0000355811-15-000025 - Gentex Investor Relations

... Investments (continued) provide increased consistency in how fair value determinations are made under various existing accounting standards that permit, or in some cases, require estimates of fair-market value. This standard also expanded financial statement disclosure requirements about a company’s ...

... Investments (continued) provide increased consistency in how fair value determinations are made under various existing accounting standards that permit, or in some cases, require estimates of fair-market value. This standard also expanded financial statement disclosure requirements about a company’s ...

Managing Short-Term Capital Flows in New Central Banking

... Amended by cabinet decision (01.01.2013) to differentiate 15 % tax rate taken from interest income of deposits according to maturity of the deposit. New tax rates are as follows: In TL deposits rates are 15% for 6 months, 12% for 6 - 12 months and 10% for more than one year. In FX deposits rates are ...

... Amended by cabinet decision (01.01.2013) to differentiate 15 % tax rate taken from interest income of deposits according to maturity of the deposit. New tax rates are as follows: In TL deposits rates are 15% for 6 months, 12% for 6 - 12 months and 10% for more than one year. In FX deposits rates are ...

glossary and abbreviations - ACT Treasury

... Grants (non ACT Government) These include payments to individuals or organisations for general assistance or for a particular purpose that contribute to the achievement of the program’s objectives. Grants may be for capital and the grant name or category reflects the use of the grant. Grants are usu ...

... Grants (non ACT Government) These include payments to individuals or organisations for general assistance or for a particular purpose that contribute to the achievement of the program’s objectives. Grants may be for capital and the grant name or category reflects the use of the grant. Grants are usu ...

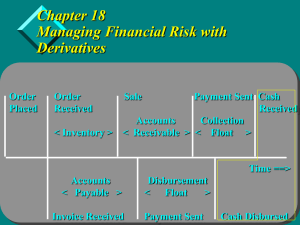

Document

... Interest rate swaps were created to take advantage of arbitrage opportunities in the various fixed- and floating-rate capital markets. Arbitrage opportunities exist because some markets react to change more rapidly than others, because credit perceptions differ from market to market, and because rec ...

... Interest rate swaps were created to take advantage of arbitrage opportunities in the various fixed- and floating-rate capital markets. Arbitrage opportunities exist because some markets react to change more rapidly than others, because credit perceptions differ from market to market, and because rec ...

MN20211A-2009 - people.bath.ac.uk

... Management wasted money on unnecessary R and D. also started diversification programs outside the industry. Evidence- McConnell and Muscerella (1986) – increases in R and D caused decreases in stock price. Retrenchment- cancellation or delay of ongoing projects. ...

... Management wasted money on unnecessary R and D. also started diversification programs outside the industry. Evidence- McConnell and Muscerella (1986) – increases in R and D caused decreases in stock price. Retrenchment- cancellation or delay of ongoing projects. ...

IOSR Journal Of Humanities And Social Science (IOSR-JHSS)

... Adegbite and Adetiloye (2013) identified the factors that determine the level or degree of financial globalization of a country as the nominal exchange rate, the level of financial development as captured by the level of financial deepening of the financial system and trade. Using the Capital openin ...

... Adegbite and Adetiloye (2013) identified the factors that determine the level or degree of financial globalization of a country as the nominal exchange rate, the level of financial development as captured by the level of financial deepening of the financial system and trade. Using the Capital openin ...

Trade in the options empire

... remember that one of the key benefits of binary options trading is that it affords you a high level of control over your portfolio. It is the one form of trading that actually allows you to minimize and set your own levels of risk. This means that diligent traders automatically enjoy higher levels o ...

... remember that one of the key benefits of binary options trading is that it affords you a high level of control over your portfolio. It is the one form of trading that actually allows you to minimize and set your own levels of risk. This means that diligent traders automatically enjoy higher levels o ...

Tail Risk Hedging: A Roadmap for Asset Owners

... Recently, as markets have generally become more sophisticated and liquid, pensions and their consultants have begun to consider and advocate for derivatives in their portfolios. The desire to gain access to some asset classes via derivatives has aided acceptance of derivatives, but ...

... Recently, as markets have generally become more sophisticated and liquid, pensions and their consultants have begun to consider and advocate for derivatives in their portfolios. The desire to gain access to some asset classes via derivatives has aided acceptance of derivatives, but ...

File - The Institute of International Finance

... investor base in the secondary market. Individuals depend on these markets as investors, as pension beneficiaries, and as employees and customers of dynamic companies that raise capital in equity markets to grow. Because of these dependencies, an overly conservative regulatory regime that unnecessar ...

... investor base in the secondary market. Individuals depend on these markets as investors, as pension beneficiaries, and as employees and customers of dynamic companies that raise capital in equity markets to grow. Because of these dependencies, an overly conservative regulatory regime that unnecessar ...

The Importance of Financial Literacy

... ‘seem too good to be true’ and are. Others – especially in a low-inflation, low-interest rate environment – are tempted to go off in search of investments offering far higher returns without fully understanding that these higher returns are likely to go hand-in-hand with much more risk. We have all ...

... ‘seem too good to be true’ and are. Others – especially in a low-inflation, low-interest rate environment – are tempted to go off in search of investments offering far higher returns without fully understanding that these higher returns are likely to go hand-in-hand with much more risk. We have all ...

Stage 2 - Jersey Funds Association

... implied, that the products or services referred to are available in your jurisdiction. Accordingly, if it is prohibited to advertise or make the products or services available in your jurisdiction, or to you (by reason of nationality, residence or otherwise) such services are not directed at you. Th ...

... implied, that the products or services referred to are available in your jurisdiction. Accordingly, if it is prohibited to advertise or make the products or services available in your jurisdiction, or to you (by reason of nationality, residence or otherwise) such services are not directed at you. Th ...

Securities Trading Policy

... • for an individual – a fine of up to $220,000 and a jail term of up to 5 years; and • for a corporation – a fine of up to $1,100,000. In addition, the insider trader, and any other persons involved in the contravention, may also be liable to compensate third parties for any resulting loss. 2.3 Exam ...

... • for an individual – a fine of up to $220,000 and a jail term of up to 5 years; and • for a corporation – a fine of up to $1,100,000. In addition, the insider trader, and any other persons involved in the contravention, may also be liable to compensate third parties for any resulting loss. 2.3 Exam ...

IS-LM

... The Keynesian Theory of Business Cycles and Macroeconomic Stabilization A) Keynesian business cycle theory (cont.) 5. Procyclical labor productivity and labor hoarding a. As discussed in Sec. 11.1, firms may hoard labor in a recession rather than fire workers, because of the costs of hiring and tra ...

... The Keynesian Theory of Business Cycles and Macroeconomic Stabilization A) Keynesian business cycle theory (cont.) 5. Procyclical labor productivity and labor hoarding a. As discussed in Sec. 11.1, firms may hoard labor in a recession rather than fire workers, because of the costs of hiring and tra ...

NBER WORKING PAPER SERIES UNINSURED IDIOSYNCRATIC INVESTMENT RISK AND AGGREGATE SAVING George-Marios Angeletos

... neglected idiosyncratic risks in private production and capital returns.1 In contrast, the typical investor in the US economy — and presumably even more so in less developed economies — appears to be exposed to large idiosyncratic risks in capital returns: privately-held businesses account for almos ...

... neglected idiosyncratic risks in private production and capital returns.1 In contrast, the typical investor in the US economy — and presumably even more so in less developed economies — appears to be exposed to large idiosyncratic risks in capital returns: privately-held businesses account for almos ...

mmi13 Clemens 19074764 en

... labor to be immobile and output goods to be nontradeable. Hence, all trade between economies is financial.2 The capital market is perfectly competitive. The economy is populated by a continuum [0, 1] of infinitely–lived households, each endowed with one unit of labor. In each period of time, individua ...

... labor to be immobile and output goods to be nontradeable. Hence, all trade between economies is financial.2 The capital market is perfectly competitive. The economy is populated by a continuum [0, 1] of infinitely–lived households, each endowed with one unit of labor. In each period of time, individua ...