* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download The Stock Market

Survey

Document related concepts

Transcript

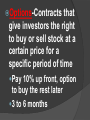

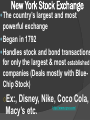

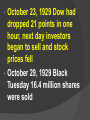

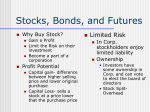

Stock- represent ownership in a corporation Shares- portions of stock • Purpose??... • Raise money to start or expand a business. How do Stockholders make a Profit? • Dividends-Pay out by corporations. Paid in quarters. • The higher the profit, the larger the dividend per share of stock. • Capital Gains-Sell the stock for more than he or she paid for it. – Capital Loss- Selling a stock at a lower price than it was purchased for. Types of Stocks Income Stock-Stock pays dividends at regular times during the year Ex: most commonly found as companies operating within real estate, energy sectors, utilities, natural resources and financial institutions. BP, Exxon, Citigroup Growth Stock Pays few or no dividends Company reinvests earnings The business then Increases its value over time. Examples: Aeropostale, Urban Outfitters, Panera Bread Common Stock Investors who are voting owners of the company. One vote for each share. Fannie Mae, Citigroup, Exxon Preferred Stock Investors who are nonvoting owners of the company. Receive dividends before the owners of common stock. If the company goes out of business, preferred stockholders get their investments back before common stockholders. Blue-Chip Stock Is the stock of a wellestablished company having stable earnings and no extensive liabilities Wal-Mart, Coca-Cola, Gillette, and Exxon-Mobile. Risks of Buying Stock Purchasing stock is risky because the firm selling the stock may earn lower profits than expected, or it may lose money. If a company goes bankrupt, stockholders might not get their money back!! How Are Stocks Traded? Stockbroker-a person who links buyers and sellers of stock. Advises them to buy or sell particular stocks. Brokerage Firm-businesses that specialize in trading stocks. Stockbrokers and brokerage firms cover their costs and earn a profit by charging a commission, or fee for each transaction. Options for Buying Stock • Stock Splits • Owners of common stock may sometimes vote on whether to initiate a stock split. • A stock split means that each single share of stock splits into more than one share. • A company may seek to split a stock when the price of stock becomes so high. Example: You own 200 shares of GM. Each share is worth $100. After the split, you own 2 shares of GM stock for every single share you owned, so now you have 400 shares. However each share is now worth only $50. Futures • Futures are contracts to buy or sell commodities at a specific date in the future at a price specified today. • Markets in which futures are bought and sold are associated with grain and livestock. Ex: Buyer and seller agree today at price of $4.50 for a bushel of soybeans 6 or 9 months in the future. The buyer would pay some portion of the money today, and the seller would deliver the goods in the future. Options-Contracts that give investors the right to buy or sell stock at a certain price for a specific period of time Pay 10% up front, option to buy the rest later 3 to 6 months Day Trading Try to predict minute-by minute price changes based on computer programs. Many trades made each day. Stocks held for minutes or even seconds. Extremely Risky!!! Stock Exchanges Markets for buying and selling stock Major US Markets New York Stock Exchange (NYSE) NASDAQ-AMEX (National Association of Securities Dealers’ Automated Quotation systemAmerican Stock Exchange) OTC Market (Over the Counter) New York Stock Exchange (NYSE) New York Stock Exchange The country’s largest and most powerful exchange Began in 1792 Handles stock and bond transactions for only the largest & most established companies (Deals mostly with BlueChip Stock) ○Ex:, Disney, Nike, Coco Cola, Macy’s etc. http://www.nyse.com/ NASDAQ-AMEX 2 merged together in 1998 Sells slightly riskier stocks from less-established and small companies ○Pharmaceutical companies, energy companies ○Microsoft, Apple, Intel ○http://www.nasdaq.com/ OTC (Over the Counter) Market An electronic marketplace for stock that is not listed or traded on an organized exchange. New and Growing Companies. How to Read a Stock Table The Dow Jones Industrial Average Has shown how certain stocks have traded on every business day since 1896. Represent 30 large companies in various industries, such as food, entertainment and technology. Ex: McDonalds, Microsoft, CocaCola, Citigroup, Walt Disney, Continental Airlines, FedEx Dow Jones S&P 500 Standard & Poor’s 500 Tracks the price changes of 500 different stocks as a measure of overall stock market performance. Bull and Bear Markets Bull Market-Stocks rise steadily over a period of time Bear Market-Market falls for a period of time The Great Crash of 1929 The 1920s saw a long term Bull market Dow was at an all-time high in 1929 (381 points) Investors were buying on margin (credit) small amount up front & promise to pay rest later • • October 23, 1929 Dow had dropped 21 points in one hour, next day investors began to sell and stock prices fell October 29, 1929 Black Tuesday 16.4 million shares were sold