10-1 Reasons for Saving and Investing

... b. contingency fund planning c. political risk d. hedging ...

... b. contingency fund planning c. political risk d. hedging ...

Systemic Risk and the Financial Crisis: A Primer

... following example: Suppose Bank A purchases an option from Bank B to hedge the risk of a change in the term structure of interest rates. If Bank B later fails, perhaps because of bad investments in home mortgages, then the option sold by Bank B may lose value or even become worthless. Thus, Bank A—w ...

... following example: Suppose Bank A purchases an option from Bank B to hedge the risk of a change in the term structure of interest rates. If Bank B later fails, perhaps because of bad investments in home mortgages, then the option sold by Bank B may lose value or even become worthless. Thus, Bank A—w ...

Handling Market Volatility

... The silver lining of a down market is the opportunity to buy shares of stock at lower prices. One of the ways you can do this is by using dollar-cost averaging. With dollar-cost averaging, you don't try to "time the market" by buying shares at the moment when the price is lowest. In fact, you don't ...

... The silver lining of a down market is the opportunity to buy shares of stock at lower prices. One of the ways you can do this is by using dollar-cost averaging. With dollar-cost averaging, you don't try to "time the market" by buying shares at the moment when the price is lowest. In fact, you don't ...

FASB Statement 149 and Redeemable Preferred

... The other two categories of instruments are (i) financial instruments embodying, or indexed to, an obligation to repurchase the company’s equity shares that requires or could require settlement by transfer of assets (e.g., written put options or forward contracts), that are physically settled or net ...

... The other two categories of instruments are (i) financial instruments embodying, or indexed to, an obligation to repurchase the company’s equity shares that requires or could require settlement by transfer of assets (e.g., written put options or forward contracts), that are physically settled or net ...

FORM No. IV

... *In case of first appointment please indicate date of appointment -------------------------------------------------------------------------Note 1. This return shall contain particulars of all assets and liabilities of the public servant either in his/her own name or in the name of any other person. ...

... *In case of first appointment please indicate date of appointment -------------------------------------------------------------------------Note 1. This return shall contain particulars of all assets and liabilities of the public servant either in his/her own name or in the name of any other person. ...

Risk Management and Financial Institutions

... where xi and xj are yield curve shifts considered for delta To avoid too many numbers being produced one possibility is consider only i = j Another is to consider only parallel shifts in the yield curve and calculate convexity Another is to consider the first two or three types of shift given by a p ...

... where xi and xj are yield curve shifts considered for delta To avoid too many numbers being produced one possibility is consider only i = j Another is to consider only parallel shifts in the yield curve and calculate convexity Another is to consider the first two or three types of shift given by a p ...

Micro Chapter 22 Presentation 2

... 1. Golf and movie theatres- different age and time costs (seniors, weekend)more expensive on the weekend ...

... 1. Golf and movie theatres- different age and time costs (seniors, weekend)more expensive on the weekend ...

Financial Innovation: The Bright and Dark Sides

... innovations reduce agency costs, facilitate risk sharing, complete the market, and ultimately improve allocative efficiency and economic growth Innovation-fragility hypothesis – the dark side: financial innovations as the root cause of the recent Global Financial Crisis credit expansion that hel ...

... innovations reduce agency costs, facilitate risk sharing, complete the market, and ultimately improve allocative efficiency and economic growth Innovation-fragility hypothesis – the dark side: financial innovations as the root cause of the recent Global Financial Crisis credit expansion that hel ...

Are markets anticipating a new world order?

... Business and economic news continues to improve The increased uncertainty about how the US will interact economically and politically with the rest of the world under the new administration might indeed justify higher risk premia in markets – all other things being equal. But other political and eco ...

... Business and economic news continues to improve The increased uncertainty about how the US will interact economically and politically with the rest of the world under the new administration might indeed justify higher risk premia in markets – all other things being equal. But other political and eco ...

Monetary and Financial Conditions in 2016 Exchange Rate Volatility

... The diverging path of monetary policy between the US and other advanced economies will also continue to cause swings in capital flows and significant volatility in emerging market currencies. Going forward, the fact that economic, financial and geopolitical shocks are becoming more common amidst per ...

... The diverging path of monetary policy between the US and other advanced economies will also continue to cause swings in capital flows and significant volatility in emerging market currencies. Going forward, the fact that economic, financial and geopolitical shocks are becoming more common amidst per ...

Weighted Average Cost of Capital

... Equity : Raised capital from many investors to purchase and manage property, includingnleasing, development and tenant services. Acquisition and development of properties for their own portfolio rather than resell them once developed. ...

... Equity : Raised capital from many investors to purchase and manage property, includingnleasing, development and tenant services. Acquisition and development of properties for their own portfolio rather than resell them once developed. ...

Answers to Chapter 22 Questions

... the FI in part (b) is exposed to interest rate increases. The FI in part (c) has the least amount of interest rate risk exposure since the absolute value of the repricing gap is the lowest, while the opposite is true for part (b). 3. a. The repricing model has four general weaknesses: i. It ignores ...

... the FI in part (b) is exposed to interest rate increases. The FI in part (c) has the least amount of interest rate risk exposure since the absolute value of the repricing gap is the lowest, while the opposite is true for part (b). 3. a. The repricing model has four general weaknesses: i. It ignores ...

Chapter 37 The Stock Market and Crashes

... 16. An S-corporation is designed a. For large new incorporations b. To allow stock sales to other corporate entities c. To allow for unlimited numbers of shareholders D. For small businesses to incorporate ...

... 16. An S-corporation is designed a. For large new incorporations b. To allow stock sales to other corporate entities c. To allow for unlimited numbers of shareholders D. For small businesses to incorporate ...

master-ppt-embed-class8

... Decentralization is beneficial because it creates greater responsiveness to the needs of local customers, suppliers, and employees. Managers at lower levels are more knowledgeable about local markets and the needs of customers, etc. A decentralized organization is also more likely to respond flexibl ...

... Decentralization is beneficial because it creates greater responsiveness to the needs of local customers, suppliers, and employees. Managers at lower levels are more knowledgeable about local markets and the needs of customers, etc. A decentralized organization is also more likely to respond flexibl ...

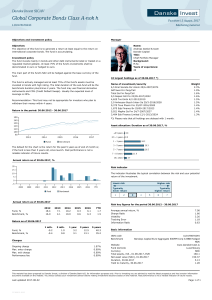

Global Corporate Bonds Class A-nok h

... The fund invests mainly in bonds and other debt instruments listed or traded on a regulated market globally. At least 75% of the fund's investments shall be denominated in euro or hedged to euro. The main part of the fund's NAV will be hedged against the base currency of the fund. The fund is active ...

... The fund invests mainly in bonds and other debt instruments listed or traded on a regulated market globally. At least 75% of the fund's investments shall be denominated in euro or hedged to euro. The main part of the fund's NAV will be hedged against the base currency of the fund. The fund is active ...

MARKET REVIEW AND ECONOMIC OUTLOOK 2014 Q2 MARKET

... “I have always considered a bet on ever‐rising U.S. prosperity to be very close to a sure thing……..who has ever benefitted during the past 237 years by betting against America………America’s best days lie ahead” – Warren Buffet, Berkshire Hathaway 2013 Year‐End Letter to Shareholders The first quarte ...

... “I have always considered a bet on ever‐rising U.S. prosperity to be very close to a sure thing……..who has ever benefitted during the past 237 years by betting against America………America’s best days lie ahead” – Warren Buffet, Berkshire Hathaway 2013 Year‐End Letter to Shareholders The first quarte ...