* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

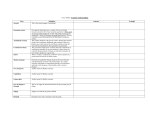

Download Contents, Explanatory notes, Abbreviations and Overview

Nouriel Roubini wikipedia , lookup

Transition economy wikipedia , lookup

Global financial system wikipedia , lookup

Economic growth wikipedia , lookup

Globalization and Its Discontents wikipedia , lookup

Chinese economic reform wikipedia , lookup

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Rostow's stages of growth wikipedia , lookup