Introducing Price Competition at the Box Office

... value for untested goods. We leave that guesswork up to the most interested party (the rights holder), and market response is the ultimate judge of whether goods are priced appropriately. But how does the monopolist decide what price to set? One possible approach involves pricing based upon perceive ...

... value for untested goods. We leave that guesswork up to the most interested party (the rights holder), and market response is the ultimate judge of whether goods are priced appropriately. But how does the monopolist decide what price to set? One possible approach involves pricing based upon perceive ...

Download paper (PDF)

... Several theoretical and empirical papers, however, do link these concepts. One view is that illiquidity represents a transaction cost for informed arbitrageurs whose trades make prices more efficient. For example, when liquidity increases in Kyle’s (1985) model, informed traders bet more aggressive ...

... Several theoretical and empirical papers, however, do link these concepts. One view is that illiquidity represents a transaction cost for informed arbitrageurs whose trades make prices more efficient. For example, when liquidity increases in Kyle’s (1985) model, informed traders bet more aggressive ...

ACICO Industries Company New(1). - Kuwait University

... ACICO Construction: ACICO Construction Co. is classified as grade "1" Construction Company by Central Tenders Committee (CTC) in Kuwait and UAE. Since its inception in 1990, ACICO has experienced sustained and steady growth and became a leading company in engineering, procurement and construction (E ...

... ACICO Construction: ACICO Construction Co. is classified as grade "1" Construction Company by Central Tenders Committee (CTC) in Kuwait and UAE. Since its inception in 1990, ACICO has experienced sustained and steady growth and became a leading company in engineering, procurement and construction (E ...

The growth of emerging economies and global macroeconomic

... changes in the relative size of countries could also be generated by other factors besides productivity (for example population growth, investment, real exchange rates), in the model these additional changes are isomorphic to productivity changes. This point will become clear in the quantitative sec ...

... changes in the relative size of countries could also be generated by other factors besides productivity (for example population growth, investment, real exchange rates), in the model these additional changes are isomorphic to productivity changes. This point will become clear in the quantitative sec ...

Slide 1

... Insurance can encourage adaptation through pricing – if insurance costs that much, maybe I should do something different! Access and price of insurance can be directly linked to adaptation strategies Fire insurance: extinguishers in the house? Proximity to a fire hydrant Improved building ...

... Insurance can encourage adaptation through pricing – if insurance costs that much, maybe I should do something different! Access and price of insurance can be directly linked to adaptation strategies Fire insurance: extinguishers in the house? Proximity to a fire hydrant Improved building ...

The French Stock Market in War

... It is interesting to identify the extreme cases of changes in the stock exchange caused by wars. Stock return depends on how the war is financed. The Franco-Prussian war was financed only by regular debt thus stocks reflected only situations of real activity. WWI was partially financed by short term ...

... It is interesting to identify the extreme cases of changes in the stock exchange caused by wars. Stock return depends on how the war is financed. The Franco-Prussian war was financed only by regular debt thus stocks reflected only situations of real activity. WWI was partially financed by short term ...

Fama EF and French KR (1996) Multifactor explanations of asset

... significant even when factors based on size and book-to-market were included. What can be concluded is that the returns from stock investments can be explained with the help of both market factors as well as the accounting based fundamentals related to the stocks, the relative importance of these fa ...

... significant even when factors based on size and book-to-market were included. What can be concluded is that the returns from stock investments can be explained with the help of both market factors as well as the accounting based fundamentals related to the stocks, the relative importance of these fa ...

This PDF is a selection from an out-of-print volume from... Bureau of Economic Research

... inflation lowers the real net yield on bonds as an alternative to share ownership.5 (6) The favorable tax rules for investment in land, gold, owner-occupied housing, etc., imply that the real net opportunity cost of shareholding does not fall as much as the real net yield on bonds and may actually r ...

... inflation lowers the real net yield on bonds as an alternative to share ownership.5 (6) The favorable tax rules for investment in land, gold, owner-occupied housing, etc., imply that the real net opportunity cost of shareholding does not fall as much as the real net yield on bonds and may actually r ...

Stock market

... rise is considered to be an up and coming economy. In fact, the stock market is often considered the primary indicator of a country's economic strength and development. Rising share prices, for instance, tend to be associated with increased business investment and vice versa. Share prices also affe ...

... rise is considered to be an up and coming economy. In fact, the stock market is often considered the primary indicator of a country's economic strength and development. Rising share prices, for instance, tend to be associated with increased business investment and vice versa. Share prices also affe ...

The Monthly Letter

... long-term ones of high debt and poor demographics, include the risk of a rising yen and legislative /policy uncertainty in the U.S., especially around international trade and tax treatment of imports, which could challenge its export-oriented economy. Also, at this juncture, its proximity to North K ...

... long-term ones of high debt and poor demographics, include the risk of a rising yen and legislative /policy uncertainty in the U.S., especially around international trade and tax treatment of imports, which could challenge its export-oriented economy. Also, at this juncture, its proximity to North K ...

A Model of Capital and Crises Zhiguo He Arvind Krishnamurthy May 2011

... capital of at most Wt + mWt to purchase the risky asset. In some states of the world, this total capital is su¢ cient that the risk premium is identical to what would arise in an economy without the capital constraint. This corresponds to the states where Wt is high and the capital constraint is sla ...

... capital of at most Wt + mWt to purchase the risky asset. In some states of the world, this total capital is su¢ cient that the risk premium is identical to what would arise in an economy without the capital constraint. This corresponds to the states where Wt is high and the capital constraint is sla ...

Finance Companies, Central Bank of Nigeria and Economic

... measure of economic development, while Activities of Finance houses proxy by domestic credit and total assets, CBN activities proxy by the shareholders fund and minimum paid up capital, estimation of regression models and subsequent analysis of results using micro fit 4.1 econometric, statistical an ...

... measure of economic development, while Activities of Finance houses proxy by domestic credit and total assets, CBN activities proxy by the shareholders fund and minimum paid up capital, estimation of regression models and subsequent analysis of results using micro fit 4.1 econometric, statistical an ...

International Stock Market Efficiency: A Non-Bayesian Time

... occurs simultaneously in many countries’ stock markets? Recent technological progress in the financial sector has enabled information and funds to be rapidly transmitted, thereby providing investors with many opportunities in world stock markets, rather than in just a local stock market. Also, econo ...

... occurs simultaneously in many countries’ stock markets? Recent technological progress in the financial sector has enabled information and funds to be rapidly transmitted, thereby providing investors with many opportunities in world stock markets, rather than in just a local stock market. Also, econo ...

Sectoral Accounts, Balance Sheets, and Flow of Funds

... Expand the sector, financial instrument, and nonfinancial asset details Compile financial positions and flows on a from-whom-to-whom basis (starting with positions for specific sectors and instruments) ...

... Expand the sector, financial instrument, and nonfinancial asset details Compile financial positions and flows on a from-whom-to-whom basis (starting with positions for specific sectors and instruments) ...

The Valuation and Characteristics of Bonds

... current satisfaction • Putting money to work to earn more money • Common types of investments • Debt—lending money • Equity—buying ownership in a business ...

... current satisfaction • Putting money to work to earn more money • Common types of investments • Debt—lending money • Equity—buying ownership in a business ...

Presentation Title

... The Barclays Aggregate Index declined 0.2% in March, but returned 1.8% in the first quarter. The Barclays High Yield Index extended its year-to-date outperformance by gaining 0.2% in March, while EM bonds snapped back with a return of 1.3%. Municipal bonds also continued its 2014 leadership, gaining ...

... The Barclays Aggregate Index declined 0.2% in March, but returned 1.8% in the first quarter. The Barclays High Yield Index extended its year-to-date outperformance by gaining 0.2% in March, while EM bonds snapped back with a return of 1.3%. Municipal bonds also continued its 2014 leadership, gaining ...

“Empirical Studies of Industries with Market Power”, Bresnahan`s

... existing products to get discounts; tie in sales & full line forcing can exclude competitors who can only offer a restricted range of products ...

... existing products to get discounts; tie in sales & full line forcing can exclude competitors who can only offer a restricted range of products ...

A Statistical Analysis of a Stock`s Volatility

... Where RF = the risk-free rate of return (i.e., US Treasury bond) And R M = the expected return on the market as a whole (i.e., S&P500) The focus of this project is not on the other values involved in this calculation (they are easily obtained or estimated) but rather on the important role that β pla ...

... Where RF = the risk-free rate of return (i.e., US Treasury bond) And R M = the expected return on the market as a whole (i.e., S&P500) The focus of this project is not on the other values involved in this calculation (they are easily obtained or estimated) but rather on the important role that β pla ...

The Macroeconomics of International Financial Trade Philip R. Lane Trinity College Dublin

... external investors. In the other direction, holding foreign assets provides diversification, since the returns on these foreign assets will be determined by external events. Of course, the precise mechanics of risk sharing will depend on the composition of the international balance sheet as between ...

... external investors. In the other direction, holding foreign assets provides diversification, since the returns on these foreign assets will be determined by external events. Of course, the precise mechanics of risk sharing will depend on the composition of the international balance sheet as between ...

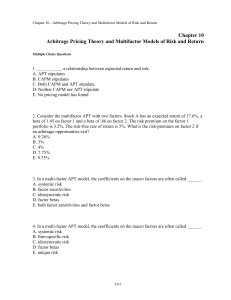

Chapter 10 Arbitrage Pricing Theory and Multifactor Models of Risk

... A. The SML has a downward slope. B. The SML for the APT shows expected return in relation to portfolio standard deviation. C. The SML for the APT has an intercept equal to the expected return on the market portfolio. D. The benchmark portfolio for the SML may be any well-diversified portfolio. E. Th ...

... A. The SML has a downward slope. B. The SML for the APT shows expected return in relation to portfolio standard deviation. C. The SML for the APT has an intercept equal to the expected return on the market portfolio. D. The benchmark portfolio for the SML may be any well-diversified portfolio. E. Th ...