthalmologists see worst patients; many “silent sufferers” u Off-label prescribing by ophthalmologists • Scant reimbursement; patients pay out-of-pocket u High FDA hurdle: traditional endpoint • Onerous in chronic settings of inflammation/infection (blepharitis) u Industry “Holy Grail”: front-of-eye focus u Classic first-to-market opportunity • Only company in Phase 3/post-Phase 3 development 19 InSite Vision’s pursuit of the first approved agent for the treatment of blepharitis u 2008 Phase 3 study: blepharoconjunctivitis • AzaSite Plus & DexaSite > AzaSite: Steroid effects • AzaSite Plus > DexaSite: Antibiotic effects u 2011 FDA Special Protocol Assessment (SPA) designation on new Phase 3 DOUBle study • • • • u AzaSite Plus vs. AzaSite vs. DexaSite DexaSite vs. DuraSite New recurrence endpoint, digital photography, scoring system Patient Quality of Life instrument inclusion 2012 European Health Authority Meetings • 2008 results & DOUBle study design u July 2013 DOUBle results: endpoints unachievable 20 Blepharitis Global Regulatory Update u Successful June 16th FDA post Phase 3 Meeting • DexaSite – results of a single Phase study sufficient to support indication of blepharitis, given breadth of dexamethasone data • First Phase 3 study to significantly improve blepharitis irritation § DexaSite > vehicle (p=0.0053) • InSite to file NDA in 2015 § Additional CMC/manufacturing work • AzaSite Plus: data and/or endpoint discussions to continue, following results of EU regulatory meetings/discussions and results § InSite commits to share all EU meeting minutes with FDA u EU Post-Phase 3 Regulatory Meetings Planned – Q3 • Same briefing package as FDA • DexaSite: Pursuing exact same filing strategy as with FDA • AzaSite Plus: Pursuing request to accept MAA filing: current Phase 3 data sets u Cataleant Manufacturing Suite now EU/ROW compliant, as of January 2014 u Partnering discussions ongoing 21 The InSite Vision Blepharitis Opportunity u Classic first-to-market advantage u Potential for broad payor strategy, reimbursement, promotion and use upon approval u DexaSite: Potential for first approved agent to significantly improve symptom of irritation, as reported by the patient u Potential for EU authorities to confirm DexaSite filing strategy (blepharitis), and anchor AzaSite Plus filing strategy (bacterialrelated blepharitis) u Discussions with FDA on AzaSite Plus for bacterial-related blepharitis to continue, following European meetings 22 AzaSite Plus and DexaSite DexaSite:: Substantial Market Opportunities u Assuming moderate market penetration and current pricing of drugs prescribed for blepharitis, possible sales ranges are: • AzaSite Plus • DexaSite $500M to $1B [Based on 10% at $120/prescription] $200M to $400M [Based on 5% at $90/prescription] 23 R&D Pipeline – What’s Next? u DexaSite: Phase 3 ready for post-cataract surgery u ISV-101: Bromfenac solution in DuraSite • IND filed and Phase 1/2 study planned following results of Phase 3 programs u AzaSite Xtra™ (ISV-405): Azithromycin (2.0%) solution in DuraSite • “Double strength” AzaSite with issued global IP through end-2027 • Completed all formulation/stability data and all GLP toxicology work to support global IND and/or IND-equivalent filings u ISV-504: BromDex in DuraSite 2 • Ongoing formulation/stability studies • Potential combination therapy for post-cataract surgery 24 InSite’s ModerateModerate-to to--Severe Dry Eye Disease Program u The Dry Eye Disease market segment is large • Largest “front of the eye” disease therapeutic area to date • Restasis is the first and only drug approved • Estimated 25M dry eye disease sufferers in the United States alone u We have two “shots on goal” in our pipeline • ISV-101 (bromfenac in DuraSite) • ISV-104 (immunosuppressant in DuraSite 2) 25 Moderate--to Moderate to--Severe Dry Eye Disease Program u ISV-101 (Bromfenac in DuraSite) • 0.01%, 0.02%, and 0.04% bromfenac formulations • Preservative free, unit-dose formats • Approved IND (2011) and Phase 1/2 Design § Clinical trials material is manufactured and ready to start • Issued patent/exclusivity to August 2029 u ISV-104: immunosuppressant in DuraSite 2 • Potential therapy for severe dry eye disease u Clinical/Regulatory Strategy • First, do not pursue “all comers” • Study patients with severe dry eye disease with substantial clinical signs and/or symptoms of inflammation • Potential to pursue Restasis failures 26 Severe Dry Eye Disease Program - Summary u Substantial and large market opportunity • Restasis 2013 revenues $900M+ • Disease incidence increases with age u Clear market need for additional commercial products • Restasis only works in ~25% of patients • Patient population likely not homologous 27 Summary u Post-Cataract Surgery Franchise • BromSite, DexaSite, & (ISV-504) “BromDex” u Blepharitis Program • AzaSite Plus & DexaSite u Severe Dry Eye Disease Program • ISV-101 & ISV-104 u AzaSite Franchise • AzaSite ROW & AzaSite Xtra u Partnering discussions ongoing 28