* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Step 2 - HopgoodGanim

Survey

Document related concepts

United States labor law wikipedia , lookup

South African labour law wikipedia , lookup

Whistleblower protection in the United States wikipedia , lookup

Fair Labor Standards Act of 1938 wikipedia , lookup

Indian labour law wikipedia , lookup

Iranian labor law wikipedia , lookup

Transcript

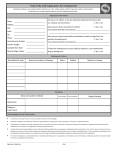

Redundancy: Process and Payments Getting It Right Rosalie Cattermole, Senior Associate Claire Tuffield, Solicitor Definition Redundancy – Redundancy occurs when an employer no longer requires anyone to perform a particular job due to changes in the operational requirements of its business. “Genuine Redundancy”? Three Steps – Step one: the employee is terminated because the employer no longer requires anyone to do the job due to changes in the operational requirements of the employer’s enterprise; – Step two: the employer has complied with any consultation requirements outlined in an applicable modern award or enterprise agreement; and – Step three: it was not reasonable (in all the circumstances) for the employer to redeploy the employee within their own enterprise or that of an associated entity. Step 1: Operational Changes Restructuring Downsizing Closing down Outsourcing Step 2: Consultation The employer must comply with any consultation requirements outlined in an applicable modern award or enterprise agreement. Meet with affected employees to provide information and discuss: – Measures to avert or minimise redundancies; and – Measures to lessen the adverse effects of any redundancies eg, outplacement support. Step 2: Consultation continued... Step 1 – Provide affected employees with written notification of the changes that are proposed. Step 2 – Discuss the operational changes with affected employees (and their representatives). Step 3 – Listen to affected employees, consider what they have to say and respond. ** FAILURE TO CONSULT? NOT A GENUINE REDUNDANCY/ CIVIL PENALTIES ** Step 3: Redeployment It is not reasonable (in all the circumstances) for the employer to redeploy the employee within their own enterprise or that of an associated entity. Redeployment means: – offering a redundant employee continued employment in another role as an alternative to dismissal. Step 3: Redeployment continued... Is redeployment reasonable? – Is there a position available? – Does the employee have skills and qualifications required? – Will retraining be required? – Does the location of the job make it reasonable? – Will the employee earn less? Step 3: Redeployment Checklist – Is there a position available within your business or with the enterprise or an associated entity? – If the available position is in an associated entity, do you have the power to offer it to the employee? – Does the employee have the skills and competencies required to perform the role to required standard, either immediately or with a reasonable period of retraining (having regard to the nature of the position, the qualifications required to perform the job and the employee’s qualifications and experience)? Step 3: Redeployment Checklist continued... – Does the location of the job in relation to the employee’s residence make redeployment feasible, i.e. the employee is unlikely to accept the redeployment offer without some compensation, e.g. for the additional travel and it would be unreasonable for you to provide that compensation? – Will the employee earn less in the vacant role such that redeployment is not feasible, i.e. the employee is unlikely to accept the lesser remuneration without some form of compensation, and it would be unreasonable for you to provide that compensation? Making more than 15 positions redundant? Notify Centrelink Notify and consult with Unions Redundancy Pay Compensation for loss of benefits the affected employees would otherwise accrue as a result of long service: Period of Service Redundancy Pay 1-2 years 4 weeks 2-3 years 6 weeks 3-4 years 7 weeks 4-5 years 8 weeks 5-6 years 10 weeks 6-7 years 11 weeks 7-8 years 13 weeks 8-9 years 14 weeks 9-10 years 16 weeks More than 10 years 12 weeks Service prior to 1 January 2010 Service prior to 1 January 2010 – Service prior to 1 January 2010 will only count for accruing redundancy pay if the employee’s terms and conditions of employment (under an award, agreement or employment contract) immediately before 1 January 2010 provided an entitlement to redundancy pay. Other Payments Other payments: – Notice (in lieu of actual notice) either in accordance with their agreement or the NES, whichever is greatest; – Untaken annual leave; – Untaken long service leave payment (subject to minimum service requirements); and – Any other monies due under their agreement. When you may not have to pay Redundancy Pay You redeploy the employee; The employee voluntarily resigns; It is a transfer of business situation; You are a small business employer; or The redundancy is caused by insolvency. Taxation of Redundancy Pay The good GREAT news: – a “genuine redundancy payment” for tax purposes (GRP) is tax free up to a limit worked out under the tax rules. Both the employer and employee need to know whether all or part of a purported GRP is actually a GRP: – the employer particularly needs to know if it is required to withhold from the payment, and if so, how much to withhold; and – the penalty for failing to withhold is equal to the amount the payer failed to withhold (subject to remission). The basics: what is a GRP Subject to the cap under the tax rules: 1. A payment received in consequence of the termination of an employee’s employment – follows from and would not be made ‘but for’ the termination of employment. What is a GRP? 2. The employee is dismissed from employment – all employment with the employer must be severed; – the decision to terminate employment is at the employer’s initiative without the consent of the employee; and – ‘constructive dismissal’ is a dismissal under the tax rules. Essentially, where there is no consent from the employee such as where an employee resigns under threat (explicit or implicit) of dismissal. What is a GRP... 3. The dismissal is caused by the redundancy of the employee’s position – not for some other reason (eg poor performance); – “when the functions, duties and responsibilities formerly attached to the position are determined by the employer to be superfluous to the current needs and purposes of the organisation”; – if there is more than one reason for the dismissal, the redundancy of the position must be the most influential reason; and – Weeks v Commissioner of Taxation (2013) FFC. What is a GRP... 4. The redundancy payment is genuinely made because of redundancy (and not ‘contrived redundancy) – eg, where an employee is terminated on outsourcing of particular duties and the employee is immediately re-engaged to perform those functions; or – where an employing entity is wound up and some or all of the employees are immediately re-engaged by a new employing entity. What is a GRP? 5. To the extent the payment exceeds the amount that could reasonably be expected to be received by the employee in consequence of the voluntary termination of employment. When a payment will NOT be a GRP – conditions that must be satisfied The employee must be less than 65 years’ old at the time of the dismissal – if the employee’s employment would have terminated at a younger age then this younger age becomes the employee’s age-based limit. The payment is not at the end of a fixed period of employment – subject to the ATO’s comments around rolling fixed term contracts. If the employer and employee are not dealing at arm’s length in relation to the dismissal – the payment does not exceed the amount that could reasonably be expected to be made if the dismissal were at arm’s length. When a payment will not be a GRP... At the time of the dismissal, there must not be any arrangement between the employee and the employer, or between the employer and another person, to employ the employee after the dismissal: – the worker can be re-engaged as an independent contractor subject to employment law considerations. A payment will not be a GRP if it is another type of payment such as: – unused long service leave or annual leave (although these payments are concessionally taxed when paid with a GRP). How is the tax-free part calculated? You have excluded all amounts that are subject to more specific tax treatment. If all of the conditions for a GRP have been satisfied, how is the tax free part calculated? Step 1: deduct that amount that could reasonably be expected if the employee had voluntarily terminated their employment. Step 2: the tax-free part will be so much of the payment as does not exceed. Base amount + [service amount x years of service]. How is the balance treated? For 2014/15: – Base amount = $9,514 – Service amount = $4,758 Years of service? – the number of whole years in the period, or sum of periods, of employment to which the payment relates; and – no requirement for the years of service to be continuous provided the earlier years of service with a previous employer are carried over and acknowledged on commencement with a new employer. How is the balance treated? – as an employment termination payment; and – even if paid more than 12 months after termination. Thank you ROSALIE CATTERMOLE, SENIOR ASSOCIATE CLAIRE TUFFIELD, SOLICITOR www.hopgoodganim.com.au