chapter one - McGraw Hill Higher Education

... price of an option. While analysts talk of “intrinsic value,” they know they can’t calculate it exactly. Think of intrinsic value as the best guess of what a share is worth. Investing is intrinsically (!) uncertain; fundamental analysis reduces uncertainty but doesn’t eliminate it completely. There ...

... price of an option. While analysts talk of “intrinsic value,” they know they can’t calculate it exactly. Think of intrinsic value as the best guess of what a share is worth. Investing is intrinsically (!) uncertain; fundamental analysis reduces uncertainty but doesn’t eliminate it completely. There ...

Interaction Between Value Line`s Timeliness and

... measure of average book-to-market ratios across timeliness and safety ranks. T1 stocks had an average book-tomarket ratio of 0.26 compared to 1.31 for T5 stocks. Higher book-to-market ratios are also apparent with riskier securities, as investors demand more value to compensate for the higher risk l ...

... measure of average book-to-market ratios across timeliness and safety ranks. T1 stocks had an average book-tomarket ratio of 0.26 compared to 1.31 for T5 stocks. Higher book-to-market ratios are also apparent with riskier securities, as investors demand more value to compensate for the higher risk l ...

Use of Ratings in Insurance Industry

... No ratings exist for mortgages; therefore, factors were developed on the basis of experience on the entire mortgage portfolio. Factor based on insurer’s mortgage experience relative to industry experience (i.e., MEAF) ...

... No ratings exist for mortgages; therefore, factors were developed on the basis of experience on the entire mortgage portfolio. Factor based on insurer’s mortgage experience relative to industry experience (i.e., MEAF) ...

How to view electricity

... Is electricity to be treated as a public good with universal service obligation of the state or is it a should be treated like a commodity and work on market based principles ? Double sided bidding or supply side bidding ? ...

... Is electricity to be treated as a public good with universal service obligation of the state or is it a should be treated like a commodity and work on market based principles ? Double sided bidding or supply side bidding ? ...

Securities Markets

... also useful as a proxy for liquidity, in facilitating comparisons across markets where impact cost is not measured. Table 4.8 shows the growth of “net” or “one-way” turnover on the Indian equity market. From 2003 onwards, derivatives turnover has exceeded spot market turnover, as is the case with al ...

... also useful as a proxy for liquidity, in facilitating comparisons across markets where impact cost is not measured. Table 4.8 shows the growth of “net” or “one-way” turnover on the Indian equity market. From 2003 onwards, derivatives turnover has exceeded spot market turnover, as is the case with al ...

Illiquid assets - Select Investment Partners

... For example, the current sale price of an illiquid wholesale unlisted fund (in the secondary market) investing in infrastructure or private equity is rarely the same as its Net Asset Value (NAV) or carrying value. Sometimes it is higher (for example, mature private equity portfolios pregnant with up ...

... For example, the current sale price of an illiquid wholesale unlisted fund (in the secondary market) investing in infrastructure or private equity is rarely the same as its Net Asset Value (NAV) or carrying value. Sometimes it is higher (for example, mature private equity portfolios pregnant with up ...

The World is Too Much With Us… Although originally scribed more

... “current price” rather than a more disciplined structure that has an objective measurement of present valuation (like P/E and similar ratios) relative to an investment’s future benefits – like dividend cash flow rates into retirement. Often times this is compounded by a morphing of their perceived r ...

... “current price” rather than a more disciplined structure that has an objective measurement of present valuation (like P/E and similar ratios) relative to an investment’s future benefits – like dividend cash flow rates into retirement. Often times this is compounded by a morphing of their perceived r ...

Financial Innovation, Macroeconomic Stability and Systemic Crises

... interchangeable. However, their wealth is relatively limited: although they receive an endowment, n0 , of the consumption good in period 0 (this may be thought of as their initial net worth), this is assumed to be very small relative to e. We also assume that intermediaries are unable to trade each ...

... interchangeable. However, their wealth is relatively limited: although they receive an endowment, n0 , of the consumption good in period 0 (this may be thought of as their initial net worth), this is assumed to be very small relative to e. We also assume that intermediaries are unable to trade each ...

Liquidity and Asset Prices

... Inequality (4) says that, since the agent cannot sell more than a fraction θ of his existing (depreciated) stock λkt or of his new capital i t , he has to retain at least a fraction 1 − θ. Inequality (5) says that he cannot short sell land. Taken together, these inequalities constitute the agent’s l ...

... Inequality (4) says that, since the agent cannot sell more than a fraction θ of his existing (depreciated) stock λkt or of his new capital i t , he has to retain at least a fraction 1 − θ. Inequality (5) says that he cannot short sell land. Taken together, these inequalities constitute the agent’s l ...

Competency Standard

... Training and assessment to include access to a real or simulated workplace that provides the candidate with an opportunity to demonstrate application of knowledge of financial and legal issues that impact on the management of physical assets to specific tourism and hospitality workplace situations a ...

... Training and assessment to include access to a real or simulated workplace that provides the candidate with an opportunity to demonstrate application of knowledge of financial and legal issues that impact on the management of physical assets to specific tourism and hospitality workplace situations a ...

Financial Amplification Mechanisms and the Federal Reserve`s

... Shleifer and Vishny (1997) examine the effect of inter-temporal wealth constraints on the incentives of arbitrageurs to eliminate mispricings between two securities with identical cash flows. They consider the agency relationship between arbitrageurs with specialized market knowledge (e.g. hedge fun ...

... Shleifer and Vishny (1997) examine the effect of inter-temporal wealth constraints on the incentives of arbitrageurs to eliminate mispricings between two securities with identical cash flows. They consider the agency relationship between arbitrageurs with specialized market knowledge (e.g. hedge fun ...

The safe asset meme - Université Paris

... of recent history. It is not a useful, necessary or an enduring feature of the financial landscape.’ (P. Fisher in BIS 2013, p. 65) In finance, we use the concept of the ‘risk-free rate’ in the CAPM model and portfolio theory. In macroeconomics and monetary theory too, we have the base asset or rese ...

... of recent history. It is not a useful, necessary or an enduring feature of the financial landscape.’ (P. Fisher in BIS 2013, p. 65) In finance, we use the concept of the ‘risk-free rate’ in the CAPM model and portfolio theory. In macroeconomics and monetary theory too, we have the base asset or rese ...

The wrong tool for the right job: The Fed shouldn`t raise interest rates

... In summary, changes in the Fed’s short-term interest rates simply don’t provide a directenough lever on home prices to make short-term rates a useful tool in restraining home prices. Moreover, the collateral damage from raising rates enough to stem a home price bubble would have been enormous. The d ...

... In summary, changes in the Fed’s short-term interest rates simply don’t provide a directenough lever on home prices to make short-term rates a useful tool in restraining home prices. Moreover, the collateral damage from raising rates enough to stem a home price bubble would have been enormous. The d ...

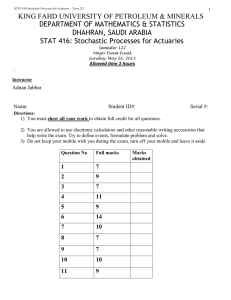

Final - Academic Information System (KFUPM AISYS)

... (a) Suppose you arrive at a post office having two clerks at a moment when both are busy but there is no one else waiting in line. You will enter service when either clerk becomes free. If service times for clerk i are exponential with rate λi, i = 1,2, find E[T], where T is the amount of time that ...

... (a) Suppose you arrive at a post office having two clerks at a moment when both are busy but there is no one else waiting in line. You will enter service when either clerk becomes free. If service times for clerk i are exponential with rate λi, i = 1,2, find E[T], where T is the amount of time that ...

Chapter 1

... A simple capital needs analysis takes into account all financial cash flow factors. A risk adjusted capital needs analysis provides a subjective attempt to account for uncertainty. Monte Carlo Simulations can present the probability of achieving a certain outcome. Total Portfolio Management provides ...

... A simple capital needs analysis takes into account all financial cash flow factors. A risk adjusted capital needs analysis provides a subjective attempt to account for uncertainty. Monte Carlo Simulations can present the probability of achieving a certain outcome. Total Portfolio Management provides ...

Clean Tech - GreenWorld Capital, LLC

... Warrant must be considered indexed to the issuing Company’s own stock per EITF 07-5 and be considered to be an equity instrument per the requirements in EITF 00-19 in order for the option to not be treated as a derivative Items that could be issues include – • Down round protection on exercise price ...

... Warrant must be considered indexed to the issuing Company’s own stock per EITF 07-5 and be considered to be an equity instrument per the requirements in EITF 00-19 in order for the option to not be treated as a derivative Items that could be issues include – • Down round protection on exercise price ...