* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download What is a partnership?

Corporation wikipedia , lookup

South African company law wikipedia , lookup

Limited liability company wikipedia , lookup

International joint venture wikipedia , lookup

Corporate law in Vietnam wikipedia , lookup

Joint venture wikipedia , lookup

Partnership taxation in the United States wikipedia , lookup

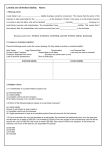

Chapter Accounting for Partnerships Section 1: Forming a Partnership Section Objectives 1. Explain the major advantages and disadvantages of a partnership. 2. State the important provisions that should be included in every partnership agreement. 3. Account for the formation of a partnership. 19 QUESTION: What is a partnership? ANSWER: A partnership is an association of two or more persons who carry on, as co-owners, a business for profit. Objective 1. Explain The Major Advantages And Disadvantages Of A Partnership. Advantages of a Partnership It pools the skills, abilities, and financial resources of two or more individuals. It is easy and inexpensive to form. A partnership does not pay income tax. Each partner is taxed individually on his or her share of the partnership’s income. Disadvantages of a Partnership Each partner has unlimited liability. The partnership is a mutual agency. The business lacks continuity. It has a limited life. Ownership rights are not freely transferable. QUESTION: What is meant by unlimited liability? ANSWER: Unlimited liability means that an individual partner’s personal assets can be required in payment of the partnership’s debts. QUESTION: What is meant by mutual agency? ANSWER: Mutual agency means that each partner may act as an agent for the partnership, binding the firm by his or her acts. Limited Partnership Has one or more limited partners. Limited partners: Liable only for their investment in the business. Must have at least one general partner. General partner: Has unlimited liability. Limited partners may not take an active management role and their names may not appear in the name of the partnership. Objective 2. Explain The Important Provisions Which Should Be Included In A Partnership Agreement. QUESTION: What is a partnership agreement? ANSWER: A partnership agreement is a legal contract forming a partnership and specifying certain details of the operation. Every partnership agreement should contain: Names of the partners. Name, location, and nature of the business. Starting date of the agreement. Life of the partnership. Rights and duties of each partner. Every partnership agreement should contain: Amount of capital to be contributed by each partner Drawings (withdrawals) by the partners. Fiscal year and accounting method. Method of allocating income or loss to the partners. Procedures to be followed if the partnership is dissolved or the business is liquidated. Partnerships dissolve upon a partner’s: death, incapacity, or withdrawal. Objective 3. Account For The Formation Of A Partnership. Accounting for the Formation of a Partnership Memorandum entry to record formation of partnership. Investment of assets and liabilities by partners. Setting up partners’ capital accounts. Setting up partners’ drawing accounts. Subsequent investments and permanent withdrawals. Example: Ellen Barret, sole proprietor of Old Army, is forming a partnership with Jerry Reed. Memorandum Entry to Record Formation of Partnership 20-Jan. 1 On this date a partnership was formed between Ellen Barret and Jerry Reed to carry on a retail clothing business under the name of Old Army, according to the terms of the partnership agreement effective this date. Investments of Assets and Liabilities by a Sole Proprietor 20-Jan. 1 Accounts Receivable Merchandise Inventory Store Equipment Allow. for Doubtful Accts. Notes Payable—Bank Accounts Payable Interest Payable Ellen Barret, Capital Investment of Ellen Barret 20,500.00 105,200.00 3,000.00 1,200.00 39,100.00 34,700.00 500.00 53,200.00 Assets that are transferred to a partnership should be appraised and recorded at the agreed-upon fair market value at the time of transfer. Investment of Cash by Partner Jan. 1 Cash Jerry Reed, Capital 28,000.00 New Partner Investment of cash by ReedGiven Credit for Amount Invested 28,000.00 DRAWING ACCOUNTS Any withdrawal by a partner, whether it is cash or some other asset, is a return of equity to that partner. The partner’s drawing account balance reduces that partner’s equity. SECTION R E V I E W Complete the following sentences: unlimited liability for the Each partner has _______________ partnership’s debt. general In a limited partnership, only the _______ partner has unlimited liability. _______ Mutual agency is the characteristic that _____________ binds the firm by the acts of an individual partner. SECTION R E Complete the following sentences: When a partner dies or is incapacitated, dissolved the partnership is _________. V I E W The first entry in the general journal of the memorandum new partnership is a(n) ____________ entry _____. Capital drawing accounts ______ accounts and _______ are set up for each partner. Thank You for using College Accounting, 11th Edition Price • Haddock • Brock