Shifting the Lens – A De-Risking Toolkit for Impact Investment

... the demand side, charitable organisations are becoming increasingly market-based, enterprise is becoming more socially-motivated and the public sector is increasingly ‘spinning out’ provision of services. On the supply side, a broadening range of asset owners are beginning to engage with the idea of ...

... the demand side, charitable organisations are becoming increasingly market-based, enterprise is becoming more socially-motivated and the public sector is increasingly ‘spinning out’ provision of services. On the supply side, a broadening range of asset owners are beginning to engage with the idea of ...

Supplemental Pay Forms requiring approval form

... the effort was performed. If these dates are not within the period indicated by the Start Month, an explanation should be included in the comments section explaining why they are different. For example, if the Start Month is June 2009, but the Service Begin date is 1/1/2009 and the Service End date ...

... the effort was performed. If these dates are not within the period indicated by the Start Month, an explanation should be included in the comments section explaining why they are different. For example, if the Start Month is June 2009, but the Service Begin date is 1/1/2009 and the Service End date ...

FREE Sample Here

... a. Once a firm declares bankruptcy, it is liquidated by the trustee, who uses the proceeds to pay bondholders, unpaid wages, taxes, and lawyer fees. b. A firm with a sinking fund payment coming due would generally choose to buy back bonds in the open market, if the price of the bond exceeds the sink ...

... a. Once a firm declares bankruptcy, it is liquidated by the trustee, who uses the proceeds to pay bondholders, unpaid wages, taxes, and lawyer fees. b. A firm with a sinking fund payment coming due would generally choose to buy back bonds in the open market, if the price of the bond exceeds the sink ...

Why firms issue callable bonds: Hedging

... In the first part of the paper, we develop a theory on a firm's ex ante choice between issuing a callable or non-callable bond, its ex post decisions whether to call back a callable bond, and whether to refund it. On the one hand, our theory explains the existing empirical findings in the current liter ...

... In the first part of the paper, we develop a theory on a firm's ex ante choice between issuing a callable or non-callable bond, its ex post decisions whether to call back a callable bond, and whether to refund it. On the one hand, our theory explains the existing empirical findings in the current liter ...

LEVERAGE, HEDGE FUNDS AND RISK

... Using the notional value of the derivative can be misleading and may not fully capture the risk of the derivative, particularly when selling an option (as opposed to buying one), because the worst case loss on such a trade can be large and the payoff profile asymmetric. For example, if one sells cre ...

... Using the notional value of the derivative can be misleading and may not fully capture the risk of the derivative, particularly when selling an option (as opposed to buying one), because the worst case loss on such a trade can be large and the payoff profile asymmetric. For example, if one sells cre ...

Capital structure and volatility of risk

... (VRV). Second we obtain daily series of volatilities implied from option prices for each day in the previous calendar year. The standard deviation of these IVs provides our second measure called volatility of implied volatility (VIV). All our results are implemented both of these measures of volatil ...

... (VRV). Second we obtain daily series of volatilities implied from option prices for each day in the previous calendar year. The standard deviation of these IVs provides our second measure called volatility of implied volatility (VIV). All our results are implemented both of these measures of volatil ...

AVVISO n. 198

... debt securities to raise the funding required to effect the settlements with holders of its Untendered Debt. ...

... debt securities to raise the funding required to effect the settlements with holders of its Untendered Debt. ...

The influence of macroeconomic developments on Austrian banks

... different sectors of the economy, and the fact that their assets are in effect longer-term and less liquid than their liabilities. Banks’ health reflects to a large extent the health of their borrowers, which in turn reflects the health of the economy as a whole. A useful way to analyse the macroeco ...

... different sectors of the economy, and the fact that their assets are in effect longer-term and less liquid than their liabilities. Banks’ health reflects to a large extent the health of their borrowers, which in turn reflects the health of the economy as a whole. A useful way to analyse the macroeco ...

Notes to Consolidated Financial Statements

... gains and losses in our operating results, noting that it is generally preferable to accelerate the recognition of deferred gains and losses into income rather than to delay such recognition. This change will improve transparency in our operating results by more quickly recognizing the effects of ec ...

... gains and losses in our operating results, noting that it is generally preferable to accelerate the recognition of deferred gains and losses into income rather than to delay such recognition. This change will improve transparency in our operating results by more quickly recognizing the effects of ec ...

Joint Center for Housing Studies Harvard University

... servicers to modify distressed loans, to little avail. In contrast, the Obama Administration adopted the second model, offering subsidies to servicers to modify distressed loans.13 During the early stages of the crisis, in 2007 and the first part of 2008, public policy was mostly concerned with imp ...

... servicers to modify distressed loans, to little avail. In contrast, the Obama Administration adopted the second model, offering subsidies to servicers to modify distressed loans.13 During the early stages of the crisis, in 2007 and the first part of 2008, public policy was mostly concerned with imp ...

Do Debt Markets Price Ṣukūk and Conventional Bonds

... By using the market pricing behavior of these two types of securities (while controlling the issuer, rating and tenure) it is possible to find evidence of their similarity or difference using causality modeling. This would give us support for answering the public policy question as how to treat or c ...

... By using the market pricing behavior of these two types of securities (while controlling the issuer, rating and tenure) it is possible to find evidence of their similarity or difference using causality modeling. This would give us support for answering the public policy question as how to treat or c ...

403(b) – Vendor Charge Comparison Annuities

... All vendors listed have entered into information-sharing agreements with the plan sponsor. District administrative requirements allow companies which meet certain standards and maintain a minimum number of employee accounts to provide 403(b) TSA accounts to employees. The companies listed are curren ...

... All vendors listed have entered into information-sharing agreements with the plan sponsor. District administrative requirements allow companies which meet certain standards and maintain a minimum number of employee accounts to provide 403(b) TSA accounts to employees. The companies listed are curren ...

The role of inflation-linked bonds Increasing, but still modest

... government and that are held by risk-averse investors. The model offers two reasons why a government may find it unattractive to use inflation-linked bonds to finance its public debt. The most important one is liquidity risk. Because of liquidity risk, investors may be unwilling to step into ILBs. I ...

... government and that are held by risk-averse investors. The model offers two reasons why a government may find it unattractive to use inflation-linked bonds to finance its public debt. The most important one is liquidity risk. Because of liquidity risk, investors may be unwilling to step into ILBs. I ...

6 Balance of Payments I CHAPTER

... CAD is being financed by capital flows and not by running down reserves. However, a sizeable share of capital is in the nature of Foreign Institutional Investors (FIIs) investment that could moderate or even reverse if investors switch to risk-off mode. The balance of payments position therefore is ...

... CAD is being financed by capital flows and not by running down reserves. However, a sizeable share of capital is in the nature of Foreign Institutional Investors (FIIs) investment that could moderate or even reverse if investors switch to risk-off mode. The balance of payments position therefore is ...

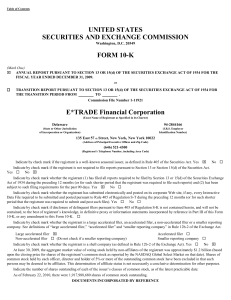

E TRADE FINANCIAL CORP - Nasdaq`s INTEL Solutions

... Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to suc ...

... Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to suc ...

Asian Investment Grade USD Bonds an Under Appreciated Asset

... of diversification. It is the old “putting all your eggs in the same basket” concept. For investments, this means holding assets that are dissimilar, have different characteristics and react differently to market events. Accordingly investors should actively seek to hold investments that have low co ...

... of diversification. It is the old “putting all your eggs in the same basket” concept. For investments, this means holding assets that are dissimilar, have different characteristics and react differently to market events. Accordingly investors should actively seek to hold investments that have low co ...

The equity premium

... puzzle." The short-term real rate in the United States has averaged less than 1 percent, so the high value of cc required to generate the observed equity premium results in an unacceptably high riskfree rate. The late Fischer Black proposed that ax = 55 would solve the puzzle.10 Indeed, it can be sh ...

... puzzle." The short-term real rate in the United States has averaged less than 1 percent, so the high value of cc required to generate the observed equity premium results in an unacceptably high riskfree rate. The late Fischer Black proposed that ax = 55 would solve the puzzle.10 Indeed, it can be sh ...

Bankruptcy Reform and the Housing Crisis.

... that mortgage default rates increased in response to the BAPCPA. A primary benefit of our quantitative approach relative to their empirical analysis is that we are able to construct the counterfactual experiment that these authors envision. In response to the recent housing crisis, there is a rapidl ...

... that mortgage default rates increased in response to the BAPCPA. A primary benefit of our quantitative approach relative to their empirical analysis is that we are able to construct the counterfactual experiment that these authors envision. In response to the recent housing crisis, there is a rapidl ...

Why Managing Inflation Risk Still Matters: A Multi

... A Multi-Asset Approach Inflation—the general increase in the prices of goods and services—is an important investment consideration for two primary reasons. First, inflation erodes the purchasing power of a portfolio’s value. For example, if the inflation rate was at its historical long-term average ...

... A Multi-Asset Approach Inflation—the general increase in the prices of goods and services—is an important investment consideration for two primary reasons. First, inflation erodes the purchasing power of a portfolio’s value. For example, if the inflation rate was at its historical long-term average ...

TD Bank Group Reports First Quarter 2017 Results

... From time to time, the Bank (as defined in this document) makes written and/or oral forward-looking statements, including in this document, in other filings with Canadian regulators or the United States (U.S.) Securities and Exchange Commission (SEC), and in other communications. In addition, repres ...

... From time to time, the Bank (as defined in this document) makes written and/or oral forward-looking statements, including in this document, in other filings with Canadian regulators or the United States (U.S.) Securities and Exchange Commission (SEC), and in other communications. In addition, repres ...

To Cut or Not to Cut? That is the (Central Bank`s)

... An increasing number of Latin American countries have been recently strengthening their monetary policy frameworks, using the policy interest rate as the main tool to calibrate the stance of monetary policy. In doing so, central bankers face the difficult task of determining how the current interest ...

... An increasing number of Latin American countries have been recently strengthening their monetary policy frameworks, using the policy interest rate as the main tool to calibrate the stance of monetary policy. In doing so, central bankers face the difficult task of determining how the current interest ...