the rev. thomas Bayes and Credibility theory

... Besides this theorem, the main tools of Bayesian statistical inference are predictive distributions, posterior distributions, and (posterior) odds ratios. Bayes’ Theorem is important to actuaries because it enables them to perform statistical inference by computing inverse probabilities, but it has ...

... Besides this theorem, the main tools of Bayesian statistical inference are predictive distributions, posterior distributions, and (posterior) odds ratios. Bayes’ Theorem is important to actuaries because it enables them to perform statistical inference by computing inverse probabilities, but it has ...

SP167: Searching for a Metric for Financial Stability

... Oriol Aspachs-Bracons is a PhD student in Economics at the London School of Economics and a member of the FMG. He would like to acknowledge the Fundacion Rafael Del Pino for their financial support. Charles A.E. Goodhart is Norman Sosnow Professor of Banking and Finance at the London School of Econo ...

... Oriol Aspachs-Bracons is a PhD student in Economics at the London School of Economics and a member of the FMG. He would like to acknowledge the Fundacion Rafael Del Pino for their financial support. Charles A.E. Goodhart is Norman Sosnow Professor of Banking and Finance at the London School of Econo ...

Presidential Elections and the Stock Market:

... and financial markets. Scholars studying currency, stock and bond markets have examined the role that electoral systems, elections, partisanship, and political uncertainty play in shaping both the value and volatility of financial assets (e.g., Freeman, Hays and Stix 2000; Martin and Moore 2003; Leb ...

... and financial markets. Scholars studying currency, stock and bond markets have examined the role that electoral systems, elections, partisanship, and political uncertainty play in shaping both the value and volatility of financial assets (e.g., Freeman, Hays and Stix 2000; Martin and Moore 2003; Leb ...

Technical Analysis

... 5. Review your psychological biases annually • Successful investing is more than knowing about financial markets, asset classes, and financial assets. It includes knowing yourself These main ideas and questions are from John R. Nofsinger, The Psychology of Investing Prentice Hall, ...

... 5. Review your psychological biases annually • Successful investing is more than knowing about financial markets, asset classes, and financial assets. It includes knowing yourself These main ideas and questions are from John R. Nofsinger, The Psychology of Investing Prentice Hall, ...

The household balance sheet and the macroeconomic assessment

... Financial assets help to increase household incomes through interest earnings or when the households receive share dividends, while household incomes are reduced by the interest they pay on their debts.17 The price change that takes place between two points in time also forms part of the return on a ...

... Financial assets help to increase household incomes through interest earnings or when the households receive share dividends, while household incomes are reduced by the interest they pay on their debts.17 The price change that takes place between two points in time also forms part of the return on a ...

Speculative Trading and Stock Prices

... and buy-backs, a common practice that firms use to “arbitrage” the missvaluation of their own stocks, are severely constrained by the restrictive rules imposed by the government. Third, Chinese stock markets were only re-opened in early 1990s after being closed for nearly half a century. Thus, stock ...

... and buy-backs, a common practice that firms use to “arbitrage” the missvaluation of their own stocks, are severely constrained by the restrictive rules imposed by the government. Third, Chinese stock markets were only re-opened in early 1990s after being closed for nearly half a century. Thus, stock ...

Conflictive gambles

... Method Expected utilities for all ambiguous and conflictive gambles were 0.5*$10. The variance of the probabilities associated with each conflictive gamble was approximately equal to the variance in a corresponding ambiguous gamble. All of the valuations were analyzed with a 2-level choice model (s ...

... Method Expected utilities for all ambiguous and conflictive gambles were 0.5*$10. The variance of the probabilities associated with each conflictive gamble was approximately equal to the variance in a corresponding ambiguous gamble. All of the valuations were analyzed with a 2-level choice model (s ...

F Stock Prices and the Equity Premium during the Recent Bull and

... true to previous experience, the companies with the greatest market capitalization and the highest priceearnings ratios accounted for most of the value of the index and most of its variation. The particularly high stock prices that emerged in the 1990s, especially for the few companies that accounte ...

... true to previous experience, the companies with the greatest market capitalization and the highest priceearnings ratios accounted for most of the value of the index and most of its variation. The particularly high stock prices that emerged in the 1990s, especially for the few companies that accounte ...

Challenging traditional attitudes towards investment risk and

... most encouraging finding of our detailed research is the staggering difference a little investment risk can make to outcomes when your savings are at their largest and the power of compounding can be used to best effect. This paper also dares to challenge traditional financial planning models that b ...

... most encouraging finding of our detailed research is the staggering difference a little investment risk can make to outcomes when your savings are at their largest and the power of compounding can be used to best effect. This paper also dares to challenge traditional financial planning models that b ...

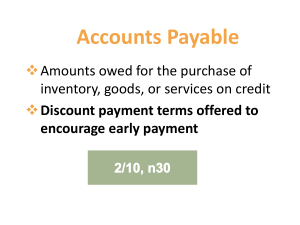

Current Period - Binus Repository

... ACCOUNTING • Operating guidelines are classified as assumptions, principles, and constraints. • Assumptions provide a foundation for the accounting process. • Principles indicate how transactions and other economic events should be recorded. • Constraints on the accounting process allow for a relaxa ...

... ACCOUNTING • Operating guidelines are classified as assumptions, principles, and constraints. • Assumptions provide a foundation for the accounting process. • Principles indicate how transactions and other economic events should be recorded. • Constraints on the accounting process allow for a relaxa ...

1. Introduction to risk

... the event of a default of an obligor, a firm generally incurs a loss equal to the amount owed by the obligor less a recovery amount which the firm recovers as a result of foreclosure, liquidation or restructuring of the defaulted obligor. All portfolios of exposures exhibit credit default risk, as t ...

... the event of a default of an obligor, a firm generally incurs a loss equal to the amount owed by the obligor less a recovery amount which the firm recovers as a result of foreclosure, liquidation or restructuring of the defaulted obligor. All portfolios of exposures exhibit credit default risk, as t ...

Putnam Bond Index Fund

... 144A after the name of an issuer represents securities exempt from registration under Rule 144A under the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. See Note 2 to the financial statements re ...

... 144A after the name of an issuer represents securities exempt from registration under Rule 144A under the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. See Note 2 to the financial statements re ...

Clear perspectives on bond market liquidity

... even in times of market stress. This may include cash and cash equivalents, highly rated investmentgrade sovereign bonds, and bonds from supranational issuers such as the World Bank. • The liquidity of the underlying market. We consider market trading volume statistics and the quality and breadth o ...

... even in times of market stress. This may include cash and cash equivalents, highly rated investmentgrade sovereign bonds, and bonds from supranational issuers such as the World Bank. • The liquidity of the underlying market. We consider market trading volume statistics and the quality and breadth o ...

Clear perspectives on bond market liquidity

... even in times of market stress. This may include cash and cash equivalents, highly rated investmentgrade sovereign bonds, and bonds from supranational issuers such as the World Bank. • The liquidity of the underlying market. We consider market trading volume statistics and the quality and breadth o ...

... even in times of market stress. This may include cash and cash equivalents, highly rated investmentgrade sovereign bonds, and bonds from supranational issuers such as the World Bank. • The liquidity of the underlying market. We consider market trading volume statistics and the quality and breadth o ...

Free Sample - Exam Test Bank Store

... student realizes that the absolute amount of the capital gain or loss is not affected by the margin requirement. The impact is on the return on the investor's funds which depends not only on the capital gain but also the interest paid to finance the position and the amount of funds the investor has ...

... student realizes that the absolute amount of the capital gain or loss is not affected by the margin requirement. The impact is on the return on the investor's funds which depends not only on the capital gain but also the interest paid to finance the position and the amount of funds the investor has ...

DOC - Douglas Dynamics Investor Relations

... Common collective trust is valued at the net asset value (“NAV”) which is based on the market value of its underlying investments. Our plan offers one fund that is a common collective trust. This fund is a collective investment trust that contains synthetic investment contracts comprised of both und ...

... Common collective trust is valued at the net asset value (“NAV”) which is based on the market value of its underlying investments. Our plan offers one fund that is a common collective trust. This fund is a collective investment trust that contains synthetic investment contracts comprised of both und ...

Example - Cengage

... those items that must be reported on the balance sheet International standards have a lower threshold for those items that must be reported so thus more items will be recorded on the balance sheet. International standards require the amount of the recorded liability be discounted (recorded at pr ...

... those items that must be reported on the balance sheet International standards have a lower threshold for those items that must be reported so thus more items will be recorded on the balance sheet. International standards require the amount of the recorded liability be discounted (recorded at pr ...

`surrender charge` on international units in the Australian ETS

... recover by 2015, it is clear that the potential for international units to be cheaper than the floor price is not a mere theoretical concern. Figure 1, which is a development of Figure 4 in Hepburn et. al. (2006), describes the situation when the supply curve for international units lies below the a ...

... recover by 2015, it is clear that the potential for international units to be cheaper than the floor price is not a mere theoretical concern. Figure 1, which is a development of Figure 4 in Hepburn et. al. (2006), describes the situation when the supply curve for international units lies below the a ...

Official PDF , 38 pages

... As in most of the endogenousgrowth literature,steady state per capita growth only occurs in this paper if agents make investmentdecisions that yield sufficientlyhigh rates of human capital accumulationand technological progress.4 Human capital and technologyare augmented in "firms",where groups of p ...

... As in most of the endogenousgrowth literature,steady state per capita growth only occurs in this paper if agents make investmentdecisions that yield sufficientlyhigh rates of human capital accumulationand technological progress.4 Human capital and technologyare augmented in "firms",where groups of p ...

NBER WORKING PAPER SERIES FINANCIAL GLOBALIZATION, FINANCIAL CRISES, AND THE EXTERNAL

... account of the emerging economy, a fall in the real interest rate and the desire to smooth consumption induce agents to borrow from abroad and increase leverage. Equity returns fall because of the lower risk-free rate and the lower risk premium implied by the improved consumption smoothing (i.e. a l ...

... account of the emerging economy, a fall in the real interest rate and the desire to smooth consumption induce agents to borrow from abroad and increase leverage. Equity returns fall because of the lower risk-free rate and the lower risk premium implied by the improved consumption smoothing (i.e. a l ...

NBER WORKING PAPER SERIES Paul Beaudry Amartya Lahiri

... markets. In fact, we show that efficient financial arrangements can cause simple transitory disturbances to be both amplified and propagated over time, thereby explaining how a developed financial system may be a contributor to macroeconomic fluctuations as opposed to being a stabilizing force. The ...

... markets. In fact, we show that efficient financial arrangements can cause simple transitory disturbances to be both amplified and propagated over time, thereby explaining how a developed financial system may be a contributor to macroeconomic fluctuations as opposed to being a stabilizing force. The ...

NBER WORKING PAPER SERIES OVERBORROWING, FINANCIAL CRISES AND 'MACRO-PRUDENTIAL' TAXES Javier Bianchi

... to those examined by Mendoza and Smith (2006) and Mendoza (2010). These studies showed that cyclical dynamics in a competitive equilibrium lead to periods of expansion in which leverage ratios raise enough so that the collateral constraint becomes binding, triggering a Fisherian deflation that cause ...

... to those examined by Mendoza and Smith (2006) and Mendoza (2010). These studies showed that cyclical dynamics in a competitive equilibrium lead to periods of expansion in which leverage ratios raise enough so that the collateral constraint becomes binding, triggering a Fisherian deflation that cause ...

Lifeplan ICFS Financial Advice Satisfaction Index

... ¡¡ Female investors continue to show a higher level of perceptions regarding their advisors than male investors. However, the results show that male investors showed a very strong increase in all three drivers of perception. ¡¡ Investors in the 30-44 age bracket show the strongest increase in all th ...

... ¡¡ Female investors continue to show a higher level of perceptions regarding their advisors than male investors. However, the results show that male investors showed a very strong increase in all three drivers of perception. ¡¡ Investors in the 30-44 age bracket show the strongest increase in all th ...