Wed issue Dft#1 040710(2)IF

... We have an economy in a state of collapse and part of the reason for that is free trade, globalization, offshoring and outsourcing, which since 2000 has cost America some 8 million good quality jobs. Where are you Smoot-Hawley now that we need you? There are many reasons why the American economy is ...

... We have an economy in a state of collapse and part of the reason for that is free trade, globalization, offshoring and outsourcing, which since 2000 has cost America some 8 million good quality jobs. Where are you Smoot-Hawley now that we need you? There are many reasons why the American economy is ...

Full year 2008 preliminary results

... Highest F&C income generator among its peer group, with a ratio of F&C income over NII of 39% Key sources of F&C: a) MPB’s leading investment and brokerage franchise b) MIG advisory fees, c) strong structured finance expertise within the Group’s corporate lending business, d) leading player in IBB b ...

... Highest F&C income generator among its peer group, with a ratio of F&C income over NII of 39% Key sources of F&C: a) MPB’s leading investment and brokerage franchise b) MIG advisory fees, c) strong structured finance expertise within the Group’s corporate lending business, d) leading player in IBB b ...

0001558370-16-008972 - Douglas Dynamics Investor Relations

... The accompanying financial statements have been prepared in accordance with accounting principles generally accepted in the United States for interim financial information. Accordingly, they do not include all of the information and footnotes required by generally accepted accounting principles for ...

... The accompanying financial statements have been prepared in accordance with accounting principles generally accepted in the United States for interim financial information. Accordingly, they do not include all of the information and footnotes required by generally accepted accounting principles for ...

Non-rating revenue and conflicts of interest

... involving non-rating services as follows: “[…] an NRSRO might issue a more favorable than warranted credit rating to an issuer or other party in order to obtain ancillary services business from them, or an issuer that purchases a large amount of ancillary services could pressure the NRSRO to issue a ...

... involving non-rating services as follows: “[…] an NRSRO might issue a more favorable than warranted credit rating to an issuer or other party in order to obtain ancillary services business from them, or an issuer that purchases a large amount of ancillary services could pressure the NRSRO to issue a ...

simmons first national corp

... Purchases of premises and equipment, net Proceeds from sale of foreclosed assets held for sale Proceeds from sale of foreclosed assets held for sale, covered by FDIC loss share Proceeds from sale of available-for-sale securities Proceeds from maturities of available-for-sale securities Purchases of ...

... Purchases of premises and equipment, net Proceeds from sale of foreclosed assets held for sale Proceeds from sale of foreclosed assets held for sale, covered by FDIC loss share Proceeds from sale of available-for-sale securities Proceeds from maturities of available-for-sale securities Purchases of ...

DOC - Investors

... Beginning in the second half of 1999, and continuing through the first three quarters of 2000, industry demand exceeded industry capacity. The Company’s gross profit margins reached a peak of 34.4% in the third quarter of 2000 and 31.6% for the year 2000. In addition, OEM customers and distributors ...

... Beginning in the second half of 1999, and continuing through the first three quarters of 2000, industry demand exceeded industry capacity. The Company’s gross profit margins reached a peak of 34.4% in the third quarter of 2000 and 31.6% for the year 2000. In addition, OEM customers and distributors ...

US CORNER - Paul, Weiss

... (a) incurrence of additional indebtedness (especially if the unsecured debt had unused baskets or room in an incurrence test); (b) asset sales; (c) waivers of cash sweeps from issuance of new equity; (d) financial covenant relief; and (e) acquisition transactions. Also, it would not have b ...

... (a) incurrence of additional indebtedness (especially if the unsecured debt had unused baskets or room in an incurrence test); (b) asset sales; (c) waivers of cash sweeps from issuance of new equity; (d) financial covenant relief; and (e) acquisition transactions. Also, it would not have b ...

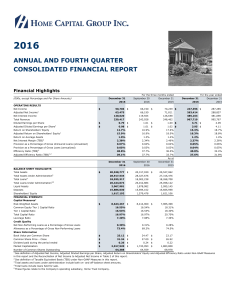

2016 Q4 Report - Home Capital Group

... The traditional single-family residential portfolio is the Company’s “Classic” mortgage portfolio which consists of primarily uninsured mortgages with loan-to-value ratios of 80% or less, serving selected segments of the Canadian financial services marketplace that are not the focus of the major fin ...

... The traditional single-family residential portfolio is the Company’s “Classic” mortgage portfolio which consists of primarily uninsured mortgages with loan-to-value ratios of 80% or less, serving selected segments of the Canadian financial services marketplace that are not the focus of the major fin ...

Unlocking funding for European investment and growth

... accessibility; creation of an SME risk and information database; and establishing or expanding credit mediation services. A further option is to support the expansion of SME securitisation, to increase funding and capital capacity for bank lending. 2. Large and mid-sized corporates. Mid-sized and pa ...

... accessibility; creation of an SME risk and information database; and establishing or expanding credit mediation services. A further option is to support the expansion of SME securitisation, to increase funding and capital capacity for bank lending. 2. Large and mid-sized corporates. Mid-sized and pa ...

Country spreads and emerging countries: Who drives whom?

... wrongly assumes that the spread is completely independent of domestic conditions, the change in the interest rate would be interpreted as an exogenous innovation, and therefore part of the accompanying expansion would be erroneously attributed to a spread shock, when in reality it was entirely cause ...

... wrongly assumes that the spread is completely independent of domestic conditions, the change in the interest rate would be interpreted as an exogenous innovation, and therefore part of the accompanying expansion would be erroneously attributed to a spread shock, when in reality it was entirely cause ...

Optimal Bank Capital

... (ii) The extent to which changes in the average cost of bank funding brought about by shifts in the mix of funding reflect the tax treatment of debt and equity and the offsetting impact from any extra tax revenue received by government. (iii) The extent to which the chances of banking problems decli ...

... (ii) The extent to which changes in the average cost of bank funding brought about by shifts in the mix of funding reflect the tax treatment of debt and equity and the offsetting impact from any extra tax revenue received by government. (iii) The extent to which the chances of banking problems decli ...

The Accounting Equation

... Says that income can be determined for any period of time (month, quarter, year, etc.) Any accounting period of twelve months is called a FISCAL YEAR ...

... Says that income can be determined for any period of time (month, quarter, year, etc.) Any accounting period of twelve months is called a FISCAL YEAR ...

Evaluation of Firm Performance

... This ratio, sometimes called the “acid test,” is a more stringent measure of liquidity than the current ratio. Sometimes the numerator of the quick ratio is defined simply as the current ratio minus inventory. The quick ratio takes into account only the most liquid of current assets (defined as cash ...

... This ratio, sometimes called the “acid test,” is a more stringent measure of liquidity than the current ratio. Sometimes the numerator of the quick ratio is defined simply as the current ratio minus inventory. The quick ratio takes into account only the most liquid of current assets (defined as cash ...

Handbook of German States - Erik F. Nielsen

... as Bunds continues to be attractive. With ongoing ECB buying in the European SSA market, those issuers not on the list will become increasingly attractive – both due to their spread pickup, but also due to better liquidity. ...

... as Bunds continues to be attractive. With ongoing ECB buying in the European SSA market, those issuers not on the list will become increasingly attractive – both due to their spread pickup, but also due to better liquidity. ...

GOLDEN STAR RESOURCES LTD

... alleviating some of the Company's going concern considerations. Progress on the acquisition of the Prestea property adjoining the Bogoso gold mine in Ghana (owned by Bogoso Gold Limited ("BGL"), the Company's 90%-owned subsidiary), commencement of mining at Prestea, a modest improvement in gold pric ...

... alleviating some of the Company's going concern considerations. Progress on the acquisition of the Prestea property adjoining the Bogoso gold mine in Ghana (owned by Bogoso Gold Limited ("BGL"), the Company's 90%-owned subsidiary), commencement of mining at Prestea, a modest improvement in gold pric ...

fasb adopts ownership approach in liability and equity debate

... redeemable and non-redeemable preferred stock into liabilities. As shown, the change does not dramatically affect the totals or percentages, with average total liabilities increasing by $129 million (up to $22.155 billion from $22.026 billion) and the leverage ratio increasing by one-half percentage ...

... redeemable and non-redeemable preferred stock into liabilities. As shown, the change does not dramatically affect the totals or percentages, with average total liabilities increasing by $129 million (up to $22.155 billion from $22.026 billion) and the leverage ratio increasing by one-half percentage ...

What is owners equity in accounting? Peter Baskerville The

... Owners equity represents the resources invested by the owners in the business. It is often known as the 'residual' claim over the assets because the claim of the debt funders (liabilities) must be satisfied before the claim of the owners. Some characteristics of 'owners equity' are: 1. Owners equity ...

... Owners equity represents the resources invested by the owners in the business. It is often known as the 'residual' claim over the assets because the claim of the debt funders (liabilities) must be satisfied before the claim of the owners. Some characteristics of 'owners equity' are: 1. Owners equity ...

CFA Institute Member Poll: Cash Flow Survey

... (e.g., cash from customers, cash paid to suppliers, etc.). That information is not available when operating cash flows are presented indirectly (net income is reconciled to operating cash flows). The Boards are trying to get an understanding of how useful for corporate valuation and risk analysis th ...

... (e.g., cash from customers, cash paid to suppliers, etc.). That information is not available when operating cash flows are presented indirectly (net income is reconciled to operating cash flows). The Boards are trying to get an understanding of how useful for corporate valuation and risk analysis th ...

printmgr file - Morgan Stanley

... Debt valuation adjustments (“DVA”) represent the change in the fair value resulting from fluctuations in the Firm’s credit spreads and other credit factors related to liabilities carried at fair value, primarily certain Long-term and Short-term borrowings. Amounts include Provision for (benefit from ...

... Debt valuation adjustments (“DVA”) represent the change in the fair value resulting from fluctuations in the Firm’s credit spreads and other credit factors related to liabilities carried at fair value, primarily certain Long-term and Short-term borrowings. Amounts include Provision for (benefit from ...

Financialization and the nonfinancial corporation

... financial profits, rentiers’ income or payments to the financial sector as indicators of financialization raises the question of what changed over the post-1970 period such that these variables rose in a dramatic and sustained way. Take, for example, Orhangazi’s (2008) finding that increased flows b ...

... financial profits, rentiers’ income or payments to the financial sector as indicators of financialization raises the question of what changed over the post-1970 period such that these variables rose in a dramatic and sustained way. Take, for example, Orhangazi’s (2008) finding that increased flows b ...

interest rate and inflation risks in PFI contracts

... debt has a term of 20-30 years; the Unitary Charge would then be subject to variation in line with prevailing interest rates after 10 years. In this case, the Authority will need to consider whether it is content for interest-rate risk to revert to it in this way (after 10 years), or whether it woul ...

... debt has a term of 20-30 years; the Unitary Charge would then be subject to variation in line with prevailing interest rates after 10 years. In this case, the Authority will need to consider whether it is content for interest-rate risk to revert to it in this way (after 10 years), or whether it woul ...

Meeting of the Full Council

... Background and Advice The UK Municipal Bonds Agency (MBA) was established by the Local Government Association (LGA) and 56 local authorities, including Lancashire County Council, for the purpose of enabling local authorities to borrow on better rates of interest than would otherwise be available to ...

... Background and Advice The UK Municipal Bonds Agency (MBA) was established by the Local Government Association (LGA) and 56 local authorities, including Lancashire County Council, for the purpose of enabling local authorities to borrow on better rates of interest than would otherwise be available to ...

“Accounting Dictionary”

... PAY CYCLE is a set of rules that defines the criteria by which scheduled payments are selected for payment creation, e.g., payroll may be on a weekly, bi-weekly, or monthly pay cycle. PAYMENT is the satisfaction of a debt or claim; primarily money paid to fulfill an obligation. PAYMENT DUE DATE is ...

... PAY CYCLE is a set of rules that defines the criteria by which scheduled payments are selected for payment creation, e.g., payroll may be on a weekly, bi-weekly, or monthly pay cycle. PAYMENT is the satisfaction of a debt or claim; primarily money paid to fulfill an obligation. PAYMENT DUE DATE is ...

The impact of a firm`s carbon risk profile on the cost of debt capital

... its cost of debt. Specifically, we predict and test the following two propositions: (1) firms with higher carbon-related risk exposure face a higher cost of debt and (2) firms can mitigate this ‘carbon risk’ penalty to their cost of debt by providing evidence regarding its awareness of the carbon-re ...

... its cost of debt. Specifically, we predict and test the following two propositions: (1) firms with higher carbon-related risk exposure face a higher cost of debt and (2) firms can mitigate this ‘carbon risk’ penalty to their cost of debt by providing evidence regarding its awareness of the carbon-re ...