* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Prezentace aplikace PowerPoint

Steady-state economy wikipedia , lookup

Ragnar Nurkse's balanced growth theory wikipedia , lookup

State (polity) wikipedia , lookup

History of macroeconomic thought wikipedia , lookup

Embedded liberalism wikipedia , lookup

History of economic thought wikipedia , lookup

Classical liberalism wikipedia , lookup

Anthropology of development wikipedia , lookup

Economic calculation problem wikipedia , lookup

Postdevelopment theory wikipedia , lookup

Left-libertarianism wikipedia , lookup

Criticisms of the labour theory of value wikipedia , lookup

Political economy in anthropology wikipedia , lookup

Development economics wikipedia , lookup

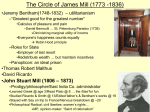

History of economic thought Presentation 6 Petr Wawrosz Classical political economy Historical background • The seventeenth century: the emergence of the idea of an autonomous sphere of economic relations. • The classical economists produced their „magnificent dynamics“ during a period in which capitalism was emerging from feudalism and in which the industrial revolution was leading to vast changes in society. • The period of inventions and discoveries: e.g. steam engine Historical background • • • The central problem of European political philosophy in the period from the beginning of the Renaissance to the French Revolution was that of accounting for social life without having to resort to metaphysical presuppositions. In the Middle Ages, social consensus was maintained by two fundamental principles: authority and faith, both justified by the assumption of the existence of God. The problem of modern social thought was: how is social life possible if those two principles and their metaphysical justification are left aside? One answer to this question was given by Machiavelli and Hobbes: the natural egoism of man makes free social life impossible and the absolute State necessary; the principle of authority is based on the monopoly of power, and does not need to be legitimized. It is based on violence, and only obtains obedience through its strength. The citizens, mindful of a primitive ‘social contract’ of subjection and driven by the survival instinct and the desire for security, can do nothing else but obey. Civil society originates from repeated acts of obedience. The alternative would be social disintegration and the law of the jungle. So power gives foundation to the State, and the State makes harmonious social life possible. This solution was certainly applicable to the absolutist States of the sixteenth and seventeenth centuries. It was no longer tenable after 1649, the year of the proclamation of the English Commonwealth, and, above all, after the Glorious Revolution (1688) and the Declaration of Rights (1689). Basic characteristics • Most of the main contributors to the classical tradition - and all of its founding fathers - viewed the economic order as analogous to the physical universe depicted by Newtonian mechanics. Economic affairs were regarded as governed by laws which, though ascertainable by man, lay beyond his direct control. In their day-today business, men were still well advised to understand the properties of these laws in order to guide their actions intelligently. It was indeed an important objective of economic studies to propagate an understanding of the significance of these laws. • God created the universe together with the laws that regulate it and then he stood aside. There is no need for his continual intervention to hold the world together, as it is completely selfregulating. Furthermore, as the natural order is rational, it can be understood by human intelligence. Basic characteristics • In the hands of classical economists the 'natural order' became a weapon with which to attack the state regulation and protection associated with the mercantilist era. Basic characteristics • The analysis of economic growth over extended time periods. Though the theoretical literature of classicism was to deal with a variety of issues, an overriding concern with the theme of economic growth too precedence in the moulding of its analytical categories. • Theory interested in questions of long-term economic development, and focused their attention on the evolution of the economic system as a whole, at the level of economic aggregates. • The Laissez-faire Message of Classical Political Economy. Basic characteristics • What distinguished Smith, Mill and others from many later sociologists and economists was their ambition to define economics in a broad manner and to be interested in the insights of other social sciences. • It is no accident that most classical economists had some training in philosophy or were themselves philosophers: Smith was a moral philosopher; Malthus studied mathematics and natural philosophy; Mill was trained in both political economy and philosophy, and published books in economics, philosophy, politics and social theory. Adam Smith (1723 – 1790) Basic facts about life • Studied at Glasgow university and at Oxford. • Became professor at Glasgow university. • The Theory of Moral Sentiments (1759): foundation of moral sentiments • Spent some time in France, met the Physiocrats. • An Inquiry into Nature and Causes of the Wealth of Nation (1776) (shortly: Wealth of nation) • Customs inspectror. Wealth of nation • • • • Divided into 5 books: 1. Microeconomic, price theory 2. capital accumulation, financial systém 3. historical: development of capital accumulation • 4. international trade, criticism of mercantelsim • 5. public sector, taxes and public expenditures Price theory • Example: hunting of a beaver takes 2 more time than hunting of a deer → the price of beaver must be twice of the price of deer. • Generally: the relative prices of commodities are determined by the relative amounts of labor needed to produce them. • Smith widen his theory: the prices are determined by cost of production (wages, rents for use of land, profits, costs of capital goods). • Wages, rents, profits tend toward their normal level („natural price“). The natural price . . . is, as it were, the central price, to which the prices of all commodities are continually gravitating’ • The market price can differ from natural price. • However it cannot stay for long below → the owners withdraw the resources for market. • The market price is possible to be higher due to use of resources of unusual quality or a monopoly granted by the government. Division of labor (DoL) • The division of labor is a process by which a particular productive operation is subdivided into a certain number of separate operations, each of which is carried out by a different person. With the division of labor the worker’s skill increases, the idle time in transferring a worker from one activity to another is reduced and, above all, technical progress is stimulated. • The division of labor is limited by the size of the market, is only possible when the economy can produce for a sufficiently large market, and can be intensified only if the market is expanding. • Smith‘s opinion: division of labor → enlargement of the markets → increases in labor productivity, and • so on; a real virtuous circle of growth. Accumulation of capital • Drives DoL. • Fixed capital: consisting of machinery, plant, buildings, etc. • Circulating capital: is used to buy raw materials and pay for labor and energy • The wages fund is that part of the circulating capital which is used to pay the workers. In real terms, it is a part of the goods produced in a productive cycle which is used to pay the workers in the successive cycle. Wages are paid before the product is sold, and for the capitalist, who advances them, they are capital. The theory of income distribution • Smith divided society into 3 classes. • The landowners: who do not own productive capital, are not interested in its enlargement and have no incentive to save and accumulate capital. Their propensity to save is zero, and they make no contribution to the growth of the wealth of the nation. • The workers: only possess their labor. The competitive forces on the labor market push real wages down to subsistence levels. But with a subsistence wage the propensity to save must be zero. • The capitalists: possess the productive capital and aim to increase it. This means they have a very high propensity to save. It follows that the higher the proportion of the national income going to profits, the higher the growth in the wealth of the nation. The general interest of the nation, therefore, coincides with that of the bourgeois class. The theory of income distribution • Wages: determined by the bargaining power of the parties, fewer employers than workers. • Level of subsistence: wages must be at least so high that the workers can survive (he and his family, including 4 children). • If demand for labor is higher than supply of labor wage can be higher than the level of subsistence. • In real life wages reflect the particular circumstances pertaining to different positions (including how difficult and expensive is to learn the profession). The theory of income distribution • The owner of capital takes a larger risk, so they expected higher profit than wage of workers. • Time factor. • Remuneration is influenced by government intervention. The invisible hand • "It is not from the benevolence of the butcher, the brewer or the baker that we expect our dinner, but from their regard to their own selfinterest... [Every individual] intends only his own security, only his own gain. And he is in this led by an invisible hand to promote an end which was no part of his intention. By pursuing his own interest, he frequently promotes that of society more effectually than when he really intends to promote it." The invisible hand • „Every individual necessarily labors to render the annual revenue of the society as great as he can. He generally indeed neither intends to promote the public interest, nor knows how much he is promoting it. By preferring the support of domestic to that of foreign industry, he intends only his own gain, and he is in this, as in many other cases, led by an invisible hand to promote an end which was no part of his intention. By pursuing his own interest he frequently promotes that of the society more effectually than when he really intends to promote it. I have never known much good done by those who affected to trade for the public good.” The invisible hand – today interpretation • Each individual strives to become wealthy "intending only his own gain" but to this end he must exchange what he owns or produces with others who sufficiently value what he has to offer; in this way, by division of labor and a free market, public interest is advanced. • Smith assumed that individuals try to maximize their own good (and become wealthier), and by doing so, through trade and entrepreneurship, society as a whole is better off. Furthermore, any government intervention in the economy isn't needed because the invisible hand is the best guide for the economy. Free competition • Invisible hand requires free entry to and exit from industry otherwise the market price is higher than natural price • Free competition can be destroyed including the facts the sellers have an incentive to collaborate in order to increase their market power. • Market as a set of institutions: private ownership, ban on monopolistic practices, etc. • Smith had a concept of man as a subject blessed with multiple selves, whose soul was characterized by different and contrasting sentiments. Broadly speaking, there are selfish and altruistic sentiments. International trade • Criticism of mercantilism: support of export and restrictions to the import prevents the market system from functioning efficiently. The function of the state • To protect society against violence and invasion from other societies. • To protect each single member of society against injustice and oppression from other members of society. • To offer public goods (necessary good that market does not offer). Tax principles • • • • Every taxpayer have to contribute to the state income to the same extent. This, however, raises a question what does to "the same extent" mean? It can be interpreted as giving to the state budget the same percentage of income by every taxpayer * what is called a flat tax nowadays (this view was supported by Adam Smith) or diversifying the tax rate between taxpayers. Within the second approach, taxpayers that have bigger income should pay bigger percentage of that income to the state budget, so the tax progression is applied. Every taxpayer has to be sure how much taxes he will have to pay. According to Adam Smith, this rule is of great importance. He indicated it as one of the most important features of the tax system. The confidence on how much tax should be paid determines often the overall condition and assessment of the tax system. Every tax should be collected at the time and in the manner that is most appropriate for the taxpayer. Adam Smith shows that this is very important as well for the taxpayer, because then he can pay taxes on time, and for the tax collector, because then he can collect taxes on time. Every tax should return to the society in the value similar to the value of the tax collected from the society. The perfect situation would be that the same value that was collected comes back to the society, however this would mean no administration costs, which is impossible. However, the lower the administration costs, the better for the tax system. Is there conflict between The Theory of Moral Sentiments and The Wealth of nation? • • ToMS: a man as basically a moral and altruistic being. WoN: emphasizes self-interest. • Self-interested behavior is not sufficient to generate social harmony in the presence of perfect liberty. Some form of moral and institutional restraint is necessary. Human nature is endowed with altruistic sentiments, like benevolence, which prompts the individual to please his fellow men and directly generates co-operative behavior. Human nature is also endowed with altruistic sentiments, like benevolence, which prompts the individual to please his fellow men and directly generates co-operative behavior. Attention for another is a fundamental part of human nature, and therefore that to assume its existence is essential to the understanding of all human choices, including economic ones. This system of rules guarantees orderly functioning of the market without the individuals having continuously to resort to enforcement to compel their counter-parties to play by the ‘rules of the game’. • • • Other representatives of classical political economy List of names • • • • • Jean Baptiste Say (1767 – 1832) Thomas Malthus (1766 – 1834) David Ricardo (1772 – 1823) Nassau Senior (1790 – 1864) John Stuart Mill (1806 -1873) Historical background • The thirty-year period from the Congress of Vienna (1815) to the 1848 revolutions was of crucial importance for the history of Europe. It is known as the ‘Age of Restoration’. In reality, it was a period of deep economic and social changes and sharp political crises; a period full of conflicts, marked as it was by the attempt of the aristocratic powers to restore the traditional absolutist order just when the Industrial Revolution was definitively undermining the economic foundations of that order. • In some of countries, political uprisings led by democratic forces occurred repeatedly and with increasing intensity during the thirtyyear period until the great revolutionary upheaval in 1848, but they were always defeated. The reason for this can perhaps be traced to the small mass base that the existing social structures offered the democratic movements; and underlying this situation was undoubtedly the slow process of capitalist accumulation. Historical background – the Corn law (1816) in England • The Napoleonic wars, by drastically reducing the imports of food supplies, had provoked a substantial increase in the prices of cereals, in particular corn; the prices of manufacturing goods, on the other hand, had increased less rapidly than agricultural products and wages. • The Corn law: Tariffs were fixed at such a high level that corn, the foreign prices of which were much lower than the internal ones, could not enter the country at all. • Abbolished 1846. Jean Baptiste Say (1767 – 1832) • Say’s Law or Say’s Law of Markets: the production is the source of demand. One’s ability to demand goods and services from others derives from the income produced by one’s own acts of production. Wealth is created by production not by consumption. My ability to demand food, clothing, and shelter derives from the productivity of my labor or my nonlabor assets. The higher or lower that productivity is, the higher or lower is my power to demand other goods and services. • John Maynard Keynes, in 1936, famously formulated Say's Law as: "From the time of Say and Ricardo the classical economists have taught that supply creates its own demand...“ Thomas Malthus • An Essay of the Principle of Population (1798): • Population increases in a geometrical ratio (the passion between sexes is necessary and will remain nearly in the present state). • Subsistence only in an arithmetical ratio (food is necessary to the existence of man). • The affirmations are based on the research, but biased. • Malthus supposed decreasing returns to scale in agriculture. • Subsistence wages: if the real wage is higher, family have more children (→ more income), lower the growth of labor forces → the fall of the wages (the iron law of wages). • Principles of Political Economy Considered with a View to their Practical Application (1820): the theory of insufficient aggregate demand. David Ricardo • The Principles of Political Economy and Taxation (1817): theoretical book with many economic models: - the theory of price formation and income distribution - the taxation theory and principles - international trade an other issues. David Ricardo • Price theory: beaver – deer example: for hunting beaver or deer we need weapon and other tools. How they affect the price of goods? • We can add to the time necessary for hunting the animal also the time necessary for production all tools. • The importance of capital goods: if capital good speeder the pruduction (capital intensive goofs) they earn hihger interests. The value of interest deviate the market price of final good from labor value, deviation is about 6-7 percent. David Ricardo • Theory of rent (what the price of land depends on): it is demand for goods that influence the price of land. Is a good need land for its production and demand for good is high than demand for land will be also high and landowners get high rent. • The rare (scarce) good: the proce depends on the demand, it is not posiible to increase amount of the good. David Ricardo • Theory of international trade – theory of comparative advantages: • International trade increases the stnadard of living. Even the country that is not best at any activity can gain from international trade. • The countries shold specilizy on activities with their lower opportunity costs (compare to OPC of other countries). David Ricardo • The table tells us how many people (per years) are necessary to produce 1 unit of wine or cloth. • England wine OPC: 120/100 = 1,2 cloth • Portugal wine OPC: 80/90 = 0,88 cloth. • Portugal has in wine production lower OPC and should produce wine. England Portugal Wine 120 80 Cloth 100 90 David Ricardo • • • • Theory of taxation What is the burden of taxation? „Weight dead loss.“ „There are no taxes which do not weaken the economy‘s power to accumulate“ • Ricardian equivalence. John Stuart Mill • Principles of political economy (1848) – first economic text-book – economics was taught from the book till 90th 19th century. • Essays on Some unsettled Questions of Political Economy (1844) • On Liberty (1859): the bible of liberalism? John Stuart Mill • The price theory: first introduced supply and demand analysis – the price of commodity tends to adjust the level where supply equals demand. • The question of over-production. • The law of diminishing returns: leads to stationary state. • Supported equal access to basic educating for all (both rich and poor). The upper class should not take responsibility for poor. • Supported free competition. Although he had sympathy for socialistic movement he condemned its tendency to reduce competition and said that it is not in compliance with interest of working class. John Stuart Mill • The role of the state: • To protect ownership rights = must be interpreted narrowly as that ensuring each individual the right to his own produce or to what he has legitimately obtained from other producers. • Rent-seeking: the protection of some industries against foreign competition may yield short-run benefits for some groups, but for the country as a whole it will in the long run be a harmful policy. • Supported women rights