DOC - Lasalle Hotel Properties

... of its affiliates (collectively "LaSalle"). The Company will be managed and advised by LaSalle Hotel Advisors, Inc. (the "Advisor"), a wholly owned subsidiary of LaSalle, and will be the exclusive vehicle for LaSalle's hotel property investment activities in the United States. See "REIT Management-A ...

... of its affiliates (collectively "LaSalle"). The Company will be managed and advised by LaSalle Hotel Advisors, Inc. (the "Advisor"), a wholly owned subsidiary of LaSalle, and will be the exclusive vehicle for LaSalle's hotel property investment activities in the United States. See "REIT Management-A ...

western gas partners, lp - corporate

... Western Gas Holdings, LLC, the general partner of the Partnership (the “General Partner”) will adopt a Second Amended and Restated Agreement of Limited Partnership of the Partnership (the “Second A&R LPA”) to, among other things, authorize and establish the terms of the Preferred Units; (ii) the Par ...

... Western Gas Holdings, LLC, the general partner of the Partnership (the “General Partner”) will adopt a Second Amended and Restated Agreement of Limited Partnership of the Partnership (the “Second A&R LPA”) to, among other things, authorize and establish the terms of the Preferred Units; (ii) the Par ...

Master Limited Partnerships (MLPs): A General Primer

... net income is a nice measure of financial performance, at the end of the day cash is king. That is fundamentally what master limited partnerships ( MLPs) are all about: cash (or to be more specific, cash flow). In essence, an MLP is a business enterprise that historically has been measured largely b ...

... net income is a nice measure of financial performance, at the end of the day cash is king. That is fundamentally what master limited partnerships ( MLPs) are all about: cash (or to be more specific, cash flow). In essence, an MLP is a business enterprise that historically has been measured largely b ...

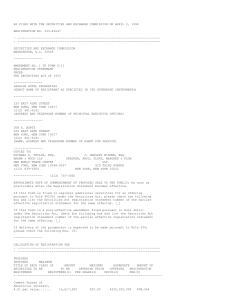

1 Filed pursuant to Rule 424(b)(4) File No. 333

... --------------------To enhance the Partnership's ability to make the Minimum Quarterly Distribution on the Common Units during the Subordination Period, which will generally extend at least through May 31, 2001, each holder of Common Units will be entitled to receive the Minimum Quarterly Distributi ...

... --------------------To enhance the Partnership's ability to make the Minimum Quarterly Distribution on the Common Units during the Subordination Period, which will generally extend at least through May 31, 2001, each holder of Common Units will be entitled to receive the Minimum Quarterly Distributi ...

Law and the Rise of the Firm

... with their creditors and, correlatively, to shield those assets from the claims of their owners' personal creditors. This legal characteristic which two of us previously termed affirmative asset partitioning,' and which we here call entity shielding2 - has deep but largely unexamined roots in the hi ...

... with their creditors and, correlatively, to shield those assets from the claims of their owners' personal creditors. This legal characteristic which two of us previously termed affirmative asset partitioning,' and which we here call entity shielding2 - has deep but largely unexamined roots in the hi ...

Harvard Law School

... to commit assets to bond their agreements with their creditors and, correlatively, to shield those assets from the claims of their owners’ personal creditors. This legal characteristic — which two of us previously termed “affirmative asset partitioning,”1 and which we here call “entity shielding”2 – ...

... to commit assets to bond their agreements with their creditors and, correlatively, to shield those assets from the claims of their owners’ personal creditors. This legal characteristic — which two of us previously termed “affirmative asset partitioning,”1 and which we here call “entity shielding”2 – ...

Accounting for Receivables

... • Occurs when customers do not pay for items or services purchased on credit. • Bad Debts are uncollectible accounts receivables. • The uncollectible expense is placed on the income statement as a selling expense. ...

... • Occurs when customers do not pay for items or services purchased on credit. • Bad Debts are uncollectible accounts receivables. • The uncollectible expense is placed on the income statement as a selling expense. ...

Wahlen_1e_IM_Ch09 (new window)

... obligations where there is no legal requirement to transfer assets but the transfer typically occurs as part of the normal operations of a business. These include items such as liabilities to employees for vacation pay or year-end bonuses. Current Liabilities Current liabilities are obligations a co ...

... obligations where there is no legal requirement to transfer assets but the transfer typically occurs as part of the normal operations of a business. These include items such as liabilities to employees for vacation pay or year-end bonuses. Current Liabilities Current liabilities are obligations a co ...

LEGAL ENTITIES AND ASSET PARTITIONING IN ROMAN

... partnership agreement, the partners can enter into contracts that bind the partnership and thus commit this pool of partnership assets. This asset pool is “partitioned” in the sense that it must be used for paying the partnership’s debts before it can be claimed by creditors who transacted with part ...

... partnership agreement, the partners can enter into contracts that bind the partnership and thus commit this pool of partnership assets. This asset pool is “partitioned” in the sense that it must be used for paying the partnership’s debts before it can be claimed by creditors who transacted with part ...

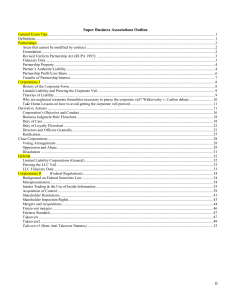

Corporations I - Phi Delta Phi

... (1) Fenwick v. Unemployment Compensation Commission - No partnership established for an employee in a beauty salon because although they met the first four requirements Fenwick maintained exclusive control over the business. So although there was profit sharing, Mrs. Chesire, the employee, had no co ...

... (1) Fenwick v. Unemployment Compensation Commission - No partnership established for an employee in a beauty salon because although they met the first four requirements Fenwick maintained exclusive control over the business. So although there was profit sharing, Mrs. Chesire, the employee, had no co ...

Filling Gaps in the Close Corporation Contract: A Transaction Cost

... corporations to partnerships. I believe that proponents of each view are partially correct. Some investors who choose unmodified close corporation form would adopt modifications, sometimes modeled on partnership law, but for bargaining impediments. On the other hand, some investors in closely held f ...

... corporations to partnerships. I believe that proponents of each view are partially correct. Some investors who choose unmodified close corporation form would adopt modifications, sometimes modeled on partnership law, but for bargaining impediments. On the other hand, some investors in closely held f ...

Business Ownership Notes

... A partnership can avoid some of the problems associated with sole proprietorships, but it also has its disadvantages. These include: Unlimited liability Possible disagreement among partners Shared profits Limited life Large financial risks ...

... A partnership can avoid some of the problems associated with sole proprietorships, but it also has its disadvantages. These include: Unlimited liability Possible disagreement among partners Shared profits Limited life Large financial risks ...

sole proprietorship

... A partnership can avoid some of the problems associated with sole proprietorships, but it also has its disadvantages. These include: Unlimited liability Possible disagreement among partners Shared profits Limited life Large financial risks ...

... A partnership can avoid some of the problems associated with sole proprietorships, but it also has its disadvantages. These include: Unlimited liability Possible disagreement among partners Shared profits Limited life Large financial risks ...

A Perspective to Reconsider Partnership Law

... partnerships from every other business association. All other business associations are statutory in origin. They are formed by the happening of an event designated in a statute as necessary to their formation. . . . Partnership is the residuum, including all forms of co-ownership, of a business exc ...

... partnerships from every other business association. All other business associations are statutory in origin. They are formed by the happening of an event designated in a statute as necessary to their formation. . . . Partnership is the residuum, including all forms of co-ownership, of a business exc ...

Chapter 8: Business Organizations Section 1

... • nonprofit organization: an institution that functions much like a business, but does not operate for the purpose of making a profit • professional organization: a nonprofit organization that works to improve the image, working conditions, and skill levels of people in particular occupations • busi ...

... • nonprofit organization: an institution that functions much like a business, but does not operate for the purpose of making a profit • professional organization: a nonprofit organization that works to improve the image, working conditions, and skill levels of people in particular occupations • busi ...

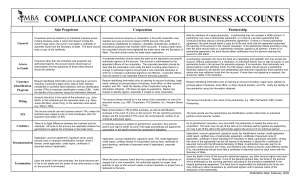

COMPLIANCE COMPANION FOR BUSINESS ACCOUNTS

... An LLP/LLLP is a general partnership whose partners are ordinarily not liable for the debts or obligations of the partnership. An LLP/LLLP may maintain any type of an account except a NOW account. The LLP/LLLP should have filed a registration with the Secretary of State. If the LLP/LLLP has a formal ...

... An LLP/LLLP is a general partnership whose partners are ordinarily not liable for the debts or obligations of the partnership. An LLP/LLLP may maintain any type of an account except a NOW account. The LLP/LLLP should have filed a registration with the Secretary of State. If the LLP/LLLP has a formal ...

Is the future here? - American Bar Association

... deal with the state-imposed "control rule," which treated the limited partners as general partners if they participated too heavily in management. In 1977, there was a little-noticed development that ultimately led to a new era in business forms. Wyoming passed a limited liability company (LLC) stat ...

... deal with the state-imposed "control rule," which treated the limited partners as general partners if they participated too heavily in management. In 1977, there was a little-noticed development that ultimately led to a new era in business forms. Wyoming passed a limited liability company (LLC) stat ...

Chapter 5 The Time Value of Money

... This accountability is unlimited liability because an owner is liable not only to the extent of what is invested in the business but also for any other assets owned. ...

... This accountability is unlimited liability because an owner is liable not only to the extent of what is invested in the business but also for any other assets owned. ...

Limited partnership

... agreement, which must be in written form. The agreement does not have to be drafted in the form of a notarial deed. After an agreement is concluded, the partnership should be registered in the National Court Register (KRS). A KRS application should be filed with the regional court having jurisdictio ...

... agreement, which must be in written form. The agreement does not have to be drafted in the form of a notarial deed. After an agreement is concluded, the partnership should be registered in the National Court Register (KRS). A KRS application should be filed with the regional court having jurisdictio ...

Chapter 8 onlevel

... • A business organization is an establishment formed to carry on commercial enterprise. Sole proprietorships are the most common form of business organization. • Most sole proprietorships are small. All together, sole proprietorships generate only about 6 percent of all United States sales. ...

... • A business organization is an establishment formed to carry on commercial enterprise. Sole proprietorships are the most common form of business organization. • Most sole proprietorships are small. All together, sole proprietorships generate only about 6 percent of all United States sales. ...

Organizational – Legal Forms of Companies

... Limited Liability Partnership (LLP) Similar to practices in other jurisdictions, a limited liability partnership remains one of the most popular forms of a business organization. This is mostly due to limitation of its partners’ liability to the amounts contributed to the charter fund. Under the law ...

... Limited Liability Partnership (LLP) Similar to practices in other jurisdictions, a limited liability partnership remains one of the most popular forms of a business organization. This is mostly due to limitation of its partners’ liability to the amounts contributed to the charter fund. Under the law ...

proposed regulations addressing disguised

... services provided to the partnership, and, when appropriate, the partnership must capitalize these amounts (or otherwise treat such amounts in a manner consistent with their recharacterization). The partnership must also treat the arrangement as a payment to a non-partner in determining the remainin ...

... services provided to the partnership, and, when appropriate, the partnership must capitalize these amounts (or otherwise treat such amounts in a manner consistent with their recharacterization). The partnership must also treat the arrangement as a payment to a non-partner in determining the remainin ...

Sole Proprietorship Entity – Key Factors Analysis

... be a viable business option. This raises a host of tax issues: for example, has the business in the new jurisdiction established “nexus” (i.e., are there sufficient operations in the new location to justify that location imposing a tax for goods and services used in the new jurisdiction)? If the ans ...

... be a viable business option. This raises a host of tax issues: for example, has the business in the new jurisdiction established “nexus” (i.e., are there sufficient operations in the new location to justify that location imposing a tax for goods and services used in the new jurisdiction)? If the ans ...