* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download 2. Institutions and their role in economic growth. Theoretical

Survey

Document related concepts

Transcript

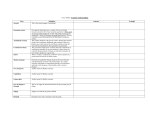

ABSTRACT Institutions and Economic Growth. The Role of Institutions in the Process of Economic Transition. JEL Class: O2 The paper presents the impact of various institutions on economic growth in transition economies. The impact of the size of government, structure of the economy and use of markets, monetary policy and price stability, freedom to use alternative currencies, legal structure and property rights, international exchange, freedom of exchange in capital and financial markets on economic growth is far from being negligible. The paper analyses the correlation between economic performance and the institutional development in 26 transition economies for the period 1995-2002. The paper shows that freedom affects economic performance, higher level of freedom (not just economic, but overall) leads to higher growth rates and also higher per capita GDP. The hypothesis was tested with the help of simple correlation analysis, to establish whether a correlation exists, and was further tested on a panel data set. REDEK Tjaša Ekonomska fakulteta Kardeljeva ploščad 17 1000 Ljubljana Slovenia Email: [email protected] 0 CONTENTS 1. Introduction ..................................................................................................................... 2 2. Institutions and their role in economic growth. Theoretical introduction and definition................................................................................................................................... 2 2.1. Why are institutions important in the process of economic growth? ................. 2 2.2. The definition of institutions ...................................................................................... 5 3. From theory to facts. ........................................................................................................... 7 3.1. The last decade under socialism. Initial conditions. .............................................. 7 3.2. Transition begins. ...................................................................................................... 11 4. Do institutions matter? How and why? ......................................................................... 15 4.1. Correlation analysis .................................................................................................. 15 4.2. Growth empirics with institutional measures ...................................................... 16 4.2.1. Specification ............................................................................................................ 16 4.2.2. Data and results ...................................................................................................... 18 5. Conclusion .......................................................................................................................... 19 References:.............................................................................................................................. 20 APPENDIX A: The Fraser Institute Index of Economic Freedom, Freedom House Freedom Index and the Heritage Foundation Index ................................................................................ 21 APPENDIX B: Institutional quality in transition economies prior to transition .................... 24 1 1. Introduction Since the fall of Berlin Wall in 1989, the countries of Central and Eastern Europe (CEE) and the former Soviet Union (FSU) have been engaged in a historic process of transition from centrally planned to market oriented economies. Economic performance has widely differed among the countries during the years of transition. So have economic policies. Of course, although transition economies all come from a centrally planned background, the initial conditions differed significantly. Now, ten years later, we can distil important conclusions from this natural experiment, which can have broader conclusions (Moers, p.2). The article investigates how important the differences in the quality of institutions have been as an explanation for differences in economic performance since the start of transition in the countries of Central and Eastern Europe (CEE) and the former Soviet Union (FSU), relative to other factors. Institutions are, as we shall see, very loosely defined as the rules of the economic game, encompassing both the rule of law (enforced by the state, for example property rights), or formal institutions and the rules of the civil society, some formal, other informal. Among other things, transition means moving from plan to market institutions. It is fair to say that at the start of transition few acknowledged the importance of institutions. Priority was given to rapid macroeconomic stabilization and liberalization. I will focus in the article on the critique of such a myopic view, and try to prove that institutions played a significant role. The structure of the article will be following: Chapter 2 will present a theoretical background, and motivation for the article, a definition of institutions and give a short insight of how they affect economic performance, Chapter 3 will present transition economies now and at the start of transition, provide a comparison in the economic performance and institutional development and ask the question: what was the contribution of institutions to economic performance of these countries. Chapter 4 will present results of the econometric analysis performed on a sample of transition economies and prove that institutions indeed matter. 2. Institutions and their role in economic growth. Theoretical introduction and definition. 2.1. Why are institutions important in the process of economic growth? The comparative experience with economic growth over the past few decades after the World War II has posed a number of intriguing questions. It has become evident that the growth process itself cannot be explained merely by the simple neoclassical equation, stating that per capita product is a simple function of efficiency labour. As already Adam Smith emphasized, economic growth can be presented only by a much more general equation, assuming that the gross domestic product is a 2 function of the employed production factors, namely capital and labour, their productivity, and institutions. Smith put special emphasis on natural conditions, government and international relations. Many of the theories, developed later, especially in the neoclassical tradition, neglected the importance of institutions in the process of economic growth. Nevertheless, many articles published in the last two decades, emphasize the importance of institutions as supporting factors in the growth process. The neoclassical framework neglects the direct role of various institutions on long run economic growth. However, institutions and their efficiency undoubtedly play a significant role in the process of economic growth. Why? It is important how markets work, whether competition drives efficiency, innovation, whether the government is active in helping the supply driven growth or hinders it with high taxes, corruption, whether the rule of law is reliable or not, how international relations work, how democracy works etc. These factors are becoming increasingly important. Many articles have recognized the increasing role of institutions in the process of sustainable growth. In the Solow-Swan model output is determined by the production function Y=F(K,L) or in per capita term y=f(k), the steady state is determined by the saving rate, depreciation rate and rate od growth of population: s*f(k)=n+d. Figure 1: Neoclassical growth model y, s f(k) with institutions (thick line) is larger than one without. f(k),institutions f(k) s*f(k), high quality institutions s*f(k), bad institutions k* In the steady state, there is no per capita growth, aggreagte Y, C and S growth with the rate of growth of population. The model is the foundation of the modern growth theory, which leaves out the role of institutions in the broadest sense. But as already classical political economy stressed (Smith, Ricardo), capital, labour and productivity are neccessary but not sufficient for growth. Institutions matter! k* with high quality institutions Full line – with high quality institutions Dashed – without institutions Moers (2002) presented the role of institutions and how they affect economic growth, also in transition economies. He investigated the performance in Russia and found that institutions hindered economic development and transition process there. He also found an important impact of poor institutions on capital flight from transition economies. Minsoo Lee (1999) investigated the importance of various institutions, above all fiscal policy and the speed and quality of institutional change on economic growth in transition economies. The results show that poor institutional framework had negative impact on foreign direct investment, human capital development and also on structural change, which all contributed to slower transition process and poorer economic results. 3 Sachs (1996) regressed output levels in 1995 against EBRD´s index of liberalization, finding that countries with the highest index of liberalization recovered from transition recession most quickly. Similarily, de Melo, Denzier and Gelb (1996) estimated average growth rate of GDP as a function of cumulative liberalization index, per capita income in 1989, which is used to take into account the negative effects of more pervasive central planning and overindustialization and a dummy variable if the country was subject to regional tensions. Institutions turned out to be important again. Fischer, Sahay and Vegh (1996) took somewhat different approach. They regressed the log of inflation on liberalization index, government fiscal balance and fixed exchange rate as a dummy variable, to account for the impact of CMEA collapse, they added a dummy for the share of exports to CMEA. Again, liberalization turns out to have significant effect. Many other authors1 also analysed the interplay between economic growth and institutions. Rodrik for example (Rodrik, 2000) presented one of the most thorough analyses of the role of institutions in the process of economic growth. The analysis took under consideration the role of property rights, regulatory institutions, institutions for macroeconomic stabilization, institutions for social insurance and institutions of conflict management. Although there is some diversity among countries regarding economic growth and the structure and efficiency of the institutions mentioned above, countries with higher quality institutions marked higher rates of economic growth. Especially important is the role of property rights, regulatory institutions and institutions for macroeconomic stabilization. Rodrik emphasised that every well-functioning market economy is a mix of state and market, laissez faire and intervention. It is the efficiency of the mix that is crucial. On the basis of what others wrote, I can conclude that institutions do affect economic performance. Property rights, democracy, markets – their efficiency can contribute to economic growth. But before I continue with the problems of institutions in transition economies and their effect on economic growth, it is necessary to provide a definition of institutions. 1 Helliwell (Helliwell, 1992) analysed the interplay between democracy and growth. He proved that income affects democracy, the effect of income on democracy is found to be robust and positive. However, democracy also affects growth and therefore income levels. The emphasis of the article is on the fact that it is not possible to identify any systematic net effects of democracy on subsequent economic growth. Barro (Barro, 1994) analyzed the effects of democracy on growth in even more detail. He analyzed a panel of 100 countries over 30 years (1960-90). The analysis included the effects of democracy on growth indirectly via positive effects of the maintenance of the rule of law, free markets, small government consumption and high human capital. Caballero and Hammour (Caballero, Hammour, 2000) present a very interesting article on creative destruction and economic growth and the role of various institutions in the process of economic restructuring and growth. Efficient institutional framework is of core importance in implementing new technologies, labour force reallocation and keeping up with latest developments in the world economy. The process of creative destruction, that is the implementation of new technologies and replacing the old, is often impeded by political shortsightedness, inadequate contractual environments and financial underdevelopment. All these factors contribute to slower economic growth. 4 2.2. The definition of institutions What are institutions? Is the question of their importance new in economic theory or not? I will attempt to answer these two questions in this section. Let me start with a quote from the 17 th century. Locke said: ´˝To understand political power right, and derive it from its original, we must consider, what state all men are naturally in, and that is a state of perfect freedom to order their actions, and dispose of their possessions and persons, as they think fit, within the bounds of the law of nature, without asking leave, or depending upon the will of any other man…..As much land as man tills, plants, improves, cultivates, and can use the product of, so much is in his property. He by his labour does, as it were, enclose it from the common. Nor will it invalidate his right, to say every body else has an equal title to it. … Political power then, I take to be a right of making laws with penalties of death, and consequently all less penalties, for the regulating and preserving of property, and employing the force of the community, in execution of such laws, and in the defence of the common wealth from foreign injury, and all this for the public good2.´´ John Locke, a preclassical economist, freetrader, was one of the first to emphasize the importance of three crucial institutions: freedom, property rights and the regulatory role of the state. Adam Smith3 included the importance of institutions into his model of economic growth, which was based on capital accumulation and rise of productivity. But institutional framework was essential as it supported the efficiency of the invisible hand, and was hence crucial for long run growth. Authors in the classical tradition all emphasize the crucial role of private property rights and their protection, due to the impact on incentives and hence growth. I would like to point out that the absence of private property should (if classical economists were right) have a negative impact on growth. Therefore this could be a problem Marx and other socialist economist overlooked. Marx developed a model of communism, which was supposed to be superior to capitalism and should eradicate poverty. Therefore it should foster long run growth. But the first criticism of communism emerged with the implementation of the first step on the way there, socialism. As early as 1920 the Austrian economist von Mises4 pointed to the inherent difficulties of communism and predicted that rational economic calculation would be impossible without private ownership of means of production and money prices. Mises demonstrated that without private property there could be no competitive markets and no prices to guide rational economic calculations. As such the centrally planned socialist 2 By John Locke, 1690, p. 267 Look at Wealth of Nations, 1776 4 Socialism: An economic and sociological analysis (1922) 3 5 economy would fail to duplicate the efficiency and wealth creation of a private free market system. Hayek5 under the influence of Mises showed that if all the means of production were vested in single hand (be it society or a dictator) this body has total authority. Hence, communism leads to loss of freedom. Both authors emphasize the importance of private property for economic efficiency and the role of markets. Private property is today regarded as one of the most important factors for economic growth, also the use of markets and the signalling role of prices. But these are only few of the institutions that matter in the process of economic growth. Which are others? A very systematic and thorough definition and classification of institutions was provided by Rodrik. He says it might be useful to think of institutions broadly as a ˝ set of humanly devised behavioural rules that govern and shape the interactions of human beings in helping them to form expectations of what other people will do (Rodrik, 2000, p.3).˝ Rodrik (2000, p.4) emphasized the importance of the following institutions for the process of economic growth: property rights, regulatory institutions, institutions for macroeconomic stabilization , institutions for social insurance and, institutions of conflict management. In the article I shall rely on the definition and classification of institutions of the Fraser Institute6. They define the concept of economic freedom7. The higher the economic freedom, the better is the institutional framework of a country. So, let’s have a look at the concept of economic freedom. Table 1: Components of Index of Economic Freedom8 I. Size of Government: Consumption, Transfers, and Subsidies II. Structure of the Economy and Use of Markets (production and allocation via governmental and political mandates rather than private enterprises and markets) III. Monetary policy and Price Stability IV. Freedom to Use Alternative Currencies V. Legal structure and property rights VI. International exchange: Freedom to trade with foreigners VII. Freedom of exchange in capital and financial markets A very shallow and surface analysis of the structure of the concept of economic freedom leads to the conclusion that the higher the economic freedom the higher the rates of economic growth are. The government undoubtedly plays a significant and very important role in the process of economic development. But a too high level of government consumption, a large level of subsidies and transfers 5 Road to Serfdom, 1944 Look at www.fraserinstitute.com. It is an organization dealing with economic freedom and publishes a number of publications dealing with the quality of institutions. 7 The concept of economic freedom could be regarded as a substitute for Smith´s invisible hand. Economic efficiency is possible if incentives for good performance exist and are not hindered by the state or failure of competition etc. And the institutions they include into their formulation of economic freedom are cruical in ensuring efficiency. 8 A detailed explanation is given in Appendix A. 6 6 on one side place a large tax burden on successful economic subjects and on the other hand allow a less effective allocation of resources. The more developed the market mechanisms are, the lesser the role of the state should be. Markets play a crucial role in efficient allocation of resources in an economy, production and allocation via governmental and political mandates will in the long run surely be less efficient, subject to power pressures of various political parties. A sound monetary system and price stability also play a very important role in the long – run efficiency of the market. A low level of inflation and an effective system of relative prices are a crucial factor determining the performance of the markets. Developed capital and financial markets also are very important in the process of economic growth. Freedom to use alternative currencies usually exhibits the position of the balance of payments and the competitiveness of the economy in the international markets. Last but not least – a sound legal structure, security of private ownership is of course a prerequisite to a working market system, the rule of law and a non-discriminatory judiciary are essential to the long – run performance of the markets. So institutions do matter. And institutions matter also in transition economies and they played a massive role in the transition process. In the following few chapters I will show how. First I will in short describe the paths of transition, provide the data on GDP, inflation and some other indicators to get a feeling on the initial conditions and the success of transition. I will also provide some measures of institutional framework. On the basis of this data I will try to examine to what extent institutions affected transition process. 3. From theory to facts. The aim of this article is to analyze the institutional shortfalls of socialist economies and examine whether they contributed to the depth of transformational recession and whether the countries that realized the importance of building the appropriate institutional framework for the emerging capitalist economies are winners of the transition process. I showed which institutions matter. Now, I shall first consider transition economies prior to transition. 3.1. The last decade under socialism. Initial conditions. The road from plan to market was far from being the road to prosperity. Paved with high inflation, output fall beyond wildest expectation, high unemployment, social distress. But despite bad first few years, some countries marked positive growth already in 1993. Some keep struggling even today. In this chapter I will present data on some basic economic indicators and also provide a measure of institutional development. 7 The socialist countries were marked by relatively remarkable growth rates till mid-1970s driven by large flows of resources into the development of industry. It turned into a negative or very low growth rate in 1980s, when the whole political and economic system began to collapse. The reforms that followed were massive. What seemed to be a system that defied the odds, collapsed. Since I will speak about the performance of transition economies in the 1990s, and since this performance depends on the initial conditions I will very shortly present some data. First, let me say a few words about economic growth. Table 2: CEE and FSE GNP growth rates Hungary Poland 5.6 1971-5 1.7 1976-80 -0.9 1981-5 0.2 1986-9 -1 1989 -4 1990 -11 1991 -5 1992 Source: Bruno, p.203 11.9 0.4 -1.6 2.9 0 -12 -7 3 Czechoslovakia 6.1 2.2 -1.6 2.9 0 -12 -7 3 Bulgaria 8.6 2.8 3.6 1.7 -5 -11 -23 -3 Romania 11.3 7.2 4.4 1.7 -8 -7 -13 -5 GDR 4.9 3.6 1.1 3.8 2 -16 -31 - Eastern Europe 7.9 3.5 2.1 2.4 -1 -9 -16 - USSR YU 5.1 3.9 2.8 1.9 1 -2 -10 -16 5.8 5.6 0.6 0 -2 -8 -29 - Table 2 presents data just for a group of economies. The obvious pattern is the falling growth rate in the 1980s, which turned negative at the end of the decade for all countries. Inflation took off (Table 3). The reasons for the collapse of what seemed to be a successful economic system were many: from sectoral structure (almost vanishing traditional sector, importance of industry), property rights and incentive mechanism, the structure and nature of international trade, underdevelopment of financial system, excessive welfare spending, irrational government spending, external debts, dependence of central banks and many other – microeconomic and macroeconomic9. I would like to argue that most of these reasons are institutionally based. Institutional deficiencies of socialist economies led to their inability to foster economic efficiency and growth. The results of transition process, as we shall see, confirm that institutions were important. Gomulka (1986) argues that political system is important from the aspect of economic efficiency. Although he argues from a more political view, it is obvious that the countries he mentions to be the first to attempt liberalization are also today the winners of transition. He mentions above all Poland, Hungary and Czechoslovakia (in the 50s and 60s). Also Yugoslavia implemented some market oriented reforms early on. Today Poland, Slovenia, Czech Republic, Slovakia, Hungary are the most successful transition economies. 9 Look at Gomulka: Macroeconomic policies and Acievements in transition Economies 1989-99, or The puzzles of fairly rapid growth and collapse under socialsim for additional information. 8 Table 3: Inflation rates in CEE and FSU (% annual rate) Hungary 10 1986-8 20 1989 30 1990 37 1991 21 1992 Source: Bruno, p. 207 Poland 33 700 517 70 45 CSFR 0 1 11 59 14 Bulgaria 1 4 26 460 49 Romania 2 1 5 161 181 USSR 6 89 1180 YU 131 2700 584 270 - Although several countries (as already mentioned) undertook some market oriented reforms already in the 1960s, 1970s and 1980s (especially Yugoslavia), the absolute collapse of the socialist system was inevitable and followed the crisis that happened at the end of 1980s in most of the countries. Everything changed. In the following few chapters we will take a look at the success of transition economies on the path of transition, especially we will focus on the role of institutions in this process. To do that, we first need to have an idea of the quality of institutions prior to transition. I will present data published by two organizations: the already mentioned Fraser Institute and Freedom house. They both publish indices of economic freedom that assess the quality of institutions (for additional explanation of data, look at Appendix A.). Table 4: Institutional development at the end of socialism10, data on economic freedom, by Freedom House, selected countries and years Year 1974-75 1979-80 1984-85 1988-89 Bulgaria Czechoslovakia DDR 7,7,NF 7,7,NF 7,7,NF 7,7,NF 7,6,NF 7,7,NF 7,7,NF 7,6,NF 7,6,NF 7,7,NF 7,6,NF 7,6,NF Source: www.freedomhouse.org Hungary 6,6,NF 6,5,NF 6,5,PF 5,4,PF Poland 6,6,NF 6,5,PF 6,5,PF 5,5,PF Romania 7,6,NF 7,6,NF 7,7,NF 7,7,NF USSR 6,6,NF 6,6,NF 7,7,NF 6,5,NF Yugoslavia† 6,6,NF 6,5,NF 6,5,PF 5,5,PF Table 4 and Table 5 present data on institutional development in transition economies prior to transition. Freedom House data (Table 4) presents data on political rights and civil liberties and gives an overall assessment of freedom (including economic). Table 5 presents an overall index of economic freedom published by Fraser Institute, which is a weighted average of 7 areas (look at App.A for detailed information). Both indices show that institutional development in transition economies was rather poor prior to transition. They were mostly unfree (Freedom House) or had markedly lower 10 The characters representing scores for each year are, from left to right, political rights, civil liberties, and freedom status. Each of the first two is measured on a one-to-seven scale, with one representing the highest degree of freedom and seven the lowest. “F,” “PF,” and “NF” respectively stand for “free,” “partly free,” and “not free.” Countries whose combined averages for political rights and for civil liberties fall between 1.0 and 2.5 are designated "free"; between 3.0 and 5.5. “partly free”; and between 5.5 and 7.0 “not free.” 9 USA 1,1,F 1,1,F 1,1,F 1,1,F values than developed economies (Fraser Institute)11. Both tables present selected countries and years. For all data look at Appendix B. Table 5: Fraser Institute Index of Economic Freedom, selected countries and years Country 1970 1975 1980 1985 6,05 Bulgaria Czech Rep. 4,52 4,76 Hungary 3,60 Poland 3,63 Romania 1,61 1,60 1,59 Russia (FSU) Slovak Republic Slovenia 7,65 7,99 8,35 8,51 USA Source: www.fraserinstitute.com *if empty, data not available 1990 3,87 3,85 4,73 4,64 4,24 1,51 3,85 8,76 1995 5,08 6,70 6,88 6,28 4,23 4,81 6,26 5,86 8,74 1999 5,87 6,56 7,11 5,70 3,82 3,86 6,30 6,15 8,73 Under socialism institutional framework was marked by: high levels of government control and spending, too much was spent on subsidizing inefficient companies, which led to lack of incentive to perform well, profit motive did not work, welfare state was too big for the given level of development, taxes were inefficient and not fair, the structure of the economy was not balanced, too much emphasis was put on the development of industry, services and traditional sector were neglected, allocation was not led by market signals but was ruled by the government, private enterprises were not allowed or just in small number, financial system was underdeveloped, the main shortfall being the total dependence of central bank, prices were controlled by the government and therefore could not provide the right signal to companies, also inflation was caused by monetary overhang and characteristics of the financial system, currencies of the countries were not convertible, trade was conducted mostly in CMEA, a lot of it was barter trade, trade with the developed was poor, exchange in foreign capital and financial markets was not existent due to financial underdevelopment and property rights characteristics, state ownership was typical for socialist economies. The lack of private property led to the lack of incentive and additional inefficiencies. Institutional framework in all of the economies was very poor at the start of the transition. Only few countries had market oriented reforms prior to transition, for example: Yugoslavia, Poland, and Hungary. I would like to argue that the speed of institutional recovery helped transition process and contributed to smaller crisis and faster recovery. Since all countries started from basically the 11 Some data on some countries are not available and were therefore also not included in the analysis (data for countries in the FSU prior to 1990, countries in former Yugoslavia, Czech and Slovak Republic). 10 same, poor level, I can say that they had to build their institutions from almost scratch. How fast and how successful and how much that contributed to higher economic growth? 3.2. Transition begins. The reform of economic system, which occurred in CEE and FSU in 1990s has been fundamental, involving major changes of institutions, types of ownership, corporate governance, laws (…). The institutional changes were superimposed on massive changes in relative prices and pattern of foreign trade, the latter changes caused, in turn, major shifts in the composition of output. The reforms focused on micro-liberalization, macro-stabilization, structural changes, building new market institutions (especially commercial codes, property rights and financial/capital market sector) and safety nets (Gomulka, 2000). The economies all followed a similar path of development at the beginning of 1990´s, the economies slumped. The best group recorded positive growth rates already in 1993 (Slovenia, Poland, Czech Republic) and the growth rates remained positive. The second group is the group of countries that recorded an upturn in economic activity in the middle of 1990´s, but declined again due to unstable institutional framework. Examples of such countries are Romania, Albania. The third group of countries had problems with economic growth till the end of the decade and the countries are only now recording positive growth rates. FSU economies are examples of such a transition path. Countries recorded an inflation trend opposite to the growth path. All countries indeed marked high inflation in the beginning of transition, but a stabilization of the economy brought about positive growth and a decline in inflation. What was happening with the institutional framework in the last decade? Obviously, countries were building a capitalist system; therefore they were also building a new institutional framework. I do not want to go too deep into explaining all reforms, as it would be too space consuming, but be brief on theory and focus more on data. Efficient institutions mean establishment of private property, strong and not corrupted legal system, efficient markets (competitive) and macroeconomic stability with small and supporting state. Most of transition economies followed a similar path of reforms. Gomulka (2000, p.2) states that a typical reform process had six major components: micro liberalization (especially with regard to prices, trade and entry), macro stabilization (especially with regard to inflation, public finances and debt), structural changes (especially privatization and international trade), new market institutions (especially with regard to commercial codes, property rights and the financial/capital market sector), safety nets and external assistance. What I would like to extract from this reform package are the crucial institutional reforms. Micro liberalization was extremely important – price liberalization is important because prices have an important signalling and allocative role in the economy, also free trade allowed more competition and also had an important impact on lowering 11 prices and also normalizing relative prices. So micro liberalization was the first step towards working markets, which is one of the crucial institutions. Macro stabilization is also crucial – it incorporates two important institutional parts – price stability and small and supporting state. The liberal view on the state says that the state should merely protect property rights, provide some public goods and defence. Transitional countries had due to recession serious fiscal problems (underdeveloped tax systems, debts from past and those accumulated in transition, welfare state was too big for their development levels etc.). Despite reforms, public finances remained serious problem through the last decade and are still problematic. Structural reforms, above all privatization, along side building new market institutions (above all commercial code, private property rights protection and building financial markets) were most important. The most successful in building these institutions and implementing reforms were Poland, Hungary, Slovenia, Czech Republic and Slovakia. Least successful were FSU states. Data from both Freedom House and Fraser Institute confirm these hypotheses. Table 6: Freedom index (Fraser Institute) state Albania Bulgaria Croatia Czech Rep. Estonia Hungary Latvia Lithuania Poland Romania Russia Slovakia Slovenia Ukraine fi90 2,78 3,87 3,85 4,73 4,64 4,24 1,51 3,85 fi99 4,70 5,87 5,21 6,56 7,45 7,11 6,95 6,48 5,70 3,82 3,86 6,30 6,15 4,57 Source: Fraser Institute Report fiXX – denotes freedom index for a given year *missing data are not available, also data on the rest of transition economies are not available at the Fraser Institute Both Table 6 and Chart 1 present the data on institutional quality for years 1990 and 1999 or 2000 (chart). We can see that the differences at the beginning of the transition process among the countries were not very big. Most of transition countries had an index between 3 and 4 (Fraser Institute), except Russia, which was far behind. Russia had the most orthodox socialist system or the 12 socialism was the most developed. Other countries had some reforms in 50s and 60s and some market institutions were already present. These were also the countries that most dramatically improved their institutional framework – they reached a value around 7 (on a scale to 10 (USA has 9,9 or 10)). Also I would like to point out the Baltic States. They recorded a massive improvement in GDP and are the fastest growing economies among transition countries. Institutions undoubtedly contributed a lot. For instance, they have large FDI inflows, which is surely also due to good legal system and private property protection. Figure 2: Economic Freedom Index – The composite index – Freedom House Yugoslavia† Uzbekistan Ukraine Turkmenistan Tajikistan Slovenia Slovakia Russia Romania Poland Moldova Macedonia Lithuania 2000 Latvia 1990 Kyrgyz Rep. Kazakhstan Hungary Georgia Estonia Czech Rep. Croatia Bulgaria Bosnia-Herzegovina Belarus Azerbaijan Armenia Albania 0 1 2 3 4 5 6 7 8 The logic is reversed with the Freedom House index (the index has scale 1-7, 1 being best, 7 worst). Again, a massive improvement in Baltic States is obvious, also the lack of reform in 13 institutional framework in FSU. Again, due to previous reforms in socialist times, Slovenia, Hungary, Poland, Czech Republic and Slovakia have a much better value already in 1990, but they also improved a lot. So these alongside Baltic States have the best institutional framework, with index just above 1. They are also the most successful in the transition process. Do institutions matter or not? Slovenia has GDPpc in PPP 15000$, Czech Republic 12000, FSU economies with practically no reforms of institutions are far far behind. I would also like to pint out that the countries with the best institutional framework came out of the crisis already in the first half of the past decade, while FSU countries have positive growth rates for just a few years now (2-3). Obviously institutions do matter. Table 7: Transition economies and some EU economies, GDP pc in $ PPP, year 2001 Country 2001 Azerbaijan 1703,9 Bulgaria 5600 Croatia 7400 Czech Rep. 11913,8 Estonia 6790 Germany 26680,1 Greece 17830 Hungary 9470 Kazakhstan 4510 Latvia 5280 Lithuania 5270,2 Macedonia 4530 Moldova 2100 Poland 8050 Portugal 18620 Romania 4982,8 Russia 5406,5 Slovakia 8946,4 Slovenia 14990 Ukraine 2690 Yugoslavia 3100 Source: EIU data, http://countrydata.bvdep.com/ In the following chapter I will attempt to show with the help of econometrics, that such a connection exists. Higher quality of institutions, higher levels of economic growth and higher per capita GDP. 14 4. Do institutions matter? How and why? In this chapter I will try to establish whether the data really confirms the hypothesis that better quality of institutions contributes a lot to economic performance in a given country. First, I will perform a simple correlation analysis to establish whether the correlation exists or not. Then I will use panel data analysis to establish whether this impact is really strong enough to be considered as an important factor in the growth process. 4.1. Correlation analysis I argued that the countries which in the past decade built a better institutional framework also came out of the crisis earlier, recorded higher growth rates which all means that they have today higher per capita GDP. Using Freedom House index as a measure for the quality of institutions and GDP pc data, I can conclude, that the countries that had better institutions already in 1990 recorded higher difference in the GDP levels (comparing initial 1990 and 2000 level). The results show, that if the freedom index was lower (remember, Freedom House index is on a scale 1-7, 1 highest), the difference in GDP was higher, the results are significant. Table 8: Initial quality of institutions and the difference in levels of GDPpc in 1990 and 2000 Correlations dGDP(902000) 1 -,490* , ,011 26 26 -,490* 1 ,011 , 26 26 FI90 FI90 dGDP(90-2000) Pearson Correlation Sig. (2-tailed) N Pearson Correlation Sig. (2-tailed) N *. Correlation is s ignificant at the 0.05 level (2-tailed). The quality of institutions does matter. The better the institutions, the better the performance. But there is a problem with such an analysis. The country that performed some reform prior to transition (Slovenia, Poland etc.) was richer in 1990 and could also afford to build even better institutions even faster. Other macroeconomic variables like inflation, foreign direct investment and other contributed to economic performance too. So to control for these variables, a number of other variables will be included in the panel data analysis. 15 4.2. Growth empirics with institutional measures 4.2.1. Specification Modelling output in transition economies is a complex task, that requires more in depth analysis of possible variables than a simple analysis of a growth equation. The central issue will be, naturally, the question of institutions. Do they, how and which are those with the most impact. But there are many other factors that need to be considered: investment, stabilization programmes, foreign direct investment etc. The figure below will give a very thorough representation of the model, of the question which variables to include. Figure 3: The complexity of modelling output in transition External developments (shocks) Initial conditions The institutional system Outcomes (performances) Policies - reforms - other policies Economic developments Socio – political developments The figure reveals the complexity of the output development in transition economies. The output itself is affected by a number of variables, additionally there is endogenuity among many variables. The purpose is to estimate the output path and identify the variables that have affected the output development. In other words, we seek to identify the following equation: 16 Yit F ( X EC it , Pit s , I it s , S i 0 , Z i ) , where: Y – output, XEC – economic variables, P – policies (present and past), I – institutional development (also political development), S – initial conditions, Z – external shocks. Modelling output in transition economies is a very complex problem. A simple growth model approach does not suffice; the model must also take into account initial conditions, structural changes, war etc. Authors have taken different approaches: Fischer (1996) focused on monetary stabilization and liberalization, Havrylyshyn (2001, 1998) and Fischer and Sahay (2000) focused also on monetary stabilization and liberalization, but added structural reform, Staehr (2003) focused also on the sequencing and complementarity of reforms, Radulescu and Baarlow (2002) examined the importance of vanishing effects of initial conditions, Campos (2000), in a more future prospects oriented article, also examined the effects of population growth, human capital. Numerous suggestions do not simplify the choice of variables to enter into the model. The complexity of such a decision makes the general to specific approach that much more appealing. The following sets of variables are suggested by several authors: Table 9: A set of possible variables to be included in the model Macroeconomic variables Structural reform Initial conditions Institutional development Other (controls) Other fiscal balance inflation investments (foreign and domestic) exchange rate private sector share overindustrialization privatization pretransition GDP pretransition growth rate degree of urbanization natural source endowments trade dependency agricultural share in 1989 time under communism private property rights protection legal system regulation government international relations average growth in OECD terms of trade dummies for war human capital (secondary school enrolment) rate of growth of population 17 4.2.2. Data and results The analysis was performed on the data set of 25 countries in transition and spanned over 8 years (1995-2002). The data on institutional quality was provided by the Heritage foundation data set, only the overall score was used. Due to a large number of variables and very little guidance from theory, I decided to take a general to specific approach as suggested by Berg, Borensztein, Sahay, Zettelmeyer (1999). I will present here only the results of the final model, no intermediate steps will be dealt with here. The first model that was tested was a dynamic panel data model: as a dependent variable will be log of per capita GDP index. There were a number of independent variables tested: (1) Ief _ score: the freedom house overall freedom index as a proxy for institutional quality (2) ieflag1, ief_sc_2, ief_sc_3: lags of institutional quality, to account for the possibility that institutional reforms have lagged affects (3) liypcp_1, liypcp_2 : lag of log of per capita GDP index, to get a dynamic structure (4) inigdp: initial per capita gdp, to account for initial conditions (5) socyears: years under socialism, to account for initial conditions (6) war: dummy for countries torn by war (7) dind: share of industial output, to account for structural reforms (8) psbr: budget deficit (budget deficit controlled for inflation might have positive effect on output through a rise in demand or negative due to crowding out) (9) dcpi: inflation rate (10) scfin: share of gross fixed investment in GDP (11) sfdi: share of inward foreign direct investment in GDP Also, we would like to point to the fact, that the log of index of per capita GDP was used as a dependent variable. The dependent variable was tested for stationarity, the DF test showed that in 9 out of 19 cases the I[1] null hypothesis can not be rejected. If ADF[1] is used in 12 out of 18 cases the unit root null can not be rejected12. The conclusion is somewhat sensitive to specification – in some cases ADF[x] gives rejection. In summary there is questionable evidence against the unit root. But also there is questionable evidence in favour of unit root. Preliminary testing of several models showed that the use of log of per capita GDP index gave best results. The right hand side variables were ratios of variables to GDP, hence stationarity problem was avoided to at least some extent. The relationship between economic performance and institutional development clearly suffers from possible endogenuity problems. To test this, Granger and Sims test were performed. They both reveal clear evidence that institutional development affects economic performance, while there is questionable (marginal) effect of output on institutional development. Panel data analysis was performed using fixed effects to account for possible country specific effects, since all variables capturing initial conditions had to be excluded. 12 The stationarity was tested also on other (independent variables). Again, the results do not give a straightforward answer. But to avoid the stationarity problem, a differenced model was tested, but the results were very poor. Hence, we decided to use the original data as do also the authors of the articles mentioned. 18 Table 10: Regression results liypcp Coef. Std. Err. t P>t ief_scor -.2378703 .0585691 -4.061 0.000 psbr .0239327 .0054027 4.430 0.000 dcpi -.0001774 .0001102 -1.609 0.111 ieflag1 -.202873 .0569432 -3.563 0.001 dind -.0044641 .0014846 -3.007 0.003 scfin 1.654988 .8139676 2.033 0.045 _cons 6.247503 .219186 28.503 0.000 R-sq= 0.5092 F(6,83) = 14.35 The results show that the output was affected significantly by the quality of institutional framework (the negative sign is expected – the better the institutional quality, the lower the index, the higher the output). The lag of institutional quality also turned out to be significant, which implies that institutional reforms might have a postponed effect. Also budget balance, inflation, share of gross fixed investment in GDP and the share of industrial output (as a proxy for macroeconomic distortions from socialism) affected economic performance in transition economies in the past decade. 5. Conclusion The road to prosperity is the road of economic progress. Growth is a result of an interplay between capital accumulation, human capital accumulation, productivity growth, technological progress and numerous other factors, which Adam Smith called the invisible hand. Factors that foster economic efficiency. Institutions. Institutional aspects of economic transition are of crucial importance for the performance of these economies in the past decade and in the future. The paper shows that institutions do matter, above all legal system, private property rights and the government. The winners of transition process, Slovenia, Poland, Baltic states, Czech Republic, Slovakia are the countries that were the first to implement reforms, built the capitalist institutional framework faster. Russia, with a 70-year history of radical socialism has biggest problems. The results are no surprise. The role of institutions is far from negligible. Although with the rise of neoclassical economics institutions were squeezed out of main line economic theory, the experience of transition economies proves that the Solow-type models in neoclassical tradition are not enough to explain the performance of an economy off of the steady state path. Institutions do matter. 19 References: 1. Barro Robert J.: Democracy and growth, NBER Working Paper No. 4909, www.nber.com, 1994 2. Beach W., O´Driscoll G.: The Role of Property Rights in Economic Growth, in 2002 Index of Economic Freedom, Fraser Institute 3. Berg A., Borensztein E., Sahay R., Zettelmeyer J.: The Evolution of Output in Transition Economies. Explaining the Differences. IMF Working Paper WP/99/73, 81 p. 4. Bruno, M.: Stabilization and reform in Eastern Europe, Ch. 7 in Bruno (et.al), Crisis, Stabilization and Economic Reform, OUP, 1993 5. Caballero Ricardo, Hammour Mohamed: Creative Destruction and Develpment: Institutions, crises and restructuring, NBER Working Paper No. 7849, www.nber.com, 2000 6. Campos N. F.: Back to the future: The growth prospects of transition economies reconsidered. ZEI Working Paper, B13 2000, 29 p. 7. De Melo, M., Denzier C., Gelb A.: From plan to market. Patterns in transition. Policy research Working Paper no. 1564, The World Bank 8. De Melo, M., Gelb A.: A comparative analysis of twenty – eight transition economies in Europe and Asia. Post Soviet Geography Econ. 37, p. 265 – 285, May 1996 9. Fischer S., Sahay R., Vegh C.: Stabilization and growth in transition economies: the early experience. Jounal of Economic Perspectives, 10, p. 45-66 10. Fisher S., Sahay R.: The Transition Economies After 10 Yeas, v Orlowski L.: Transition and Growth in PostCommunist Countries. London : E. Elgar, 2001. str. 342. 11. Gomulka S.: Growth, Innovation and Reform in East Europe, Wheatsheaf Books, 1986 12. Gomulka S.: Macroeconomic policies and Acievements in Transition Economies 1989-99, Economic Survey of Europe, Dec. 2000 13. Gomulka S.: The Puzzles of Fairly Fast Growth and Rapid Collapse under Socialism, in B.H. Koo and D.H. Perkins (eds) Social Capability and Longterm Economic Growth, MacMillan, 1995 14. Havrylyshyn O.: Recovery and Growth in Transition. A Decade of Evidence. IMF Staff Papers, Vol. 48, special issue, p.53-87 15. Helliwell John F.: Empirical Linkages between Democracy and Economic Growth, NBER Working Paper No. 4066, www.nber.com, 2000 16. Krueger G., Ciolko M.: A note on initial conditions and liberalization during transition. Journal of Comparative Economics 26, p. 718 – 734 17. Locke J.: Concerning civil government. Second essay. An Essay concerning the true original extent and end of civil government, 1690, at: http://www.4literature.net/John_Locke/Civil_Government_Second_Essay/ 18. Minsoo Lee: Growth in Transition Economies.Foreign Direct Investment, Fiscal Policy, Human Capital and Structural Change. A PhD Thesis.Washington State University. Department of Economics. 1999. 116 p 19. Moers, Luc: Institutions, Economic performance and Transition, Tinbergen Institute Research Series, Working Paper no. 269, 2002 20. Radulescu R., Barlow D.: The Relation between Policies and Growth in Transition Economies. Economics of Transition, Vol. 10, No.3, p. 719-745 21. Rodrik Dani: Institutions for high quality growth: What they are and how to acquire them, NBER Working Paper No. 7540, www.nber.com, 1992 22. Sachs, J.: The transition at mid-decade. American Economic Review. Papers Proc. 86, 2: 128132, May 1996 23. Staehr K.: Reforms and economic growth in transition economies: Complementarity, sequencing and speed. Bank of Finland Discussion paper, 2003/no.1, 31p. 20 Data sources: 24. 25. 26. 27. 28. 29. www.eiu.com www.heritage.org www.freedomhouse.org www.imf.org www.worldbank.org www.fraserinstitute.ca APPENDIX A: The Fraser Institute Index of Economic Freedom and Freedom House Freedom Index The Fraser Institute Index of Economic Freedom The first index of economic freedom is the index composed by the Fraser Institute in Vancouver. It is a very objective and thorough measure of economic freedom. The composite index of economic freedom is made up of seven sub indices, covering different areas. The composition of the index is presented below. Table A1: Components of Index of Economic Freedom 1. Size of Government: Consumption, Transfers, and Subsidies a) general government consumption expenditures as a percentage of total consumption b) transfers and subsidies as a percentage of GDP 2. Structure of the Economy and Use of Markets (production and allocation via governmental and political mandates rather than private enterprises and markets) a. government enterprises and investment as a percentage of the economy b. price controls: extent to which business are free to set their own prices c. top marginal tax rate d. the use of conscripts to obtain military personnel 3. Monetary policy and Price Stability a. average annual growth rate of money supply during the last five years minus the growth rate of real GDP during last 10 years b. standard deviation of the annual inflation rate during the last five years c. annual inflation rate during the most recent year 4. Freedom to Use Alternative Currencies a. freedom of citizens to own foreign currency bank accounts domestically and abroad b. difference between the official exchange rate and the black market rate 5. Legal structure and property rights a. legal security of private ownership rights (risk of confiscation) b. rule of law: legal institutions, including access to a non-discriminatory judiciary, that are supportive of the principles of the rule of law 6. International exchange: Freedom to trade with foreigners a. taxes on international trade i. revenue from taxes on international trade as a percent of exports plus imports ii. mean tariff rate iii. standard deviation of tariff rates b. actual size of trade sector compared to the expected size 21 7. Freedom of exchange in capital and financial markets a. ownership of banks: percentage of deposits held in privately owned banks b. extension of credit: percentage of credit extended to private sector c. interest rate controls and regulation that lead to negative interest rates d. restrictions on the freedom of citizens to engage in capital transactions with foreigners A very shallow and surface analysis of the structure of the index leads to the conclusion that the higher the index of economic freedom a country has the higher the rates of economic growth are (a higher index (on a scale of 1 to 10) means a higher level of economic freedom). Freedom House Freedom Index A more in – depth econometric analysis will be performed on another set of economic freedom indices, published by Freedom House. The composite index of freedom is made up of three sub indices: a) Democratization score: taking into account the average political, the role of civil society, the independence of media and the efficiency of governance and public administration, b) Rule of law score – summarizing constitutional, legislative and judicial framework and the level of corruption, c) Economic liberalization score – summarizing the successfulness of privatization, macroeconomic policy and microeconomic policy. The index is a less exact representation of the economic structure and performance of an economy, due to the fact that the composite index places a large part of the emphasis on the political structure and performance of the country. But the index is available on the yearly basis and therefore allows an in – depth econometric analysis. The Freedom House index grades each country on a scale from 1 to 7, 1 being the highest grade. Therefore the logic is inversed in the case of Freedom House – the smaller the index, the more developed is a certain institution in a given country and the higher the growth rate will be. 22 The Heritage Foundation Index The Heritage Foundation Index of Freedom is available for transition economies for the time from 1995-2002. Panel data analysis was performed using this index. It runs on a scale from 1 to 5, 1 being best, 5 worst. The overall score is comprised of 10 subscores: trade policy, fiscal burden of government, government intervention in the economy, monetary policy, capital flows and foreign investment, banking and finance, wages and prices, property rights, regulation, and informal market activity. Table A1: Comparison of indices Fraser Institute Freedom House 1990 1999 1990 1999 2,78 4,7 7,6 4,5 Albania 3,87 5,85 3,4 2,3 Bulgaria 3,85 6,56 2,2 1,2 Czech Republic 7,45 2,3* 1,2 Estonia 4,73 7,11 2,2 1,2 Hungary 6,95 2,3* 1,2 Latvia 6,48 2,3* 1,2 Lithuania 4,64 5,7 2,2 1,2 Poland 4,24 4,6 6,5 2,2 Romania 1,51 5,4 5,4 4,5 Russia 3,85 6,3 2,2 1,2 Slovakia 6,15 2,3* 1,2 Slovenia 4,57 3,3* 3.apr Ukraine Source: web pages of organizations 23 Heritage Found. 1995 2002 3,60 3,50 3,50 3,40 2,20 2,40 2,40 1,80 2,40 2,50 3,90 2,35 3,60 2,70 3,50 3,70 2,80 3,70 2,90 3,10 3,70 3,85 APPENDIX B: Institutional quality in transition economies prior to transition Year 1972-73 1973-74 1974-75 1975-76 1976-77 1977-78 1978-79 1979-80 1980-81 1981-82 1982-83 1983-84 1984-85 1985-86 1986-87 1987-88 1988-89 1989-90 Table B1: Institutional development at the end of socialism13, data on economic freedom, by Freedom House Bulgaria Czechoslovakia Germany, Hungary Poland Romania USSR Yugoslavia† E. 7,7,NF 7,7,NF 7,7,NF 6,6,NF 6,6,NF 7,6,NF 6,6,NF 6,6,NF 7,7,NF 7,7,NF 7,7,NF 6,6,NF 6,6,NF 7,6,NF 6,6,NF 6,6,NF 7,7,NF 7,7,NF 7,7,NF 6,6,NF 6,6,NF 7,6,NF 6,6,NF 6,6,NF 7,7,NF 7,6,NF 7,7,NF 6,6,NF 6,6,NF 7,6,NF 7,6,NF 6,6,NF 7,7,NF 7,6,NF 7,7,NF 6,6,NF 6,6,NF 7,6,NF 7,6,NF 6,6,NF 7,7,NF 7,6,NF 7,7,NF 6,5,NF 6,5,NF 7,6,NF 7,6,NF 6,5,NF 7,7,NF 7,6,NF 7,6,NF 6,5,NF 6,5,PF 7,6,NF 7,6,NF 6,5,NF 7,7,NF 7,6,NF 7,7,NF 6,5,NF 6,5,PF 7,6,NF 6,6,NF 6,5,NF 7,7,NF 7,6,NF 7,6,NF 6,5,NF 6,4,PF 7,6,NF 6,7,NF 6,5,NF 7,7,NF 7,6,NF 7,7,NF 6,5,NF 5,4,PF 7,6,NF 6,7,NF 6,5,NF 7,7,NF 7,6,NF 7,7,NF 6,5,NF 6,5,NF 7,6,NF 6,7,NF 6,5,NF 7,7,NF 7,6,NF 7,7,NF 6,5,NF 6,5,PF 7,6,NF 6,7,NF 6,5,PF 7,7,NF 7,6,NF 7,6,NF 6,5,PF 6,5,PF 7,7,NF 7,7,NF 6,5,PF 7,7,NF 7,6,NF 7,6,NF 5,5,PF 6,5,PF 7,7,NF 7,7,NF 6,5,PF 7,7,NF 7,6,NF 7,6,NF 5,5,PF 6,5,PF 7,7,NF 7,7,NF 6,5,PF 7,7,NF 7,6,NF 7,6,NF 5,4,PF 5,5,PF 7,7,NF 7,6,NF 6,5,PF 7,7,NF 7,6,NF 7,6,NF 5,4,PF 5,5,PF 7,7,NF 6,5,NF 5,5,PF 7,7,NF 6,6,NF 6,6,NF 4,3,PF 4,3,PF 7,7,NF 6,5,NF 5,4,PF Source: www.freedomhouse.org Table B2: Fraser Institute Index of Economic Freedom Country 1970 1975 1980 1985 1990 2,78 Albania 6,05 3,87 Bulgaria Croatia 3,85 Czech Rep. Estonia 4,52 4,76 4,73 Hungary Latvia Lithuania 3,60 4,64 Poland 3,63 4,24 Romania 1,61 1,60 1,59 1,51 Russia 3,85 Slovak Republic Slovenia Ukraine 7,65 7,99 8,35 8,51 8,76 United States Source: www.fraserinstitute.com, *if empty, data not available 13 1995 4,75 5,08 4,07 6,70 5,95 6,88 5,49 5,54 6,28 4,23 4,81 6,26 5,86 2,80 8,74 1999 4,70 5,87 5,21 6,56 7,45 7,11 6,95 6,48 5,70 3,82 3,86 6,30 6,15 4,57 8,73 The characters representing scores for each year are, from left to right, political rights, civil liberties, and freedom status. Each of the first two is measured on a one-to-seven scale, with one representing the highest degree of freedom and seven the lowest. “F,” “PF,” and “NF” respectively stand for “free,” “partly free,” and “not free.” Countries whose combined averages for political rights and for civil liberties fall between 1.0 and 2.5 are designated "free"; between 3.0 and 5.5. “partly free”; and between 5.5 and 7.0 “not free.” 24 United States 1,1,F 1,1,F 1,1,F 1,1,F 1,1,F 1,1,F 1,1,F 1,1,F 1,1,F 1,1,F 1,1,F 1,1,F 1,1,F 1,1,F 1,1,F 1,1,F 1,1,F 1,1,F