* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Acquiring, developing and retaining profitable customers with

Survey

Document related concepts

Transcript

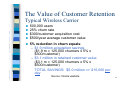

Creating Customer and Company Value through CRM Richard Staelin Edward & Rose Donnell Professor of Business Administration Duke University What is CRM? Strategic CRM Operational CRM Analytical CRM 2 Core CRM Processes Collaborative Communication Information Capture Information Integration Information Access Information Use – – – – – – – – Develop customer profile Segmentation Retention behavior Channel analysis Customize offers Best customers CLV Knowledge of costs 3 What has gone wrong with CRM? Core Capabilities Firm Performance Technology 4 Why CRM works The more relationships the customer has with the firm, the higher the real and psychological switching costs Number of years with the bank 20 15 10 5 0 2 or less 4 6 8 or more Number of Services Used 5 Why CRM works The more relationships the customer has with the firm, the greater the expected profits Contribution Margin (Index) 450 400 350 300 250 200 150 100 50 0 2 or less 4 6 8 or more Number of services used 6 Why CRM works The more relationships the firm has with the customer, the more the firm knows about the customer’s behavior – Use CRM as a tool for learning about customers’ needs – Avoid “black-box” tools for database marketing when doing CRM – Good predictions are even better with behavioral insights 7 Why CRM works Cost of acquiring new customers is higher than cost of retaining them – New customer you can acquire at the margin is likely to be a “switcher” who will eventually switch to a better offer. Retention probability Marginal acquisition cost 8 The Problem “In many businesses, the customers most likely to sign on are precisely the worst customers you could possibly find” » Reichheld, The Loyalty Effect. » “The customers you want to attract don't respond, and the ones you don't want to attract do” » Richard E. Mirman, Chief Marketing Officer, Harrah’s Entertainment, Inc. “(M)ost of the people applying for a card with say, a 12 percent APR, were the last people issuers would approve” » Lucy Lazarony, bankrate.com 9 The Culprit: Adverse Selection There are good and bad customers Often, you do not know which is which before it is too late Major problem in marketing risk products – Insurance, loans, credit cards Potential for conflict between functions acquiring and approving customers Solutions: – Self-selection through multiple products • Need as many products as types of customers – Screening 10 Problems with Screening Costly – Must screen all customers to determine type When cross-selling to current customers… – Best customers will not respond • Wider range of options – Rejection can lead to termination of relationship 11 Results for Top 3 Deciles N = 1157 Select based on Response Select based on Approval Simultaneous Approach Responses 835 319 689 Approvals 214 198 284 Rejections 621 121 405 12 Analytic CRM for Customer Retention How bad is customer churn? Some Industry Statistics: – Cellular Paging Computer on-line service Long Distance Phone 25-35% 30-48% 33% 25% 13 The Value of Customer Retention Typical Wireless Carrier 500,000 users 25% churn rate $300/customer acquisition cost $500/year average customer value 5% reduction in churn equals: – $1.9 million acquisition savings ($1.9 m = 125,000 churners x 5% x $300/customer) – $3.1 million in retained customer value ($3.1 m = 125,000 churners x 5% x $500/customer) TOTAL SAVINGS: $5.0 million => $15,000 per day Source: Oracle website 14 How to reduce churn? Don’t be too aggressive in customer acquisition (marginal acquisitions are more likely to attrite) Your current customer is your best prospect – Cross-selling – Up-selling Exit surveys & early attrition-detection 15 Customer Retention Modeling Exit surveys – Why do you want to leave? – Where are you going? – What could we have done to keep you? (too late) Attrition modeling (looking at the past) – Detecting early signals of attrition – Identifying customers “at risk” for preventive measures 16 Early defection detection Exit Interview Past behavior 17 Analytic CRM for Customer Development Customer transactions are becoming increasingly impersonal, reducing the opportunities for personal selling Cross-selling – increases the number of ties between the firm and the customer (higher switching costs) – Opportunity to learn about customer’s needs, improving the firm’s competitiveness – is done by value rather than persuasion – More effective on incoming than outgoing calls Must avoid “over-touching” the customer – The right product for the right customer at the right time 18 “The Royal Bank of Canada experienced a direct response rate of 40% when it increased the timeliness and relevancy of its campaigns.” - Peppers & Rogers Group 19 Observed ? Product Purchased Q1 Predicted High Technology Industry Q2 Q3 Q4 Q5 Q6 Time Managerial Questions: •Which customers would provide revenue in the next planning cycle? •What product (s) would a customer purchase given past purchases? •When would the customers make their purchase(s)? •How much to spend on a given customer? 20 Results from the field experiment (B-to-B High Tech Firm) Difference between test and control group Hardware Software Hardware & Software 356 180 -15 -952*** -1,182** -1000*** -6*** - 4*** -5*** Profits ($) 970*** 1,1116*** 749** Return on Investment 1.4*** 1.5*** 1.9*** Parameter Revenue ($)a Cost of Communication ($) Number of Contacts Before Purchase The reported values are unit values per customer during the experiment year and are cell medians; a *** Significant at α = .01 21 Cross-selling of financial services If there is a “natural” sequence of acquisition of financial services, it can be inferred from observed buyer behavior – Services are ordered according to their “difficulty” – The financial needs or “financial maturity” of a household can be inferred from the financial services currently in use. 22 The pyramid of financial independence Risk & Tax Protection Growth stocks, municipal bonds, tax shelters & real estate Growth to offset inflation Stocks, mutual funds, bonds, cash management accounts Risk management Insurance, Pension/IRA plans Emergency cash reserve Money market, time deposits Foundation Products Checking, savings, credit card, loans 23 Empirical Evidence Panel of 3000 investors in the US Portfolio of financial services utilized during a year Application of Latent Trait Theory to estimate: – “difficulty” of each financial service – Financial Maturity of each investor – Item Characteristic Curve relating a service “difficulty” to the investors’ Financial Maturity 24 Item characteristic curve Likelihood of Buying 1 0.5 0 -3 -2 -1 0 1 2 3 Score 25 Foundation Products 100.0% 90.0% Usage Probablity 80.0% 70.0% 60.0% 50.0% Average Difficulty of Foundation Products 40.0% 30.0% 20.0% Difficulty of a service 10.0% 0.0% -6 -4 -2 0 2 4 6 Financial Maturity Checking/Savings/NOW Bank Credit Card Home Mortgage Other Loans 26 Risk Management & Cash Reserves 100.0% 90.0% Usage Probablity 80.0% 70.0% 60.0% 50.0% 40.0% 30.0% 20.0% 10.0% 0.0% -6 -4 -2 0 2 4 6 Financial Maturity Life Insurance Pension Plan IRA Money Market 27 Growth to offset inflation 100.0% 90.0% Usage Probablity 80.0% 70.0% 60.0% 50.0% 40.0% 30.0% 20.0% 10.0% 0.0% -6 -4 -2 0 2 4 6 Financial Maturity Corporate Stocks Cash Management Account Mutual Funds 28 Risk and Tax Protection 100.0% 90.0% 80.0% Usage Probablity 70.0% 60.0% 50.0% 40.0% 30.0% 20.0% 10.0% 0.0% -6 -4 -2 0 2 4 6 Financial Maturity Tax Shelters Corp.Govmt Bonds Real Estate 29 Current Income -Post Retirement 100.0% 90.0% 80.0% Usage Probablity 70.0% 60.0% 50.0% 40.0% 30.0% 20.0% 10.0% 0.0% -6 -4 -2 0 2 4 6 Financial Maturity CD/T-Bill Time Deposit Annuity 30 Probability of Ownership How to utilize the model Financial Maturity 31 Probability of Ownership How to utilize the model Financial Maturity 32 The iceberg effect The customer database provides only a glimpse of the customers’ behavior Relationship with your firm Relationships with your competitors 33 Cross-selling of financial services Sample of customers from a commercial bank in Brazil Data – Internal (customer database) • Number of transactions/month • Volume of Deposits in the bank • Demographic data • Use of 22 services within the bank – External (survey) • Use of 22 services outside the bank 34 Model Calibration DATA Customer Database MODEL Sequence of acquisition for services within and outside the bank Survey 35 Implementation Test Model of service usage within and outside the bank Customer Database Survey Test Likelihood of usage outside the bank 36 % of all users outside the bank Top users outside the bank, as predicted by the model 37 38 39 Product Centric Cross-selling Prod.A Prod.B Etc…. Prod.Z Cust.1 Cust.2 Etc. Cust.N 40 Customer-Centric Cross-Selling Analyze customer behavior Measure customer value What should be the strategy with this customer? – Cost reduction – Revenue enhancement – Development – Retention 41 Customer Centric Cross-selling Prod.A Prod.B Etc…. Prod.Z Cust.1 Cust.2 Etc. Cust.N 42 How analytics can enhance CRM Acquisition: Look back at past acquisition efforts to identify the profile of profitable acquired customers. Development: Look at patterns of past service usage across customers to identify the next service to cross-sell to each customer Retention: Relate exit surveys to past customer behavior to identify early signals of attrition 43 Acquiring, developing and retaining profitable customers What’s CRM Why CRM works Analytical CRM – Customer acquisition – Developing customer relationships – Churn management 44 What’s CRM: A Historical Perspective Mass Marketing Segmented Marketing One-to-One Marketing 45 One-to-One Marketing Small businesses Limited number of customers Regional monopolies 46 Mass Marketing 47 Segmented Marketing 48 What’s CRM: Back to One-to-One Marketing Market saturation Brand proliferation Consumer demand for personalized services Brand switching Customization CRM Information Technology 49 The Customer’s Value to Us Low High Customer Relationship Management ? Low High Our Value to the Customer 50 The customer life cycle Universe of Customers acquisition Prospect Development and retention Retained or repeat customer Responder Low Value Target Market Responder New Customer Former Customer Forced Churn High Potential High Value Voluntary Churn Winback 51 Analytic CRM for Customer Acquisition Typical Customer Acquisition Program 1-4% RESPONSE SAMPLE OF LEADS NON-RESPONSE 96-99% GEO-DEMOGRAPHICS (AND THE KITCHEN SINK) RESPONSE MODEL: RESPONSE = f(β, PREDICTORS) 52 Problems with Response Modeling for Customer Acquisition Most response models pay more attention to non-responses (majority) than to responses, leading to false negatives – False positives produce small direct costs – False negatives produce larger opportunity costs Leads with high response probability might not be the most attractive customers on the long run – Learn from the past, by looking at subsequent Customer Lifetime Value from previous acquisition programs 53