Corporate Law Exam Notes 2011

... and reasonable in the circumstances. Thus the amount payable per share would have to reflect the value of shares in a company which is returning to profitability and which carry the priority right to receive 5 years of accumulated dividends. In these circumstances, the shareholders should receive ma ...

... and reasonable in the circumstances. Thus the amount payable per share would have to reflect the value of shares in a company which is returning to profitability and which carry the priority right to receive 5 years of accumulated dividends. In these circumstances, the shareholders should receive ma ...

Danish Covered Bond Handbook

... Mortgage banks are closely supervised by the Danish FSA. Mortgage collateral will observe LTV limits at single loan levels at all times. A key feature of the Danish system is very well-defined property rights through a general register of all properties in Denmark. This is called the Danish title nu ...

... Mortgage banks are closely supervised by the Danish FSA. Mortgage collateral will observe LTV limits at single loan levels at all times. A key feature of the Danish system is very well-defined property rights through a general register of all properties in Denmark. This is called the Danish title nu ...

Bond Prospectus of Limited Liability Company

... The risks indicated in this section may reduce the Issuer’s ability to fulfil its obligations and cause its insolvency in the worst-case scenario. Bondholders have to take into account that Bonds are not secured by pledge and third parties have not guaranteed for Bonds and Coupon payments related th ...

... The risks indicated in this section may reduce the Issuer’s ability to fulfil its obligations and cause its insolvency in the worst-case scenario. Bondholders have to take into account that Bonds are not secured by pledge and third parties have not guaranteed for Bonds and Coupon payments related th ...

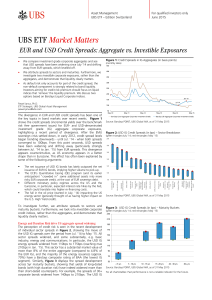

Does austerity pay off?

... the introduction, we construct a mostly spread-based measure using yields for securities issued in common currency. To the extent that goods and financial markets are sufficiently integrated, we thus eliminate fluctuations in yields due to changes in real interest rates, inflation expectations, and ...

... the introduction, we construct a mostly spread-based measure using yields for securities issued in common currency. To the extent that goods and financial markets are sufficiently integrated, we thus eliminate fluctuations in yields due to changes in real interest rates, inflation expectations, and ...

in Central, Eastern, and Southern European

... We are pleased to introduce this volume, which summarizes the proceedings of an important and timely conference on the key policy challenge of reinvigorating credit growth in Central, Eastern, and Southern European Economies (CESEE).1 The need to act decisively and remove structural barriers to a hi ...

... We are pleased to introduce this volume, which summarizes the proceedings of an important and timely conference on the key policy challenge of reinvigorating credit growth in Central, Eastern, and Southern European Economies (CESEE).1 The need to act decisively and remove structural barriers to a hi ...

The Macro-Economic Effects of Directed Credit Policies: A Real

... massive expansion of priority lending up to 1988 and an appreciable reduction since 1991, when India began its process of structural reforms. The bulk of the priority lending accrues to farmers and small-scale industrialists. The aim of the priority lending scheme for agriculture was to facilitate t ...

... massive expansion of priority lending up to 1988 and an appreciable reduction since 1991, when India began its process of structural reforms. The bulk of the priority lending accrues to farmers and small-scale industrialists. The aim of the priority lending scheme for agriculture was to facilitate t ...

AMBICOM HOLDINGS, INC

... prior to January 15, 2010 related to its organization, initial funding and share issuances. On January 15, 2010, the Company authorized an amendment to its Articles of Incorporation (the “Amendment”) to change its name to AmbiCom Holdings, Inc., to increase the number of its authorized shares of cap ...

... prior to January 15, 2010 related to its organization, initial funding and share issuances. On January 15, 2010, the Company authorized an amendment to its Articles of Incorporation (the “Amendment”) to change its name to AmbiCom Holdings, Inc., to increase the number of its authorized shares of cap ...

Basel Committee guidance on accounting for IFRS 9 expected credit

... Further details about the new ECL model in IFRS 9 are included in our In depth INT 2014-06 IFRS 9: Expected Credit Losses. The Basel Committee on Banking Supervision (‘the Committee’) issued its ‘Guidance on credit risk and accounting for expected credit losses’ in December 2015. This sets out super ...

... Further details about the new ECL model in IFRS 9 are included in our In depth INT 2014-06 IFRS 9: Expected Credit Losses. The Basel Committee on Banking Supervision (‘the Committee’) issued its ‘Guidance on credit risk and accounting for expected credit losses’ in December 2015. This sets out super ...

Building Sub-national Debt Markets

... borrowers as agents have an incentive not to repay their lenders as principals because they perceive that they will be bailed-out by the central government in case of default, resulting in moral hazard. The second agency problem is that of hidden information, in which sub-national borrowers as agent ...

... borrowers as agents have an incentive not to repay their lenders as principals because they perceive that they will be bailed-out by the central government in case of default, resulting in moral hazard. The second agency problem is that of hidden information, in which sub-national borrowers as agent ...

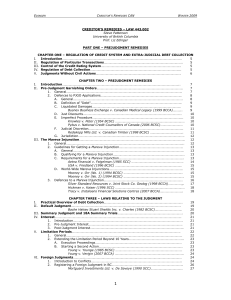

443-Creditors_Remedies-Edinger

... - There are 4 principles to keep in mind in all creditors remedies cases: a) Law believes that just debts should be paid - Just debts occur when it is determined 'x' owes '$' b) Some protection for the debtor, his/her family, and innocent 3rd parties - See chapters on exemptions and immunities c) So ...

... - There are 4 principles to keep in mind in all creditors remedies cases: a) Law believes that just debts should be paid - Just debts occur when it is determined 'x' owes '$' b) Some protection for the debtor, his/her family, and innocent 3rd parties - See chapters on exemptions and immunities c) So ...

The Canadian Fixed Income Market Report

... Money markets vs debt capital markets Fixed income securities are products that provide investors a fixed number of payments over a pre-determined period of time. Those that are issued with a maturity of one year or less constitute the money market and those issued with a maturity date greater than ...

... Money markets vs debt capital markets Fixed income securities are products that provide investors a fixed number of payments over a pre-determined period of time. Those that are issued with a maturity of one year or less constitute the money market and those issued with a maturity date greater than ...

V7-Mutual Fund year book

... We are pleased to release the third edition of The CRISIL Mutual Fund Year Book, a one-stop insight on the mutual fund industry. This is in line with our objective of making markets function better and improving connect with retail investors. 2012 was a turnaround year for the Indian capital markets ...

... We are pleased to release the third edition of The CRISIL Mutual Fund Year Book, a one-stop insight on the mutual fund industry. This is in line with our objective of making markets function better and improving connect with retail investors. 2012 was a turnaround year for the Indian capital markets ...

Sovereign Money in Critical Context PDF

... The typical case in point is banking regulation according to Basel III (bank equity and liquidity requirements in relation to various classes of assets and liabilities). Basel III supporters believe that implementing such higher requirements would solve the problem.9 However, one has good reason to ...

... The typical case in point is banking regulation according to Basel III (bank equity and liquidity requirements in relation to various classes of assets and liabilities). Basel III supporters believe that implementing such higher requirements would solve the problem.9 However, one has good reason to ...

accounting ratios

... an ideal current ratio is 2: 1. But if a firm is able to procure additional funds easily and immediately, in that case current ratio of less than 2 may be considered good. b) No precise terminology Terms used to calculate accounting ratios have no standard and precise definition. For example, net pr ...

... an ideal current ratio is 2: 1. But if a firm is able to procure additional funds easily and immediately, in that case current ratio of less than 2 may be considered good. b) No precise terminology Terms used to calculate accounting ratios have no standard and precise definition. For example, net pr ...

Unresolved Issues in Modeling Credit Risky Assets

... similar to the range used to define a credit event in the credit default swap markets and it is this diversity of events and the resulting disparity in recovery that lead to the introduction of Modified Restructuring, Modified - Modified Restructuring, and No Restructuring default swap contracts. S ...

... similar to the range used to define a credit event in the credit default swap markets and it is this diversity of events and the resulting disparity in recovery that lead to the introduction of Modified Restructuring, Modified - Modified Restructuring, and No Restructuring default swap contracts. S ...

IMF World Economic Outlook (WEO)

... factors slowed GDP growth in emerging market and developing economies from about 9 percent in late 2009 to about 5¼ percent recently. Indicators of manufacturing activity have been retreating for some time (Figure 1.3, panel 1). The IMF staff’s Global Projection Model suggests that more than half of ...

... factors slowed GDP growth in emerging market and developing economies from about 9 percent in late 2009 to about 5¼ percent recently. Indicators of manufacturing activity have been retreating for some time (Figure 1.3, panel 1). The IMF staff’s Global Projection Model suggests that more than half of ...

Managing Interest Rate Risk: Duration GAP and Economic

... losses if the security is sold prior to maturity. Decreases in interest rates will decrease the HPR from a lower reinvestment rate but increase the HPR from capital gains if the security is sold prior to maturity. ...

... losses if the security is sold prior to maturity. Decreases in interest rates will decrease the HPR from a lower reinvestment rate but increase the HPR from capital gains if the security is sold prior to maturity. ...

DOL Fact Sheet on Final Fiduciary Rule

... FACT SHEET: Middle Class Economics: Strengthening Retirement Security by Cracking Down on Conflicts of Interest in Retirement Savings “For Americans who are doing the hard work of saving for retirement, let’s make sure that they get a fair deal.” – President Barack Obama, White House Conference on A ...

... FACT SHEET: Middle Class Economics: Strengthening Retirement Security by Cracking Down on Conflicts of Interest in Retirement Savings “For Americans who are doing the hard work of saving for retirement, let’s make sure that they get a fair deal.” – President Barack Obama, White House Conference on A ...

FINANCIAL STATEMENTS AND NOTES TABLE OF CONTENTS

... of Citigroup Inc. and subsidiaries (the ―Company‖ or ―Citigroup‖) as of December 31, 2011 and 2010, and the related consolidated statements of income, changes in stockholders’ equity and cash flows for each of the years in the three-year period ended December 31, 2011. These consolidated financial s ...

... of Citigroup Inc. and subsidiaries (the ―Company‖ or ―Citigroup‖) as of December 31, 2011 and 2010, and the related consolidated statements of income, changes in stockholders’ equity and cash flows for each of the years in the three-year period ended December 31, 2011. These consolidated financial s ...

Download attachment

... Proceedings of Applied International Business Conference 2008 The LBO fund is usually not wealth-constrained, like the private equity funds: these funds participate in the formation of large companies and they issue high level of equity. In Venture capital2, the venture capitalist fund (hereafter V ...

... Proceedings of Applied International Business Conference 2008 The LBO fund is usually not wealth-constrained, like the private equity funds: these funds participate in the formation of large companies and they issue high level of equity. In Venture capital2, the venture capitalist fund (hereafter V ...