RTF 49.1 KB - Productivity Commission

... the $AUS rises and falls – especially as it has done over the past 10 years Australian houses become more or less attractive to overseas investors. In the same way if housing investment becomes far less profitable than investing in say the share market then house prices would be expected to fall and ...

... the $AUS rises and falls – especially as it has done over the past 10 years Australian houses become more or less attractive to overseas investors. In the same way if housing investment becomes far less profitable than investing in say the share market then house prices would be expected to fall and ...

The Yield Curve

... bond equals the average of shortterm rates expected to occur over the lifetime of the long-term bond plus a risk premium due to higher market risk in the long-term bond. ...

... bond equals the average of shortterm rates expected to occur over the lifetime of the long-term bond plus a risk premium due to higher market risk in the long-term bond. ...

What are the end-of-period-adjustments in accounting? Peter Baskerville

... End-of-period-adjustments in accounting are journal entries made to the accounts of a business prior to the preparation and distribution of the financial statements for a given accounting period. End-of-period adjustments ensure that the these financial statements reflect the true financial position ...

... End-of-period-adjustments in accounting are journal entries made to the accounts of a business prior to the preparation and distribution of the financial statements for a given accounting period. End-of-period adjustments ensure that the these financial statements reflect the true financial position ...

Sunway Berhad

... Readers should be fully aware that this report is for information purposes only. The opinions contained in this report are based on information obtained or derived from sources that we believe are reliable. MIDF AMANAH INVESTMENT BANK BERHAD makes no representation or warranty, expressed or implied, ...

... Readers should be fully aware that this report is for information purposes only. The opinions contained in this report are based on information obtained or derived from sources that we believe are reliable. MIDF AMANAH INVESTMENT BANK BERHAD makes no representation or warranty, expressed or implied, ...

Paper - Federal Reserve Bank of Kansas City

... My work with Julian Kozlowski and Venky Venkateswaran explores the reasons for sustained, high tail risk and its consequences for real activity as well as financial market outcomes, such as low interest rates8. We argue that tail risk remained high after the financial crisis because agents learne ...

... My work with Julian Kozlowski and Venky Venkateswaran explores the reasons for sustained, high tail risk and its consequences for real activity as well as financial market outcomes, such as low interest rates8. We argue that tail risk remained high after the financial crisis because agents learne ...

emerging economies are less dependent on debt, less vulnerable to

... even modest portfolio rebalancing of international investors can result in greater volatility of net flows (the difference between capital entering and capital leaving a country). If an economy comes under pressure, inflows can stop and outflows rise simultaneously, leading to a double blow in terms ...

... even modest portfolio rebalancing of international investors can result in greater volatility of net flows (the difference between capital entering and capital leaving a country). If an economy comes under pressure, inflows can stop and outflows rise simultaneously, leading to a double blow in terms ...

Credit standards and financial institutions’ leverage ∗ Gilles Dufr´enot

... respectively. In good times, institutions are more optimistic about the future prospects of the economy, they increase their leverage and potentially invest in riskier projects, whose risk-return profile has improved. On average, this behavior can result in bigger losses in the future, a correction ...

... respectively. In good times, institutions are more optimistic about the future prospects of the economy, they increase their leverage and potentially invest in riskier projects, whose risk-return profile has improved. On average, this behavior can result in bigger losses in the future, a correction ...

an indication of a `credit-fuelled` burst that was `fictitious`.

... for imperialism. However, it is worth making some brief points on this topic. Public expenditure is largely financed through taxation, so it is a drain on the private capitalist sector and on the total surplus value produced, even though some of the expenditures may also benefit sections of private ...

... for imperialism. However, it is worth making some brief points on this topic. Public expenditure is largely financed through taxation, so it is a drain on the private capitalist sector and on the total surplus value produced, even though some of the expenditures may also benefit sections of private ...

Market Forces at Work in the Banking Industry: Evidence from the

... presents similar data for the 100 largest U.S. bank holding companies (BHC) over a shorter time period (note the left-hand scale). In 1986, these firms had book equity equal to 6% of their total assets, which increased to 7.97% by the end of 2000. The market value of BHC common equity rose even more ...

... presents similar data for the 100 largest U.S. bank holding companies (BHC) over a shorter time period (note the left-hand scale). In 1986, these firms had book equity equal to 6% of their total assets, which increased to 7.97% by the end of 2000. The market value of BHC common equity rose even more ...

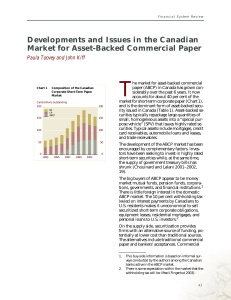

Developments and Issues in the Canadian Market

... paper will usually be more expensive for all but the highest-rated firms, since the market demands a higher rate of return on instruments rated below typical ABCP. Bankers’ acceptances effectively carry the guarantee of a top-rated bank and can be issued at rates that are competitive with those on A ...

... paper will usually be more expensive for all but the highest-rated firms, since the market demands a higher rate of return on instruments rated below typical ABCP. Bankers’ acceptances effectively carry the guarantee of a top-rated bank and can be issued at rates that are competitive with those on A ...

business objectives: corporate/ethics 4b

... The aim and mission statements of a business share the same problems – they lack SPECIFIC detail for operational decisions and they are rarely expressed in quantitative terms. ...

... The aim and mission statements of a business share the same problems – they lack SPECIFIC detail for operational decisions and they are rarely expressed in quantitative terms. ...

Week in Focus - Investment banking

... Germany: Housing overpriced but boom continues House prices in Germany keep on rising. According to our new model, they are now overpriced by around 10%. Only a marked rise in interest rates would be likely to end this boom and such a move is nowhere in sight. House prices should therefore continue ...

... Germany: Housing overpriced but boom continues House prices in Germany keep on rising. According to our new model, they are now overpriced by around 10%. Only a marked rise in interest rates would be likely to end this boom and such a move is nowhere in sight. House prices should therefore continue ...

R e c e n t d e... f i n a n c i a l ...

... different countries. This directly affects the cost of capital for the individual firms that rely on capital market financing. Furthermore, as New Zealand is highly indebted, and we continue to run current account deficits and borrow from abroad, international financial market conditions directly af ...

... different countries. This directly affects the cost of capital for the individual firms that rely on capital market financing. Furthermore, as New Zealand is highly indebted, and we continue to run current account deficits and borrow from abroad, international financial market conditions directly af ...

Investor Relations Communications Plan

... quantitative techniques based on key financial fundamentals of an investor's portfolio: primarily, the portions of the portfolio above the weighted average of the S&P 500 for price-to-earnings ratio, dividend yield, price-to-book ratio, and five year estimated earnings per share (EPS) growth. An ins ...

... quantitative techniques based on key financial fundamentals of an investor's portfolio: primarily, the portions of the portfolio above the weighted average of the S&P 500 for price-to-earnings ratio, dividend yield, price-to-book ratio, and five year estimated earnings per share (EPS) growth. An ins ...

time-varying effects of housing and stock prices

... reflects, in part, the wealth effect on household spending. The wealth effect characterises the mechanism through which asset price fluctuations may affect financial and business cycles dynamics, making it crucial for policymakers in charge of macroeconomic and financial stability. This paper consid ...

... reflects, in part, the wealth effect on household spending. The wealth effect characterises the mechanism through which asset price fluctuations may affect financial and business cycles dynamics, making it crucial for policymakers in charge of macroeconomic and financial stability. This paper consid ...

Shaping the New Financial System

... preceding the recent crisis.2 The FSB’s role in this process stems from its unique capacity as a forum for the international standard setters and other international bodies, as well as officials from regulatory agencies, central banks, and treasuries of its member countries. The IMF, for its part, a ...

... preceding the recent crisis.2 The FSB’s role in this process stems from its unique capacity as a forum for the international standard setters and other international bodies, as well as officials from regulatory agencies, central banks, and treasuries of its member countries. The IMF, for its part, a ...

PSG Global Equity Feeder Fund Class A

... The information and content of this publication is provided by PSG as general information about its products. The information does not constitute any advice and we recommend that you consult with a qualified financial adviser before making investment decisions. For further information on the funds a ...

... The information and content of this publication is provided by PSG as general information about its products. The information does not constitute any advice and we recommend that you consult with a qualified financial adviser before making investment decisions. For further information on the funds a ...

A Problem With the Pure Time Preference Theory of Interest:

... Here we see that Sraffa conceives of market prices in the fashion of the classical economists. Yes, a sudden surge in demand can drive up the actual price of cotton above its “costs of production,” but then the higher profits will lead to more cotton production, which would push the cotton price bac ...

... Here we see that Sraffa conceives of market prices in the fashion of the classical economists. Yes, a sudden surge in demand can drive up the actual price of cotton above its “costs of production,” but then the higher profits will lead to more cotton production, which would push the cotton price bac ...

“Carry Trade” Model of Commodity Prices

... for storage costs) for the foreign interest rate. A popular alternative approach is the competitive storage model of Deaton and Laroque (1996). ...

... for storage costs) for the foreign interest rate. A popular alternative approach is the competitive storage model of Deaton and Laroque (1996). ...

Donated Capital Asset

... the donated service requires specialized skills, and is provided by individuals possessing those skills, and would typically need to be purchased if not provided by donation (examples: accountants, architects, doctors, lawyers, etc.) ...

... the donated service requires specialized skills, and is provided by individuals possessing those skills, and would typically need to be purchased if not provided by donation (examples: accountants, architects, doctors, lawyers, etc.) ...

Financial turmoil and global imbalances: ... Bretton Woods II?

... Note, the global economic and monetary arrangements authored by the US after WWII – the so-called Bretton Woods system – did not allow a large-scale transfer of net savings between countries via the current account (Brenner and Pisani, 2007). The system’s raison d’etre was to rehabilitate global tra ...

... Note, the global economic and monetary arrangements authored by the US after WWII – the so-called Bretton Woods system – did not allow a large-scale transfer of net savings between countries via the current account (Brenner and Pisani, 2007). The system’s raison d’etre was to rehabilitate global tra ...

BOX INC (Form: 4, Received: 04/11/2017 21:30:05)

... have maintained a level that is 25% higher than the options' exercise price (rounded down to the nearest whole penny) for a period of 30 consecutive trading days. If the performance condition in clause (b) is not met prior to the fourth anniversary of the grant date, no options will vest and all wil ...

... have maintained a level that is 25% higher than the options' exercise price (rounded down to the nearest whole penny) for a period of 30 consecutive trading days. If the performance condition in clause (b) is not met prior to the fourth anniversary of the grant date, no options will vest and all wil ...