* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download PDF - Deutsche Bank

Investment management wikipedia , lookup

Syndicated loan wikipedia , lookup

Systemic risk wikipedia , lookup

International asset recovery wikipedia , lookup

Financial economics wikipedia , lookup

Shadow banking system wikipedia , lookup

Securitization wikipedia , lookup

Fractional-reserve banking wikipedia , lookup

Systemically important financial institution wikipedia , lookup

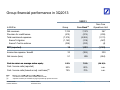

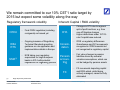

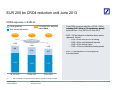

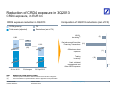

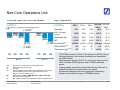

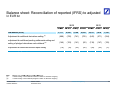

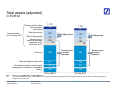

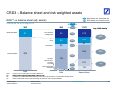

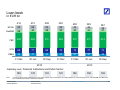

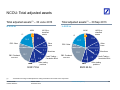

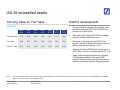

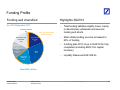

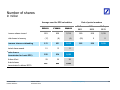

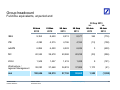

Deutsche Bank Deutsche Bank 3Q2013 results 29 October 2013 Group financial performance in 3Q2013 3Q2013 In EUR m Group Net revenues Provision for credit losses Total noninterest expenses thereof: Litigation thereof: Cost-to-achieve Core Bank (1) Non-Core Operations Unit 7,745 (512) (7,215) (1 163) (1,163) (236) 7,379 (274) (5,904) (316) (232) 367 (238) (1,311) (847) (4) IBIT (reported) 18 1,201 (1,183) Income tax expense / benefit 33 (306) 339 Net income (loss) 51 895 (844) Post-tax return on average active equity 0 3% 0.3% 7 5% 7.5% (34 9)% (34.9)% Cost / income ratio (reported) 93% 80% n.m. Cost / income ratio (based on adj. cost base)(2) 72% 70% n.m. N t Note: (1) (2) Figures may nott add Fi dd up d due tto rounding di diff differences Core Bank includes CB&S, GTB, DeAWM, PBC and C&A Adjusted cost base (as calculated on page 15) divided by reported revenues Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 financial transparency. 2 Agenda 1 Key current themes 2 Group p results 3 Segment results Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 financial transparency. 3 Litigation Litigation reserves Contingent liabilities(1) Mortgage repurchase demands/reserves In EUR bn In EUR bn In USD bn Demands(2) Reserves ~6.3 ~5.9 ~4.1 ~3.0 ~1.2 ~1.3 ~0.5 30 Jun 2013 (1) (2) 30 Sep p 2013 30 Jun 2013 30 Sep p 2013 30 Jun 2013 ~0.6 p 2013 30 Sep Contingent liabilities, liabilities also referred to as reasonabl reasonably possible losses abo above e pro provisions, isions are recogni recognized ed pursuant p rs ant to acco accounting nting standards when hen an outflow o tflo of ffunds nds is determined to be more than remote (>10%) but less than probable (<50%) and an estimate of such outflow reliably can be made Based on original principal balance ot the loans Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 financial transparency. 4 CRD4 – Common Equity Tier 1 capital and RWA development Pro-forma Pro forma, fully loaded Common Equity Tier 1 capital RWA In EUR bn In EUR bn 10.0% 36.5 9.7% 0.0 (0.2) (0.3) (0.3) 35.3 (0.1) (0 4) (0.4) Dividend Capital Equity Other Net 30 Jun (1) 2013 income accrual deduction compen- FX effect items sation 366.7 1.2 1.0 0.3 364.9 Credit risk Market risk Operational risk 30 Sep 2013 (4 3) (4.3) 30 Sep 2013(2) 30 Jun 2013 FX effect xx Note: (1) (2) Common Equity Tier 1 Ratio Figures may not add up due to rounding differences Net income attributable to Deutsche Bank shareholders Totals do not include any capital deductions that may arise in relation to insignificant holdings in financial sector entities; final CRD4/CRR rules still subject to Corrigendum and EBA consultation Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 financial transparency. 5 We remain committed to our 10% CET1 ratio target by 2015 but expect some volatility along the way Regulatory framework volatility — Changes in DTA due to regional split of profit and loss, e.g. from one-off litigation charges — Higher deductions under 10/15% rule if capital base reduced CRD4 — Final CRD4 regulation (including corrigenda) not issued yet EBA RTS — Ongoing issuance of Regulatory Technical Standards providing guidance on rule application and implementation details in Europe Consolidation — IFRS vs regulatory differences: Gains/losses and OCI movements recognized in IFRS financials but not recognized in regulatory capital — ECB taking over regulatory supervision for large European banks in 2014 with potential implications for regulatory practice Pension accounting g — Fair value changes in pension liabilities driven by actuarial valuation assumptions, which can not be hedged by pension assets FX — FX movements impacting capital and RWA which, whilst being actively managed, cannot be fully eliminated SSM(1) (1) Inherent Capital / RWA volatility DTA Single Supervisory Mechanism Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 financial transparency. 6 EUR 200 bn CRD4 reduction until June 2013 CRD4 exposure, in EUR bn CRD4 gross-up X.X% Total assets (adjusted)(1) 2.6% Leverage ratio, adjusted f ll lloaded fully d d — Total CRD4 exposure reduction of EUR ~200 bn, including EUR ~40 bn of FX movements, movements already achieved from 1 July 2012 to 30 June 2013 3.0% — EUR ~130 bn reduction of balance sheet assets (adjusted), thereof — EUR ~45 45 bn from NCOU de-risking — EUR ~45 bn cash/interbank deposits — EUR ~30 bn reverse repos — EUR ~10 bn non-derivative trading assets 2.6% EUR ~(200) bn 1,788 484 (1) 1,683 474 1,583 413 1,304 1 209 1,209 1 170 1,170 30 Jun 2012 31 Dec 2012 30 Jun 2013 — EUR ~70 70 bn reduction of CRD4 gross-up from derivatives See reconciliation to reported balance sheet in appendix of this presentation Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 financial transparency. 7 Reduction of CRD4 exposure in 3Q2013 CRD4 exposure, exposure in EUR bn CRD4 exposure reduction in 3Q2013 CRD4 gross-up FX Total assets (adjusted) Reductions (net of FX) NCOU de-risking(1) 1,583 (28) 413 Composition of 3Q2013 reductions (net of FX) (36) 1,519 (64) 397 1,170 1,122 Derivatives and Securities Financing Transactions (5) (21) Off-balance sheet exposure Trading inventory Cash, collateral management and Other CRD4 exposure 30 Jun 2013 Note: (1) (2) 3Q changes (1) (10) 1 30 Sept 2013 Numbers may not add up due to rounding Includes exposure reductions related to NCOU across all other categories See reconciliation to reported balance sheet in appendix of this presentation Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 financial transparency. 8 Leverage Toolbox: CRD4 reduction roadmap and impact Product category, in EUR bn Reduction target Jun 2013 – Dec 2015 NCOU d de-risking i ki (1) ~40 40 Derivatives and Securities Financing Transactions ~105(2) Off-balance Off balance sheet commitments ~15 15 Trading inventory ~30 Cash, collateral management(3) and a d ot other e C CRD4 e exposure posu e(4) ~60 Total reduction (excl. FX) ~250 FX(5) Note: (1) (2) (3) (4) (5) (6) Implementation timeline Achieved by 30 Sep 2013 By end 2015 ~5 5 Largely end 2014 By end 2015 Recurring IBIT impact from 2015, in EUR m One-off implementation costs, in EUR m ~21 ~1 1 ~450-500 450-500 ~600 600((6)) ~450-500 ~600(6) ~10 ~(1) ~36 ~28 Numbers may not add up due to rounding Includes exposure reductions related to NCOU across all other categories Comprised of EUR 75 bn from trade compression, tear-up, re-striking and process enhancements as well as EUR 30 bn from enhanced regulatory netting Comprised of cash and deposits with banks as well as cash collateral paid/margin receivables Includes selective growth within overall target reduction level as well as regulatory adjustments (e.g., capital deduction items, product and consolidation circle adjustments) FX impact calculated based on 30 June 2013 balances at 30 September 2013 FX rates Includes one-off costs relating to asset reductions as well as associated liability measures Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 financial transparency. 9 CRD4 exposure and leverage ratio simulation until 2015 In EUR bn, bn period end CRD4 exposure Tier 1 capital Eligible AT1(1) Adjusted j fully y loaded 1,583 (28) CRD4 leverage ratio 1,519 (36) ~(214) Jun 2013 Note: (1) (2) FX Reduction Sep 2013 3.0% 3.1% 47.8 46.5 ~1,305 Reduction Dec 2015 until Dec pro-forma 2015 3Q2013 results 29 October 2013 5.0 2.5 11.3 11.3 13.8 36.5 35.3 35.3 Jun 2013 Sep 2013 Numbers may not add up due to rounding Eligible AT1 outstanding under grandfathering rules; including 10% phase-out effect for 2013 Indicative Deutsche Bank Investor Relations 49 1 49.1 AT1 phaseAT1 out(2) issuance Retained earnings Dec 2015 4Q2013 – YE2015 financial transparency. 10 Agenda 1 Key current themes 2 Group p results 3 Segment results Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 financial transparency. 11 Key Group financial highlights Profitability Balance sheet Regulatory ratios (CRD4, pro-forma) (1) (2) (3) (4) (5) 9M2013 9M2012 Income before income taxes (in EUR bn) 3.2 4.0 Net income (in EUR bn) 2.0 2.8 Diluted EPS (in EUR) 1 99 1.99 2 92 2.92 Post-tax return on average active equity 4.9% 6.8% Cost / income ratio (reported) 82% 80% Cost / income ratio (based on adjusted cost base)(1) 69% 72% 30 Sep 2013 30 Jun 2013 Total assets IFRS (in EUR bn) 1,788 1,910 Total assets adjusted (in EUR bn)(2) 1,122 1,170 Book value per share outstanding (in EUR)(3) 54.87 55.68 Common Equity Tier 1 ratio (fully loaded) Risk-weighted assets (fully loaded, in EUR bn) Leverage ratio (adjusted fully loaded)(4) Exposure (in EUR bn)(5) 9.7% 365 3.1% 1,519 10.0% 367 3.0% 1,583 Adjusted cost base (as calculated on page 15) divided by reported revenues Adjusted for netting of derivatives and certain other components Shareholders’ equity divided by the number of basic shares outstanding (both at period end) Comprises pro-forma fully loaded CET1, plus all current eligible AT1 outstanding (under phase-in). Assumes that new eligible AT1 will be issued as this phases out Total assets (adjusted) plus CRD4 gross-up; see calculation on page 8 Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 financial transparency. 12 Net revenues In EUR bn 9.2 8.6 8.0 1Q 2Q 3Q 9.4 7.9 4Q 1Q 2012 8.2 7.7 2Q 3Q 2013 Contribution to Group revenues ex Consolidation & Adjustments by business segment(1): CB&S 50% 42% 44% 42% 47% 44% 37% GTB 11% 13% 12% 14% 11% 12% 13% DeAWM 12% 12% 14% 14% 13% 12% 16% PBC 25% 29% 27% 30% 25% 29% 29% NCOU 3% 5% 4% 0% 4% 2% 5% (1) Figures may not add up due to rounding differences Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 financial transparency. 13 Provision for credit losses In EUR m Non-Core Operations Unit Cost of Risk Deutsche Bank Group(1) Core Bank Cost of Risk Core Bank(1) 555 Cost of Risk(1) 0.80% 434 418 0.70% 0 60% 0.60% 314 0.50% 300 138 105 354 174 512 238 87 91 0.40% 473 0.46% 0.32% 0.30% 0.20% 223 281 255 1Q 2Q 3Q 328 267 299 274 4Q 1Q 2Q 3Q 0.10% 2012 2013 CB&S(2) 21 (1) 18 43 51 26 43 GTB(2) 44 58 39 67 92 79 58 PBC 160 216 189 216 111 194 171 Note: (1) (2) Divisional figures do not add up due to omission of DeAWM; figures may not add up due to rounding differences Provision for credit losses annualized in % of total loan book Figures for GTB and CB&S have been restated due to transfer of business Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 financial transparency. 14 Noninterest expenses 10.6 In EUR bn Compensation and benefits General and administrative expenses Other noninterest expenses(1) 3.2 7.0 6.6 7.0 36 3.6 34 3.4 3.3 3.2 0.2 3.3 (0.0) 3.2 1Q 2Q 6.6 40% 42% 7.2 3.2 2.9 53 5.3 35 3.5 4.1 2.1 3.6 0.4 2.8 0.3 0.2 0.2 3Q 4Q 1Q 2Q 3Q 2012 Compensation ratio 6.9 2013 38% 40% 38% 39% 38% xx Adj. cost base (in EUR m) excluding: Cost-to-Achieve (2) Litigation (3) Policyholder benefits and claims Other Ot e se severance e a ce Remaining Cost/income ratio (adjusted) Note: (1) (2) (3) (4) 6,411 6,117 6,045 6,090 6,034 5,910 5,600 69 240 96 272 384 308 355 1,787 224 132 356 630 236 1,163 150 (3) 162 107 192 (7) 171 101 0 22 98 56 43 3 25 5 2,262 (4) 11 31 42 18 20 0 24 70% 76% 70% 64% 72% 72% 77% Figures may not add up due to rounding differences Incl. policyholder benefits and claims, restructuring costs, impairment of goodwill and other intangible assets where applicable Includes CtA related to Postbank and OpEx Figures differ to previously reported numbers due to methodology change in 1Q2013 Includes other divisional specific cost one-offs (including EUR 280 m charges related to commercial banking activities in the Netherlands, EUR 90 m IT write-down in DeAWM and impairment of goodwill and other intangible assets of EUR 1,876 m) Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 financial transparency. 15 Progress on Operational Excellence Program Targeted CtA and savings Program to date progress In EUR bn In EUR bn CtA p per yyear 9M2013 Cumulative savings g 4.5 2H2012 2014 target I Invested/achieved t d/ hi d 4.5 4.0 2.9 2014 target 2013 target 1.7 1.6 1.5 1.5 2013 target 1.3 0.6 0.4 2012 Deutsche Bank Investor Relations 0.2 2013 2014 3Q2013 results 29 October 2013 2015 9M2013 0.8 1.1 9M2013 2H2012 0.5 0.4 2H2012 Cumulative CtA Cumulative savings financial transparency. 16 OpEx: How initiatives are progressing 100% 97% 74% EUR 1.5 bn savings already realized across categories 40% Percent of target 2015 9% Underlying savings, in EUR 4.5 bn 4.4 bn 3.3 bn 1.8 bn 0.4 bn Number of programs/ initiatives >165 ~165 165 ~120 120 ~55 55 ~5 5 Initiatives validated, execution ramping up Initiatives in execution, partially delivered Initiatives fully completed Ideas generated Note: Initiatives detailed Figures may not add up due to rounding differences; Number of programs/initiatives adjusted for technical corrections Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 financial transparency. 17 Profitability Income before income taxes Adjusted IBIT(2) In EUR bn 19 1.9 1.0 Net income In EUR bn 2.4 1.1 0.8 0.3 1.4 0.0 1.7 0.7 0.8 2Q 3Q 4Q 1Q 2012 2Q 3Q 5% 5% FY2012: 0% (1) (2) 1Q 2013 Post-tax return on equity(1) 10% (18)% 0.1 (2.5) (3.2) 1Q 0.3 2Q 3Q 2012 4Q 1Q 21% 31% 2Q 3Q 2013 Effective tax rate 12% 2% 0% 9M2013: 5% 25% 31% 33% FY2012: 61% 58% n.m. 9M2013: 37% Annualized, based on average active equity IBIT adjusted for impairment of goodwill and other intangible assets and significant litigation related charges Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 financial transparency. 18 Agenda 1 Key current themes 2 Group p results 3 Segment results Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 financial transparency. 19 Corporate Banking & Securities Income before income taxes Key features In EUR m In EUR m 3Q13 3Q12 Impairment p of g goodwill and other intangible g assets 1,893 Revenues (1) Prov. for credit losses Noninterest exp. 1,844 1,088 783 (3) 568 511 345 1,174 (606) 1Q 2Q 3Q 4Q 1Q 2012 2Q 3Q 2013 CtA 0 Note: (1) (2) (3) 0 (226) (86) (115) (25) (73) Figures may not add up due to rounding differences 3Q2013 revenues include negative mark to market on CVA of EUR 99 m (EUR 0 m in 3Q2012 and negative EUR 31 m in 2Q2013) driven by CRD4 pro-forma RWA mitigation efforts. CB&S revenues include EUR 24 m of DVA gains on uncollateralized derivative liabilities booked in other CB&S (EUR 0 m in 3Q2012 and loss of EUR 58 m in 2Q2013) Based on average active equity IBIT adjusted for impairment of goodwill and other intangibles Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 2,936 3,947 3Q13 vs. 3Q13 vs. 2Q13 3Q12 (26)% 3,666 (20)% 2Q13 (43) (18) (26) 135 % 69 % (2,539) (2,832) (2,856) (10)% (11)% 783 (68)% (56)% IBIT 345 1 088 1,088 CIR 86% 72% 78% 15 ppt 9 ppt Post-tax RoE(2) 5.9% 12.7% 9.6% (7) ppt (4) ppt — 3Q2013 revenues affected by a slowdown in market activity exacerbated b t db by uncertainty t i t over quantitative tit ti easing i tapering t i — Excluding the impact of CVA and DVA, CB&S revenues were down 24% y-o-y vs. a very strong 3Q2012 — Lower IBIT primarily reflected lower revenues and higher litigation charges, partially offset by ongoing momentum on cost reduction initiatives — CB&S CRD4 pro-forma exposure down 5% q-o-q reflecting solid progress on de-leveraging initiatives financial transparency. 20 Sales & Trading revenues Revenues Key features Debt S&T, in EUR m 3,168 2,135 2,729 2,462 1,906 1,420 1Q 2Q 3Q 4Q , 1,286 1Q 2Q 3Q Equity S&T, in EUR m 683 507 1Q 2Q 597 3Q 766 787 1Q 2Q 500 4Q 2012 Deutsche Bank Investor Relations 643 Debt Sales & Trading — A slowdown in activityy and challenging g g conditions resulted in significantly lower revenues vs. a record 3Q2012 — Rates & Credit trading revenues significantly lower y-o-y. Rates in particular was negatively affected by market uncertainty and a lack of liquidity. RMBS was affected by weak client demand — Despite record 3Q volumes, a flat trading environment saw tighter i h spreads d and d positioning i i i llosses negatively i l affecting ff i FX revenues — Emerging Markets revenues in line y-o-y, despite significant outflows — Credit Solutions revenues in line y-o-y Equity Sales & Trading — Revenues in line y-o-y as significantly higher revenues in Equity Derivatives were partially offset by lower revenues in Cash Equities — Equity q y Derivatives revenues higher g yy-o-y, y, especially p y in Europe p — Prime Brokerage revenues in-line y-o-y reflecting stable client balances 3Q 2013 3Q2013 results 29 October 2013 financial transparency. 21 Origination & Advisory Revenues Key features In EUR m Origination Advisory 677 701 638 173 121 509 159 738 676 116 653 69 155 136 517 528 517 607 622 499 372 1Q 2Q 3Q 4Q 1Q 2012 Note: 2Q 3Q13 3Q12 2Q13 9M2013 9M2012 Overall — Revenues in line y-o-y y o y driven by stable revenues across all Revenues products Prov. for credit — Top 3 global leading debt origination business with increased losses market share vs. full year 2012 Noninterest Advisory IBIT — Ranked No. 4 in EMEA CIR (in %) EquityRoE Origination Pre-tax (in %) — Revenues in line y-o-y — Ranked No. 1 in EMEA and No. 4 in APAC Debt Origination — Revenues in line y-o-y — Ranked No. 3 globally across debt origination — Ranked No. 2 in HY globally and No. 1 in EMEA 3Q 2013 Rankings and market share refer to Dealogic; figures may not add up due to rounding differences. APAC= Asia Pacific Ex-Japan Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 financial transparency. 22 Global Transaction Banking Income before income taxes Key features In EUR m In EUR m 3Q13 3Q12 Impairment p of g goodwill and other intangible g assets 318 323 309 283 323 379 (2) (175) 1Q 2Q 1Q 2012 2Q 3Q 2013 CtA 0 Note: (1) (2) (3) (4) 0 0 (41) (7) (23) (18) Figures may not add up due to rounding differences Based on average active equity IBIT adjusted for impairment of goodwill and other intangible assets The Banker Innovation in Technology and Transaction Banking Awards 2013, September 2013 Euromoney Cash Management Survey 2013, October 2013 Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 1,024 1,045 (58) (39) (79) 48 % (27)% (587) (684) (633) (14)% (7)% IBIT 379 323 323 18 % 17 % CIR 57% 65% 61% (8) ppt (4) ppt 21.1% 19.2% 16.7% 2 ppt 4 ppt Post-tax RoE (73) (249) 3Q 4Q Revenues Prov. for credit losses Noninterest exp. 3Q13 vs. 3Q13 vs. 2Q13 3Q12 (2)% 1,036 (1)% 2Q13 (1) — Solid revenue development on the back of growing volumes in an ongoing challenging market environment — Q-o-q decrease in loan loss provisions driven by single client credit event in prior quarter — Ongoing positive development of noninterest expenses q-o-q due to a continued focus on cost management — Awarded as ‘Most Most innovative Transaction Bank from Europe(3)‘, as No. 1 Cash Manager in Germany & in Western Europe (Nonfinancial Institutions)(4) and No. 1 Euro & Dollar Institutional Cash Management Provider in Europe and North America respectively(4) financial transparency. 23 Deutsche Asset & Wealth Management Income before income taxes Key features In EUR m In EUR m 283 Impairment p of g goodwill and other intangible g assets 221 207 96 113 82 (55) (5) (202) 1Q 2Q (257) 3Q 4Q 1Q 2Q 3Q 2013 CtA Note: (1) (2) (3) (4) (5) 0 (91) (14) (14) (171) (60) Figures may not add up due to rounding differences Includes Abbey Life gross up Includes policyholder benefits and claims In EUR bn Based on average active equity IBIT adjusted for impairment of goodwill and other intangible assets Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 1,264 3Q12 1,235 3Q13 vs. 3Q13 vs. 2Q13 3Q12 2% 1,040 22 % 2Q13 (1) (8) (0) (86)% n.m. (980) (1,115) (959) (12)% 2% IBIT 283 113 82 151 % nm n.m. Invested assets (3) 934 922 943 1% (1)% Net new money (3) (11) (9) 1 22 % n.m. 13.8% 4.6% 9 ppt 10 ppt Post-tax RoE(4) 2012 0 Revenues(1) Prov. for credit losses Noninterest exp.(2) 3Q13 3.7% — Revenues, excluding Abbey Life gross up, flat versus the prior year; higher management fees offset by lower client activity — The adjusted cost base, excluding litigation, cost-to-achieve, and the Abbey Life effect, decreased EUR 114 m or 13% y-o-y; eadcou t dec decreased eased by 9% ssince ce Ju June e 2012 0 headcount — CIR, excluding CtA, litigation and policyholder benefits and claims, improved a further 9 percentage points y-o-y — Net asset outflows of EUR 11 bn; revenue margin of outflows very low; net flows accretive to revenues financial transparency. 24 Private & Business Clients Income before income taxes Key features In EUR m In EUR m 483 507 460 367 404 347 287 1Q 2Q 3Q 4Q 1Q 2012 2Q 3Q 2013 (2) CtA (68) Note: (1) (2) (93) (71) (209) (84) (133) (83) Revenues Prov. for credit losses Noninterest exp. 3Q13 2,323 3Q12 2,434 3Q13 vs. 3Q13 vs. 2Q13 3Q12 (5)% 2,448 (5)% 2Q13 (171) (189) (194) (9)% (12)% (1,805) (1,841) (1,747) (2)% 3% IBIT 347 404 507 (14)% (32)% CIR 78% 76% 71% 2 ppt 6 ppt Post-tax RoE (1) 7.6% 8.2% 9.4% (1) ppt (2) ppt — Revenues impacted p by y challenging g g environment and decrease in non-operating revenues (e.g. lower results from Postbank's investment securities portfolio) — Further improvement in provisions for credit losses – Germany improved, Advisory Banking International stable vs. prior quarter — Underlying noninterest expenses lower y-o-y; development q-o-q impacted, i d among others, h b by provision i i release l iin 2Q2013 — Postbank integration remains well on track; CtA expected to increase in 4Q2013 Figures may not add up due to rounding differences B Based d on average active ti equity it Includes CtA related to Postbank integration and other OpEx measures Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 financial transparency. 25 Private & Business Clients: Profit by business unit Income before income taxes taxes, in EUR m Cost-to-Achieve(3) Private & Commercial Banking(1) Advisory Banking International Postbank(2) 28 32 22 42 51 49 233 137 149 93 59 118 126 5 53 74 88 107 1Q 2Q 3Q 4Q 1Q 2Q 3Q 2012 2013 — Higher credit product revenues and improved risk costs mainly offset by lower other revenues (e.g. from asset and liability management) y-o-y (1) (2) (3) 19 41 51 40 182 131 11 63 204 177 1 25 117 139 123 129 151 161 5 204 155 1Q 2Q 3Q 4Q 1Q 2Q 3Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 2012 2013 2012 2013 — IBIT mainly impacted by non-operating effects (e.g. de-risking of investment securities portfolio and lower releases of loan loss allowances) and lower deposit revenues y-o-y — Stronger investment product revenues offset by lower deposit revenues y-o-y; significant contribution from HuaXia Private P i t & Commercial C i lB Banking ki (f (formerly l Ad Advisory i B Banking ki G Germany; now iincluding l di PBC share h iin mid-cap id JV with ith GTB / CB&S) Contains the major core business activities of Postbank AG as well as BHW and norisbank Includes CtA related to Postbank integration and other OpEx measures Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 financial transparency. 26 Non-Core Operations Unit Income before income taxes Key features In EUR m In EUR m 3Q13 3Q12 Impairment p of g goodwill and other intangible g assets (1,227)(5) (549) (218) (196) (507) ((699)) (1,648) 2Q 3Q 4Q 1Q 2012 Note: (1) (2) (3) (4) (5) 2Q 3Q 2013 Figures may not add up due to rounding differences Based on average active equity In EUR bn Pro-forma RWA equivalent (RWA plus equivalent of items currently deducted 50/50 from Tier 1/Tier 2 capital whereby the Tier 1 deduction amount is scaled at 10%) T t l assets Total t according di to t IFRS adjusted dj t d for f netting tti off derivatives d i ti and certain other components IBIT adjusted for impairment of goodwill and other intangible assets Deutsche Bank Investor Relations IBIT (1,183) Post-tax RoE (421) 1Q Revenues Prov. for credit losses Noninterest exp. 3Q2013 results 29 October 2013 (1) 3Q13 vs. 3Q13 vs. 2Q13 3Q12 (8)% 193 90 % 2Q13 367 397 (238) (300) (174) (21)% 37 % (1,311) (607) (718) 116 % 83 % (1 183) (1,183) (507) (699) 133 % 69 % (34.9)% (10.6)% (17.0)% (24) ppt (18) ppt (2)(3) (2)(3) RWA (CRD4) (Basel 3) 62 Total assets (adj.)(2)(4) 66 n.a. 115 80 n.a. (23)% 73 (43)% (10)% — CRD4 RWA reduction of EUR 18 bn achieved in 3Q2013 driven by asset disposals, risk reduction measures and operational risk RWA transfer — Adjusted assets lower by EUR 7 bn, mainly from sales and rollp and ex-CB&S wholesale offs of Postbank GIIPS exposure assets — Ongoing capital accretion from asset de-risking on the back of marginal net gains from asset sales in the period — Noninterest expenses have been significantly impacted by litigation costs related to legacy US RMBS business financial transparency. 27 NCOU: De-risking since June 2012 De-risking milestones since June 2012 — CRD4 RWA equivalent reduction > 50% and adjusted assets 46% lower. De-risking momentum maintained — Significantly Si ifi tl ahead h d off D Dec 2013 ttargett off EUR < 80 bn b — Regulatory capital accretion of approximately EUR 6.1 bn(2) (~148 bps CET1 ratio benefit(2)) Major 2013 accomplishments (CRD4 RWA equivalent) — Wholesale asset disposals in former CB&S business including IAS 39 reclassified assets (EUR 7 bn) — Postbank’s legacy investment portfolio, including US CRE portfolio and recent focus on GIIPS exposure (EUR 6 bn) — Trade commutations and bond sales in Monoline portfolio (EUR 5 bn) — Risk reduction measures targeting Credit Correlation (EUR 6 bn) Size of Non-Core Operations Unit Adjusted assets(1), in EUR bn 120 95 73 66 52 40 31 26 18 21 ~2 15 ~2 14 ~2 Jun 2012 Dec 2012 106 ~13 13 19 4 15 63 7 3 Dec 2013 Dec 2012 7 2 Jun 2013 CB&S financial transparency. 62 46 8 Figures may not add up due to rounding differences Total assets according to IFRS adjusted for netting of derivatives and certain other components On a pre-tax basis excluding litigation related expenses Incl. EUR 7 bn re-allocation for operational risk to the Core business 3Q2013 results 29 October 2013 Sep 2013 69(3) 80 Jun 2012 Deutsche Bank Investor Relations ~1 106 81 — Strong de-risking pipeline for 4Q2013 — Credit Risk represents ~50% of remaining RWA 36 15 14 CRD4 RWA equivalent, in EUR bn 141 Outlook Note: (1) (2) (3) Jun 2013 66 7 7 2 Sep 2013 PBC Dec 2013 CI AWM 28 3Q2013 results: Key messages Quarterly results affected by substantial litigation charges CB&S results driven by weak Debt Sales & Trading Good progress in DeAWM, GTB and PBC experiencing some revenue pressure EUR 36 bn of de-levering in the quarter, EUR 64 bn with FX movements C Committed i d to 10% CET1 ratio i by b 2015, 201 although lh h volatility l ili lik likely l Management g remains committed to Strategy gy 2015+ Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 financial transparency. 29 Deutsche Bank Appendix Appendix: Table of Contents Balance sheet 32 Loan book 35 NCOU: Breakdown of adjusted assets 38 IAS 39 reclassified assets 39 Regulatory capital: CRD3 and reconciliation to CRD4 40 Private & Business Clients: Adjusted IBIT 43 Consolidation & Adjustments j 44 Value-at-Risk 45 Funding 46 Number of shares 48 Invested assets 49 Employees 51 Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 financial transparency. 31 Balance sheet: Reconciliation of reported (IFRS) to adjusted In EUR bn 2012 2013 31 M Mar 30 J Jun 30 S Sep 31 D Dec 31 M Mar 30 J Jun 30 S Sep Total assets (IFRS) 2,111 (1) 2,249 2,194 2,022 2,033 1,910 1,788 (688) (782) (741) (705) (642) (571) (524) (2) (146) (153) (141) (82) (138) (147) (125) Adjustment for additional reverse repos netting (14) (10) (23) (26) (28) (23) (17) Adjustment for additional derivatives netting Adjustment for additional pending settlements netting and netting of pledged derivatives cash collateral j ) Total assets ((adjusted) N t Note: (1) (2) 1,263 1,304 1,289 1,209 1,225 1,170 1,122 Fi Figures may nott add dd up d due tto rounding di diff differences Includes netting of cash collateral received in relation to derivative margining Includes netting of cash collateral pledged in relation to derivative margining Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 financial transparency. 32 Total assets (adjusted) In EUR bn Positive market values from derivatives post netting Financial assets at FV through P&L Note: N t (1) Trading securities Other trading assets Reverse repos / securities borrowed Loans des. at FV Other des. at FV 1,170 1,122 57 70 210 237 Trading assets 27 23 128 136 18 14 N t loans Net l 388 Cash and deposits with banks 117 Securities borrowed / reverse repos Brokerage & securities rel. receivables Other(1) 65 197 19 Reverse repos p / securities 201 borrowed 219 Trading assets 19 Reverse repos p / securities 187 borrowed 382 114 19 59 22 106 103 30 Jun 2013 30 Sep 2013 Figures may nott add Fi dd up due d to t rounding di differences diff Incl. financial assets AfS, equity method investments, property and equipment, goodwill and other intangible assets, income tax assets, derivatives qualifying for hedge accounting and other Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 financial transparency. 33 CRD3 – Balance sheet and risk weighted assets XX XX RWA(1) vs. balance sheet (adj. assets) In EUR bn, as of 30 Sep 2013 ~28% 260 Market Risk RWA Non-derivative trading assets 51 64 64 RWA density incl. operational risk RWA density excl. operational risk 260 ~23% 1,122 , 56 ~26% 219 Avg RWA density Avg. ~28% Credit Risk RWA Oth Other 36 ~22% 22% Derivatives(2) 32 ~57% 163 57 382 250 209 ~35% 35% ~35% 132 Lending(3) Reverse repo / securities borrowed Cash and deposits with banks RWA Note: (1) (2) (3) 187 ~1% 2 2 RWA ~2% Figures may not add up due to rounding differences RWA excludes Operational Risk RWA of EUR 49 49.5 5 bn Excludes any related Market Risk RWA which has been fully allocated to non-derivatives trading assets RWA includes EUR 23.5 bn RWA for lending commitments and contingent liabilities Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 ~1% 1% 114 Balance Sheet financial transparency. 34 Loan book In EUR bn 412 415 408 402 400 63 28 58 30 54 29 50 30 PBC 208 209 211 GTB 69 71 CB&S 44 31 Mar NCOU DeAWM 43 3 30 393 34 31 387 32 31 209 211 211 214 69 70 75 77 72 47 45 43 41 40 39 30 Jun 30 Sep 31 Dec 31 Mar 30 Jun 30 Sep 2013 2012 Germany excl. Financial Institutions and Public Sector: 180 Note: 178 181 181 182 182 183 Loan amounts are gross of allowances for loan losses. Figures may not add up due to rounding differences. Prior-period figures for GTB, DeAWM and CB&S have been restated due to transfer of business in 3Q2013. Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 financial transparency. 35 Composition of loan book and provisions by category In EUR bn, bn as of 30 Sep 2013 Core Bank Non-Core Operations Unit 512 3Q2013 provision for credit losses, in EUR m 207 387 32 107 ― Low loan to value (8) (154) 355 ― Mostly German domiciled ― Partially ― Highly hedged diversified― (1) ― Mostly short-term ― (30) (72) Mostly collate- ― SubS b ralised stanLiquid tial collateral collateral (1) (32) Total loan book, gross 198 PBC mortgages Inv grade / Postbank non-retail (1) GTB (1) AWM(1) (1) (18) PBC small corporates/ others ― Highly collateralised ― Mostly shortterm ― Strong under― Sublying ― High stantial asset margin collaquality business teral / hedging (2) (3) (1) (2) (12) (20) Corporate Asset PBC InvestFinance consumer ments (DB sponsored finance conduits) ((3)) (12) ― Partially ― Diversihedged fied ― Mostly asset senior pools secured (1) (0) (2) (4) Collatera- Financing of Leveraged lised / pipeline Finance hedged assets structured transactions Moderate risk bucket Lower risk bucket ― Predominantly mortgage secured ― Diversified by asset type and location (7) (20) Commercial Real Estate (3) (8) Other Higher risk bucket 80% 92% Note: (1) Loan amounts are gross of allowances for loan losses. Figures may not add up due to rounding differences. Categories re-aligned to changes in management reporting structure due to transfer of mid-cap business in 3Q2013 Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 financial transparency. 36 Impaired loans(1) In EUR bn Non-Core Operations Unit Impaired loan ratio Deutsche Bank Group(3) Core Bank Impaired loan ratio Core Bank(3) Impaired loan ratio 4.50% 4.00% 3 50% 3.50% 9.8 3.8 10.5 10.9 4.2 44 4.4 10.3 10.1 4.0 3.7 3.00% 9.3 9.7 3.2 3.5 2.51% 2.50% 2 00% 2.00% 6.0 6.4 6.2 6 6.3 6.4 61 6.1 62 6.2 30 Jun 30 Sep 1.50% 31 Mar 30 Jun 30 Sep 31 Dec 31 Mar 2012 Cov. ratio(2) Note: (1) (2) (3) 42% 42% 1.75% 2013 42% 45% 48% 54% 54% Figures may not add up due to rounding differences IFRS impaired loans include loans which are individually impaired under IFRS, i.e. for which a specific loan loss allowance has been established, as well as loans collectively assessed for impairment which have been put on nonaccrual status Total on-balance on balance sheet allowances divided by IFRS impaired loans (excluding collateral); total on on-balance balance sheet allowances include allowances for all loans individually impaired or collectively assessed Impaired loans in % of total loan book Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 financial transparency. 37 NCOU: Total adjusted assets Total adjusted assets(1) – 30 June 2013 Total adjusted assets(1) – 30 Sep 2013 In EUR bn In EUR bn AWM CI 1.5 PBC: Postbank non-core CI 11.7 14.4 PBC: Other AWM IAS 39 reclassified assets 3.8 13.7 5.5 Other loans 7.1 o o es Monolines 0.9 5.8 Other 8.9 Credit Trading – Correlation Book 1.3 17.0 10.8 PBC: Other 4.2 7.3 5.1 3.6 PBC: Postbank non-core Other trading positions EUR 73 bn (1) 15.4 13 7 13.7 IAS 39 reclassified assets 6.4 80 8.0 0.4 11.0 11 0 22.1 7.2 6.3 12.3 5.4 Oth Other Other loans Monolines Credit Trading – Correlation Book Other trading positions EUR 66 bn Total assets according to IFRS adjusted for netting of derivatives and certain other components Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 financial transparency. 38 IAS 39 reclassified assets Carrying Value vs. Fair Value 3Q2013 developments In EUR bn — The gap between carrying value and fair value has decreased by EUR 0.3 bn in 3Q2013 to a historic low of EUR 0.6bn — Decrease of fair value by EUR 0.7 bn includes the sale of assets and restructures — Decrease of carrying value by EUR 0.9 bn includes the sale of assets and restructures, as well as selected write-downs / LLPs. — Assets sold during 3Q2013 had a book value of EUR 194 m; net loss on disposal was EUR 10 m — Sales, restructuring and refinancing of legacy IAS39 assets primarily in European CRE portfolio remain the key focus area both from a capital consumption and de-risking perspective Dec 2009 Dec 2010 Dec 2011 Dec 2012 Mar 2013 Jun 2013 Sep 2013 Carrying Value 33.6 26.7 22.9 17.0 15.3 11.7 10.8 Fair Value 29.8 23.7 20.2 15.4 14.3 10.9 10.2 CV vs FV Gap (3.7) (3.0) (2.7) (1.6) (1.0) (0.9) (0.6) Note: At the reclassification dates, assets had a carrying value of EUR 37.9 bn; incremental RWAs were EUR 4.4 bn; there have been no reclassifications since 1Q2009; figures may not add up due to rounding differences Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 financial transparency. 39 CRD3 – Common Equity Tier 1 capital and RWA development Common Equity Tier 1 capital RWA In EUR bn In EUR bn 13.3% 41.7 13.0% 314.3 0.0 (0.2) 30 Jun 2013 Note: (1) ((0.3)) (0.1) (0 1) (0.1) (0 1) (0.1) Equity Actuarial Other compengains & sation Dividend Capital losses accrual deduction items Net income(1) 40.3 0.3 ((3.0)) (0.5) FX 30 Sep effect 2013 1.5 30 Jun 2013 309.6 (3 4) (3.4) FX effect Credit risk xx Market risk Operational risk 30 Sep 2013 Basel 2.5 (CRD3) Common Equity Tier 1 Ratio Figures may not add up due to rounding differences Net income attributable to Deutsche Bank shareholders Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 financial transparency. 40 CRD4 – CET1 ratio and risk-weighted assets 10.0 7.8 401 4Q 8.8 380 1Q 2012 Note: N t (1) 9.7 CET1 ratio (B3 fully loaded), in % 367 2Q 365 RWA (Basel 3 fully loaded) loaded), in EUR bn 3Q 2013 Common E C Equity it Ti Tier 1 ratio ti = (Ti (Tier 1 capital it l - hybrid h b id Tier Ti 1 capital) it l) / RWA Totals do not include any capital deductions that may arise in relation to insignificant holdings in financial sector entities; final CRD4/CRR rules still subject to Corrigendum and EBA consultation Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 financial transparency. 41 RWA and CET1: Reconciliation of CRD3 to CRD4(1) In EUR bn, bn as per 30 Sep 2013 Common Equity Tier 1 capital RWA 13 0% 13.0% CRD4 phase-in 61 14 6% 14.6% CRD4 fully loaded 371 CRD4 phase-in 365 11 2 9 7% 9.7% CRD4 fully loaded 54 ((6)) 310 40 35 (19) B 2.5 (CRD3) Note: (1) (2) (3) Incremental Total Incremental Total B 2.5 (CRD3) T1 Incremental deductions put against eligible AT1(2) capital first Total(3) Incremental Total(3) xx Figures may not add up due to rounding differences Pro-forma figures based on latest CRD4/CRR, subject to final European / German implementation Additional Tier 1 capital Totals do not include any capital deductions that may arise in relation to insignificant holdings in financial sector entities; final CRD4/CRR rules still subject to Corrigendum and EBA consultation Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 financial transparency. Common Equity Tier 1 Ratio 42 Private & Business Clients: Adjusted IBIT In EUR m, m post post-minorities minorities 1Q2012 1Q2013 2Q2013 3Q2013 5 (149) 468 (268) 118 (51) 126 (59) 74 (53) 260(4) 178 142 154 735(4) 168 186 127 Reported IBIT Cost-to-achieve 139 123 129 (0) 151 (19) 543 (19) 161 (1) 204 (11) 155 (5) Adjusted IBIT 139 123 130 170 563 162 215 159 Reported IBIT Cost-to-achieve (3) PPA 88 (40) (64) 107 (51) (72) 182 (22) (74) 131 (41) (86) 508 (155) (296) 204 (32) (83) 177 (63) (82) 117 (25) (82) Adjusted IBIT 191 231 278 258 958 318 321 225 Reported IBIT Cost-to-achieve (3) PPA 460 367 404 287 1,519 482 507 347 (68) (64) (93) (72) (71) (74) (209) (86) (442) (296) (84) (83) (133) (82) (83) (82) 591(4) 533 549 583 2,256(4) 649 722 512 Adjusted IBIT Adjusted IBIT (1) (2) (3) (4) FY2012 93 (49) Advisory Banking International PBC 4Q2012 137 (42) Reported IBIT Cost-to-achieve Postbank 3Q2012 233 (28) Private & Commercial (1) Banking (2) 2Q2012 Private & Commercial Banking (formerly Advisory Banking Germany; now including PBC share in mid-cap JV with GTB / CB&S) C t i th Contains the major j core b business i activities ti iti off Postbank P tb k AG as wellll as BHW and d norisbank i b k Net regular FVA amortization Also includes adjustment of EUR 1 m related to Greek government bonds Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 financial transparency. 43 Consolidation & Adjustments Income before income taxes Key features In EUR m In EUR m (73) (255) (293) (205) (152) ((694)) 2Q 3Q 4Q 1Q 2012 Note: N t (1) 3Q12 3Q13 vs. 3Q13 vs. 2Q13 3Q12 (48)% (205) (26)% 2Q13 (152) (293) (58) (273) (9) (79)% n.m. (85) (76) (87) 11 % (3)% Bank levies (30) 16 (26) n.m. 15 % Remaining 20 40 (83) (50)% n.m. IBIT thereof V&T differences (1) Spreads for capital instruments 3Q2013 key drivers — Valuation & Timing g differences were mainly y driven by y losses on credit spread narrowings on fair value option debt, mark to market valuation effects of U.S. dollar/euro basis swaps and effects related to short-term interest rates that significantly impacted 3Q2012 — Prior year quarter included a credit for the UK bank levy due to the application of a related double tax treaty (432) 1Q 3Q13 2Q 3Q 2013 Figures may nott add Fi dd up d due tto rounding di diff differences Valuation and Timing (V&T): reflects the effects from different accounting methods used for management reporting and IFRS Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 financial transparency. 44 Value-at-Risk DB Group, Group 99% 99%, 1 day day, in EUR m Average VaR Constant VaR(1) 120 Sales & Trading revenues EUR 3.8 bn EUR 3.5 bn 100 80 60 40 20 (1) 56 30 3Q2012 60 33 4Q2012 59 32 1Q2012 55 31 2Q013 48 25 3Q2013 Constant VaR is an approximation of how the VaR would have developed in case the impact of any market data changes since 4th Oct 2007 on the current portfolio of trading risks was ignored and if VaR would not have been affected by any methodology changes since then Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 financial transparency. 45 Funding activities update Funding cost development In bps Observations European Peer CDS(1) US Peer CDS(2) DB 5yr Senior CDS DB issuance spread(3) DB issuance volume 360 320 280 240 200 160 120 80 — Funding plan of up to EUR 18 bn for 2013 fully completed — Issuance at EUR 15.2 bn for the first nine months at average L+40 bps (ca. 55 bps inside CDS) and average tenor of 4 4.6 6 years — EUR 4.2 bn (~30%) by benchmark issuance (unsecured and subordinated) — EUR 11 bn ((~70%)) raised via retail & other private placements 40 0 €6bn €3.5bn €6bn €5bn €5bn €2bn €6bn €6.5bn €2.7bn 3Q2011 4Q2011 1Q2012 2Q2012 3Q2012 4Q2012 1Q2013 2Q2013 3Q2013 30 Jun 30 Sep 31 Dec 31 Mar 30 Jun 30 Sep 31 Dec 31 Mar 30 Jun 30 Sep 2011 Source: (1) (2) (3) 2012 2013 — Additional EUR 3 bn funding raised via capital increase in 2Q2013; no significant funding requirements for the remainder of the year Bloomberg, Deutsche Bank Average of BNP, BNP Barclays Barclays, UBS UBS, Credit Suisse Suisse, SocGen, SocGen HSBC Average of JPM, Citi, BofA, Goldman 4 week moving average Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 financial transparency. 46 Funding Profile Funding well diversified Highlights 3Q2013 As of 30 September 2013 Financing Vehicles 2% Secured Funding and a d Shorts S o ts 16% 65% from most stable funding sources Capital Markets and Equity 19% Discretionary Wholesale 7% Other Customers 10% Retail 28% — Total funding liabilities slightly lower, mainly in discretionary wholesale and secured funding and shorts — Most stable funding sources increased to 65% of funding — Funding plan 2013 of up to EUR 18 bn fully completed (including EUR 3 bn capital increase)) — Liquidity Reserves EUR 209 bn Transaction Banking 18% Total: EUR 1,015 bn Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 financial transparency. 47 Number of shares In million Average used for EPS calculation FY2011 FY2012 Common shares issued 929 Total shares in treasury (17) Common shares outstanding 913 921 1,015 15 13 11 928 934 1,026 29 26 26 957 960 1 052 1,052 Vested share awards Basic shares (denominator for basic EPS) Dilution effect Diluted shares (denominator for diluted EPS) Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 929 3Q2013 (9) 1,019 (4) End of period numbers 31 Dec 2011 929 (25) 905 financial transparency. 31 Dec 2012 30 Sep 2013 929 1,019 0 0 929 1,019 48 Regional invested assets – DeAWM In EUR bn Americas A i P Asia Pacific ifi EMEA excl. Germany Germany DeAWM 30 Sep 2013 30 Sep 2013 30 Sep 2012 31 Dec 2012 31 Mar 2013 30 Jun 2013 30 Sep 2013 vs. vs. 30 Jun 2013 30 Sep 2012 276 277 291 281 267 (14) (9) 54 55 58 54 55 1 1 272 280 286 281 287 6 15 320 317 328 327 325 (2) 5 922 930 963 943 934 (9) 12 Regional net new money – DeAWM 3Q2012 America Asia Pacific EMEA excl. Germany Germany Other DeAWM Note: (1) (0) 0 (7) (1) (9) 4Q2012 (4) 2 (2) 7 (4) 0 1Q2013 2 (0) 2 3 0 6 2Q2013 (4) 1 0 4 0 1 3Q2013 (6) 2 (0) (5) 0 (11) Figures may not add up due to rounding differences Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 financial transparency. 49 Invested assets – PBC In EUR bn 30 Sep 2013 30 Sep 2013 30 Sep 2012 31 Dec 2012 31 Mar 2013 30 Jun 2013 30 Sep 2013 vs. vs. 30 Jun 2013 30 Sep 2012 Private & Business Clients 297 293 290 285 285 0 (11) I Investment t t & Insurance I Products P d t 138 139 142 141 143 2 5 Deposits excl. Sight Deposits 158 154 148 144 142 (2) (16) Memo: Sight Deposits Deutsche Bank Investor Relations 74 3Q2013 results 29 October 2013 80 79 82 82 financial transparency. 0 8 50 Group headcount Full-time Full time equivalents equivalents, at period end 30 Jun 2012 31 Dec 2012 30 Jun 2013 30 Sep 2013 30 Sep 2013 vs. vs. 30 Jun 30 Jun 2013 2012 CB&S 9,353 8,650 8,213 8,577 365 (776) GTB 4,292 4,315 4,196 4,184 (13) (108) DeAWM 6,896 6,450 6,243 6,246 3 (650) 40,534 39,678 40,268 40,238 (30) (296) 1,549 1,457 1,419 1,428 9 (121) 38,030 37,668 36,819 37,989 1,170 (41) 100,654 98,219 97,158 98,662 1,505 (1,992) PBC NCOU Infrastructure / Regional Management Total Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 financial transparency. 51 Cautionary statements This presentation contains forward-looking statements. Forward-looking statements are statements that are not historical y include statements about our beliefs and expectations p and the assumptions p underlying y g them. These facts;; they statements are based on plans, estimates and projections as they are currently available to the management of Deutsche Bank. Forward-looking statements therefore speak only as of the date they are made, and we undertake no obligation to update publicly any of them in light of new information or future events. By their very nature, nature forward forward-looking looking statements involve risks and uncertainties. uncertainties A number of important factors could therefore cause actual results to differ materially from those contained in any forward-looking statement. Such factors include the conditions in the financial markets in Germany, in Europe, in the United States and elsewhere from which we derive a substantial portion of our revenues and in which we hold a substantial portion of our assets, the development of asset prices and market volatility, potential defaults of borrowers or trading counterparties, the implementation of our strategic initiatives, the reliability of our risk management policies, procedures and methods, and other risks referenced in our filings with the U.S. Securities and Exchange Commission. Such factors are described in detail in our SEC Form 20-F of 15 April 2013 under the heading “Risk Factors.” Copies of this document are readily available upon request or can be downloaded from www.db.com/ir. This presentation also contains non-IFRS financial measures. For a reconciliation to directly comparable figures reported under IFRS, to the extent such reconciliation is not provided in this presentation, refer to the 3Q2013 Financial Data Supplement, which is accompanying this presentation and available at www.db.com/ir. Deutsche Bank Investor Relations 3Q2013 results 29 October 2013 financial transparency. 52