Overview of the Consumer Financial Protection Bureau

... released a proposed rule that defined debt collectors and the consumer reporting agencies as larger market participants, making them susceptible to the bureau’s nonbank supervision program. The proposed rule would include third-party debt collectors with more than $10 million in annual receipts and ...

... released a proposed rule that defined debt collectors and the consumer reporting agencies as larger market participants, making them susceptible to the bureau’s nonbank supervision program. The proposed rule would include third-party debt collectors with more than $10 million in annual receipts and ...

International Interbank Borrowing During the Global Crisis

... empirical link between sudden stops and current account reversals. Kaminsky (2008) shows that the risk of a sudden stop increases with the extent of financial integration. Calvo et al. (2008) point to the link between sudden stops and reliance on short-term bank borrowing. Earlier research on the gl ...

... empirical link between sudden stops and current account reversals. Kaminsky (2008) shows that the risk of a sudden stop increases with the extent of financial integration. Calvo et al. (2008) point to the link between sudden stops and reliance on short-term bank borrowing. Earlier research on the gl ...

Consumer Law and Credit / Debt Law

... This manual contains limited references to case law (the collection of previous written legal decisions in a particular jurisdiction such as a province or a country; over time, case law develops and establishes principles that are used in understanding the law and deciding future cases). In many ins ...

... This manual contains limited references to case law (the collection of previous written legal decisions in a particular jurisdiction such as a province or a country; over time, case law develops and establishes principles that are used in understanding the law and deciding future cases). In many ins ...

Slices - personal.kent.edu

... Line of credit – prearranged agreement with a bank that allows the firm to borrow up to a certain amount on a short-term basis Committed – formal legal arrangement that may require a commitment fee and generally has a floating interest rate Non-committed – informal agreement with a bank that is ...

... Line of credit – prearranged agreement with a bank that allows the firm to borrow up to a certain amount on a short-term basis Committed – formal legal arrangement that may require a commitment fee and generally has a floating interest rate Non-committed – informal agreement with a bank that is ...

Money Management

... down all expenses including purchases as minor as a cup of coffee. At the end of the month you will be able to accurately assess where your money is being spent. ...

... down all expenses including purchases as minor as a cup of coffee. At the end of the month you will be able to accurately assess where your money is being spent. ...

A big leap forward

... surpassing the government’s official target as personal consumption remained strong and all sectors of the economy led by services expanded. The vigorous economic growth was supported by sound macroeconomic fundamentals. Prudent policies kept inflation and interest rates low and peso exchange rate s ...

... surpassing the government’s official target as personal consumption remained strong and all sectors of the economy led by services expanded. The vigorous economic growth was supported by sound macroeconomic fundamentals. Prudent policies kept inflation and interest rates low and peso exchange rate s ...

Financial globalization or great financial expansion

... interaction of each trend with financial vulnerabilities, in determining whether these have been significant antecedents of banking crises. Exploring these two narratives is important not only ...

... interaction of each trend with financial vulnerabilities, in determining whether these have been significant antecedents of banking crises. Exploring these two narratives is important not only ...

PDF

... to 3 percent of GNP or more. The lesson to be learned is that a country with a deficit can avoid inflation by borrowing to finance the deficit while slowing money growth. Should we, however, be concerned that, as in Mexico, Brazil, or Argentina, continued borrowing will pile up debts that we will ha ...

... to 3 percent of GNP or more. The lesson to be learned is that a country with a deficit can avoid inflation by borrowing to finance the deficit while slowing money growth. Should we, however, be concerned that, as in Mexico, Brazil, or Argentina, continued borrowing will pile up debts that we will ha ...

Country Spreads and Emerging Countries: Who Drives Whom?

... If in reality country interest rates responded countercyclically to domestic conditions in emerging economies, then the findings of Neumeyer and Perri (2001) would be better interpreted as an upper bound on the contribution of country interest rates to business cycle fluctuations in emerging countri ...

... If in reality country interest rates responded countercyclically to domestic conditions in emerging economies, then the findings of Neumeyer and Perri (2001) would be better interpreted as an upper bound on the contribution of country interest rates to business cycle fluctuations in emerging countri ...

Guidance Note

... that time band would be 10 per cent of $90 million (ie $9.0 million). 18. The result of the above calculations is to produce a net weighted position, long or short, in each time band and a set of vertical disallowances. The maturity ladder is then divided into three zones defined as zero and up to o ...

... that time band would be 10 per cent of $90 million (ie $9.0 million). 18. The result of the above calculations is to produce a net weighted position, long or short, in each time band and a set of vertical disallowances. The maturity ladder is then divided into three zones defined as zero and up to o ...

The Relationship between Credit Growth and the Expected Returns

... characterize the balance sheet of a typical bank. In concert, these characteristics increase the likelihood that a bank will enter distress upon the realization of a tail event. Hence, as the probability of a tail event increases, projects with lower expected cash flows are rejected by the bank, eff ...

... characterize the balance sheet of a typical bank. In concert, these characteristics increase the likelihood that a bank will enter distress upon the realization of a tail event. Hence, as the probability of a tail event increases, projects with lower expected cash flows are rejected by the bank, eff ...

Economy of Iceland

... in real disposable income. At the beginning of 2007, the last phase of the personal income tax rate cuts took effect, and in March 2007, VAT and excise taxes on food and certain other items were reduced as well. The Treasury’s combined revenue loss from these cuts is estimated at around 1½% of GDP p ...

... in real disposable income. At the beginning of 2007, the last phase of the personal income tax rate cuts took effect, and in March 2007, VAT and excise taxes on food and certain other items were reduced as well. The Treasury’s combined revenue loss from these cuts is estimated at around 1½% of GDP p ...

Corporate Environmental Liabilities and Capital Structure Xin Chang

... financial debt. Firms with substantial environmental liabilities make regular and legally mandated outlays to achieve and maintain compliance with environmental laws and regulations. Similar to interest expense on financial debt, environment-related expenses and investments are tax-deductible. Fail ...

... financial debt. Firms with substantial environmental liabilities make regular and legally mandated outlays to achieve and maintain compliance with environmental laws and regulations. Similar to interest expense on financial debt, environment-related expenses and investments are tax-deductible. Fail ...

Chapter 4

... company specific - many companies will use a 5 year planning horizon but high tech companies are likely to be at the shorter end of the range. ...

... company specific - many companies will use a 5 year planning horizon but high tech companies are likely to be at the shorter end of the range. ...

- UConn School of Business

... cash-preserving incentive. This is especially true given that most managers are entitled to an actuarial lump-sum pension value on reaching retirement age, thus leaving concerns related only to losing their pension in the years leading up to their retirement.1 Our third hypothesis is therefore: ...

... cash-preserving incentive. This is especially true given that most managers are entitled to an actuarial lump-sum pension value on reaching retirement age, thus leaving concerns related only to losing their pension in the years leading up to their retirement.1 Our third hypothesis is therefore: ...

89KB - NZQA

... 2013 to finance the new salesroom, this has increased the liabilities, meaning the proportion of the assets Carl has financed has decreased. With the ratio so low, Carl may not be able to borrow from banks in 2014, because the risk is too high for banks, with the level of debt the business has. Carl ...

... 2013 to finance the new salesroom, this has increased the liabilities, meaning the proportion of the assets Carl has financed has decreased. With the ratio so low, Carl may not be able to borrow from banks in 2014, because the risk is too high for banks, with the level of debt the business has. Carl ...

Simulation_of_Correlated_Default_Processes

... of correlated defaults particularly important. The joint distributions developed here may be extended to multivariate cases easily and used for pricing of credit derivatives such as collateralized default obligations (CDOs) and credit default swaps (CDSs). From a risk management perspective, the joi ...

... of correlated defaults particularly important. The joint distributions developed here may be extended to multivariate cases easily and used for pricing of credit derivatives such as collateralized default obligations (CDOs) and credit default swaps (CDSs). From a risk management perspective, the joi ...

the relationship betweeen financial leverage and

... Abor (2005) defines financial leverage as the amount of debt that an entity uses to buy more assets. Leverage is employed to avoid using too much equity to fund operations. An excessive amount of financial leverage increases the risk of failure, since it becomes more difficult to repay debt. The fin ...

... Abor (2005) defines financial leverage as the amount of debt that an entity uses to buy more assets. Leverage is employed to avoid using too much equity to fund operations. An excessive amount of financial leverage increases the risk of failure, since it becomes more difficult to repay debt. The fin ...

1 UNITED STATES SECURITIES AND EXCHANGE COMMISSION

... Financial Corporation and subsidiaries as of December 31, 1998 and 1997, and the related consolidated statements of operations, changes in stockholders' equity, and cash flows for each of the three years in the period ended December 31, 1998. These financial statements are the responsibility of the ...

... Financial Corporation and subsidiaries as of December 31, 1998 and 1997, and the related consolidated statements of operations, changes in stockholders' equity, and cash flows for each of the three years in the period ended December 31, 1998. These financial statements are the responsibility of the ...

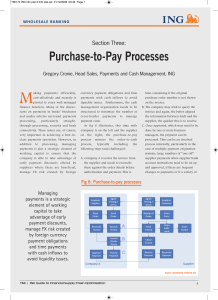

Purchase-to-Pay Processes

... the firm wanted to achieve greater bank independence, allowing them to decide on our banking relationships based on the quality of service rather than simply the links that were in place. Consequently, the company made the decision to connect to SWIFT in order to rationalise the number of proprietar ...

... the firm wanted to achieve greater bank independence, allowing them to decide on our banking relationships based on the quality of service rather than simply the links that were in place. Consequently, the company made the decision to connect to SWIFT in order to rationalise the number of proprietar ...