Financial System Overview and the Flow of Funds

... Closer scrutiny of the money market and important factors influencing conditions Detailed review of important credit markets and the market for equity J. K. Dietrich - FBE 524 – Fall 2005 ...

... Closer scrutiny of the money market and important factors influencing conditions Detailed review of important credit markets and the market for equity J. K. Dietrich - FBE 524 – Fall 2005 ...

PROGRAMME First High-Level Follow-up Dialogue HIGH-LEVEL SPEAKERS

... 12:30 - 13:30 | Luncheon hosted by Yoo Jeong-Bok, Mayor of Incheon Metropolitan City 13:30 - 15:30 | Session 2: Capital markets, securities commissions and regulations in Asia and the Pacific The development of domestic capital markets with an appropriate mix of debt and equity is crucial for the pr ...

... 12:30 - 13:30 | Luncheon hosted by Yoo Jeong-Bok, Mayor of Incheon Metropolitan City 13:30 - 15:30 | Session 2: Capital markets, securities commissions and regulations in Asia and the Pacific The development of domestic capital markets with an appropriate mix of debt and equity is crucial for the pr ...

1 Solutions to End-of-Chapter Problems in

... estimate the value of nominal income, say, 10- years from now without knowing what will be the rate of price inflation over the next 10 years. But future values of income can be expected to move in proportion to future rates of price inflation so that the future value of real income may be estimated ...

... estimate the value of nominal income, say, 10- years from now without knowing what will be the rate of price inflation over the next 10 years. But future values of income can be expected to move in proportion to future rates of price inflation so that the future value of real income may be estimated ...

Geneva, Switzerland, 4 December 2014

... FATF Recommendations require countries to understand risks and apply a RBA, including simplified measures where the risks are lower Financial inclusion measures can be used in low-risk situations (or as part of a strategy to reduce the risks) However, there needs to be balance-risks must be understo ...

... FATF Recommendations require countries to understand risks and apply a RBA, including simplified measures where the risks are lower Financial inclusion measures can be used in low-risk situations (or as part of a strategy to reduce the risks) However, there needs to be balance-risks must be understo ...

2. Overview of the Financial System

... the interbank market, this impedes liquidity management by individual banks, posing a risk to financial stability, and could result in the central bank having to supply liquidity to banks on a case-by-case basis, complicating the management of monetary policy. 2.23 The bond market is the market in l ...

... the interbank market, this impedes liquidity management by individual banks, posing a risk to financial stability, and could result in the central bank having to supply liquidity to banks on a case-by-case basis, complicating the management of monetary policy. 2.23 The bond market is the market in l ...

CV - Tyler Abbot

... Ph.D. in Economics, May 2018 (expected) M.Sc. in Economics, May 2015. Cum laude (top 10% for all master’s programs). Princeton University, Princeton, NJ, USA Visiting Exchange Student, Department of Economics, Fall 2017 - Spring 2018 Columbia University, New York, NY, USA Visiting Scholar, Departmen ...

... Ph.D. in Economics, May 2018 (expected) M.Sc. in Economics, May 2015. Cum laude (top 10% for all master’s programs). Princeton University, Princeton, NJ, USA Visiting Exchange Student, Department of Economics, Fall 2017 - Spring 2018 Columbia University, New York, NY, USA Visiting Scholar, Departmen ...

Quarterly Commentary—Artisan Global Equity

... In a market environment characterized by weak demand and low (or even falling) inflation, growth has been more difficult to find generally, and companies have been pressured to cut prices in order to compete for market share. Against this backdrop, we are particularly drawn to companies that are cap ...

... In a market environment characterized by weak demand and low (or even falling) inflation, growth has been more difficult to find generally, and companies have been pressured to cut prices in order to compete for market share. Against this backdrop, we are particularly drawn to companies that are cap ...

DIAMOND FIELDS INTERNATIONAL LTD. Management`s

... On July 24, 2007, following acceptance by the Toronto Stock Exchange, the Company announced that it had entered into a joint venture agreement with Lion Fields Limited (“Lions Fields”) for mineral exploration in a highly prospective area in western Zambia. Lion Fields, a company controlled by Mr. Je ...

... On July 24, 2007, following acceptance by the Toronto Stock Exchange, the Company announced that it had entered into a joint venture agreement with Lion Fields Limited (“Lions Fields”) for mineral exploration in a highly prospective area in western Zambia. Lion Fields, a company controlled by Mr. Je ...

Ch01 - Introduction

... The goal of management science is to recommend the course of action that is expected to yield the best outcome with what is available. ...

... The goal of management science is to recommend the course of action that is expected to yield the best outcome with what is available. ...

Monetary Policy and Asset Prices Revisited Donald L. Kohn

... To be sure, some observers contend that the low level of the federal funds rate in 2003 and 2004 was clearly a primary cause of the housing bubble, and that a significantly tighter stance of monetary policy would have been warranted. As you know, the Federal Open Market Committee (FOMC), after havin ...

... To be sure, some observers contend that the low level of the federal funds rate in 2003 and 2004 was clearly a primary cause of the housing bubble, and that a significantly tighter stance of monetary policy would have been warranted. As you know, the Federal Open Market Committee (FOMC), after havin ...

amundi index jp morgan gbi global govies - ie

... of the fund (FCP), collective employee fund (FCPE), SICAV, SICAV sub-fund or SICAV investing primarily in real estate (SPPICAV) (collectively, “the Funds”) described herein and should in no case be interpreted as such. This document is not a contract or commitment of any form. Information contained ...

... of the fund (FCP), collective employee fund (FCPE), SICAV, SICAV sub-fund or SICAV investing primarily in real estate (SPPICAV) (collectively, “the Funds”) described herein and should in no case be interpreted as such. This document is not a contract or commitment of any form. Information contained ...

Chapter 20 - uob.edu.bh

... Long-term marketing activities • Replacement of equipment • Expansion of facilities ...

... Long-term marketing activities • Replacement of equipment • Expansion of facilities ...

Stable Value - Prudential Retirement

... **Represents investment management and administrative fees only. The fund has additional expenses for investment contracts and other administrative fees. As of 12/31/16, this additional expense was: 27.0 bps. ...

... **Represents investment management and administrative fees only. The fund has additional expenses for investment contracts and other administrative fees. As of 12/31/16, this additional expense was: 27.0 bps. ...

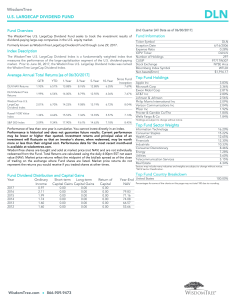

WisdomTree LargeCap Dividend Fund

... The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s (“S&P”), a division of The McGraw-Hill Companies, Inc. and is licensed for use by WisdomTree Investments, Inc. Neither MSCI, S&P nor any ...

... The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s (“S&P”), a division of The McGraw-Hill Companies, Inc. and is licensed for use by WisdomTree Investments, Inc. Neither MSCI, S&P nor any ...

Talking Point Schroders Investing in Australian smaller companies and the importance of

... however, the opportunity was significant, as they had no legacy business to protect and could fully capitalise on the new market opportunity by positioning themselves as the leader in online space through network economics (more job seekers = more advertisers = more job seekers). This story is well ...

... however, the opportunity was significant, as they had no legacy business to protect and could fully capitalise on the new market opportunity by positioning themselves as the leader in online space through network economics (more job seekers = more advertisers = more job seekers). This story is well ...

A Modern, Behavior-Aware Approach to Asset Allocation and

... is considered the only “free lunch” available in investing – is that a portfolio of assets will always have a risk level less-than-or-equal-to the riskiest asset within the portfolio. Yet it was not until Dr. Harry Markowitz published his seminal article “Portfolio Selection” in 1952 that investors ...

... is considered the only “free lunch” available in investing – is that a portfolio of assets will always have a risk level less-than-or-equal-to the riskiest asset within the portfolio. Yet it was not until Dr. Harry Markowitz published his seminal article “Portfolio Selection” in 1952 that investors ...

C 0 - chass.utoronto

... • Consider the following two investors investing all their money on the stocks of a single firm. Their well-being is thus tied to the well-being of the firm. Consider the firm is making decision of what to produce. • Fisher Separation Theorem implies even the two investors differ in their subjective ...

... • Consider the following two investors investing all their money on the stocks of a single firm. Their well-being is thus tied to the well-being of the firm. Consider the firm is making decision of what to produce. • Fisher Separation Theorem implies even the two investors differ in their subjective ...

NBER WORKING PAPER SERIES CAPITAL MOBILITY AND DEVALUATION IN AN

... crete rise in the price of foreign exchange occasions a proportional issue of central-bank money, a transfer of interest-bearing foreign bonds from the public to the bank, and nothing more. The optimization hypothesis, as applied here, eliminates the indeterminacy typically associated with models as ...

... crete rise in the price of foreign exchange occasions a proportional issue of central-bank money, a transfer of interest-bearing foreign bonds from the public to the bank, and nothing more. The optimization hypothesis, as applied here, eliminates the indeterminacy typically associated with models as ...

Input Demand: The Capital Market and the Investment Decision

... Appendix: Calculating Present Value • Lower interest rates result in higher present values. The firm has to pay more now to purchase the same number of future dollars. The present value of $100 in 2 years with interest rate is 10 %: ...

... Appendix: Calculating Present Value • Lower interest rates result in higher present values. The firm has to pay more now to purchase the same number of future dollars. The present value of $100 in 2 years with interest rate is 10 %: ...