* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Are markets anticipating a new world order?

Survey

Document related concepts

Transcript

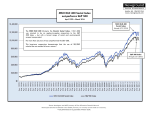

Publication for professional investors A brief look ahead at the market & review of key indices Week 4 – 23 January 2017 Marketexpress The impact of new US leadership may depend on developments elsewhere in the world. Meanwhile, a solid global economy calls for a continued tilt towards risky assets. Are markets anticipating a new world order? Last Friday a new leader took over at the helm of the most powerful country of the world, a man about whom – and by whom – much has already been said. The reality-TV star’s ascendancy, his election as president of the US, his choice of advisers and cabinet members, and his still-vague policy plans have created worries around the world about the stability of international relationships, among other things. Some commentators have suggested that markets may be ignoring the risks to trade and security. an even higher level. The populist wave could spread to the Netherlands, France and Italy and put the European Union further at risk. The security situation in Southeast Asia may deteriorate as a result of short-sighted and populist diplomacy by both the US and regional leaders. The US-Chinese trade relationship could suffer from this as well and provide a dangerously direct channel to undermine the current upturn in the global business cycle. Monitoring the market mood Business and economic news continues to improve The increased uncertainty about how the US will interact economically and politically with the rest of the world under the new administration might indeed justify higher risk premia in markets – all other things being equal. But other political and economic developments are currently unfolding that could amplify or dilute the impact of the upcoming behaviour of US policy makers. Markets may not be very rational much of the time, but they are notoriously hard to outsmart. One should understand that an inherently uncertain future always results from the interaction of many moving parts. The underlying economy, policy and politics and the markets themselves continuously interact to create an everchanging future. The market never overlooks what is happening to the global business cycle, inflation and corporate profits or defaults. On these fronts, the news has improved substantially, even while headlines were full of political drama. Global growth is stronger and unemployment rates are lower almost everywhere, inflation and wages are finally moving up and the outlook for earnings growth has brightened. One might even argue that the recent consolidation in markets is already a reflection of higher political risk premia, because given the direction of economic fundamentals, risky assets deserve to drift higher. The reality check for markets will certainly come. When it does, the real economy might provide better guidance than the tweet-storms or broadcasts of tumultuous press conferences. What might also help is monitoring closely what markets are telling us on some of these potential event risks. The extent to which US economic growth or corporate earnings prospects are at risk of being shocked lower by US policy will be reflected in expectations about the future equity market volatility. A good gauge of such expectations is the CBOE Volatility Index (VIX), which measures the implied volatility of S&P 500 index options. Global trade risks will be reflected most noticeably in currencies of EM exporters that are sensitive to protectionist stances from major developed economy importers, most importantly the US, so currencies like the Mexican Peso or the Korean Won are a good barometer. The market appears not to be worried about growth and profits, but certainly seems concerned about risks to global trade if one sees how much a Peso-Won index has weakened in recent weeks (see chart). Two measures of US policy risk Not the only game in town The US does not own the world of politics. The other regions of the world have their own political shows that deserve close monitoring. Europe and Asia have more than enough political ammunition to shake the regional policy outlooks. This could happen in positive or negative directions. A more supportive fiscal agenda could help growth; strong electoral performances by non-populist newcomers, such as France’s Emmanuel Macron, or by the authentic traditional leaders like Germany’s Angela Merkel or Japan’s Shinzo Abe, could enhance political stability. European and Asian political dynamics could of course conspire with US policy shocks to raise international tension and fragmentation to Source: Thomson Reuters Datastream, NN Investment Partners www.nnip.com Publication for professional investors Fundamentals still favourable for emerging market equities The strong performance of emerging market equities that started late last year may be surprising, given the vulnerability of emerging markets to more US protectionism. EM fundamentals are in fact not bad. Macro and trade data are strong, earnings momentum is positive and commodity prices are rising. On top of that, the USDappreciation has stopped as well as the rise in US bond yields. If it weren’t for the headwinds of political uncertainty, emerging markets would be doing even better. Earnings season starts with promising bank results Last week, the earnings season kicked off, this time with the banking sector. Their results were encouraging, helped by higher interest income (rising yields and a steeper curve), lower provisioning for bad loans (higher oil price and macro improvement) and lower taxes. The outlook for the current year is also good, and the plans for US deregulation and taxes are feeding this optimism. The US earnings outlook for 2017 is positive, with bottom-up consensus expecting a rise of 12% on a revenue increase of 6%. Two sectors are key: financials and energy. This means the trend in bond yields and oil prices will be important variables for the US earnings growth outlook. Global earnings momentum continues to rise. Consensus growth estimates indicate a 12% rise in earnings this year for the Eurozone and the US and even slightly higher for Japanese companies. These are realistic estimates and could even be revised higher depending on rates, oil prices and the strength of the economy. For the Eurozone and Japan the currency impact is also important. Implantation of new US tax rules may take time An important factor for equity markets will be new tax rules in the US and when they will be implemented. This may take more time than had been hoped, given the Republicans’ slim majority in the Senate (52 to 48) and the very different impact on companies resulting from the voting behaviour of Republican senators of heavily impacted states. On the table are a border tax reform levying taxes on US imports, a general cut in the marginal taxation rate, and different treatment of overseas cash repatriation, interest expense deductibility and depreciation. This will take time, and repealing Barack Obama’s Affordable Care Act may be a bigger priority for the incoming government. The current background of solid economic data and corporate earnings – and more talk than action in the political arena – seems to justify the balanced view on these event risks that the market is taking. This could easily change to a new world order of inwardlooking economic and security policies and confrontational dialogue between the leaders of the world’s most powerful countries. For now, though, we stick to what we know and where a strong economy and a cash-rich investor base are guiding us to: stay tilted towards risky assets. Week 4 – 23 January 2017 MSCI Regional Indices (EUR) % 13 - 20 Ja n YTD MSCI Worl d -0.79 0.61 MSCI Europe -0.92 0.33 MSCI Emergi ng Ma rkets -0.80 2.34 MSCI US -0.63 0.41 MSCI Ja pa n -1.25 1.10 MSCI Devel oped As i a ex Ja pa n -0.69 3.38 13 - 20 Ja n -0.93 YTD -2.04 MSCI Worl d Ma teri a l s MSCI Worl d Indus tri a l s 0.04 -0.42 3.30 1.09 MSCI Worl d Cons umer Di s creti ona ry -0.81 1.46 MSCI Worl d Cons umer Sta pl es MSCI Worl d Hea l th Ca re 0.53 -1.92 0.13 -0.09 MSCI Worl d Fi na nci a l s MSCI Worl d Informa ti on Technol ogy -1.68 -0.36 -0.09 2.17 MSCI Worl d Tel ecom Servi ces -0.28 0.94 MSCI Worl d Uti l i ti es MSCI Worl d Rea l Es ta te -0.31 -0.84 -0.85 -0.55 20-Ja n 13-Ja n 10-yr Bund (Germa ny) 10-yr Trea s ury (US) 0.42 2.47 0.34 2.38 US Inves tment Gra de Credi ts Euro Inves tment Gra de Credi ts 3.38 0.82 3.33 0.76 Gl oba l Hi gh Yi el d 5.64 5.62 EMD Ha rd Currency As i a n Debt Compos i te 5.66 4.62 5.59 4.52 MSCI Sector Indices (EUR) MSCI Worl d Energy % Bond & Credit Yields % FX & Commodities 20-Ja n 13-Ja n EUR/USD 1.063 1.066 Crude Oi l (WTI Spot, USD) 52.33 52.36 DJ UBS Commodi ty i ndex 178.74 179.06 Eurozone Cons umer Confi dence (Ja n) Da te 23-Ja n Cons ens us -4.80 Eurozone Ma rki t Compos i te PMI (Ja n) US Exi s ti ng Home Sa l es (Dec) 24-Ja n 24-Ja n 54.5 5.52M Ja pa n Exports / Imports (Dec, y-o-y) 25-Ja n 1.2%/-0.8% UK GDP (Q4, q-o-q / y-o-y) 26-Ja n 0.5%/2.1% US New Home Sa l es (Dec) 26-Ja n 587K Ja pa n Core CPI (Dec, y-o-y) US Dura bl e Goods Orders (Dec, m-o-m) 27-Ja n 27-Ja n -0.3% 2.6% US GDP (Q4, q-o-q a nnua l i s ed) 27-Ja n 2.2% Economic Releases (23 - 27 Jan) Source: Thomson Reuters Datastream/Eikon. YTD data until 20 January 2017 Disclaimer The elements contained in this document have been prepared solely for the purpose of information and do not constitute an offer, in particular a prospectus or any invitation to treat, buy or sell any security or to participate in any trading strategy. This document is intended only for MiFID professional investors. While particular attention has been paid to the contents of this document, no guarantee, warranty or representation, express or implied, is given to the accuracy, correctness or completeness thereof. Any information given in this document may be subject to change or update without notice. Neither NN Investment Partners B.V., NN Investment Partners Holdings N.V. nor any other company or unit belonging to the NN Group, nor any of its officers, directors or employees can be held directly or indirectly liable or responsible with respect to the information and/or recommendations of any kind expressed herein. The information contained in this document cannot be understood as provision of investment services. If you wish to obtain investment services please contact our office for advice. Use of the information contained in this document is solely at your risk. Investment sustains risk. Please note that the value of your investment may rise or fall and also that past performance is not indicative of future results and shall in no event be deemed as such. This document and information contained herein must not be copied, reproduced, distributed or passed to any person at any time without our prior written consent. Any claims arising out of or in connection with the terms and conditions of this disclaimer a re governed by Dutch law. 2