* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Lecture 04: Risk Preferences and Risk Preferences and Expected

Survey

Document related concepts

Transcript

Fin 501: Asset Pricing

Lecture 04: Risk Preferences and

Expected Utility Theory

• Prof. Markus K. Brunnermeier

Slide 04

04--1

Fin 501: Asset Pricing

O

Overview:

i

Ri k Preferences

Risk

P f

1. State

State--byby-state dominance

2. Stochastic dominance

3. vNM expected utility theory

a) Intuition

b) Axiomatic

A i

ti foundations

f d ti

[DD4]

[L4]

[DD3]

4. Risk aversion coefficients and portfolio choice [DD5,L4]

5 Prudence coefficient and precautionary savings [DD5]

5.

6. Mean

Mean--variance preferences

[L4.6]

Slide 04

04--2

Fin 501: Asset Pricing

St t -by

StateState

b -state

byt t Dominance

D i

- State-by-state

y

dominance Ä incomplete

p

rankingg

- « riskier »

Table 2.1 Asset Payoffs ($)

t=0

Cost at t=0

investment 1

i

investment

t

t2

investment 3

- 1000

- 1000

- 1000

t=1

Value at t=1

π1 = π2 = ½

s=1

s=2

1050

1200

500

1600

1600

1050

- investment 3 state by state dominates 1.

Slide 04

04--3

Fin 501: Asset Pricing

St t -by

StateState

b -state

byt t Dominance

D i

((ctd.)

td )

Table 2.2 State Contingent ROR (r )

Investment 1

Investment 2

Investment 3

State

St

t C

Contingent

ti

t ROR (r

( )

s=1

s=2

Er

σ

5%

20%

12.5%

7.5%

-50%

60%

5%

55%

5%

60%

32.5%

27.5%

- Investment 1 mean-variance dominates 2

- BUT investment 3 does not m-v dominate 1!

Slide 04

04--4

Fin 501: Asset Pricing

St t -by

StateState

b -state

byt t Dominance

D i

((ctd.)

td )

Table 2.3 State Contingent Rates of Return

investment 4

investment 5

State Contingent Rates of Return

s=1

s=2

3%

5%

3%

8%

π1 = π2 = ½

E[r4] = 4%; σ4 = 1%

E[r5] = 5.5%;

5 5%; σ5 = 2.5%

2 5%

- What is the trade-off between risk and expected return?

- Investment

I

4 hhas a hi

higher

h Sharpe

Sh

ratio

i (E[r]-r

(E[ ] f)/σ

)/ than

h iinvestment 5

for rf = 0.

Slide 04

04--5

Fin 501: Asset Pricing

O

Overview:

i

Ri k Preferences

Risk

P f

1. State

State--byby-state dominance

2. Stochastic dominance

3. vNM expected utility theory

a) Intuition

b) Axiomatic

A i

ti foundations

f d ti

c) Risk aversion coefficients

[DD4]

[L4]

[DD3]

[DD4,L4]

4 Risk aversion coefficients and portfolio choice [DD5,L4]

4.

[DD5 L4]

5. Prudence coefficient and precautionary savings [DD5]

6. Mean

Mean--variance preferences

[L4.6]

Slide 04

04--6

Fin 501: Asset Pricing

St h ti Dominance

Stochastic

D i

Still incomplete

p

ordering

g

“More complete” than state-by-state ordering

State-by-state dominance ⇒ stochastic dominance

Risk preference not needed for ranking!

independently of the specific trade-offs (between return, risk and other

characteristics of probability distributions) represented by an agent

agent'ss

utility function. (“risk-preference-free”)

Next Section:

Complete preference ordering and utility

representations

H

Homework:

k Provide

P id an example

l which

hi h can be

b ranked

k d

according to FSD , but not according to state dominance.

Slide 04

04--7

Table 3-1 Sample Investment Alternatives

States of nature

Payoffs

Proba Z 1

Proba Z 2

1

2

10

100

.4

.6

.4

.4

EZ 1 = 64, σ z 1 = 44

Fin 501: Asset Pricing

3

2000

0

.2

EZ 2 = 444, σ z 2 = 779

Pr obability

F1

10

1.0

0.9

F2

0.8

07

0.7

0.6

0.5

F 1 and F 2

0.4

0.3

0.2

01

0.1

Payoff

0

10

100

2000

Slide 04

04--8

Fin 501: Asset Pricing

Fi t Order

First

O d Stochastic

St h ti Dominance

D i

Definition 33.1

1 : Let FA(x) and FB(x) , respectively,

respectively

represent the cumulative distribution functions of two

random variables ((cash payoffs)

p y ff ) that,, without loss off

generality assume values in the interval [a,b]. We say

that FA(x) first order stochastically dominates (FSD)

FB(x) if and only if for all x ∈ [a,b]

FA(x) ≤ FB(x)

H

Homework:

k Provide

P id an example

l which

hi h can be

b ranked

k d

according to FSD , but not according to state dominance.

Slide 04

04--9

Fin 501: Asset Pricing

Fi t Order

First

O d Stochastic

St h ti Dominance

D i

1

0.9

0.8

FB

0.7

FA

0.6

0.5

0.4

0.3

0.2

0.1

0

0

1

2

3

4

5

6

7

8

9

10

11

12

13

14

X

Slide 04

04--10

Fin 501: Asset Pricing

Table 3-2 Two Independent Investments

Investment 3

Payoff

4

5

12

Investment 4

Prob.

0 25

0.25

0.50

0.25

Payoff

1

6

8

Prob.

0 33

0.33

0.33

0.33

1

0.9

0.8

0.7

0.6

investment 4

0.5

0.4

0.3

0.2

investment 3

0.1

0

0

1

2

3

4

5

6

7

8

9

10

11

12

13

Figure 3-6 Second Order Stochastic Dominance Illustrated

Slide 04

04--11

Fin 501: Asset Pricing

S

Second

dO

Order

d St

Stochastic

h ti Dominance

D i

Definition 3.2:

3 2: Let FA ( ~x ) , FB ( ~x ) , be two

cumulative probability distribution for

random payoffs in [a, b]. We say that FA ( ~x )

second order stochastically dominates

(SSD) FB ( ~x ) if and only if for any x :

x

∫

-∞

[ FB (t) - FA (t) ] dt ≥ 0

(with strict inequality for some meaningful

interval of values of t).

Slide 04

04--12

Fin 501: Asset Pricing

Mean Preserving Spread

xB = xA + z

((3.8))

where z is independent of xA and has zero mean

for normal distributions

fA (x)

f B (x)

μ = ∫ x fA (x)dx

d = ∫ x f B (x)dx

d

~

x , Payoff

Figure 3-7 Mean Preserving Spread

Slide 04

04--13

Fin 501: Asset Pricing

Mean Preserving Spread & SSD

Theorem 3.4 : Let FA(•) and FB(•) be two distribution

functions defined on the same state space with identical

means. Then the follow statements are equivalent :

x ) SSD FB ( ~

x)

FA ( ~

x ) is a mean p

preserving

ese ving spread

sp ead of FA ( ~x )

FB ( ~

in the sense of Equation (3.8) above.

Slide 04

04--14

Fin 501: Asset Pricing

O

Overview:

i

Ri k Preferences

Risk

P f

1. State

State--byby-state dominance

2. Stochastic dominance

3. vNM expected utility theory

a) Intuition

b) Axiomatic

A i

ti foundations

f d ti

[DD4]

[L4]

[DD3]

4. Risk aversion coefficients and portfolio choice [DD4,5,L4]

5 Prudence coefficient and precautionary savings [DD5]

5.

6. Mean

Mean--variance preferences

[L4.6]

Slide 04

04--15

Fin 501: Asset Pricing

AH

Hypothetical

th ti l Gamble

G bl

Suppose someone offers you this gamble:

"I have a fair coin here. I'll flip it, and if it's tail I pay

you $1 and the gamble is over. If it's head, I'll flip

again. If it's tail then, I pay you $2, if not I'll flip again.

With every round, I double the amount I will pay to

you if it's

it s tail

tail."

Sounds like a good deal. After all, you can't loose.

So here

here'ss the question:

How much are you willing to pay to take this

gamble?

g

Slide 04

04--16

Fin 501: Asset Pricing

P

Proposal

l 1:

1 Expected

E

t d Value

V l

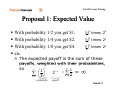

With probability 1/2 you get $1.

With probability 1/4 you get $2.

$2

With probability 1/8 you get $4.

etc.

Ê

(12 )1 times

(12 )2 times

(12 )3 times

20

21

22

The expected payoff is the sum of these

payoffs weighted with their probabilities,

payoffs,

probabilities

∞

t

so

∞

1

⎛1⎞

∑

t =1

t −1

=

⎜ ⎟ ⋅ 2

2⎠

⎝{

123

probability

∑2

t =1

1

=∞

payoff

Slide 04

04--17

Fin 501: Asset Pricing

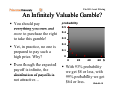

An Infinitely Valuable Gamble?

You should pay

everything you own and

more to purchase the right

to take this gamble!

Yet, in practice, no one is

prepared to pay such a

high price. Why?

E

Even though

th

h the

th expected

t d

payoff is infinite, the

distribution of payoffs is

not attractive…

probability

0.5

0.4

0.3

0.2

0.1

0

0

20

40

60 $

With 93% probability

we get $8 or less, with

99% probability

b bili we get

$64 or less.

Slide 04

04--18

Fin 501: Asset Pricing

What Sho

Should

ld We Do?

How can we decide in a rational fashion about such

gambles (or investments)?

Proposal 2: Bernoulli suggests that large gains should be

weighted less. He suggests to use the natural logarithm.

[Cremer - another great mathematician of the time - suggests the

square root

root.]]

∞

∑

t =1

t

expected utility

⎛1⎞

t −1

<∞

⎜ ⎟ ⋅ ln(2 ) = ln(2) =

of gamble

2⎠

⎝{

14243

probability

Ê

utility of payoff

Bernoulli would have paid at most eln(2) = $2 to

participate in this gamble.

Slide 04

04--19

Fin 501: Asset Pricing

Ri

Risk

Riskk-Aversion

A

i andd C

Concavity

it

u(x)

( )

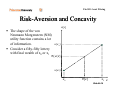

The shape of the von

Neumann Morgenstern (NM)

utility function contains a lot

of information.

Consider a fifty-fifty lottery

with final wealth of x0 or x1

u(x1)

E{u(x)}

u(x0)

x0

E[x]

x1 x

Slide 04

04--20

Fin 501: Asset Pricing

Ri

Risk

Riskk-aversion

i andd concavity

it

u(x)

( )

Risk-aversion means that the

certainty equivalent is smaller

than the expected prize.

prize

Ê

We conclude that a

risk-averse vNM

utility function

must be concave.

u(x1)

u(E[x])

E[u(x)]

u(x0)

x0

u-1(E[u(x)])

E[x]

x1 x

Slide 04

04--21

Fin 501: Asset Pricing

J

Jensen’s

’ IInequality

lit

Theorem 3.1

3 1 (Jensen

(Jensen’ss Inequality):

Let g( ) be a concave function on the interval

[[a,b],

] and be a random variable such that

Prob (x ∈[a,b]) =1

Suppose the expectations E(x) and E[g(x)] exist;

then

E [g ( ~

x )] ≤ g [E ( ~

x )]

Furthermore, if g(•) is strictly concave, then the

inequality is strict.

Slide 04

04--22

Fin 501: Asset Pricing

R

Representation

t ti off Preferences

P f

A preference ordering is (i) complete, (ii) transitive, (iii)

continuous and [(iv) relatively stable] can be represented

by a utility function, i.e.

(c0,cc1,…,ccS) Â (c

(c’0,cc’1,…,cc’S)

⇔ U(c0,c1,…,cS) > U(c’0,c’1,…,c’S)

(preference ordering over lotteries –

(S+1)-dimensional

(S

)

space)

p )

Slide 04

04--23

Fin 501: Asset Pricing

P f

Preferences

over P

Prob.

b Di

Distributions

t ib ti

Consider c0 fixed, c1 is a random variable

Preference ordering over probability distributions

Let

P bbe a sett off probability

b bilit distributions

di t ib ti

with

ith a finite

fi it

support over a set X,

a (strict) preference ordering over P

P, and

Define % by p % q if q ¨ p

Slide 04

04--24

Fin 501: Asset Pricing

S states of the world

Set of all possible lotteries

Space with S dimensions

C

Can we simplify

i lif the

th utility

tilit representation

t ti off

preferences over lotteries?

Space

S

with

ith one dimension

di

i – income

i

We need to assume further axioms

Slide 04

04--25

Fin 501: Asset Pricing

E

Expected

t d Utility

Utilit Th

Theory

A binary relation that satisfies the following

three axioms if and only

y if there exists a function

u(•) such that

p  q ⇔ ∑ u(c) p(c) > ∑ u(c) q(c)

i.e. preferences correspond to expected utility.

Slide 04

04--26

Fin 501: Asset Pricing

vNM

NM Expected

E

t d Utility

Utilit Theory

Th

Axiom 1 ((Completeness

p

and Transitivity):

y)

Agents have preference relation over P (repeated)

Axiom 2 (Substitution/Independence)

For all lotteries p,q,r ∈ P and α ∈ (0,1],

p < q iff α p + ((1-α)) r < α q + ((1-α)) r ((see next slide))

Axiom 3 (Archimedian/Continuity)

For all lotteries p,q,r

p q r ∈ P,

P if p  q  r,

r then there

exists a α , β ∈ (0,1) such that

α p + (1( α) r  q  β p + ((1 - β) r..

Problem: p you get $100 for sure, q you get $ 10 for sure, r you are killed

Slide 04

04--27

Fin 501: Asset Pricing

I d

Independence

d

Axiom

A i

Independence of irrelevant alternatives:

π

p<q

p

π

q

<

⇔

r

r

Slide 04

04--28

Fin 501: Asset Pricing

Allais Paradox –

Violation of Independence Axiom

10%

10’

≺

0

9%

15’

0

Slide 04

04--29

Fin 501: Asset Pricing

Allais Paradox –

Violation of Independence Axiom

10%

10’

≺

9%

0

100%

15’

0

10’

90%

15’

Â

0

0

Slide 04

04--30

Fin 501: Asset Pricing

Allais Paradox –

Violation of Independence Axiom

10%

10’

9%

≺

0

100%

0

10’

90%

Â

10%

15’

15’

10%

0

0

0

0

Slide 04

04--31

Fin 501: Asset Pricing

vNM

NM EU Th

Theorem

A binary relation that satisfies the axioms 1-3 if

and only

y if there exists a function u(•)

( ) such that

p  q ⇔ ∑ u(c)

( ) p(

p(c)) > ∑ u(c)

( ) q(

q(c))

i.e. p

preferences correspond

p

to expected

p

utility.

y

Slide 04

04--32

Fin 501: Asset Pricing

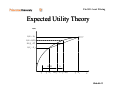

E

Expected

t d Utility

Utilit Th

Theory

U(Y)

U( Y0 + Z 2 )

~

U( Y0 + E( Z))

~

EU( Y0 + Z)

U( Y0 + Z1 )

~

CE( Z)

Y0

Y0 + Z1

Π

~

~

CE ( Y0 + Z) Y0 + E(Z)

Y0 + Z 2

Y

Slide 04

04--33

Fin 501: Asset Pricing

Expected Utility & Stochastic Dominance

Theorem 3. 2 : Let FA ( ~x ) , FB ( ~x ) , be two cumulative

x ∈ [a , b].

probability

b bilit distribution

di t ib ti for

f random

d payoffs

ff ~

Then FA ( ~x ) FSD FB ( ~x ) if and only if

for all non decreasing utility functions U(

U(•)).

E A U(~

x) ≥ E B U(~

x)

Slide 04

04--34

Fin 501: Asset Pricing

Expected Utility & Stochastic Dominance

Theorem 3. 3 : Let FA ( ~x ) , FB ( ~x ) , be two cumulative

probabilityy distribution

p

x defined on [a , b] .

for random payoffs ~

Then, FA ( ~x ) SSD FB ( ~x ) if and only if E A U(~x) ≥ E B U(~x)

f all

for

ll non decreasing

d

andd concave U.

Slide 04

04--35

Fin 501: Asset Pricing

Digression:

S bj ti EU Theory

Subjective

Th

Derive perceived probability from preferences!

Set S of prizes/consequences

Set Z of states

Set of functions f(s) ∈ Z

Z, called acts (consumption plans)

Seven SAVAGE Axioms

Goes

G

bbeyond

d scope off thi

this course.

Slide 04

04--36

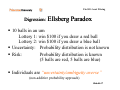

Fin 501: Asset Pricing

Digression:

Ell b

Ellsberg

Paradox

P d

10 balls in an urn

Lottery 1: win $100 if you draw a red ball

L tt

Lottery

2:

2 win

i $100 if you ddraw a bl

blue bball

ll

Uncertainty: Probability distribution is not known

Risk:

Probability distribution is known

(5 balls are red, 5 balls are blue)

Individuals are “uncertainty/ambiguity averse”

(non-additive probability approach)

Slide 04

04--37

Fin 501: Asset Pricing

Digression: Prospect

P

t Th

Theory

Value function ((over ggains and losses))

Overweight low probability events

Experimental evidence

Slide 04

04--38

Fin 501: Asset Pricing

I diff

Indifference

curves

x2

Any point in

this plane is

a particular

lottery.

Where is the

set of riskffree

lotteries?

45°

x1

If x1=x

x2,

then the

lottery

contains no

risk.Slide 04

04--39

Fin 501: Asset Pricing

I diff

Indifference

curves

x2

π

z

45°

z

x1

Where is the

set of lotteries

with expected

prize E[L]=z?

It's a

straight line,

and the

slope is

given by the

relative

probabilities

of the two

states.

Slide 04

04--40

Fin 501: Asset Pricing

Suppose the

agent is risk

averse. Where

is the set of

lotteries which

are indifferent

to (z,z)?

That's not

right! Note

th t there

that

th

are risky

lotteries

with smaller

expected

x1 prize and

which are

Slide 04

04--41

preferred.

I diff

Indifference

curves

???

x2

π

z

45°

z

Fin 501: Asset Pricing

I diff

Indifference

curves

x2

π

z

So the

indifference

curve must be

tangent to the

iso-expectedprize line.

This is a direct

p

of

implication

risk-aversion

alone.

45°

z

x1

Slide 04

04--42

Fin 501: Asset Pricing

I diff

Indifference

curves

x2

π

But riskrisk

aversion does

not imply

convexity.

This

indifference

d ff

curve is also

compatible

p

with riskaversion.

z

45°

z

x1

Slide 04

04--43

Fin 501: Asset Pricing

I diff

Indifference

curves

x2

∇ V(z,z)

π

z

The tangency

implies that

the gradient

of V at the

point (z,z) is

collinear to π.

Formally,

∇ V(z,z) = λπ,

for some λ>0.

45°

z

x1

Slide 04

04--44

Fin 501: Asset Pricing

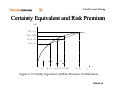

C i

Certainty

Equivalent

E i l andd Risk

Ri k Premium

P

i

(3.6)

(3.7)

~

~

EU(Y + Z ) = U(Y + CE(Y, Z ))

~

~

= U(Y +E Z - Π(Y, Z ))

Slide 04

04--45

Fin 501: Asset Pricing

C i

Certainty

Equivalent

E i l andd Risk

Ri k Premium

P

i

U(Y)

U( Y0 + Z 2 )

~

U( Y0 + E( Z))

~

EU( Y0 + Z)

U( Y0 + Z1 )

~

CE( Z)

Y0

Y0 + Z1

Π

~

~

CE ( Y0 + Z) Y0 + E(Z)

Y0 + Z 2

Y

Figure

g

3-3 Certainty

y Equivalent

q

and Risk Premium: An Illustration

Slide 04

04--46

Fin 501: Asset Pricing

O

Overview:

i

Ri k Preferences

Risk

P f

1. State

State--byby-state dominance

2. Stochastic dominance

3. vNM expected utility theory

a) Intuition

b) Axiomatic

A i

ti foundations

f d ti

[DD4]

[L4]

[DD3]

4. Risk aversion coefficients and portfolio choice [DD4,5,L4]

5 Prudence coefficient and precautionary savings [DD5]

5.

6. Mean

Mean--variance preferences

[L4.6]

Slide 04

04--47

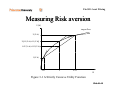

Fin 501: Asset Pricing

M

Measuring

i Ri

Riskk aversion

i

U(W)

tangent lines

li

U(Y+h)

U[0.5(Y+h)+0.5(Y-h)]

0.5U(Y+h)+0.5U(Y-h)

U(Y-h)

Y-h

Y

Y+h

W

Figure 3-1 A Strictly Concave Utility Function

Slide 04

04--48

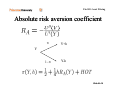

Fin 501: Asset Pricing

A

ArrowArrow

-Pratt

P tt measures off risk

i k aversion

i

and their interpretations

absolute risk aversion = - U" ((Y)) ≡ R A (Y)

U' (Y)

relative risk aversion

Y U" (Y)

=≡ R R (Y)

U' ((Y))

risk tolerance

=

Slide 04

04--49

Fin 501: Asset Pricing

Ab l t risk

Absolute

i k aversion

i coefficient

ffi i t

π

Y+h

1−π

Y-h

Y

Slide 04

04--50

Fin 501: Asset Pricing

R l ti risk

Relative

i k aversion

i coefficient

ffi i t

π

Y(1+θ)

1−π

Y(1-θ)

Y

Homework: Derive this result.

Slide 04

04--51

Fin 501: Asset Pricing

CARA and

d CRRA

CRRA--utility

tilit functions

f ti

Constant Absolute RA utility function

Constant

C

R

Relative

l i RA utility

ili function

f

i

Slide 04

04--52

Fin 501: Asset Pricing

Investor ’s

’ Levell off Relative

l i Risk

i k Aversion

A

i

1− γ

( Y + CE)

1- γ

Y=0

Y=100,000

( Y + 50,000 )1 − γ 12 ( Y + 100,000 )1 − γ

=

+

1- γ

1- γ

1

2

γ=0

γ=1

γ=2

γ=5

γ = 10

γ = 20

γ = 30

CE = 75,000 (risk neutrality)

CE = 70,711

CE = 66,246

66 246

CE = 58,566

CE = 53,991

CE = 51,858

CE = 51,209

γ=5

CE = 66,530

Slide 04

04--53

Fin 501: Asset Pricing

Ri k aversion

Risk

i andd Portfolio

P tf li Allocation

All ti

No

N savings

i

ddecision

i i (consumption

(

i occurs only

l at t=1)

1)

Asset structure

One risk free bond with net return rf

One risky asset with random net return r (a =quantity of risky assets)

Slide 04

04--54

Fin 501: Asset Pricing

• Theorem 4.1: Assume U'( ) > 0,, and U"( ) < 0 and let â

denote the solution to above problem. Then

â > 0 if and only if E~r > rf

â = 0 if and only if E~r = r

f

â < 0 if and only if E~r < rf .

• Define W(a ) = E{U (Y0 (1 + rf ) + a (~r − rf ))}. The FOC can

then be written W′(a ) = E[U′(Y0 (1 + rf ) + a (~r − rf ))(~r − rf )] = 0 .

By risk aversion (U''<0)

(U''<0), W′′(a ) = E[U′′(Y0 (1 + rf ) + a (~r − rf ))(~r − rf )2 ]

< 0, that is, W'(a) is everywhere decreasing. It follows that

â will be positive if and only if W′(0) = U′(Y0 (1 + rf ))E(~r − rf ) > 0

(since then a will have to be increased from its value of 0 to

achieve equality in the FOC). Since U' is always strictly

positive this implies aâ > 0 if and only if E(~r − rf ) > 0 .

positive,

W’(a)

W

(a)

The other assertion follows similarly.

a

0

Slide 04

04--55

Fin 501: Asset Pricing

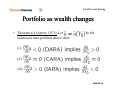

P tf li as wealth

Portfolio

lth changes

h

• Theorem 4.4 (Arrow, 1971): Let

solution to max-problem above; then:

be the

(i)

(ii)

(iii) .

Slide 04

04--56

Fin 501: Asset Pricing

P tf li as wealth

Portfolio

lth changes

h

• Theorem 4.5 (Arrow 1971): If, for all wealth levels Y,

(i)

(ii)

( )

(iii)

where

η=

da/a (elasticity)

dY /Y

Slide 04

04--57

Fin 501: Asset Pricing

L utility

Log

tilit & Portfolio

P tf li All

Allocation

ti

U(Y) = ln Y.

2 states

states, where r2 > rf > r1

Constant fraction of wealth is invested in risky asset!

Slide 04

04--58

Fin 501: Asset Pricing

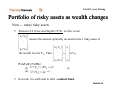

Portfolio of risky assets as wealth changes

Now -- many risky assets

Theorem 4.6 (Cass and Stiglitz,1970). Let the vector

⎡ â1 ( Y0 ) ⎤

p

y invested in the J risky

y assets if

⎢ . ⎥ denote the amount optimally

⎢

⎥

⎢ . ⎥

⎡ â1 ( Y0 ) ⎤ ⎡ a1 ⎤

⎢

⎥

â

(

Y

)

⎣ J 0 ⎦

⎢ . ⎥ ⎢.⎥

⎥ = ⎢ ⎥f ( Y0 )

the wealth level is Y0.. Then ⎢

⎢ . ⎥ ⎢.⎥

⎢

⎥ ⎢ ⎥

â

(

Y

)

J

0

⎣

⎦ ⎣a J ⎦

if andd only

l if either

ith

Δ

(i) U ' ( Y0 ) = ( θY0 + κ )

(ii) U ' ( Y ) = ξe − νY0 .

or

0

In words, it is sufficient to offer a mutual fund.

Slide 04

04--59

Fin 501: Asset Pricing

LRT/HARA--utility

LRT/HARA

tilit functions

f ti

Linear Risk Tolerance/hyperbolic absolute risk aversion

Special Cases

B=0, A>0 CARA

B ≠ 0, ≠1 Generalized Power

B=1 Log utility

u(c) =ln (A+Bc)

B=-1 Quadratic Utility

u(c)=-(A-c)2

B ≠ 1 A=0

A 0 CRRA Utilit

Utility function

f ti

Slide 04

04--60

Fin 501: Asset Pricing

O

Overview:

i

Ri k Preferences

Risk

P f

1. State

State--byby-state dominance

2. Stochastic dominance

3. vNM expected utility theory

a) Intuition

b) Axiomatic

A i

ti foundations

f d ti

[DD4]

[L4]

[DD3]

4. Risk aversion coefficients and portfolio choice [DD4,5,L4]

5 Prudence coefficient and precautionary savings [DD5]

5.

6. Mean

Mean--variance preferences

[L4.6]

Slide 04

04--61

Fin 501: Asset Pricing

I t d i Savings

Introducing

S i

• Introduce savings decision: Consumption at tt=00 and tt=11

• Asset structure 1:

– risk free bond Rf

– NO risky asset with random return

– Increase Rf:

– Substitution effect: shift consumption from t=0 to t=1

⇒ save more

– Income

I

effect:

ff t agentt is

i “effectively

“ ff ti l richer”

i h ” andd wants

t to

t

consume some of the additional richness at t=0

⇒ save less

– For log-utility (γ=1) both effects cancel each other

Slide 04

04--62

Fin 501: Asset Pricing

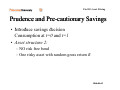

P d

Prudence

and

dP

Pre-cautionary

Preti

Savings

S i

• IIntroduce

t d

savings

i

decision

d ii

Consumption at t=0 and t=1

• Asset structure 2:

– NO risk free bond

– One risky asset with random gross return R

Slide 04

04--63

Fin 501: Asset Pricing

P d

Prudence

and

dS

Savings

i

B

Behavior

h i

Risk aversion is about the willingness to insure …

… but not about its comparative statics.

How

H ddoes th

the behavior

b h i off an agentt change

h

when

h

we marginally increase his exposure to risk?

An old hypothesis (going back at least to

J.M.Keynes) is that people should save more now

when they face greater uncertainty in the future.

The idea is called precautionary saving and has

intuitive appeal.

Slide 04

04--64

Fin 501: Asset Pricing

P d

Prudence

and

dP

Pre-cautionary

Prei

Savings

S i

Does not directlyy follow from risk aversion alone.

Involves the third derivative of the utility function.

ba ((1990)

990) de

defines

es abso

absolute

ute p

prudence

ude ce as

Kimball

P(w) := –u'''(w)/u''(w).

p

Precautionaryy savingg if anyy onlyy if theyy are prudent.

This finding is important when one does comparative

statics of interest rates.

Prudence seems uncontroversial, because it is weaker

than DARA.

Slide 04

04--65

Fin 501: Asset Pricing

Pre--cautionary Saving (extra material)

Pre

(+)

((-))

in s

Is saving s increasing/decreasing in risk of R?

Is RHS increasing/decreasing is riskiness of R?

Is U’() convex/concave?

Depends on third derivative of U()!

N.B: For U(c)=ln c, U’(sR)R=1/s does not depend on R.

Slide 04

04--66

Fin 501: Asset Pricing

P -cautionary

PrePre

ti

Saving

S i (extra material)

2 effects: Tomorrow consumption is more volatile

• consume more today, since it’s not risky

• save more for precautionary reasons

~

~

R

R

Theorem 4.7 (Rothschild and Stiglitz,1971) : Let A , B

be

~ two

~ return distributions with identical means such that

RB = RA + e, (where e is white noise) and let s and s be,

A

B

respectively, the savings out of Y0 corresponding to the

~

~

return distributions R

and

.B

R

A

If R ' R ( Y ) ≤ 0 and RR(Y) > 1, then sA < sB ;

If R ' R ( Y ) ≥ 0 and RR(Y) < 1, then sA > sB

Slide 04

04--67

Fin 501: Asset Pricing

Prudence & PrePre-cautionary Saving

P(c) =

− U ' ' ' (c)

U ' ' (c)

− cU ' ' ' (c)

P(c)c =

U ' ' (c)

~ ~

Th

Theorem 4.8

4 8 : Let

L tR

, be

b two

t return

t

distributions

di t ib ti

suchh

A RB

~ SSD ~ , and let s and s be, respectively, the

that R

RB

A

B

A

savings out of Y0 corresponding to the return distributions

~

~

R Aand R B. Then,

s A ≥ s B iff cP(c) ≤ 2, and conversely,

iff cP(c) > 2

sA < sB

Slide 04

04--68

Fin 501: Asset Pricing

O

Overview:

i

Ri k Preferences

Risk

P f

1. State

State--byby-state dominance

2. Stochastic dominance

3. vNM expected utility theory

a) Intuition

b) Axiomatic

A i

ti foundations

f d ti

[DD4]

[L4]

[DD3]

4. Risk aversion coefficients and portfolio choice [DD4,5,L4]

5 Prudence coefficient and precautionary savings [DD5]

5.

6. Mean

Mean--variance preferences

[L4.6]

Slide 04

04--69

Fin 501: Asset Pricing

M -variance

MeanMean

i

Preferences

P f

Early researchers in finance, such as Markowitz

and Sharpe, used just the mean and the variance

of the return rate of an asset to describe it.

Mean-variance characterization is often easier

than using an vNM utility function

But is it compatible with vNM theory?

The answer is yes … approximately … under

some conditions.

Slide 04

04--70

Fin 501: Asset Pricing

M -Variance:

MeanMean

V i

quadratic

d ti utility

tilit

Suppose utility is quadratic, u(y) = ay–by2.

Expected utility is then

2

E [u ( y )] = aE [ y ] − bE [ y ]

= aE

E [ y ] − b ( E [ y ] 2 + var[[ y ]).

])

Thus, expected utility is a function of the

Thus

mean, E[y], and the variance, var[y], only.

Slide 04

04--71

Fin 501: Asset Pricing

M -Variance:

MeanMean

V i

joint

j i t normals

l

Suppose all lotteries in the domain have normally

distributed prized. (independence is not needed).

This

Thi requires

i an infinite

i fi i state space.

Any linear combination of normals is also normal.

The normal distribution is completely described by its

first two moments.

Hence, expected utility can be expressed as a function of

just these two numbers as well.

Slide 04

04--72

Fin 501: Asset Pricing

MeanMean

e -V

Variance:

ce:

linear distribution classes

Generalization of joint nomarls.

Consider a class of distributions F1, …, Fn with the

f ll i property:

following

for all i there exists (m,s) such that Fi(x) = F1(a+bx) for all x.

Thi

This iis called

ll d a li

linear di

distribution

t ib ti class.

l

It means that any Fi can be transformed into an Fj by an

appropriate shift (a) and stretch (b).

(b)

Let yi be a random variable drawn from Fi. Let μi = E{yi}

and σi2 = E{(yi–μi)2} denote the mean and the var of yi.

Slide 04

04--73

Fin 501: Asset Pricing

MeanMean

e -V

Variance:

ce:

linear distribution classes

Define then the random variable x = (yi–μi)/σi. We

denote the distribution of x with F.

Note that the mean of x is 0 and the variance is 1, and F

is p

part of the same linear distribution class.

Moreover, the distribution of x is independent of which

i we start with.

Ê

We want to evaluate the expected utility of yi ,

+∞

∫− ∞ v(z)dFi (z).

Slide 04

04--74

Fin 501: Asset Pricing

MeanMean

e -V

Variance:

ce:

linear distribution classes

But yi = μi + σi x, thus

+∞

+∞

∫− ∞ v(z)dFi (z) = ∫− ∞ v(μi + σi z)dF (z)

=: u(μ i , σi ).

The expected utility of all random variables

d

drawn

ffrom the

h same linear

l

distribution

d

b

class can be expressed as functions of the

mean and the standard deviation only.

only

Slide 04

04--75

Fin 501: Asset Pricing

M -Variance:

MeanMean

V i

small

ll risks

ik

Justification for mean-variance for the case of small risks.

use a second order (local) Taylor approximation of vNM

U(c).

( ) is concave,, second order Taylor

y approximation

pp

is a

If U(c)

quadratic function with a negative coefficient on the

quadratic term.

Expectation

E

i off a quadratic

d i utility

ili function

f

i can be

b

evaluated with the mean and variance.

Slide 04

04--76

Fin 501: Asset Pricing

Mean--Variance: small risks

Mean

Let f : R Æ R be a smooth function.

function The Taylor

approximation is

( x − x0 )1

( x − x0 )2

+ f ' ' ( x0 )

+

f ( x ) ≈ f ( x0 ) + f ' ( x0 )

1!

2!

( x − x0 )3

+L

f ' ' ' ( x0 )

3!

Use Taylor approximation for E[u(x)].

Slide 04

04--77

Fin 501: Asset Pricing

Mean--Variance: small risks

Mean

Since E[u(w+x)] = u(cCE), this simplifies to

var( x)

w − cCE ≈ RA( w)

.

2

Ê

w – cCE is the risk premium.

Ê

We see here

W

h

that

th t the

th risk

i k premium

i

is

i

approximately a linear function of the

variance of the additive risk

risk, with the

slope of the effect equal to half the

coefficient of absolute risk.

Slide 04

04--78

Fin 501: Asset Pricing

Mean--Variance: small risks

Mean

The same exercise can be done with a multiplicative risk.

Let y = gw, where g is a positive random variable with

unit mean.

Doing

D i the

th same steps

t

as before

b f

leads

l d to

t

var( g )

1 − κ ≈ RR ( w)

,

2

where κ is the certainty equivalent growth rate,

u( w) = E[u(gw)].

u(κw)

E[u(gw)]

The coefficient of relative risk aversion is

relevant for multiplicative risk

risk, absolute risk

aversion for additive risk.

Slide 04

04--79

12:30 Lecture

Risk Aversion

Ê

Fin 501: Asset Pricing

E t material

Extra

t i l follows!

f ll

!

Slide 04

04--80

Fin 501: Asset Pricing

Joint savingsaving-portfolio problem

• Consumption at t=0 and t=1. (savings decision)

• Asset structure

– One risk free bond with net return rf

– One riskyy asset ((a = quantity

q

y of riskyy assets))

max U ( Y0 − s ) + δEU ( s(1 + rf ) + a ( ~r − rf ))

{ a ,s }

FOC:

s:

a:

((4.7))

U’(ct)

= δ E[U’(ct+1)(1+rf)]

E[U’(c

E[U

(ct+1)(r-r

)(r rf)] = 0

Slide 04

04--81

Fin 501: Asset Pricing

for CRRA utility functions

s:

a:

( Y0 − s) − γ ( −1) + δE ([s(1 + rf ) + a ( ~r − rf )]− γ (1 + rf ) ) = 0

[

]

E (s(1 + rf ) + a ( ~r − rf )) − γ ( ~r − rf ) = 0

Where s is total saving and a is amount invested in risky asset.

asset

Slide 04

04--82

Fin 501: Asset Pricing

MultiM lti-period

Multi

i d Setting

S tti

Canonical framework (exponential discounting)

U(c) = E[ ∑ βt u(ct)]

prefers earlier uncertainty resolution if it affect action

indifferent, if it does not affect action

Time-inconsistent (hyperbolic discounting)

Special case: β−δ formulation

U(c) = E[u(c0) + β ∑ δt u(ct)]

Preference for the timing of uncertainty resolution

recursive utility formulation (Kreps-Porteus

(Kreps Porteus 1978)

Slide 04

04--83

Fin 501: Asset Pricing

MultiM lti-period

Multi

i d Portfolio

P tf li Choice

Ch i

Theorem 4.10 ((Merton, 1971):

) Consider the above canonical

multi-period consumption-saving-portfolio allocation problem.

Suppose U() displays CRRA, rf is constant and {r} is i.i.d.

Then a/st is time invariant.

invariant

Slide 04

04--84

Fin 501: Asset Pricing

Preference

e e e ce for

o thee

timing of uncertainty resolution

Digression:

g ess o :

π

0

$100

$150

$100

$ 25

$150

$100

Kreps-Porteus

π

$ 25

Early (late) resolution if W(P1,…) is convex (concave)

Marginal rate of temporal substitution risk aversion

Slide 04

04--85