* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download assignment #2

Foreign-exchange reserves wikipedia , lookup

Nominal rigidity wikipedia , lookup

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Non-monetary economy wikipedia , lookup

Monetary policy wikipedia , lookup

Real bills doctrine wikipedia , lookup

Fractional-reserve banking wikipedia , lookup

Long Depression wikipedia , lookup

Quantitative easing wikipedia , lookup

Modern Monetary Theory wikipedia , lookup

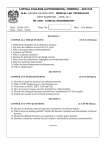

ST. FRANCIS XAVIER UNIVERSITY ECONOMICS 100.13 Instructor: Dr. Anna Klimina Macroeconomics: Quiz #2 Due: Tuesday, March 21st Question 1 (20 marks) I. In the simplified banking system with the 6 per cent required reserve ratio open market operations by the central bank add $200 million to the reserves. a) What is the new level of total money supplied? 200m*1/0.06= 3333.33 1/r= 1/0.06=16.67 3133.33*16.67=52233.28 52233.28+3333.33=55566.61 Total money supplied is $55566.61 million b) How much new money has been created? Total money created is $52233.28 million II. If the banks keep only 2 per cent of their deposits as reserves, c) What is the new level of total money supply? 200m*1/0.02= 10b 1/0.02=50 9.8b*50=490 b 490b+10b= 500b Total money supplied is $500 billion d) How much new money has been created? Total money created is $490 billion Question 2 (5 marks) Using the equation of exchange, answer the following question: Assuming velocity is constant and the money supply increases by 12 per cent, by how much does the nominal output rise? P*Q=M*V Since the velocity is constant, and the money supply goes up by 12%, the nominal GDP will also go up by 12%. Question 3 (10 marks) Suppose that a decrease in the demand for goods and services pushes the economy in recession. What happens to the price level? If we believe the downward price flexibility, and if the gov’t does nothing, what ensures that the economy still eventually gets back to the natural level of output? The price level will fall, because that is what happens during a recession. The constructionary policy because of the price being flexible will ensure that the economy still eventually gets back to the natural level of output. Question 4 (10 marks) Explain how the net export effect strengthens the effects an easy money and tight money policy. The interest rate and the investment from foreign countries will increase when the price level from an economy decreases. This will increase the exports, which also helps increase the strength of the easy money policy. If you want to strengthen the tight money policy, the interest rate will go down, making foreign country investment go down, and making goods more expensive, therefore decreasing exports and strengthening the tight money policy. Economics 100.13 QUIZ # 2 ALLISON DUGGAN 200506732