* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Key Issue 4: OBSTACLES TO DEVELOPMENT

Survey

Document related concepts

Transcript

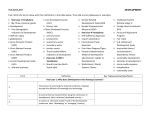

Key Issue 4: OBSTACLES TO DEVELOPMENT DEVELOPMENT OBSTACLES In order to close the gap between rich and poor countries, LDCs must develop. This means increasing the per capita GDP and then using wealth to improve social and economic conditions. The two obstacles to rapid development are: • policies that promote development. • funds to pay for the development. SELF-SUFFICIENCY MODEL FOR DEVELOPMENT Countries will choose one of two models to promote development. For most of the 20th century the SELF-SUFFICIENCY MODEL (aka balanced growth) was the most popular. THE MODEL Spread investment equally over all sectors in all regions. Incomes in the country keep pace with those in the city[Growth is modest but fair as residents everywhere share in benefits. Reducing overall poverty takes precedence over creating a wealthy upper class.] Isolate domestic business from large international competition. [Isolation allows domestic businesses to become profitable without the potentially adverse impacts by developed countries in a global market. Encourages a country’s fragile businesses to achieve independence.] Set barriers (tariffs on imports to make more expensive than domestic goods, import quotas, requiring import licenses to restrict the number of legal importers. [Improves domestic economy by forcing people to buy local] Restrict domestic businesses from exporting to foreign states. [Forces all sectors of the economy to focus on goods that improve local quality of life.] THE DRAWBACKS System protects inefficient businesses. [Because businesses can sell all their inventory at fixed prices, there is no incentive to improve quality, lower costs, reduce prices or increase production, and without international competition, companies do not need to follow technological advances or give high priority to sustainable development and environmental protection.] System creates massive bureaucracy. [Running the system requires a complex administration and fosters corruption– it becomes more lucrative to be an official than a businessman and the system creates a black market trade.] SELF-SUFFICIENCY PATH TO DEVELOPMENT The self-sufficiency path often involves heavy government spending on welfare programs and other efforts to ‘level the field’ between haves and have-nots. SELF-SUFFICIENCY PATH TO DEVELOPMENT EXAMPLE: Post- Independence INDIA After India achieved independence from Britain in 1947, it became a leading example in self-sufficiency and made effective use of many barriers to trade. During this period in India, the following policies were implemented: • Licenses had to be secured by foreign countries to import goods. The process was long and extensive. Several agencies had to approve. • Once licenses were received restrictions placed on the quantity of goods that could be sold. • Taxes on imported goods increased 2-3 X’s. • India businesses discouraged from exported goods. • Indian currency could not be converted to other currencies. Cut off from the World economy, businesses were supposed to produce goods for consumption inside India. • Government owned communications, transportation, power companies, and auto-makers private sector in most countries. • Government gave subsidies= cheap electricity/wiped out debts if companies were unable to make a profit. • Government permission was need to sell new products, modernize the factory, expand production set prices, hire and fire workers, and change job classifications for existing employees. Following this path India achieved modest development The INEFFICIENCY of SELF-SUFFICIENCY: INDIA’S MARUTI MOTORCARS Near-identical models of the ‘Maruti 800’ were made for decades with few improvements. During International trade era, they sold to Japanese Suzuki which now holds 45% of India's market. DEVELOPMENT THROUGH INTERNATIONAL TRADE MODEL What product can the country manufacture and distribute at a higher quality and a lower cost than other countries? The second model for development is the INTERNATIONAL TRADE MODEL. In it a country: --develops by expanding a distinct local industry for global export. --focuses on BASIC INDUSTRIES (basic industries manufacture a good for export and brings money into a community from the sale of the good. A non-basic industry is one that supports a basic industry but does not bring in outside money.) --attempts to find a COMPARATIVE ADVANTAGE (ability of an individual, firm, or country to produce a good or service at a lower opportunity cost than other producers). The wealth generated from exporting can then be reinvested in other, internal development. Therefore, the model banks on THE TRICKLE DOWN EFFECT (the theory that increased wealth for one class/industry/sector will benefit other classes/industries/sectors as the wealthy direct money to others through the purchase of goods and services, the expansion of business, and the reinvestment of profits in the community DEVELOPMENT THROUGH INTERNATIONAL TRADE MODEL ROSTOW’S DEVELOPMENT MODEL Rostow’s model for international trade is a five step approach: Developed in 1950’s, several countries adopted in 1960’s, still most followed the self-sufficiency approach. 1. THE TRADITIONAL SOCIETY An undeveloped society in which the majority of people are involved in subsistence agriculture and the majority of wealth is allocated to “non-productive” activities like religion and the military. Also called a SUBSISTENCE ECONOMY 2. PRECONDITIONS FOR TAKEOFF An elite group initiates innovative economic activities and the country invests in new technologies and infrastructure (transportation, power, public safety and water systems). 3. THE TAKEOFF Rapid growth in limited number of activities such as textiles and food products. Takeoff industries achieve technological advancement and production while other sectors stagnate. 4. DRIVE TO MATURITY Modern technology diffuses to other industries/sectors which also experience rapid growth. Workers become skilled/specialized. 5. AGE OF MASS CONSUMPTION Economy shifts from HEAVY INDUSTRY (industrial goods like steel, energy, industrial machinery) to consumer goods such as automobiles and refrigerators. INTERNATIONAL TRADE EXAMPLES while most counties followed the self-Sufficiency model. THE FOUR ASIAN DRAGONS : Singapore and Hong Kong, British Colonies until 1965 & 1997. Small amounts of Rural land and no natural resources. [South Korea, Singapore, Taiwan and Hong Kong all adopted approach with great success due to low labor costs and focusing on clothing/electronics] OIL-RICH ARABIAN PENINSULA STATES : Once least developed countries transformed in 1970’s due to high oil prices. [Saudi Arabia, Kuwait, Bahrain, Oman and the UAE succeeded by focusing on oil.] Financed highways, infrastructure, universities. THE DRAWBACKS INCREASED DEPENDENCE ON MDCs [ by selling products to developed countries, developing countries may scale back on production of necessities (food, clothes, etc.). Gov then uses takeoff profits to buy consumer goods from MDCs instead of reinvesting profits in their own country.] UNEVEN RESOURCE DISTRIBUTION [Developing countries focus on the sale of one product & prices of the sold commodity do not increase but decrease; therefore, the country does not make enough revenue to buy products they need. Resources/money from takeoff do not “trickle down” and islands of development appear. Also certain resource-poor areas of the country have no way to enter the economy.] MARKET DECLINE[World market for low-cost consumer goods has declined since MDCs have limited population growth/market size.] Uneven Resource Distribution: Low market prices have long kept ZAMBIA from fully benefitting from its massive copper reserves. AND THE WINNER IS… INTERNATIONAL TRADE MODEL In the late 1900s, most countries embraced the international trade approach. Many longtime advocates of the self-sufficiency method (like India) even switched their systems and dismantled their trade protections (discussed earlier). India’s GNI increased an average of 6.5% per year compared to 1.8% in the self-sufficiency model. Between 1990 and 2005 countries oriented toward international trade saw GDP increases of over 4% per year. DEVELOPMENT THROUGH INTERNATIONAL TRADE MODEL WORLD TRADE ORGANIZATION In 1995, countries representing 97% of world trade founded the WTO to promote the international trade model. The WTO reduces international trade barriers in two ways: --negotiating reduction/elimination international trade restrictions (subsidies for exports, quotas for imports, tariffs) on manufactured goods --enforcing agreements between states and international laws EX: Bringing charges against another country, protection of intellectual property-patent-copyright-illegal actions. The WTO is a highly controversial organization. Critics say it is anti-democratic, favors wealthy corporations over the common man and compromises state sovereignty. Because they lack money for development, LDCs obtain money from MDCs in two ways: Foreign Direct Investment (FDI) and Loans FOREIGN DIRECT INVESTMENT The international trade model requires countries to invest in take-off industries in other countries. Investment by a company in the economy of a foreign country is called FOREIGN DIRECT INVESTMENT (FDI). FDI does not flow equally… in 2010, only 2/5th went from an MDC to an LDC, whereas the other 3/5th went from an MDC to another MDC. FDI is also not evenly distributed between LDCs… in 2010 40% of all FDI went to China, and 20% went to Brazil, Russia and Singapore. The major source of FDI are TRANSNATIONAL CORPORATIONS (a company that operates in countries other than just the one where its headquarters are located (over half are headquartered in the US and Europe). FOREIGN DIRECT INVESTMENT Of the 500 largest transnational corporations in 2011, 384 had headquarters in developed countries. 133 in the US and 164 in Europe China=location of 61 of the 116 headquarters in developing countries. LOANS TO FINANCE DEVELOPMENT LDCs do not have the money to develop their own take-of industries, so they often obtain money from MDCs. That money comes in two form: FDI and loans from banks/international organizations. The World Bank and the International Monetary Fund (IMF) are the two biggest lenders. Read up on them. LDCs borrow money from them to build new infrastructure, and that new infrastructure encourages domestic business to expand and attracts FDI. STRUCTURAL ADJUSTMENT PROGRAMS Many loans fail (faulty engineering, bilked funds, failure to attract investment). Many LDCs are unable to repay loans and debt begins to exceed income. The inability to repay loans causes a chain reaction of problems. So, before granting debt relief, the IMF and World Bank will require a country to undergo a STRUCTURAL ADJUSTMENT PROGAM (an economic reform): THE DRAWBACKS TO SAPs --spend within budget --direct benefits to poor as well as wealthy Critics say SAPs increase poverty by focusing on --invest in education/health (not military) cutting government spending, therefore: --invest resources where profits will be greatest --cuts in healthcare, education, social services (jobs) --encourage private sector --higher unemployment --reform government --less support for the needy DEBT as a proportion of GNI WORLD BANK DEVELOPMENT ASSISTANCE Iraq and Afghanistan have been the leading recipients of aid. FINANCIAL CHALLENGES IN DEVELOPED COUNTRIES The 2008 financial crisis hit the developed world hard, with nearly every country seeing a sharp decline in GDP. Countries have been divided as to how to best respond to this crisis. FINANCIAL CHALLENGES IN DEVELOPED COUNTRIES WIDENING INEQUALITY • Most of the 20th century, the gap between the rich and poor narrowed • Developed countries used their wealth to extend healthcare and education to more people and provide assistance to the poor. • Since 1980 the inequality has increased=US and UK • In 2010 the richest 1% of Americans held 20% of the wealth, and 421 billionaires held more than 10% of the wealth in the US. • Many Americans felt it was unfair for large banks to be rescued while still making substantial profits at a time when most Americans incomes were stagnant or declining. FINACNIAL CHALLENGES IN DEVELOPING COUNTRIES Two responses have emerged for dealing with financial crises: STIMULUS – Increase gov’t spending to prop up economy; provide direct relief to increase spendable income. AUSTERITY – Cut ‘wasteful’ gov’t spending & social programs, use available money to pay down nat’l debt. Deep divisions exist between those promoting austerity or stimulus. In the US, Republicans tend to align with austerity, and Democrats with stimulus. Divisions are even deeper in Europe, where many countries have major debt issues. Wealthy northern countries favor austerity approaches for indebted countries, while poorer southern countries believe they should be provided stimulus relief. At the heart of recent financial crises has been the growth/pop of ‘bubbles’- rapid growth and then decline of prices of a commodity. A housing bubble caused the 2008 crisis. The world’s first bubble occurred in the Netherlands in 1637, when the price of TULIPS skyrocketed due to a blight and rampant speculation. MDC PROBS… First of all, life isn’t always sunny in MDCs unforeseen financial problems or unsound financial practices can weaken or destroy your economy and stifle continued development. To boot, since 1980, most MDCs have seen a widening inequality between the wealthy and the middle class and poor in their countries. US Housing Bubble Due to the economic boom of the 1990s and early 2000s, a number of countries around the world were flush with cash and looking for safe places to invest it. Many countries decided to invest their money in the growing US housing market. As more investors bought into the market, property values rose. As property values rose, many US banks encouraged both corporate and individual investors to take out loans to buy houses. This additional investment into the housing market caused US property values to rise even more, well beyond the reasonable value of the homes. As balloon payments on the houses came due, many investors could not make payments, and the value of the grossly overvalued houses rapidly declined. Since investors from all over the world were involved, a global recession ensued. Europe’s Sovereign Debt Crisis In 1999, many European countries adopted the Euro (remember from Chap 8!) believing that doing so would strengthen trade and economic development across the region. When the US Housing Bubble burst, it set of a recession in the US which then created a domino effect and turned into a global recession. This recession brought to light the unsound financial crisis and debts of a handful of EU member states (The PIIGS). Since those EU member countries were also on the Euro, their debt threatened to destabilize the Euro, the Eurozone and the Eu. THE US HOUSING BUBBLE BURSTING FAIR TRADE In order to combat uneven development, FAIR TRADE practices have greatly expanded. FAIR TRADE is commerce where products are made/traded according to standards which protect workers and small businesses in the LDC’s. AN ALTERNATE TO ROSTOW’S MODEL Standards are set by Fair Trade Organizations International (FLO) and certified in the US by TransFair USA. PRODUCER STANDARDS In LDCs, producers form worker-owned, democratically run cooperatives Cooperatives allow farmers to get loans, reduce costs and maintain high/fair prices Cooperatives benefit farmers, not absentee corporate owners Fair Trade Organizations return a higher percentage of the sale price to the farmers by bypassing middlemen. WORKER STANDARDS At least 1/3 of sale price is returned to the producer in the LDC, the rest to the wholesaler and retailer. Employers must pay workers fair wages, allow unions and comply with environmental and safety standards 60-70% of fair trade workers are women Cooperatives reinvest profits into their own communities The biggest Fair Trade retailer in the US is 10 Thousand Villages. Because fair trade organizations bypass costly distributors, a greater percentage of the retail price makes it to producers in the developing world 2/3 of artisanal products are made by WOMEN. Fair trade gives them a say in their livelihood and a voice in their community. MICROCREDIT Another development method improving lives in the developing world is MICROCREDIT – the issuance of very small loans (on average $60). Microcredit loans have a 99% repayment rate. The GRAMEEN BANK, based in Bangladesh, is the world’s largest microcredit organization. Its smallest loan was just $1, to a woman who wanted to sell rubber bracelets to tourists. MAKING PROGRESS The world has made progress with regard to several important metrics since 1980. Infant Mortality Rate has decreased universally. • From 17 to 6/1,000 in developed world; from 107 to 104 in developing. Life Expectancy increased, though gaps remain. • +8 years in developing, +7 years in developed GNI Per Capita increased but major gaps remain • From $20k to $33k developed, from $1k to $5k developing RISING GLOBAL HDI SINCE 1980 DECLINING INFANT MORTALITY SINCE 1980 RISING LIFE EXPECTANCY SINCE 1980 RISING GNI PER CAPITA SINCE 1980 (HIGHLY UNEVEN) MILLENIUM DEVELOMPENT GOALS MILLENIUM DEVELOPMENT GOALS Adopted by world leaders in the year 2000 and set to be achieved by 2015, the UN developed the Millennium Development Goals (MDGs) provide eight concrete benchmarks for tackling extreme poverty: 1. eradicate extreme poverty and hunger 2. achieve universal primary education 3. promote gender equality and empower women 4. reduce child mortality 5. improve maternal health 6. combat HIV / AIDS, malaria and other diseases 7. ensure environmental sustainability 8. develop a global partnership for development. To describe the complicated relationship between the developed/developing world, WALLERSTEIN created the ‘core/periphery.’ Resources flow primarily from LDCs to MDCs, leading to UNEVEN DEVELOPMENT. DEVELOPMENT V. STASIS Both Rostow and the Self-Sufficiency model propose that continued development for all countries is possible. However, some argue that all countries are static in their level of development. CORE-PERIPHERY WALLERSTEIN’S CORE-PERIPHERY MODEL • Also called World Systems Theory (VIDEO) Core-Periphery considers broad regional groups of countries, not specific countries. • Countries exist on one of three tiers: the core (wealthy and developed), the semi-periphery (industrializing) and the periphery (poor and undeveloped) • These levels are static… countries stay at their levels (or perhaps move downwards) • Wallerstein focuses on the relationship between the tiers: resources flow from a "periphery" of poor and underdeveloped states to a "core" of wealthy states, enriching the latter at the expense of the former. • Poor states are impoverished and rich ones enriched by the way poor states are integrated into the "world system.” • Therefore UNEVEN DEVELOPMENT is a basic characteristic of the global economy. • From Wallerstein comes DEPENDENCY THEORY: peripheral countries are “dependent” on FDI from core countries in order to have economic growth. These relationships both control and limit the extent to which regions can develop NEOCOLONIALISM MDCs still control their former colonies through the economic pressures of the global market they have created Both the Dependency Theory and neocolonialism add up to high levels of poverty and underdevelopment in countries (thus LDCs). NORTH-SOUTH SPLIT CORE-PERIPHERY MODEL