1 Filed pursuant to Rule 424(b)(4) File No. 333

... (54.4% if the Underwriters' over-allotment option is exercised in full). The General Partner will own an aggregate 2% general partner interest in the Partnership and the Operating Partnership, and 3,702,943 Subordinated Units representing an aggregate 47.0% limited partner interest in the Partnershi ...

... (54.4% if the Underwriters' over-allotment option is exercised in full). The General Partner will own an aggregate 2% general partner interest in the Partnership and the Operating Partnership, and 3,702,943 Subordinated Units representing an aggregate 47.0% limited partner interest in the Partnershi ...

Harvard Law School

... that are legally distinct from their owners and managers. Legal scholars and economists have commented extensively on one form of this partitioning between firms and owners: namely, the rule of limited liability that insulates firm owners from business debts. But a less-noticed form of legal partiti ...

... that are legally distinct from their owners and managers. Legal scholars and economists have commented extensively on one form of this partitioning between firms and owners: namely, the rule of limited liability that insulates firm owners from business debts. But a less-noticed form of legal partiti ...

Law and the Rise of the Firm

... Economic activity in modern societies is dominated not by individuals, but by firms that own assets, enter contracts, and incur liabilities that are legally separate from those of their owners and managers. A universal characteristic of these modern business firms is that they enjoy the legal power ...

... Economic activity in modern societies is dominated not by individuals, but by firms that own assets, enter contracts, and incur liabilities that are legally separate from those of their owners and managers. A universal characteristic of these modern business firms is that they enjoy the legal power ...

A Perspective to Reconsider Partnership Law

... gous to the interest of a corporate stockholder in his shares of stock. As the state law of partnership developed, the adoption of the entity approach was urged on the ground that it was a feature of the law merchant that reflected business reality more accurately than the aggregate or conduit theor ...

... gous to the interest of a corporate stockholder in his shares of stock. As the state law of partnership developed, the adoption of the entity approach was urged on the ground that it was a feature of the law merchant that reflected business reality more accurately than the aggregate or conduit theor ...

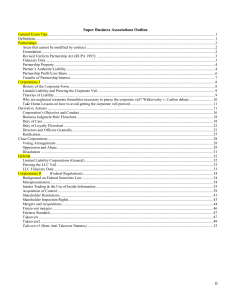

Corporations I - Phi Delta Phi

... (a) Cumulative voting – if 7 directors and 100 shares, you get 700 votes which you could put all toward one candidate or spread them out. (Allows guaranteed control of a small portion of board) (Unlike partnership which standard is one vote per partner) (b) Voting Trust – A statutory mechanism where ...

... (a) Cumulative voting – if 7 directors and 100 shares, you get 700 votes which you could put all toward one candidate or spread them out. (Allows guaranteed control of a small portion of board) (Unlike partnership which standard is one vote per partner) (b) Voting Trust – A statutory mechanism where ...

LLC`s, LLP`s, DST`s, LP`s: Why And How Are Alternative Entities

... What if the jurisdiction requires a listing of managers for Annual Reporting requirements? California requirement that each series register do business as a foreign entity. Do you list all the managers in the series as well? ...

... What if the jurisdiction requires a listing of managers for Annual Reporting requirements? California requirement that each series register do business as a foreign entity. Do you list all the managers in the series as well? ...

Limited Liability and the Corporation - Chicago Unbound

... debt investors do. Debt consequently is less risky. Why is this beneficial? And if the reallocation of some risk is beneficial, why aren't there gains from greater reallocations, such as requiring equity investors to chip in additional capital, thus reducing the debt investors' risk even further? In ...

... debt investors do. Debt consequently is less risky. Why is this beneficial? And if the reallocation of some risk is beneficial, why aren't there gains from greater reallocations, such as requiring equity investors to chip in additional capital, thus reducing the debt investors' risk even further? In ...

What is a partnership?

... Assets that are transferred to a partnership should be appraised and recorded at the agreed-upon fair market value at the time of ...

... Assets that are transferred to a partnership should be appraised and recorded at the agreed-upon fair market value at the time of ...

Organizational – Legal Forms of Companies

... Limited Liability Partnership (LLP) Similar to practices in other jurisdictions, a limited liability partnership remains one of the most popular forms of a business organization. This is mostly due to limitation of its partners’ liability to the amounts contributed to the charter fund. Under the law ...

... Limited Liability Partnership (LLP) Similar to practices in other jurisdictions, a limited liability partnership remains one of the most popular forms of a business organization. This is mostly due to limitation of its partners’ liability to the amounts contributed to the charter fund. Under the law ...

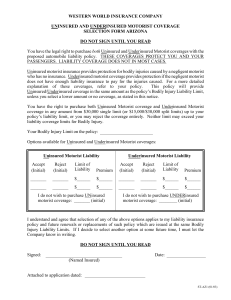

western world insurance company uninsured and underinsured

... Uninsured motorist insurance provides protection for bodily injuries caused by a negligent motorist who has no insurance. Underinsured motorist coverage provides protection if the negligent motorist does not have enough liability insurance to pay for the injuries caused. For a more detailed explanat ...

... Uninsured motorist insurance provides protection for bodily injuries caused by a negligent motorist who has no insurance. Underinsured motorist coverage provides protection if the negligent motorist does not have enough liability insurance to pay for the injuries caused. For a more detailed explanat ...

Business entities, laws, and Regulations Business entities, laws and

... Business Entity, Control, Taxation and Liability As per the scenario, Lou and Jose plan to open a sports bar and restaurant, the best business entity choice for this restaurant and sports bar is the partnership firm because Lou, Jose and Miriam are the three persons who want to start the business in ...

... Business Entity, Control, Taxation and Liability As per the scenario, Lou and Jose plan to open a sports bar and restaurant, the best business entity choice for this restaurant and sports bar is the partnership firm because Lou, Jose and Miriam are the three persons who want to start the business in ...

Sole Proprietorship Entity – Key Factors Analysis

... some type of apportionment of income may be required. The type of entity in the new jurisdiction will determine the ultimate tax burden; for example, some states do not recognize the existence of an S corporation. Also, state tax rates, rules, and “tax holidays” may vary in today’s competitive envir ...

... some type of apportionment of income may be required. The type of entity in the new jurisdiction will determine the ultimate tax burden; for example, some states do not recognize the existence of an S corporation. Also, state tax rates, rules, and “tax holidays” may vary in today’s competitive envir ...

SOLE PROPRIETORSHIP The sole proprietorship is

... o Like sole proprietorships, pass-through taxation is a great advantage of partnerships. With this form of taxation, the company is not subject to income tax, but rather this is passed-through to the partners, who then pay any of the taxes with their personal income taxes. Disadvantages Control o ...

... o Like sole proprietorships, pass-through taxation is a great advantage of partnerships. With this form of taxation, the company is not subject to income tax, but rather this is passed-through to the partners, who then pay any of the taxes with their personal income taxes. Disadvantages Control o ...

Mobile Site | Terms of Use | Privacy policy | Feedback | Advertise

... partner has unlimited liability for the debts incurred by the business. The three typical classifications of for-profit partnerships are general partnerships, limited partnerships, and limited liability partnerships. Corporation: A corporation is a limited liability business that has a separate lega ...

... partner has unlimited liability for the debts incurred by the business. The three typical classifications of for-profit partnerships are general partnerships, limited partnerships, and limited liability partnerships. Corporation: A corporation is a limited liability business that has a separate lega ...

John G. Llewellyn, PLLC

... Just one entity, or many? Although some investors form only one LLC or corporation to hold all of their properties, some set up separate entities for each property. The factors to consider in determining whether to form one or more entities include, but are not limited to: the number of properties, ...

... Just one entity, or many? Although some investors form only one LLC or corporation to hold all of their properties, some set up separate entities for each property. The factors to consider in determining whether to form one or more entities include, but are not limited to: the number of properties, ...

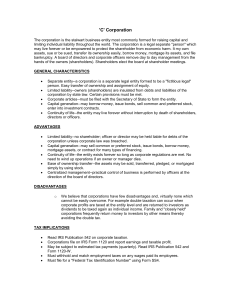

`C` Corporation

... Tax advantage--corporate income tax payments are not required. Gains and losses are passed on to shareholders who pay taxes in a manner similar to partnerships. Early loss benefit--corporations may operate at a loss in their first years. Shareholders may benefit from a reduction in their personal ta ...

... Tax advantage--corporate income tax payments are not required. Gains and losses are passed on to shareholders who pay taxes in a manner similar to partnerships. Early loss benefit--corporations may operate at a loss in their first years. Shareholders may benefit from a reduction in their personal ta ...

Chapter 5 The Time Value of Money

... and the owner needs only to start doing business. This accountability is unlimited liability because an owner is liable not only to the extent of what is invested in the business but also for any other assets owned. ...

... and the owner needs only to start doing business. This accountability is unlimited liability because an owner is liable not only to the extent of what is invested in the business but also for any other assets owned. ...

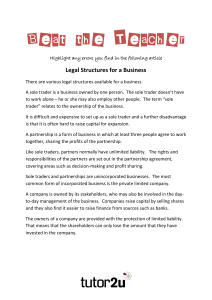

Download Beat the Teacher - Legal Structures (Worksheet)

... It is difficult and expensive to set up as a sole trader and a further disadvantage is that it is often hard to raise capital for expansion. A partnership is a form of business in which at least three people agree to work together, sharing the profits of the partnership. Like sole traders, partners ...

... It is difficult and expensive to set up as a sole trader and a further disadvantage is that it is often hard to raise capital for expansion. A partnership is a form of business in which at least three people agree to work together, sharing the profits of the partnership. Like sole traders, partners ...

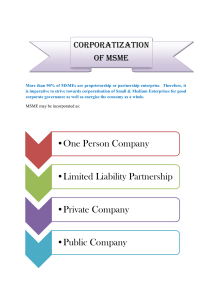

One Person Company •Limited Liability Partnership •Private

... Signatures on Annual Returns – Section 92 of the Companies Act,2013 Holding Annual General Meetings – Section 122 of the Companies Act,2013 Board Meetings and Directors – Section149, 152 & 173 of the Act Signatures on Financial Statements - Section 134 and 137 of the Companies Act. Contrac ...

... Signatures on Annual Returns – Section 92 of the Companies Act,2013 Holding Annual General Meetings – Section 122 of the Companies Act,2013 Board Meetings and Directors – Section149, 152 & 173 of the Act Signatures on Financial Statements - Section 134 and 137 of the Companies Act. Contrac ...

Is the future here? - American Bar Association

... alternative. Though the general partnership can be used by anyone from momand-pop grocery store to international accounting firm, it is best suited to very closely held firms that do little advance planning. All of the owners equally share control, profits, losses and partnership property. To addres ...

... alternative. Though the general partnership can be used by anyone from momand-pop grocery store to international accounting firm, it is best suited to very closely held firms that do little advance planning. All of the owners equally share control, profits, losses and partnership property. To addres ...

Types of Business Structures

... Limited Liability Partnership (LLP) Also called a Professional Corporation Used primarily by those who render professional services - lawyers, accountants, doctors, architects, social workers, etc. Some tax advantages - possible tax shelter Unlike a limited partnership, all partners can have limite ...

... Limited Liability Partnership (LLP) Also called a Professional Corporation Used primarily by those who render professional services - lawyers, accountants, doctors, architects, social workers, etc. Some tax advantages - possible tax shelter Unlike a limited partnership, all partners can have limite ...

Legal Forms of Organization

... tax advantages of partnership Members and interests,Articles of organization Managers, officers, members not personally liable Most organize for tax purposes as partnership No limitation to membership, more than one class ...

... tax advantages of partnership Members and interests,Articles of organization Managers, officers, members not personally liable Most organize for tax purposes as partnership No limitation to membership, more than one class ...