* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Section A

Survey

Document related concepts

Transcript

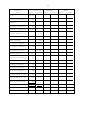

Chapter 5, TEST 5A Name Date SCORING RECORD _________________________ _________________________ Section Total Possible A B C D Total 30 30 10 30 100 Deductions Student Score Section A DIRECTIONS: Each of the following statements is true or false. Indicate your choice by writing in the Answers column T for a true answer or F for a false answer. (2 points for each correct answer) For Answers Scoring 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. The matching principle matches assets and the related revenues. _____ A fiscal period always ends on December 31. _____ The historical cost principle allows for assets to be recorded at actual cost. _____ Depreciable cost is the amount of depreciation expense recorded for each accounting period. _____ Plant assets provide benefits only in the year of purchase. _____ The current cost of an asset minus its salvage value represents the depreciation expense of an asset. _____ A contra-asset is deducted from the related asset on the balance sheet. _____ Depreciation expense is recorded for a specific period of time. _____ The Income Statement columns of a work sheet include all revenue and expense accounts. _____ When an account balance is affected by an adjusting entry, the amount shown in the Trial Balance column is extended directly to the Adjusted Trial Balance columns. _____ The balance of the owner's capital account in the last two columns on the work sheet does not include the net income and withdrawals of the current period. _____ Errors in work sheets never result from incorrectly extended adjustments. _____ The work sheet is used to gather information needed to calculate and enter adjusting entries and prepare financial statements. _____ "Adjusting" is written in the Item column of the general ledger when posting adjusting entries. _____ Adjusting entries must be entered in the general journal. _____ _____ _____ _____ _____ _____ _____ _____ _____ _____ _____ _____ _____ _____ _____ _____ 5-2 Section B Directions: Complete each of the following statements by writing in the Answers column the letter of the word or words that correctly completes each statement. (3 points each) For Answers Scoring 1. The income statement reports: (A) revenue; (B) expenses; (C) net income or loss; (D) all of these; (E) none of these. _____ _____ 2. A trial balance includes: (A) account names; (B) totals of each column; (C) debit balances of accounts; (D) credit balances of accounts; (E) all of these. _____ _____ 3. Adjusting entries always affect: (A) assets (B) the balance sheet; (C) revenues; (D) both A and C; (E) all of these. _____ _____ 4. Depreciable cost is calculated by taking the total cost of an asset and (A) dividing by useful life; (B)adding salvage value; (C) subtracting salvage value; (D) multiplying by useful life; (E) subtracting the amount of cash paid to date. _____ _____ 5. Prepaid insurance has a balance of $1,000 that represents 4 months of insurance. Two months of insurance has expired. The amount of the adjustment is (A)$1,000; (B) $500; (C) $250; (D) $100; (E) $0. _____ _____ 6. Wages earned but not yet paid amounted to $500. The adjusting entry will:(A) debit wage expense, credit wages payable; (B) debit wages payable, credit wage expense; (C)debit wages expense, credit cash; (D) debit wages payable, credit cash;(E) debit owner’s equity and credit wages payable. _____ _____ 7. Identify the main source of the information needed to prepare the balance sheet:(A)the Account Title column of the work sheet; (B) the Statement of Owner's Equity; (C) the Balance Sheet columns of the work sheet; (D) the Income Statement accounts; (E) the Trial Balance. _____ _____ 8. Supplies originally cost $600, but only $200 worth of supplies were used this period. The adjusting entry would be: (A) debit Supplies Expense, $200; credit Supplies, $200; (B) debit Supplies Expense, $400; credit Supplies, $400; (C)debit Supplies $200; credit Supplies Expense, $200; (D) debit Supplies, $400; credit Supplies Expense, $400; (E) none of these. _____ _____ 9. Cost of an asset is $8,000. Salvage value is $500. Useful life is 5 years. The amount of annual depreciation is: (A) $8,000; (B) $1,600; (C) $1,500; (D) $1,000; E) $500. _____ _____ 10. When posting an adjusting entry to the general 5-3 ledger, write: (A) "Adjusting" in the Post Ref column; (B) "Adjusting" in the Item column; (C)"Change" in the general ledger; (D) "Balance" on the work sheet; (E) "Adjusting" in the general journal. _____ _____ Section C DIRECTIONS: Calculate the following exercises. (10 points total) 1. Fantasia Company purchased a computer on January 1 for $2,400 with a useful life of 3 years and no expected salvage value. a. Prepare the adjusting entry for depreciation for the year. Date Description Post Ref Debit Credit b. Compute the book value at the end of the second year of the computer life. Section D DIRECTIONS: Complete the worksheet on the next page. (30 points total) Caren's Tax Service Work Sheet For the month ended April 30, 20__ 5-4 Account Title Cash Accounts Receivable Adjusted Trial Balance Debit Credit 14,100 2,000 Supplies 200 Prepaid Insurance 600 Computer Equipment 4,800 Accum. Deprec-C.E. 500 Accounts Payable 1,000 Wages Payable 500 A. Caren, Capital A. Caren, Drawing 5,900 1,250 Tax Service Fees Wages Expense 20,000 2,000 Advertising Expense 300 Rent Expense 650 Supplies Expense 250 Telephone Expense 100 Insurance Expense 300 Transportation Exp. 600 Deprec.Exp.- C. E. 120 Miscellaneous Exp. 630 27,900 Net Income/Loss 27,900 Income Statement Debit Credit Balance Sheet Debit Credit