* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

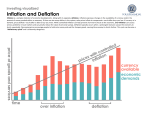

Download Inflation During and After the Zero Lower Bound

Exchange rate wikipedia , lookup

Real bills doctrine wikipedia , lookup

Full employment wikipedia , lookup

Edmund Phelps wikipedia , lookup

Nominal rigidity wikipedia , lookup

Money supply wikipedia , lookup

Quantitative easing wikipedia , lookup

Fear of floating wikipedia , lookup

Business cycle wikipedia , lookup

Phillips curve wikipedia , lookup

Monetary policy wikipedia , lookup

Stagflation wikipedia , lookup