* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Term Structure of Interest rate

Survey

Document related concepts

Transcript

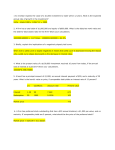

Term Structure of Interest rate - GROUP 1, TEAM 5 YUDHAJEET BANERJEE – 206 VINAY CHOKHRA – 209 AMIT MEHTA – 220 SRIKANTH REDDY – 225 NIKHIL SHETTY – 234 AMAR BHARTIA – 255 MAHESH KANKANI – 256 Agenda Definition of Yield and Yield Curve Types & Shifts in Yield Curve Theories of Term Structure Models for Term Structure of Interest rates Investor Behavior Interest Rate Risks Yield Curve Strategies Definition of Yield A bond’s yield is a measure of its potential return given certain assumptions about how the future will unfold. Interest rates are pure prices of time, and are the discounting factors used in the valuation equation for bonds. We generally associate yield to maturity as our standard meaning for yield, but there are other forms of yield: Current Yield Yield to call Yield to worst Definition of Yield Curve In finance, the yield curve is the relation between the interest rate (or cost of borrowing) and the time to maturity of the debt for a given borrower in a given currency A key function of the yield curve is to serve as a benchmark for pricing bonds and to determine yields in all other sectors of the debt market ( corporates, agencies, mortgages, bank loans, etc.). Example of Yield Curve Source - FIMMDA Types of Yield Curve Normal or Upward Sloping Yield Curve Reflects the higher inflation-risk premium Reflects investor's expectations for the economy to grow Deflation makes Future cash flows more valuable Inverted or Downward Sloping Yield Curve Long run interest rates are below short term interest rates. Reflects investor's expectations for the economy to slow or decline. Types of Yield Curve (cont.…) Flat Yield Curve Short term interest rates are equal to long term interest rates. Small or negligible difference between short and long term interest rates occurs later in the economic cycle when interest rates increase due to higher inflation expectations and tighter monetary policy. Humped Yield Curve Market expects that interest rates will first rise (fall) during a period and fall (rise) during another. Terms associated with Yield Curves Parallel shift • Interest rates change by the same amount for bonds of all terms, this is called a parallel shift in the yield curve since the shape of the yield curve stays the same, although interest rates are higher or lower across the curve. Twist • A change in the shape of the yield curve is called a twist and means that interest rates for bonds of some terms change differently than bond of other terms. Steep • The difference between long and short term interest rates is large, the yield curve is said to be steep Shift in Yield Curve If the interest rates of all If the short term interest If the medium term maturities are changed by rates are increased by interest rates are identical amounts then much larger amounts increased by much larger there will be a parallel than the longer term amounts than the longer shift in the yield curve. interest rates, the yield term interest rates, the curve becomes less steep yield curve becomes more and its slope decreases hump shaped Theories of Term Structure Expectations Theory (Pure Expectations Theory) Explains the yield curve as a function of a series of expected forward rates Implies that the expected average annual return on a long term bond is the geometric mean of the expected short term rates Bonds are priced so that the implied forward rates are equal to the expected spot rates If short term rate are expected to rise in the future, interest rate yields on longer maturities will be higher than the those of the shorter maturities – upward sloping yield curve Liquidity Preference Theory Places more weight on the effects of the risk preferences of market participants Theory asserts that risk aversion will cause forward rates to be systemically greater than expected spot rates Longer-term interest rates not only reflect investors’ future assumptions for the interest rates, but also includes a premium for holding these longer-term bonds Theories of Term Structure (cont.…) Market Segmentation Theory (Segmented Markets Theory) Based on the idea that investors and borrowers have preferences for different maturity stages The demand and supply of bonds of particular maturity are little affected by the bonds of neighboring maturities’ prices E.g.. Institutional investors may have preference for maturity ranges that closely match their liabilities etc. Preferred Habitat Theory Similar to market segmentation theory Investors have preference for particular maturity but can be induced to move from their preferred maturity ranges when yields are sufficiently higher in other (non-preferred) maturity ranges They will move only if they are compensated for the additional risk Economic v/s Statistical Models Economic models are designed to match correlations between interest rates and other economic aggregate variables Pro: Economic (structural) models use all the latest information available to predict interest rate movements Con: They require a lot of data, the equation can be quite complex, and over longer time periods are very inaccurate Statistical models are designed to match the dynamics of interest rates and the yield curve using past behavior. Pro: Statistical Models require very little data and are generally easy to calculate Con: Statistical models rely entirely on the past. They don’t incorporate new information Term Structure of Interest Rates: Development of Mathematical Models CIR Model Hull White Model • Established in 1977 • Established in 1985 • Established in 1990 • Established in 1992 • One factor Short Rate model • Extension of the Vasicek Model • Impacted by the current volatilities of all spot interest rates and all forward interest rates • Very general interest rate framework Vasicek Model Heath, Jarrow, Morton Model • Automatically calibrated to the initial yield curve Vasicek Model dit it dt dz Controls Persistence Controls Mean Controls Variance (Randomness Factor) Indicates the long term mean level of interest rates Indicates the speed of reversion". It characterizes the velocity at which such trajectories will regroup around Advantage: Vasicek's model was the first one to capture mean reversion Disadvantage: It is theoretically possible for the interest rate to become negative Using the Vasicek Model Choose parameter values Choose a starting value Generate a set of random numbers with mean 0 and variance 1 Parameter Values: Kappa= 0.2 Sigma= 2 t=0 t=1 t=2 t=3 t=4 i 6% 6.8% 6.84% 4.202% 5.5616% .2(6-i) 0 -.16 -.168 .3596 dz .4 .2 -1.1 .5 di .8 .04 -2.368 1.3596 -.9 Cox–Ingersoll–Ross model (CIR) Model The CIR framework allows for volatility that depends on the current level of the interest rate (higher volatilities are associated with higher rates) The standard deviation factor avoids the possibility of negative interest rates When the rate is at a low level (close to zero), the standard deviation also becomes close to zero, which dampens the effect of the random shock on the rate. Consequently, when the rate gets close to zero, its evolution becomes dominated by the drift factor, which pushes the rate upwards (towards equilibrium). Factors for changes in Interest Rates Inflation Changes in the supply and demand of credit Reserve Bank of India policy Fiscal policy Fluctuations in Exchange rates Economic conditions Market psychology Behavior to changes in Interest rates Investor •Long term investors tend to hold till maturity as the prices of existing bonds fall •Short term investors may reduce the average maturity of holdings by swaps to shorter maturity bonds •Short term investors may sell the bonds for capital gains as prices for existing bonds rise •Long Term Investors may extend the maturity of their holdings and increase the call protection and decrease reinvestment risk Interest Rates Issuer •Pays a competitive interest rate to get people to buy new bonds Increase •Bond issuers may redeem existing debt (Callable option) and issue new bonds at a lower interest rate Decrease Investor Risks Bond Portfolio Strategy Selection of the most appropriate strategy involves picking one that is consistent with the objectives and policy guidelines of the client or institution. Basic types of strategies: Active Laddered Barbell Bullet Passive Buy and hold Indexing Matched-funding strategies Contingent procedures (structured active management) Bond Portfolio Strategy (cont.…) Passive Portfolio Strategies Buy and hold Maximize the income generating properties of bonds The premise of this strategy is that bonds are assumed to be safe Investors Hold them to maturity Indexing Indexing is considered to be quasi-passive by design. The main objective of indexing a bond portfolio is to provide a return and risk Characteristic closely tied to the targeted index Matched-funding strategies Dedicated portfolio – exact cash match Contingent procedures (structured active management) Contingent immunization` Non-parallel shifts - Butterfly Positive Butterfly Short Intermediate Maturity Long Negative Butterfly Short Intermediate Maturity Long Butterfly Yield Positive butterfly Yield Curve Negative Butterfly Term to Maturity Yield Curve Strategies Bullet Strategy Barbell Strategy Ladder Strategy Barbell Strategy A barbell allows the investor to hedge against both interest rate and reinvestment risk If rates go up, the short portion of the barbell can be reinvested at the higher rate and help offset losses in the longer maturity. If rates decline, the long maturity gains make up for the lower interest rate available for reinvestment of the short maturity portion. Can be used to create a portfolio with the same duration as a bullet strategy but with higher convexity. If interest rates fall, then convexity will augment the rise in the price of the bond. If interest rates rise, convexity will dampen the decline in price. Ladder Strategy Environment in which interest rates are rising The investor can reinvest the proceeds of the maturing bonds at the new (higher) interest rate. Environment in which interest rates are falling The investor will reinvest the proceeds at a lower rate, but only for 10% of the portfolio. The longer maturity bonds would rise in value. Advantages Since it continues to roll over into cash it provides flexibility Reduces Investment income fluctuations Requires little investment expertise Not locked onto a single bond References Frank J. Fabozzi, Ed., The Handbook of Fixed-Income Securities, 6th Edition (New York, NY: McGraw Hill, 2000) Annette Thau, The Bond Book, 2nd Edition (New York, NY: McGraw Hill, 2001) Ali Irturk, Term Structure of Interest Rates, Spring 2006 www.fimmda.org www.nseindia.com www.rbi.gov.in Thank You!