Inflation and the Price of Real Assets ∗ Monika Piazzesi Martin Schneider

... portfolio shift, although it cannot quantitatively generate all of it. These authors have also argued that inflation has effects on real cash flows because of depreciation allowances. These effects are captured in our pessimism experiments. Previous literature has shown that demographics cannot accoun ...

... portfolio shift, although it cannot quantitatively generate all of it. These authors have also argued that inflation has effects on real cash flows because of depreciation allowances. These effects are captured in our pessimism experiments. Previous literature has shown that demographics cannot accoun ...

Ed Yardeni - EuroCapital

... titled, “Japanese Monetary Policy: A Case of Self-Induced Paralysis?” He wrote: “I agree with the recommendation…that the BOJ should attempt to achieve substantial depreciation of the yen, ideally through large open-market sales of yen. Through its effects on import-price inflation (which has been s ...

... titled, “Japanese Monetary Policy: A Case of Self-Induced Paralysis?” He wrote: “I agree with the recommendation…that the BOJ should attempt to achieve substantial depreciation of the yen, ideally through large open-market sales of yen. Through its effects on import-price inflation (which has been s ...

Czarski_Gabriel_Nothaft

... • Larger proportion with shorter Duration ? • Smaller proportion with longer Duration ? • Decomposition – Incidence • The probability that a unit will become vacant • Useful in indicating variation over time & space ...

... • Larger proportion with shorter Duration ? • Smaller proportion with longer Duration ? • Decomposition – Incidence • The probability that a unit will become vacant • Useful in indicating variation over time & space ...

Is the firm competitively stronger or weaker than key rivals?

... 1. Learn how to take stock of how well a company’s strategy is working. 2. Understand why a company’s resources and capabilities are central to its strategic approach and how to evaluate their potential for giving the company a competitive edge over rivals. 3. Discover how to assess the company’s s ...

... 1. Learn how to take stock of how well a company’s strategy is working. 2. Understand why a company’s resources and capabilities are central to its strategic approach and how to evaluate their potential for giving the company a competitive edge over rivals. 3. Discover how to assess the company’s s ...

NBER WORKING PAPER SERIES IN SEARCH OF DISTRESS RISK John Y. Campbell

... Chen 1991, Fama and French 1996). The idea is that certain companies have an elevated probability that they will fail to meet their financial obligations; the stocks of these financially distressed companies tend to move together, so their risk cannot be diversified away; and investors charge a prem ...

... Chen 1991, Fama and French 1996). The idea is that certain companies have an elevated probability that they will fail to meet their financial obligations; the stocks of these financially distressed companies tend to move together, so their risk cannot be diversified away; and investors charge a prem ...

financing poverty eradication

... as infrastructure. However the widespread rent-seeking in these sectors of the economy is consistent with investment strike, thus removing the intended trickle-down effects envisaged by conventional economics. The alternative argument suggests that the poor themselves can positively contribute to ec ...

... as infrastructure. However the widespread rent-seeking in these sectors of the economy is consistent with investment strike, thus removing the intended trickle-down effects envisaged by conventional economics. The alternative argument suggests that the poor themselves can positively contribute to ec ...

Why value value? - Spears School of Business

... focus on value creation when nonfinancial business corporations collecmarket prices of shares do not tively held 61.2 percent of listed shares in reflect good information 1983, but engaged in only 10.7 percent of trades. Most institutional shareholding is within the large business groups, the keiret ...

... focus on value creation when nonfinancial business corporations collecmarket prices of shares do not tively held 61.2 percent of listed shares in reflect good information 1983, but engaged in only 10.7 percent of trades. Most institutional shareholding is within the large business groups, the keiret ...

effects of interest rates on stock market capitalization

... Bank increases the discount rate, newly offered government securities such as treasury bills or Pakistan investment bonds, which are viewed as the safest investment, will usually experience a corresponding increase in interest rates. In other words, the risk free rate of return goes up, making these ...

... Bank increases the discount rate, newly offered government securities such as treasury bills or Pakistan investment bonds, which are viewed as the safest investment, will usually experience a corresponding increase in interest rates. In other words, the risk free rate of return goes up, making these ...

Setting revenues

... • Lagging uncertainty mechanisms – Detailed design of mechanisms being finalised for RIIO-T1. Our initial assessment favoured no lag on adjustments but a consideration of individual mechanism requirements ...

... • Lagging uncertainty mechanisms – Detailed design of mechanisms being finalised for RIIO-T1. Our initial assessment favoured no lag on adjustments but a consideration of individual mechanism requirements ...

Executive Compensation under the Emergency Economic

... of the financial institution, but not a change in ownership or control. The notice indicates that a new employment contract includes any material compensatory contract (whether or not written) entered into on or after the date in which the financial institution is first covered under TAAP. For this ...

... of the financial institution, but not a change in ownership or control. The notice indicates that a new employment contract includes any material compensatory contract (whether or not written) entered into on or after the date in which the financial institution is first covered under TAAP. For this ...

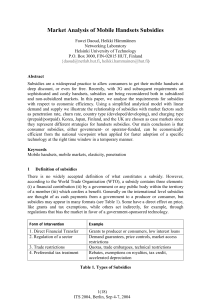

Market Analysis of Mobile Handsets Subsidies

... In Korea, cellular phone service was first introduced in 1984. In 2000, the number of CDMA subscribers exceeded that of fixed telephony. 3G licenses were granted in 2001 to three carrier groups based on auction, totaling in the amount of 2.9 billion $. Korea was the first country to introduce CDMA20 ...

... In Korea, cellular phone service was first introduced in 1984. In 2000, the number of CDMA subscribers exceeded that of fixed telephony. 3G licenses were granted in 2001 to three carrier groups based on auction, totaling in the amount of 2.9 billion $. Korea was the first country to introduce CDMA20 ...

PDF

... computing power and available memory make this curse fade appreciably, empirical practitioners must still use considerable ingenuity as well as good judgment in arriving at computationally operational yet acceptably accurate models. In many actual and potential applications of dynamic optimization t ...

... computing power and available memory make this curse fade appreciably, empirical practitioners must still use considerable ingenuity as well as good judgment in arriving at computationally operational yet acceptably accurate models. In many actual and potential applications of dynamic optimization t ...

Global Risk Aversion, Contagion or Fundamentals?

... Other government bonds have followed a similar trajectory with volatility being higher among higher-debt, lower-rated sovereigns. Likewise, the credit default swap, in other words the premium investors are willing to pay to insure the same Greek bond against a credit event, during the same period ha ...

... Other government bonds have followed a similar trajectory with volatility being higher among higher-debt, lower-rated sovereigns. Likewise, the credit default swap, in other words the premium investors are willing to pay to insure the same Greek bond against a credit event, during the same period ha ...

http://stats.lse.ac.uk/angelos/guides/2004_CT4.pdf

... Develop census formulae given the following definitions of age: age at birthday age at specified calendar date age at a specified policy anniversary where the age may be classified as next, last, or nearest relative to the birthday, calendar date, or policy anniversary as appropriate. The deaths and ...

... Develop census formulae given the following definitions of age: age at birthday age at specified calendar date age at a specified policy anniversary where the age may be classified as next, last, or nearest relative to the birthday, calendar date, or policy anniversary as appropriate. The deaths and ...

Large American Banks and Economic Recovery

... balance sheet and income statement. The four types of management I measured are cash, equity, asset, and share value. Each represents the company’s ability to make efficient use of the respective account balance or value. The ratios and equations I used can also be broken down into one of three cate ...

... balance sheet and income statement. The four types of management I measured are cash, equity, asset, and share value. Each represents the company’s ability to make efficient use of the respective account balance or value. The ratios and equations I used can also be broken down into one of three cate ...

Download paper (PDF)

... information (e.g., about the magnitude of short-term foreign indebtedness) is of little value in itself, unless one can show that there is a systematic relationship between the information observed and the information which is of relevance (e.g., aggregate exposure). 3. Increased transparency does n ...

... information (e.g., about the magnitude of short-term foreign indebtedness) is of little value in itself, unless one can show that there is a systematic relationship between the information observed and the information which is of relevance (e.g., aggregate exposure). 3. Increased transparency does n ...

Multiple Choice Questions

... (while hoping to identify undervalued securities). 5. The _______ is defined as the present value of all cash proceeds to the investor in the stock. A) dividend payout ratio B) intrinsic value C) market capitalization rate D) plowback ratio E) none of the above Answer: B Difficulty: Easy Rationale: ...

... (while hoping to identify undervalued securities). 5. The _______ is defined as the present value of all cash proceeds to the investor in the stock. A) dividend payout ratio B) intrinsic value C) market capitalization rate D) plowback ratio E) none of the above Answer: B Difficulty: Easy Rationale: ...

Counterparty A

... To invest a maturity greater than the investor’s horizon, but then to hedge the interest rate risk in futures, forwards, or other derivatives. ...

... To invest a maturity greater than the investor’s horizon, but then to hedge the interest rate risk in futures, forwards, or other derivatives. ...

ch03 - U of L Class Index

... Less liquid than other funds – investors may need to give advance notice when selling ...

... Less liquid than other funds – investors may need to give advance notice when selling ...