Corporate Financial Distress and Bankruptcy

... continually outperforms other profitability measures, including cash flow. (Altman, 1968) X4 – Market Value of Equity to Total Liabilities (MVE/TL) Equity is measured by the combined market value of all shares of stock, preferred and common, while liabilities include both current and long-term. This ...

... continually outperforms other profitability measures, including cash flow. (Altman, 1968) X4 – Market Value of Equity to Total Liabilities (MVE/TL) Equity is measured by the combined market value of all shares of stock, preferred and common, while liabilities include both current and long-term. This ...

INVENTORY finance

... consumer goods for resale • Retailers, for the purchase of equipment and consumer durable goods such as vehicles for resale to consumers (sometimes described as “floor plan financing”). ...

... consumer goods for resale • Retailers, for the purchase of equipment and consumer durable goods such as vehicles for resale to consumers (sometimes described as “floor plan financing”). ...

INSTITUTE OF ECONOMIC STUDIES Faculty of social sciences of

... a higher-lower quote means that the quoting dealer is willing to transact a swap in which he receives/pays the given fixed rate the difference between the two rates is the dealing spread the dealer earns on every matching pair of swaps swap rate is the average of bid and ask interest rates swap spre ...

... a higher-lower quote means that the quoting dealer is willing to transact a swap in which he receives/pays the given fixed rate the difference between the two rates is the dealing spread the dealer earns on every matching pair of swaps swap rate is the average of bid and ask interest rates swap spre ...

DOC - Valhi, Inc.

... interim periods ended June 30, 1999 and 2000, have been prepared by the Company, without audit. In the opinion of management, all adjustments, consisting only of normal recurring adjustments, necessary to present fairly the consolidated financial position, results of operations and cash flows have b ...

... interim periods ended June 30, 1999 and 2000, have been prepared by the Company, without audit. In the opinion of management, all adjustments, consisting only of normal recurring adjustments, necessary to present fairly the consolidated financial position, results of operations and cash flows have b ...

Swaps - dedeklegacy.cz

... swap is an off-balance sheet instrument because it does not impact on the balance sheets of the swap counterparties but only on their profit and loss accounts termination of a swap is the cancellation of the swap contract (in which case one counterparty compensates the other counterparty for the los ...

... swap is an off-balance sheet instrument because it does not impact on the balance sheets of the swap counterparties but only on their profit and loss accounts termination of a swap is the cancellation of the swap contract (in which case one counterparty compensates the other counterparty for the los ...

44 STRESS TEST FOR ISLAMIC AND CONVENTIONAL BANKS

... fall below any of the two minimum ratios required. The paper reveals that the overall pool of risk for the banking sector as a whole and for the conventional banking sector has declined whereas it increased for the Islamic banking sector. It further finds that the weight of individual risk type has ...

... fall below any of the two minimum ratios required. The paper reveals that the overall pool of risk for the banking sector as a whole and for the conventional banking sector has declined whereas it increased for the Islamic banking sector. It further finds that the weight of individual risk type has ...

Basics and Problems - Ace MBAe Finance Specialization

... the receivable collection period value varies dramatically for different firms (e.g., from 10 to over 60) and it is mainly due to the product and the industry. Such an analysis would indicate similar rapid collection periods for other drugstore chains since this is basically a cash business for the ...

... the receivable collection period value varies dramatically for different firms (e.g., from 10 to over 60) and it is mainly due to the product and the industry. Such an analysis would indicate similar rapid collection periods for other drugstore chains since this is basically a cash business for the ...

Banking Industry Country Risk Assessment

... b. Adjustment for atypical change in private-sector credit growth or asset prices 41. The score for economic imbalances will be one category better or worse if either the change in private-sector credit growth or in asset prices is not an adequate reflection of economic imbalances. 42. In practice, ...

... b. Adjustment for atypical change in private-sector credit growth or asset prices 41. The score for economic imbalances will be one category better or worse if either the change in private-sector credit growth or in asset prices is not an adequate reflection of economic imbalances. 42. In practice, ...

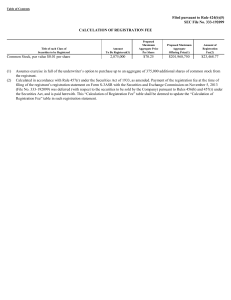

SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C.

... operations, comprehensive income, stockholders' equity and cash flows for the interim periods ended March 31, 1997 and 1998 have been prepared by the Company, without audit. In the opinion of management, all adjustments, consisting only of normal recurring adjustments, necessary to present fairly th ...

... operations, comprehensive income, stockholders' equity and cash flows for the interim periods ended March 31, 1997 and 1998 have been prepared by the Company, without audit. In the opinion of management, all adjustments, consisting only of normal recurring adjustments, necessary to present fairly th ...

2011 Annual Report (Opens in a new Window)

... ized mortgage obligations (CMO), almost all resulting in the Allowance for Loan Losses as a of which have been issued by the Government percentage of loans outstanding remaining unNational Mortgage Association (Ginnie Mae). changed at 1.50%. For most of 2011, however, Since Ginnie Mae is a U.S. Gove ...

... ized mortgage obligations (CMO), almost all resulting in the Allowance for Loan Losses as a of which have been issued by the Government percentage of loans outstanding remaining unNational Mortgage Association (Ginnie Mae). changed at 1.50%. For most of 2011, however, Since Ginnie Mae is a U.S. Gove ...

LESSON 13: FACTORING – THEORETICAL FRAMEWORK

... 5. Limited Factoring Under limited factoring, the factor discounts only certain invoices on selective basis and converts credit bills into cash in respect of those bills only. 6. Selected Seller Based Factoring The seller sells all his accounts receivables to the factor along with invoice delivery c ...

... 5. Limited Factoring Under limited factoring, the factor discounts only certain invoices on selective basis and converts credit bills into cash in respect of those bills only. 6. Selected Seller Based Factoring The seller sells all his accounts receivables to the factor along with invoice delivery c ...

Diamondback Energy, Inc.

... prospectus supplement and the accompanying prospectus, as well as other risk factors incorporated by reference into this prospectus supplement and the accompanying prospectus from the filings we make with the Securities and Exchange Commission, or the SEC, for an explanation of these risks before in ...

... prospectus supplement and the accompanying prospectus, as well as other risk factors incorporated by reference into this prospectus supplement and the accompanying prospectus from the filings we make with the Securities and Exchange Commission, or the SEC, for an explanation of these risks before in ...

Inflation and the Housing Market

... personal loans. But, obviously, our world does not meet these ideal specifications. Indeed, there is little evidence of any significant tendency on the part of lenders to make full use even of the flexibility in the existing mortgage contract to counteract the higher initial payments resulting from ...

... personal loans. But, obviously, our world does not meet these ideal specifications. Indeed, there is little evidence of any significant tendency on the part of lenders to make full use even of the flexibility in the existing mortgage contract to counteract the higher initial payments resulting from ...

RTF - North Carolina General Assembly

... Subject to the terms and conditions set forth in this Article, (i) a State governmental unit that is implementing an energy conservation measure pursuant to G.S. 143-64.17L and financing it pursuant to this Article, (ii) a State governmental unit that has solicited a guaranteed energy conservation m ...

... Subject to the terms and conditions set forth in this Article, (i) a State governmental unit that is implementing an energy conservation measure pursuant to G.S. 143-64.17L and financing it pursuant to this Article, (ii) a State governmental unit that has solicited a guaranteed energy conservation m ...

Mortgage Choice Determinants: The Role of Risk and Bank

... on tenure choice. In particular, he points out that the housing user cost depends on the loan-tovalue ratio (LTV) because mortgage interest is not deductible in Australia. ...

... on tenure choice. In particular, he points out that the housing user cost depends on the loan-tovalue ratio (LTV) because mortgage interest is not deductible in Australia. ...

Good Practices on Reducing Reliance on CRAs in Asset

... Credit rating agencies (CRAs) play a prominent role in the global financial markets. CRAs provide external credit ratings of individual financial instruments and issuers that express a view on the instrument or entity’s overall creditworthiness (hereafter “credit ratings”) 1. The role of CRAs has co ...

... Credit rating agencies (CRAs) play a prominent role in the global financial markets. CRAs provide external credit ratings of individual financial instruments and issuers that express a view on the instrument or entity’s overall creditworthiness (hereafter “credit ratings”) 1. The role of CRAs has co ...

Chapter 13 Current Liabilities and Contingencies

... It usually is backed by a line of credit with a bank, allowing the interest rate to be lower than in a bank loan. Accounting for commercial paper is exactly the same as for other short-term notes as shown in our previous illustration. ...

... It usually is backed by a line of credit with a bank, allowing the interest rate to be lower than in a bank loan. Accounting for commercial paper is exactly the same as for other short-term notes as shown in our previous illustration. ...

here - Empirical Legal Studies

... litigation, financial exposure, and ultimately risk of financial loss, or reputational risk to the banks.8 While, the OCC is charged with the mandate to enforce existing federal rules governing unfair or deceptive practices by national banks,9 it is not permitted to define what is unfair or decepti ...

... litigation, financial exposure, and ultimately risk of financial loss, or reputational risk to the banks.8 While, the OCC is charged with the mandate to enforce existing federal rules governing unfair or deceptive practices by national banks,9 it is not permitted to define what is unfair or decepti ...

Earnings Release Q3 FY 2016: Strong execution drives growth and

... involving Siemens that may constitute forward-looking statements. These statements may be identified by words such as “expect,” “look forward to,” “anticipate” “intend,” “plan,” “believe,” “seek,” “estimate,” “will,” “project” or words of similar meaning. We may also make forward-looking statements ...

... involving Siemens that may constitute forward-looking statements. These statements may be identified by words such as “expect,” “look forward to,” “anticipate” “intend,” “plan,” “believe,” “seek,” “estimate,” “will,” “project” or words of similar meaning. We may also make forward-looking statements ...

The Gains from Resolving Debt Overhang: Evidence from a

... dampened by the cost of innovation rising and a higher aggregate bankruptcy rate. Related Literature Although debt overhang is a well-known problem, this paper is – to our knowledge – the first to study it through the lens of a classical model of innovation that can match many of the key features o ...

... dampened by the cost of innovation rising and a higher aggregate bankruptcy rate. Related Literature Although debt overhang is a well-known problem, this paper is – to our knowledge – the first to study it through the lens of a classical model of innovation that can match many of the key features o ...

an aarp special report

... proposal on Sept. 29, 2015. The PUC has 180 days from that date to consider whether the proposal serves the public interest. If the PUC consents, Hunt could take control by the middle of 2016.20 Under terms of the deal, Oncor would be valued between $18 and $19 billion21 and have approximately $5 bi ...

... proposal on Sept. 29, 2015. The PUC has 180 days from that date to consider whether the proposal serves the public interest. If the PUC consents, Hunt could take control by the middle of 2016.20 Under terms of the deal, Oncor would be valued between $18 and $19 billion21 and have approximately $5 bi ...